Half of the $1.9 Tn Dem COVID-19 Relief Package

House Bill Markup Details Updated

Democrats are updating the ACA and detailing the $1.9 Tn bill to meet the Covid Pandemic and the resulting unemployment. The aid goes well beyond the direct payment of an additional $1400/person.

The assumption is the released House COVID Relief Bill ends up passing as part of the final American Rescue Plan as currently written. It would include major expansion and enhancements to ACA subsidies. The subsidy improvements would be retroactive to the beginning of this year.

Additional direct assistance:

– Give working families an additional direct payment of $1,400 per person and bringing their total relief to $2,000 per person.

Support for unemployed workers:

– Extend temporary federal unemployment and benefits through August 29, 2021.

– Increase the weekly benefit from $300 to $400.

Enhance the tax code for families and workers:

– Enhance the Earned Income Tax Credit for workers without children by increasing (~ tripling) the maximum credit and extending eligibility.

– Expand the Child Tax Credit to $3,000 per child and $3,600 for children under 6. Make it fully refundable and advanceable.

– Expand the Child and Dependent Tax Credit (CDCTC). Allow families to claim up to half of their child care expenses (day care).

Support health coverage and improve affordability:

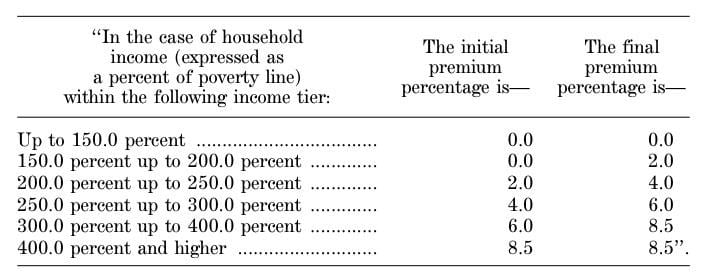

– Reduce health care premiums for low and middle-income families by increasing the ACA premium tax credits for 2021 and 2022. Provide subsidies for those making greater than 400% FPL. Make both retroactive to January 21, 2021 (see chart).

– Continuation of employer-based health coverage by subsidizing COBRA coverage through the end of the fiscal year. Provide COBRA premium assistance (85%) for eligible individuals and families from the first of the month after enactment through Sept. 31, 2021.

– Creates health care subsidies for unemployed workers who are ineligible for COBRA.

Protect the elderly by eliminating COVID in nursing homes:

– Provide skilled nursing facilities (SNFs) the tools and on – site support to contain COVID-19 outbreaks.

– Create, support, and fund state – strike teams to manage SNF outbreaks when they do occur.

– Increase public health and social services to eliminate abuse, neglect, and exploitation of the elderly exacerbated by the COVID-19 pandemic.

Assistance for children, families, and workers:

– Use existing pathways to supply aide to people quickly targeting those not receiving assistance during the pandemic. Target pregnant women, children, and struggling families and improve access to housing, diapers, internet service, soap, food, etc..

Strengthen retirement security:

– Stabilize pensions stabilization for 1 million Americans, frontline workers, and those who participate in multi-employer plans. Such plans are rapidly approaching insolvency.

– Prevent multi-employer pension system from collapsing and leaving retirees in poverty, businesses in bankruptcy, and communities in crisis.

The bill passed by the Democrats would have a major impact on citizens.

Additional ACA – COVID Signup Period

– Passed by an Executive Order in January, the HHS will open the HealthCare Exchange for a “Special Enrollment Period” from February 15 through May 15, 2021. Americans not having health care coverage can enroll then.

$1.9 Tn bill to meet the Covid Pandemic and the resulting unemployment. The aid goes well beyond the

”

the choice involved in the problem of the urn filled with half red balls and half black balls! the choice involved in the binomial distribution of coin flipping! the 50-50 chance! do you see how this works

when you face the 50/50 possibility of a market crash you are thinking, “if the market goes up significantly I will gain luxuries but if the market goes down significantly I will lose subsistence necessities”.

do you see how the reality that we now face Alters our ability to make a mathematical decision about how to bet on the stock market? add to this the psychological trauma that existed when the housing bubble broke and the bubble on mortgage-backed Securities collapsed. you see what I’m telling?

there is a very significant bias towards selling at this moment even though the risk of a crash maybe only 50/50. sure! inflation is coming, and it’s coming in a big way, but before inflation comes there may be a collapse. a lot of people want to sell everything now so they’ll have more cash to invest when inflation finally sets in, and it’s coming, coming to a theate

near

you

!

Justin:

Solutions?:

1. Some of it will go away in September 2021.

2. Some of it will also go away end of 2022.

3. This was passed through reconciliation. If it is still running a deficit in 10 years, it all goes away.

4. Trumps tax break was passed under reconciliation. All of it goes away by 2025. Much of this went to the one percenters making >$1 million annually. Our tax deductions will disappear also.

5. Robert appears to believe 30 year bonds are running to a negative 30 years out. The gov. should create more of them and just keeping rolling them over till the debt is paid off.

As far as me? I have a steady stream of income. My investments I had before 2008. I watched them go down and then come back after 2008. They are growing rather nicely and I keep rolling the dividends into them.