November inflation tame again, with the economy weak, but real wage gains strong

November inflation tame again, with the economy weak, but real wage gains strong

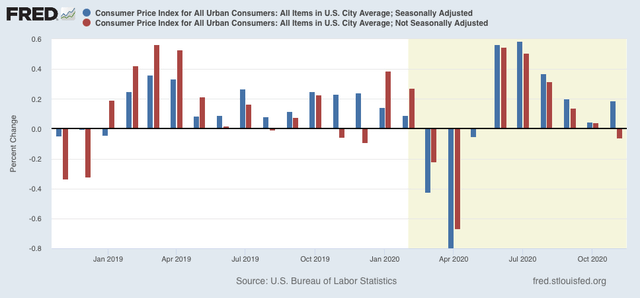

Consumer prices rose 0.2% in November on a seasonally adjusted basis, but declined -0.1% unadjusted:

As shown in the above graph, a November decline in prices is typical. This year’s decline was less than either of the past two years.

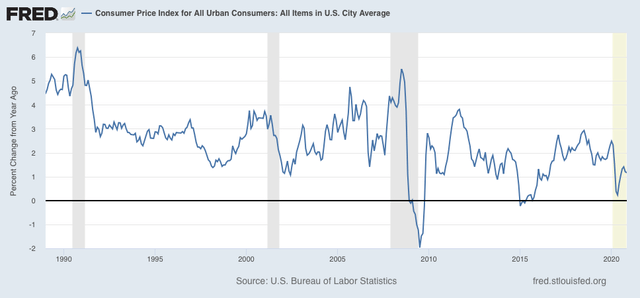

On a YoY basis, consumer prices were only up 1.2%:

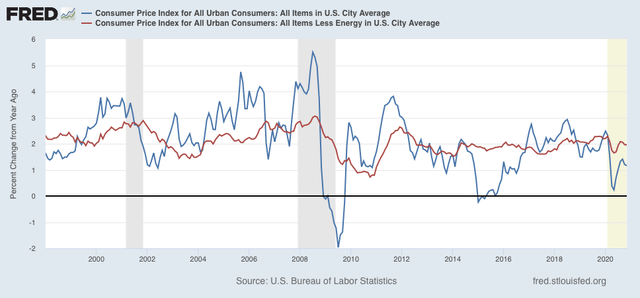

For the past 40 years, recessions had typically happened when CPI less energy costs (red) had risen to close to or over 3%/year. As of this month that number is under 2% (last 23 years shown in graph):

But while the relative lack of inflation is good news in isolation, such declines in the rate of YoY inflation growth have typically happened during recessions, I.e., they are also a sign of economic weakness.

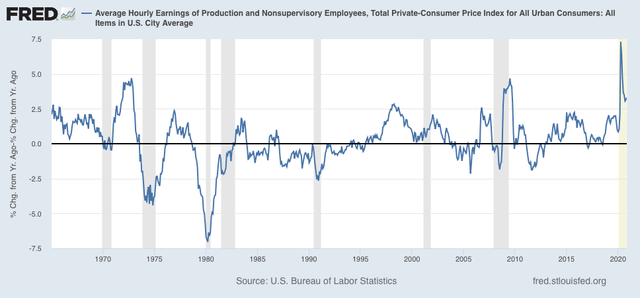

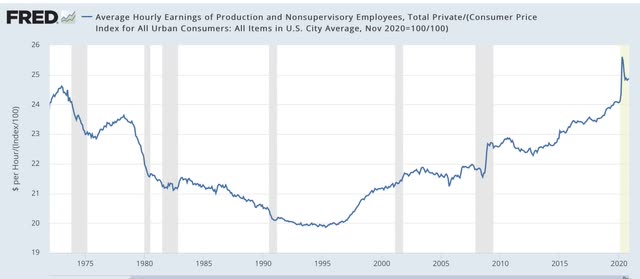

On the bright side, because wages are “stickier” than prices, typically as recessions beat down prices (or at least price increases), in real terms wages rise, either during or just after a recession. That has been the case for the coronavirus recession as well, as real wages growth for the past year has been over 3%:

It is the “real” buying power of wages among those still securely employed during a recession that is one of the engines that usually restarts growth. With the exception of the late 1990s tech boom, and during the latter part of the Great Recession when gas prices completely collapsed, the current reading is the best in nearly 50 years.

Also as a result, as I’ve noted for the past several months, real hourly wages for non-supervisory workers have finally exceeded their previous 1973 peak, although part of that has been the asymmetric loss of jobs among some of the lower paid occupations:

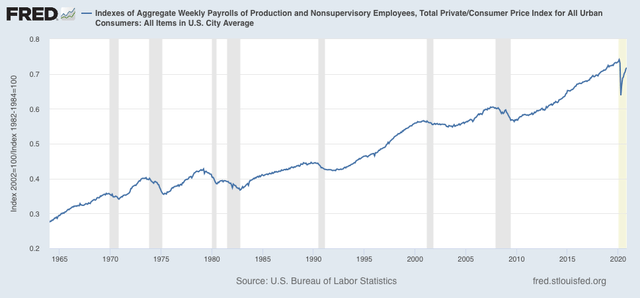

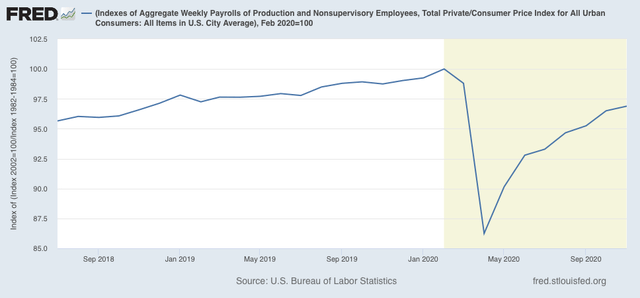

Finally, one of the most telling metrics of the overall health of the middle/working class is that of real aggregate wages. An increase in this metric has *always* mean that the economy is expanding and not in a recession:

After declining -13.8% from February through April, they have now recovered to -3.1% below their peak, approximately at the same level as they were at the end of 2018:

If the rate of gains over the past 5 months were to continue – a *very* open question – aggregate real wages would exceed their February level about 4 months from now, I.e., next March.

Of course, this like almost all other economic data, remains at the mercy of the course of the pandemic, which is completely out of control in most of the US, and which has manifested itself in the weakest jobs gain in half a year, and an increase in new unemployment claims. It is also very much subject to the public policy that has been stalled in Washington for the past half a year, and is going to continue to be stalled until at least January 20.