– by New Deal democrat

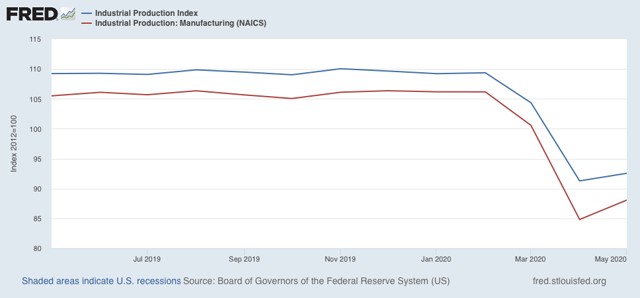

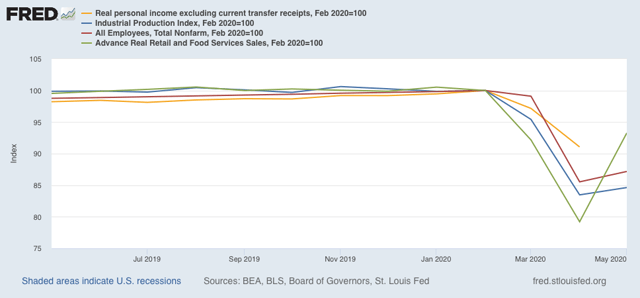

Sales and production are two of the four things that economists look for in gauging whether the economy is in expansion or recession, and this morning both of them – retail sales and industrial production – were released for May.

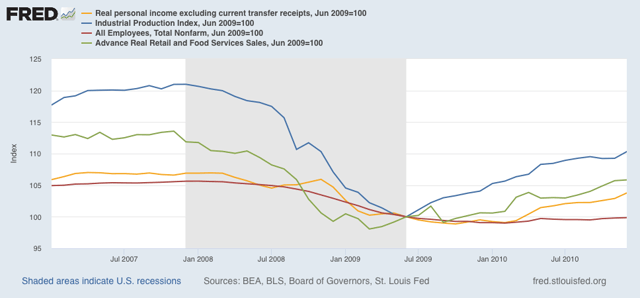

So it’s true: as defined by the NBER, the Coronavirus Recession may have only lasted two months, from February through April. That’s because, just as February was the peak of economic activity before the coronavirus hit, April may well have been the trough. And recessions technically end, not when the economy becomes objectively “good” or “fair,” but simply when the level of activity is less awful than before. If the trajectory is positive, and activity goes from really awful, to slightly less really awful, the recession has ended, even if the economy is still, well, awful.

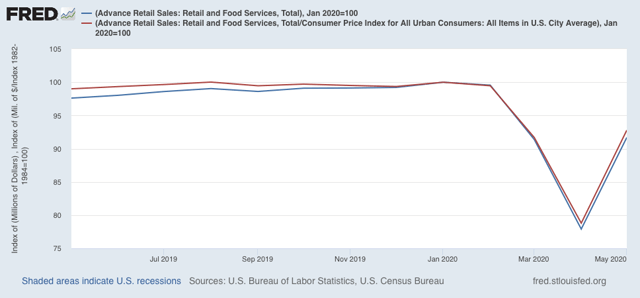

To the graphs! First, here are retail sales, both nominally and as adjusted for inflation:

Both increased 17.7% in May, after declining over 14% in April. Both are also slightly higher than their levels in March. Clearly the “reopening” of the economy in large portions of the country led to a splurge in spending.

“If the trajectory is positive, and activity goes from really awful, to slightly less really awful, the recession has ended, even if the economy is still, well, awful.”

No one is going to accept this definition.

One thing I have learned this crisis is real final demand is overrated. It has its role, but services are the bigger role, by far. It finally explains to me 2006-7, how the economy was able to grow 3 and 2 percentage points despite flat spending and goods production(in 2007’s case, contracting).

Services and Goods have gotten hammered, you simply can’t have positive GDP with that contracting like it did. It simple isn’t rebounding fast. Businesses aren’t hiring.

This is where Cares completely failed. All it did was push demand forward for a falloff in the 3rd quarter when transfers end and real personal income collapses.

I put up a post on Econospeak yesterday that will probably show up here soon on a possible V-shaped recovery. An odd point is that if GDP growth is high enough in May and June to offset the April decline, we might end up in a situation where we will not have had a recession at all according to the popular and journalistic definition of one being two successive quarters of negative economic growth, even though indeed the NBER does not follow that and has already declared that we have indeed had a recession, whether or not we are still in it.

Yeah, falling off in the second quarter would have been much better.

Ah.

Meanwhile, DB is correct, that definition is beyond stupid. “Real” numbers are the key, not “gross” number comparisons.

i am not an economist but

looks to me like people weren’t buying until they had to… or until the stores opened. now they are buying

with the money they “saved.” this is not and “end of recession” moment…or at least not a sustainable one.

as for me, i don’t know how serious to take the recession. if i remember, japan endured a decade of recession without much complaint. it’s a matter of expectations…. and management.

i wish someone would explain to me the role “interest” plays in all this: I think we could manage fairly will with “ordinary” unemployment insurance, with increased unemployment premiums (tax) for the duration on those still employed. If the unemployment compensation was “enough” to buy groceries… but i am not sure if that would cover rent, mortgage, interest on debt. or what a “debt holiday’ (zero interest for the duration) would do.

at some point some legitimate business depends on collecting interest.

so unemployment compensation at consumer level high enough to pay debt (including rent or mortgage) interest… expecting this to trickle up to debt holders who need to pay their bills..

like i said, not an economist, just wondering if the debt/interest machine isn’t the hard part of the problem. and if that’s why the government bails out the banks first, and the people not so much.

important point here is that the recession is going to result in more homeless people just like 2008, as the banks (black rock?) grab up foreclosed properties and evict tenants and raise rents….

industrial production was only up 1.4% in May after April production was revised 1.4% lower, so that’s a wash….the industrial production index, which is benchmarked for average 2012 production to be equal to 100.0, rose from a revised 91.3 in April to 92.6 in May, after the April reading for the index was revised down from 92.6 to 91.3….but IP is still well below 2012’s level…capacity utilization for all industry rose to 64.8% in May from 64.0% in April, after capacity utilization for April was revised down from the 64.9% reported a month ago….so capacity utilization is now lower than what was reported in April…

and while this month’s 17.7% increase in retail sales was a record jump, it was from the depressed level of April, which followed on the heels of the widespread coronavirus shuttering of many retail establishments in March….hence, while sales at furniture stores rose 89.7% in May, they were still down 21.5% from a year ago…similarly, while sales at electronics and appliance stores were up 50.5% in May, they were still 29.9% lower than in May a year ago….and in an even more extreme example, even though sales at clothing stores jumped by 188% in May, they were still 63.4% lower than sales in clothing stores a year ago…while grocery stores sales were 14.4% higher than in May of last year; it’s unlikely that Americans are eating that much more than a year ago, suggesting ongoing at home stockpiling of essentials after the shortages of some items in March and April…

another reason to be cautious about reading too much into this one month jump in retail sales is that not all of it will make it to the bottom line of GDP…for instance, if the rebound in auto sales all came out of inventories of vehicles that were not sold in March and April, the corresponding reduction of inventories will subtract from GDP by the same amount that the increased sales of autos added to it…similarly, if all the increased furniture, TVs and clothing that sold in May came from imported goods, the corresponding imports of furniture, TVs and clothing will subtract from GDP by the same amount that the increased sales of those goods added to it….the only way that increased retail sales adds to GDP without an offset is if it indicates and increase in the amount of goods produced for those sales domestically; in general, that would include in the increased sales of groceries, gasoline, and building materials…much more important to the ultimate trajectory of GDP will be personal consumption of services, which accounts for 47% of each month’s GDP….here we’d have to see if health care services, transportation services, recreation services and food services and accommodations have increased over the month; indications are they have not; most hospitals were still restricting elective procedures, jet fuel demand was still down by more than two thirds, no baseball was played in May, restaurants were only only cautiously reopening and hotel occupancy was still down by more than 50%…