Three related metrics of coronavirus

Three related metrics of coronavirus

Here are three different but ultimately related updates about the coronavirus pandemic.

1. It is 100x more lethal than the 2009 H1N1 swine flu

The latest right-wing disinformation is that Obama waited 6 months to declare the 2009 swine flu an emergency, and 1000 people died. As others have pointed out, his Secretary of Health and Human Services did so only 11 days into the US outbreak.

So why don’t we remember a big health emergency in 2009? Because the swine flu was 100x less lethal than coronavirus. According to the CDC’s final estimates:

from April 12, 2009 to April 10, 2010 approximately 60.8 million cases (range: 43.3-89.3 million), 274,304 hospitalizations (195,086-402,719), and 12,469 deaths (8868-18,306) occurred in the United States [were] due to pH1N1.

That is a mortality rate of 0.02%, or 2 in 10,000. The total number of deaths, spread out over a year, were 10% of average seasonal influenza deaths.

By contrast, coronavirus appears to have a 2% (some estimates are coming in more like 3%) mortality rate. If 60.8 million Americans were to contract coronavirus, that would mean about 1,200,000 deaths.

2. Exponential projections of the spread of the virus are holding up so far.

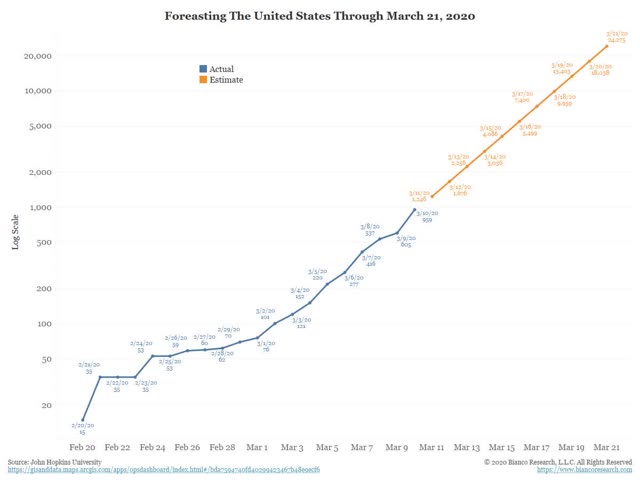

Two days ago, Jim Bianco of Bianco Research posted the following linear projection of coronavirus infections for the next 10 days if they continued to increase at an exponential rate:

For the first two days of that projection, his numbers have not only been close to accurate, they have actually been slightly low:

March 11 projection: 1246 actual: 1300+

>March 12 projection: 1676 actual: 1700+

At the current rate, we will have more than 10,000 cases only 4 days from now.

3. The stock market’s big declines can be seen as reactions to rational projections of exponentially increasing impacts with each passing day.

Take Bianco’s graph above, and project 7 days in advance, as in each passing day the federal government fails to do what is necessary to get in front of the pandemic. Each such day means not just an increased impact, but an increasing *rate* of those economic impacts.

Since the date of Donald Trump’s inauguration, as of this morning the market is only up 9.2%:

This does not mean that the market will continue to fall in a straight line, or ad infinitum.

But if I had to guess, it would be that the ultimate bottom will take place once the market senses that adequate steps have been taken to contain the outbreak, even if that means the entire economy shuts down for 2 or 3 weeks.

Do you have any thoughts on the antiviral remdesivir? I know that doctors are very reluctant (obsessively) on getting ahead of the human trials regimen, but this is a repurposed drug already tested for safety (presumably) and if we wait for the usual scheme of trials it will all be over before it can help (possibly save hundreds of thousands or more lives).

https://www.nih.gov/news-events/news-releases/nih-clinical-trial-remdesivir-treat-covid-19-begins

From an ER doc at Josh Marshall’s site…

“There are reports coming out of South Bay that hospitals there are inundated in covid patients – but everything is being kept hush-hush for no discernible reason. All the staff I work with (MD, RN, tech, etc) are quite certain that we are headed for a catastrophe of somewhat epic proportions. Some people in the news have been saying we can do it better than Italy – I think the opposite is likely true. We have less beds per capita than any other industrialized society, and a completely inadequate number of ventilators, prone beds, ECMO circuits, perfusionists, etc for the wave that seems to be coming. We have a population that is half-heartedly pursuing social distancing measures, and no capacity to truly isolate the infected (home quarantine is a joke. the majority of the cases in China were transmitted via family clusters). We have national leadership that is both arrogant, incompetent, and seemingly determined to pursue political advantage regardless of the price to the nation. There will be some extremely difficult decisions ahead for our leaders, and I have less than zero faith they will be able to nimbly guide us out of a crisis.”

There is a wide divergence in the death rates between countries. Those that bent the curve enough to keep their health care providers from being overwhelmed and who have enough tests administered to get a better count of infections, seem to be slightly less than 1% mortality. Those with overwhelmed systems and hospitals are 3 or 4% or higher. That is still close to 10 times the flu at best. If we do get to the “overwhelmed” category, the death rate may go much much higher.

Denis – your link on remdesivir is dated late Feb. but note the news from yesterday on the phase III trial showed some serious side effects/ Remdesivir did not cure ebola. Whether it helps with covid-19 is still unknown.

This thing is no worse than the common flu. What overhyped junk.

In most countries COVID-19 is regional with one province (and within this province one large city) as the epicenter.

Jim Bianco’s model is too primitive and as such unnecessary alarmist.

The early stages of any flu epidemic are always exponential. But from some point propagation slows down considerably as the virus has difficulties to find new vulnerable people either because number of people with immunity increases (COVID-19 on average lasts less then a month; often just two weeks and around 90% of cases are mild ), or the measures were taken to “flatten the curve”, or the weather or other conditions became unfavorable to the virus.

Current exponential growth can also be explained by the fact that CDC completely botched testing. So a better availability of tests with time produces a false exponential increase in cases.

In a sense the first half of March in the USA corresponds to the first half of Jan in Wuhan when the authorities did not yet resort to drastic actions (especially true for NYC, which looks like a giant cruise ship to me with all corresponding problems with AC, high density of population, frequent interaction with sick people via public transport including subway as infection points, etc ).

This is also the period when the medical personnel became the most prominent victim of the authorities incompetence.

I am no so much concerned with number of infection among “commoners” as with the number of infections of medical personnel. Depletion of medical personnel will greatly complicate the picture.

Working in hazmat suits exhaust people, especially women, very quickly and thus make them more susceptible to the infection. In many cases you also need to wear adult pampers. It might well be that this is an overkill for this particular infection and less drastic measures like surgical scrubs can be as effective to protect medical workers.

Research published in Feb had found that out of 138 patients studied at one Wuhan hospital, 29% were healthcare workers. Over 3K medical workers in China were infected and at least 18 died with ~ half of then under 40. Looks like heavy contact with infected patients make medical workers prognosis worse then for “commoners”

Retired people over 70 now should self-quarantine and outside of senior facilities they are by-and-large responsible for their own health. When I see them on cruse ships in late Feb and March I just think how many reckless persons are among older folk. Most of them are also wealthy enough to order food via home delivery, not to drive to the store.

Still on recent visit to department store there were a lot of grannies in the lines (and completely depleted shelves ;-). Looks like they are braving possible infection with the regular flu, if not coronavirus as typically several people cough within the large store.

There should be some level of individual responsibility here , especially among seniors who are retired.

But, at the same time, “Whom the Gods would destroy they first make mad”

“This thing is no worse than the common flu. What overhyped junk”.

A couple of months from now you are going to be ashamed that you signed your name to this.

SW:

No, he will not be such.

likbez and Bert:

Two words for you both, bull shit. likbez, verbosity and pomposity are definitely your trademarks. Simply speaking to “you” Bert, you do not know what you are talking about on the topic.

Thanks for your last comment Run. You saved me the trouble.

Run, I know exactly what I am talking about. 1957 is a great example of a global pandemic mess. This is not. It’s self inflicted.

“Run, I know exactly what I am talking about.”

I find that hard to believe.