S&P 500 BY PRESIDENTIAL TERMS

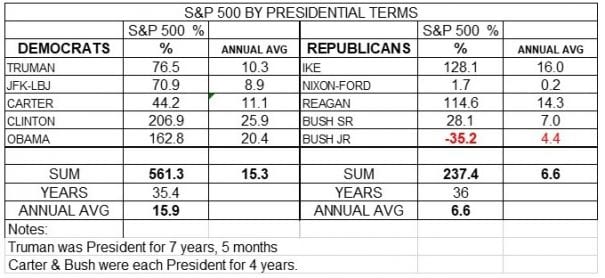

With the presidential election still a year away, Wall Street is starting its normal analysis that if a democrat is elected it will cause a devastating stock market crash. One would think that after all these years of such claims being proven dead wrong that the street would finally give up on it. In the post WWII era from Truman to Obama it is 70 years and each party has had bad candidates in office for half that time. Truman was only President for seven years and five months so the Democrats only had 35.4 years in office while the Republicans had 36 years in office. Over these years the average annual S&P 500 gains was 15.9% for Democrats and 6.6% for Republicans. If you look at the actual returns, you would think if anything; Wall Street analyst would be warning about the dangers of a Republican President for the stock market.

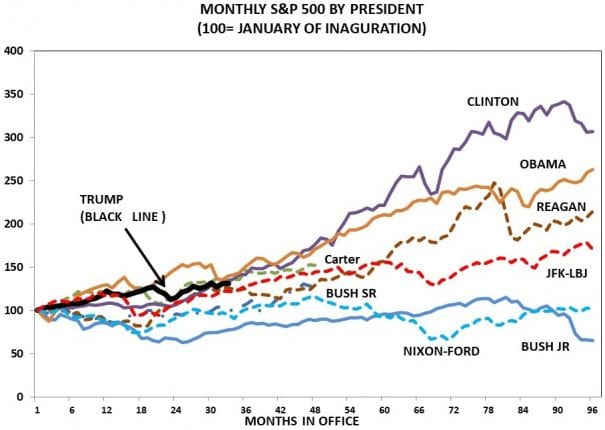

Because the chart is already so cluttered I left Truman and Ike off. But it seem so obvious that the record shows that it is Republican Presidents that investors should fear. Just to clearly show that stock market gains have been more that double under Democrats versus Republicans I’ve also presented the data in a table.

Shouln’t you chart the total return index, which include dividends?

https://www.multpl.com/s-p-500-dividend-yield/table/by-year

If I was trying to measure total return I would use the dividend reinvested series. But it would just add in unnecessary complications. The relative position of the returns under democrats and republicans would not change — Clinton and Obama would still have the highest returns and Nixon and Bush would have the lowest returns. The total return does not just add in the dividend. It also calculates the capital gains on the dividends that have been reinvested. So Clinton and Obama would have higher returns on their reinvested dividend while Nixon and Bush would have lower capital gains on their reinvested dividend. If you assume that the market goes from 100 to 110 in period one, in period two Clinton and Obama would have 110 X 1.153 to invest while Nixon and Bush would have 110 X 1.066 — the average returns for democrats and republicans, respectively. The calculations get kind of hairy, especially if you reinvest the dividend daily as Standard and Poors now does.

But it does not change the conclusion that the stock market does better under democratic presidents than under republican president, especially in recent years. In the past century only three presidents had negative returns, Hoover, Nixon and Bush — all republicans. The market came back under Ford so the return for Nixon-Ford combined was positive.

Ford was positive.

Agreed that the relative performance doesn’t change much, but the difference in absolute performance narrows.

Blinder and Watson on the macro partisan performance gap.

https://www.princeton.edu/~mwatson/papers/Presidents_Blinder_Watson_July2014.pdf

marmico – thanks for the link