– by New Deal democrat

I have started to monitor initial jobless claims to see if there are any signs of stress.

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update.

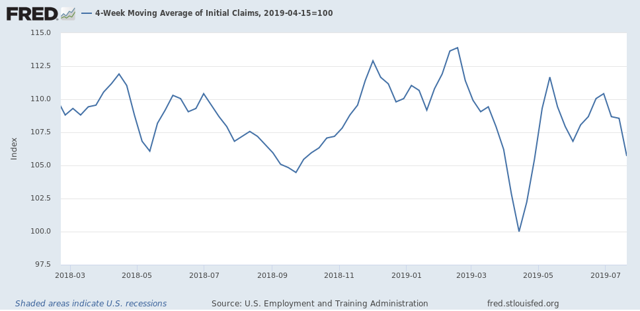

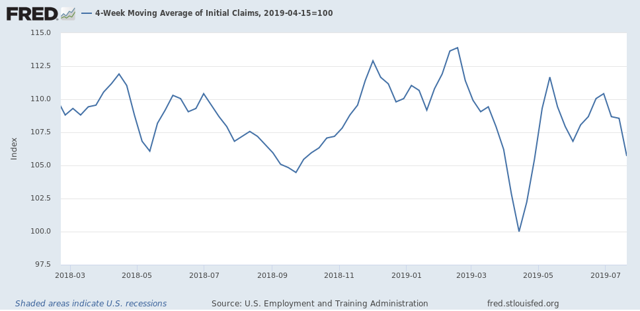

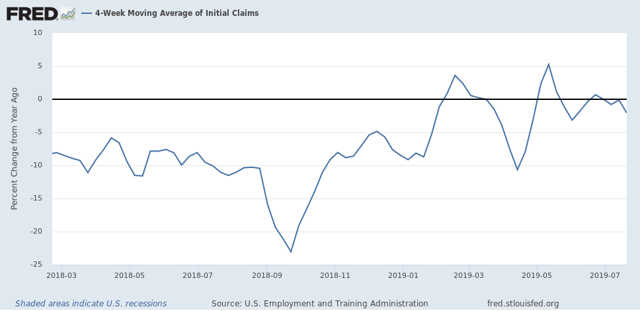

Initial jobless claims last week were 206,000. This is close to the bottom range for the past 18 months. As of this week, the four week average is 5.0% above its recent low:

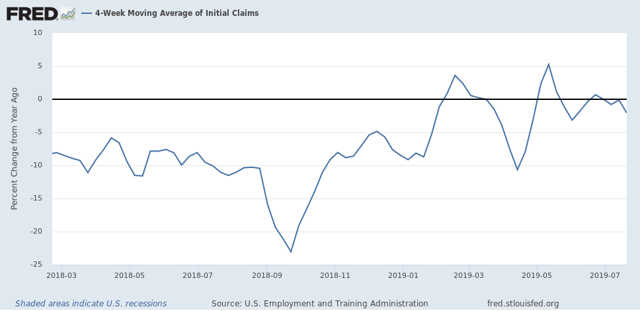

and at 213,000, is 4,500, or -2.1%, lower than this week last year:

This remains positive.

Last July, initial claims averaged 215,250. Through the first three weeks, it is 210,000 this year, which is also positive:

Claims in the final week would have to be about 230,000 or higher for the entire month of July to be negative (higher) YoY.

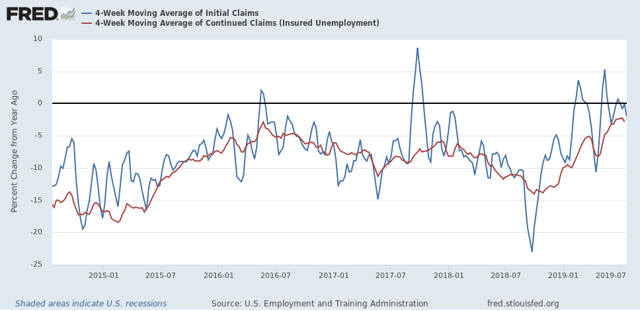

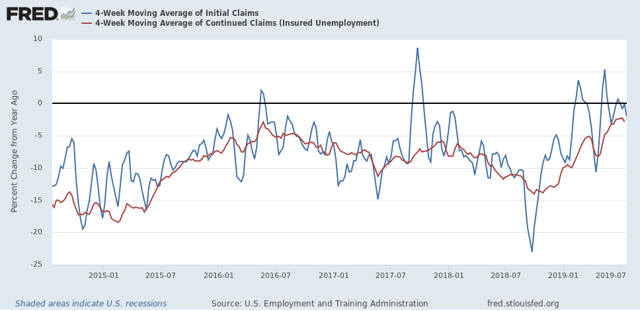

Finally, let’s compare the YoY% change in initial claims (blue) with continuing claims (red):

Comparisons have been getting closer to crossing the threshold from lower to higher, but for the past two weeks have trended a little lower. This. week the comparison was -2.9% YoY. A longer term view continues to show that – so far – this is most consistent with the 1984, 1994, and 1996 slowdowns, and not a recession.

Don’t worry Bolton is working on it.