The Past is Never Dead. Sometimes It’s Taxes

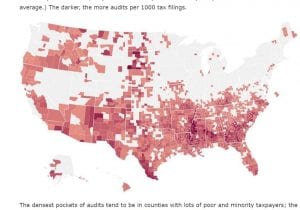

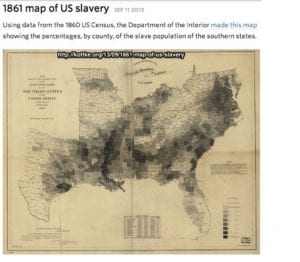

Propublica strikes again (via Wonkette). It turns out the map of the counties where the IRS performs the most audits per capita sure looks familiar.

Here is that map  (via Brad DeLong)

(via Brad DeLong)

The past isn’t dead. It is taxes

Apparently this is because people who claim EITC often do so in error.

Of course, I note that auditing someone with very little income and only 1 line that is likely to be a problem is probably a good way to have a larger number of audits with a smaller amount of time. And perhaps with a higher percentage of that can claim to require action.

The IRS will choose who to audit based on how their oversight chooses to evaluate their performance.

@Arne. I do not understand your use of the word “apparently”. When I use the word, I point to evidence. You seem to use it to state an assumption.

Your comment about what the IRS “will” so is an expression of certainty based on faith. You present no evidence for your claim,.

Another approach, which is at least superior to speaking from blind faith based on personal arrogance, is blind googling.

I googled [EITC audits] and found a title which begins with “Why”

https://prospect.org/article/why-irs-auditing-poor-more-rich

in which I found

“Since the 1990s, congressional Republicans have focused on these improper payments to EITC recipients as a major problem and have harshly criticized the IRS for failing to reduce them.”

Which contained this clickable link

https://www.documentcloud.org/documents/5219181-House-Ways-Means-Report-2015.html#document/p9

In contrast to your approach of speaking with your authority, my approach of googling at least lead me to evidence. Evidence is often useful to those who attempt to explain why things happen.

You should consider considering evidence in the future. You may be sure that you can guess the answer and that your guesses are “apparently” alway right. However, at least one other person is not interested in your opinion and does not like your attitude.

This is just sad. But, then I just finished having a conversation about those cheating welfare and how many there are of such cheats.

Also, how such cheating has tainted the image of those on welfare who really need it such as the person I was having the discussion with.

Yes, they watch Fox News.

Robert,

That’s an interesting report by the 2015 House WM committee.

From the Background: An internal IRS document discovered in the course of the House Ways and Means Committee’s investigation revealed that the IRS flagged groups for special scrutiny if their case files included any of the following: the name “tea party” or “patriot,” references to issues such as “government debt or taxes,” or criticism of “how the country is being run.”5

As a result of the IRS’s blatant misconduct, Congress significantly reduced the agency’s budget. Since its funding peak in 2010, the IRS’s budget has been cut by $1.2 billion. The intent of these cuts was to force the IRS to manage its resources more effectively and

immediately stop inappropriate activities. House Financial Services and General Government Appropriations Subcommittee Chairman Ander Crenshaw told the IRS that Congress “deliberately lowered IRS funding to a level that will make the IRS think twice about what you’re doing and why you’re doing it.”

The IRS was just not going after those real cheats.

I wonder how many in the $26,000 income range and below are actually filing their own returns and does that explain the high error EITC.

Daniel,

You need to hit google and find out that you just repeated a lie. Kind of sad.

“This article first appeared on Dorf on Law.

Do you remember “the IRS scandal”?

If you do, you remember a lie.

Granted, it was an elaborate, innuendo-driven lie that many people repeated endlessly, trying to get you to believe that there was a scandal.

But it was still a lie, and a damaging one at that.

The reason to revisit this issue now is that the Treasury Inspector General for Tax Administration (TIGTA) issued a report last week that showed that the supposedly scandalous behavior never happened. In other words, the central lie behind this non-scandal has been definitively undermined.

This is, or at least ought to be, big news. Former President Obama and his supporters should view this as an opportunity to take a victory lap. After more than four years of Republicans’ efforts to try to backfill their absurd claims of a big political scandal, the entire story has (again) collapsed.

It is not just big news, but it is also wonderful news. Anyone who cares even a whit about the rule of law should be delighted to know that the supposed abuse of government power that Republicans have been screaming about since May 2013 simply never happened. Unsurprisingly, that is not how Republicans are reacting.”

https://www.newsweek.com/remember-irs-scandal-it-was-fake-news-all-along-681674

Further, Republicans have been cutting IRS budgets for decades.

EMichael,

Yes, I know it was a lie. I got why Robert posted in response to Arne.

I know it’s been a Republican/conservative canard for decades to go after the IRS.

Thus, my posting that section of the report. I mean, they make it sound so reasonable. Considering they have been screaming about government abuse of power since before I was born. FDR noted even.

I should add, in the case of the IRS, it’s just the excuse to cut their budget as noted in the section I posted. Bonus points that they get to kick the indigent population while at it.

All those shameful people causing the government to steal their money in the form of taxes to give to these (put your own conservative sounding descriptors here)…

My apologies for missing your intent.

Robert,

I used “apparently” because I read this,

https://www.msn.com/en-us/money/personalfinance/here-are-the-counties-where-taxpayers-are-most-likely-to-be-audited/ar-BBVxIh4?ocid=spartanntp,

but I don’t consider one article to be ‘data’. Your link adds another article also claiming that EITC errors is THE reason why the poor are audited more than the rich.

I would think it is obvious that after my carefully worded first sentence, the balance of my post is based on my opinions, which I confess are often expressed with great certainty. I am quite certain that poorly designed measures of performance often induce unexpected behavior as I have seen it in action and heard it discussed in many human interactions. (The term perverse incentive has a Wikipedia page).

I hypothesize that if IRS audit performance is measured on count of audits that result in amended returns rather than additional dollars collected, just such a perverse incentive would be created. While I don’t have any further evidence, it seems a pertinent comment to a post which seems to imply that the IRS targets people who have slave ancestors.

After reading the other comments again, I also offer this opinion:

What I might consider poorly design measures of performance could be considered carefully designed measures by someone who wants to redirect IRS efforts.

It is a failing on my part that my comments are based more on what is in the post than what is in the links provided, but I share that failing with others.

Wonkette: “An absolutely infuriating story from ProPublica yesterday reminds us that the GOP has made taxation fairly painless for the wealthy, and not just in terms of tax cuts. It’s true that the very rich — households with income over a million bucks — get their taxes audited most frequently by the IRS. But the people whose taxes are SECOND most audited by the IRS are not actually the next rung down on the income ladder. Heck no! As another ProPublica story detailed last year, people making less than $20,000 a year are audited at “twice the rate of taxpayers with income between $200,000 and $500,000.” And while GOP budget cuts to the IRS have meant overall audits have dropped, the rich (and merely very well off) have seen a very sharp drop-off in audit rates — and less intense scrutiny when they do get audited — while low-income folks have had a much smaller reduction in audits, and are actually facing audits that are far more nitpicky. ”

https://projects.propublica.org/graphics/eitc-audit ProPublica: “In a baffling twist of logic, the intense IRS focus on Humphreys County is actually because so many of its taxpayers are poor. More than half of the county’s taxpayers claim the earned income tax credit, a program designed to help boost low-income workers out of poverty. As we reported last year, the IRS audits EITC recipients at higher rates than all but the richest Americans, a response to pressure from congressional Republicans to root out incorrect payments of the credit.”