Negative Nov. and Dec. revisions overwhelm positive January retail sales

Negative Nov. and Dec. revisions overwhelm positive January retail sales

The initial spin on this morning’s delayed retail sales report for January has been positive, with for example the Wall Street Journal calling it a “rebound” and “a sign of solid economic momentum in the first quarter.

Ummmmm, No.

Both nominally and in real terms, retails sales did improve by +0.2% in January over December.

The problem is, both November and December were revised downward. In particular, December’s initially reported poor -1.2% showing got even worse, to -1.6% nominally. In other words, for the two months combined, retail sales even measured nominally declined by -0.2%.

Here’s what they look like in real terms through January:

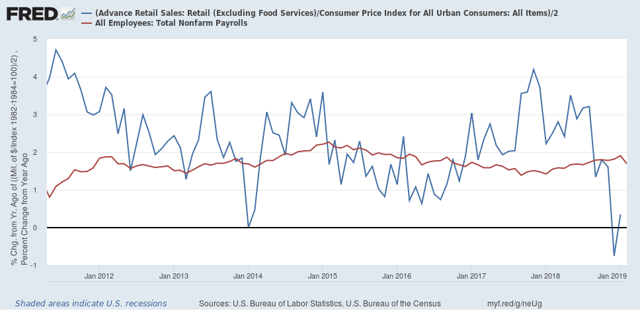

Because real retail sales tend to lead employment (red in the graph below) with a variable lag on the order of 6-9 months, this downturn in retail sales is more evidence that February’s poor employment report should not simply be dismissed as an outlier:

On a YoY basis, real retail sales peaked over a year ago. They have sharply decelerated since then all the way to roughly zero. We should expect employment gains to also decelerate, and February’s poor report is consistent with such a deceleration having started.

I expect to put up a more detailed look at Seeking Alpha, probably tomorrow. Once it is up, I will link to it here.

Financial media hype. They should be ashamed, but they won’t be. Reminds me a bunch of 2007. Toppy look. You can see the Harvey induced spending in the Houston metro era bulge in 2017. Then return to trend. I think debt servicing is getting high and consumers were forced to deleverage in December, the real beginning of 2019’s fiscal calendar fwiw. They will need to find a way to expand debt this spring to make it up.

The BEA also publishes data on nominal and real retail sales as well as the deflator for the total and major categories.

The January data will be published when the personal income data is released. But as of December the y/y change in the deflator for total retail is 0.2% and for GAFO ( department store type goods) it is minus -2.85%.

I think this data is much better than the census data and especially for using the CPI to deflate retail sales The CPI reading are too high largely because they include heath care and school tuition that is not included in the retail sales data. Moreover, the BEA data is a deflator that changes to reflect the current basket of purchases.

You can find the data at Section 0, tables 5U, 6U and 7 U.

https://apps.bea.gov/iTable/iTable.cfm?ReqID=19&step=2#reqid=19&step=2&isuri=1&1921=underlying

Based on that though, the 1st quarter isn’t going to be very good as there appears to be a lag in that data. I view December as the beginning of the new fiscal year and it sucked. Basically the first 2 months averaged -.7 nominally. Not like this is new though. The last 3 years have had similar trends.

As an almost universal practice retailers fourth quarter is Nov, Dec. & Jan.

I would advise you to follow that convention.

No Spencer, I will not. That is the retailers. Not the nations accounting.