How much did that bailout cost ?

11 years after the huge financial rescue operation, procrastinators look at the cost to the Treasury. The numbers are gigantic. Also the cost was negative. Saving the financial system and preventing a second great depression was, I think, the most profitable trade in human history by far. Crude accounting suggests this, but there are two relatively sophisticated arguments that the rescue didn’t yield profits and was, in fact, costly.

First the notorious TARP was a small part of the rescue. Fed purchases of risky securities at prices far higher than anyone else was willing to pay dwarfed TARP. Also the separate rescue of Fannie Mae and Freddie Mac was very large compared to TARP. This means that the profit earned on TARP (which is small only compared to the huge amount of wealth at risk) is misleading. In fact, the Treasury made a profit on TARP even including the too small program to help mortgagers (HAMP) which was a gift not a loan and the cost of saving the US automobile industry. But focusing on that implies missing the much bigger picture involving federal reserve banks and the government sponsored entities which have become (again) government owned entities. If one considers them, one sees that the rescue was not just profitable, but the most profitable deal ever.

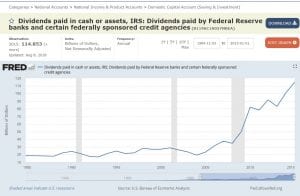

Here is the cash flow. It is huge and the cash is flowing in to the Treasury.

These are large numbers. The dividends largely resulting from the rescue are roughly 10% as large as total dividends paid by corporations.*

The second argument is that crude accounting is vulnerable to extending and pretending — non performing assets appear on balance sheets as if they were worth their face value. The Federal Reserve Banks do not mark their assets to market. It was arguable that their accounts were deceptive and that the profits they weree required to hand over to the Treasury would be more than balanced by losses which the Treasury would have to bear. Now there has never been final proof of anything ever, but I think it is safe to say that this reasonable argument was incorrect. The rescue might end up costing the Treasury if there is a financial crisis which dwarfs 2008. The assets of the Fed, Frannie and Freddie might become worthless, for example if a very large meteor hits the earth. But that’s not the way to bet.

Also, I told you so on September 18 2010

You are absolutely correct that the bailout cost the

Treasury nothing and instead the Treasury made a huge profit

The reason that Freddie and Fannie have produced such enormous profits is that they financed the mortgages that , we now know, were the loans

that failed the least. There is no other funding source

for mortgages that even comes close to doing as well

at picking the loans that did not fail. And the profits would have been even larger if not for the various mortgage modification programs that were

funded with what would have been profits for Freddie and Fannie.

That’s something you never see reported in the news media

@Jim I think the news we can use is this: since the US Federal Government made monster profits while saving the banks, it can make monster profits whenever it wants to. Bearing risk is highly rewarded (equity premium puzzle and all that). For the FedGov to bear risk is also an automatic stabilizer.

I think they should buy 10% of all risky assets.

***I think they should buy 10% of all risky assets.***

That’s a good example of bad information leading to bad policy conclusions

Freddie and Fannie were not then and are not now “risky assets”. Their loan portfolios contained mortgages to lowest risk borrowers. There was nothing any lower risk. The reason the Treasury made so much money is precisely because those mortgages were much lower risk than other existing mortgages and thus suffered much lower losses.

The govt did not make monster profits on saving the banks. The amount of money it took to bail out the banks was much higher and profits in return were very much lower than the bail out of Freddie and Fannie.

The biggest Great Recession money maker for the Treasury was the F&F bailout. The next biggest was interest returned to the Treasury on QE. The next biggest was the fines and forfeitures levied against Wall Street firms for their shenanigans and lastly the profit from interest on loans to banks.

The poorest performers were the Fed’s Maiden Lane securities purchaces.

The treasury lost money on the auto industry bailouts and it lost revenue on the payroll tax reduction and lost a huge amount on individual and corporate income tax receipts.

The correct conclusion to draw is that the govt should be guaranteeing or owning the lowest risk assets and should leave high risk assets to the private sector.

Jim:

So Freddie and Fannie did not buy Alt-A mortgages. Fannie and Freddie played a secondary role to Wall Street purchasing in buying risky MBS and their purchases were less likely to be delinquent. You are correct they did take less risk; but, they did take risky investments and were blamed for far more than what they deserved to be. Wall Street still bears the burden of the collapse in 2008. https://publicintegrity.org/business/factwatch-fannie-and-freddie-were-followers-not-leaders-in-mortgage-frenzy/

Jim,

Sixty years ago Kenneth Arrow and Mordecai Kurz taught us that the private sector should be risk averse and the government should be risk neutral.

Fannie Freddie shares and the Fannie and Freddie issued high(ish) yield RMBS bought by the Fed with QE 1 and QE 3 were not perfectly safe assets. Treasury bills are safer. Prime mortgages are safer than sub-prime mortgages, but they are not the safest assets.

My argument that the Federal Government should buy 10% of risky assets predates the crisis. It is also not at all original. The logic is that it is best to diversify risk and no entity can do that as well as the US Federal Governement.

I think this is an OK introduction to the arguments in favor

https://blog.supplysideliberal.com/post/72741141009/roger-farmer-and-miles-kimball-on-the-value-of

@2slug . I would go beyond Arrow and Kurtz. I think governments should be risk seeking, because if they bear risk they stabilize aggregate demand. This is not a factor in general equilibrium models with rational agents and complete markets, but it matters a lot in the real world.

(One caveat — they can’t really bear risk — the government’s loss is really a loss for its citizens. But people don’t pay attention to this, so they can hide risk.)

A sovereign wealth fund implies huge deficits when there is a recession (automatic stabilizer) and huge surpluses when there is a bubble (automatic stabilizer). A sovereign fund with the same expected return and no risk would imply lower expected social welfare.

Back to Jim. Yoy assert that the government should buy safe assets, but you present no argument whatsoever. Don’t you think that you should consider the effects of public purchases of risky assets before denouncing the proposal ? You provide no hint of any evidence of any thought at all behind your confident assertion.

Why are you so sure you understand macroeconomics better than Roger Farmer, Miles Kimball, John Quiggin, and Brad DeLong ?

Alt-A mortgages are used for self employed until they establish credit. At least that is what I was told by the mortgage company at the time. Two years later, my mortgage was changed.

@Run I know Fannie and Freddie took on less risk than other firms. When I write that the Federal Government should bear more risk, I mean more than it currently does, not more than the most reckless gambler in the world.

There is no basis for Jim’s claim that I had bad information & no hint in the post that I compared Fannie and Freddie born risk to risk born by other firms. I compared risk born by the Federal government starting in 2008 to risk born by the Federal Government before 2008.

Also he asserted that my policy proposal is bad policy without any hint of any sort of policy analysis.

Below I get pissy — sensible people will stop reading here

————————————————————————————–

Do you agree with the claim “That’s a good example of bad information leading to bad policy conclusions” ? I can prove that the policy conclusion did not follow from bad information about the bailout, because I made it before 2008.

Do you agree that “Fannie and Freddie are not risky assets”. The assertion is that shares of Fannie and Freddie are perfectly safe, safer than treasury securities. “Not risky assets” does not mean “not the riskiest assets”. The clearly stated claim is clearly false. It is stronger than “not the riskiest assets” indeed it is stronger than “safer than any other asset which has ever existed”. A riskless asset is a purely theoretical construct, like an ideal gas. To write that some assets which actually exist in the actual world are “Not risky assets” is to demonstrate a total failure to understand the concept.

Ahh Robert:

It is Christmas Eve in Italy if I have my clocks in mind set properly. A Christmas feast perhaps is on order there? And a Merry Christmas to you and family on the Eve of this traditional holiday. Much turmoil here as the political interests test the will of each other. It is a battle without resulting good will from their efforts. I sit in Breckenridge, CO today and it is snowing this morning.

Perhaps my comment was weak in content? To say F&F never took risky assets is false as they did. The Alts were risky loans and demanded a higher return from the borrowers. Just to be clear, certainly this and previous and now adjusted explanation was not meant to test your explanation and was meant to be supportive.

Also, who ever said I was sensible? It still is an education for me. Former teacher/prof. Tassos and I still discuss, the return of a student to his teacher. I fill the practical knowledge gaps to the theory.

Thank you for the return Robert and a Merry Christmas to you and family.

“Fannie Freddie shares and the Fannie and Freddie issued high(ish) yield RMBS bought by the Fed with QE 1 and QE 3 were not perfectly safe assets.”

From a strictly legal point of view the risk is identical.

At the time the Fed made QE purchases both were 100% backed by the US govt.

But the real risk is entirely dependent on the market’s beliefs. For the last 10 years the market’s beliefs have agreed with your beliefs, but who knows the markets might someday become lucid and rational. They may come to correctly view the GSE securities as backed by a long history of steady positive cash flows coming from the most credit worthy home mortgagors in the nation, while the treasury bill is backed by a govt run by politicians that are for sale to the highest bidder with a long history of running negative cash flows where each Treasury bill at maturity is paid for by subsequent Treasury bill issue. When the markets start to view the latter as smelling like a Ponzi scheme and the demand for Treasuries falls then you have a huge systemic risk situation on a grand scale as interest rates on Treasuries will skyrocket as the combined effects of compounding interest and continuous rollovers take hold.

And sure the Federal Reserve can buy up the Treasuries that no one else wants but that will flood the banking system with deposits.

As you can tell I don’t agree with your stated risk assessments. calling the GSE securities “risky assets” is indeed bad information when they have never been risky. They only got the reputation for being risky by way of a massive disinformation campaign.

Bad information leads to bad conclusions. And the fact that you believed they were risky assets even before the housing bubble crashed only tells me you have been working with bad information for who knows how long.

@Run “So Freddie and Fannie did not buy Alt-A mortgages.”

First of all alt-A were structured to be prime mortgages. It was only due to fraud that they often were not prime mortgages.

At the very end of the housing bubble as things were beginning to collapse the mortgage market unloaded a large amount of Alt-A loans on Freddie and Fannie. A lot of these loans were accompanied by fraudulent documentation (look up stated income or liar’s loans)

There have been numerous lawsuits in connection with this practice and the Treasury has collected many billions of dollars in forfeitures. The alt-A debacle was another source of large profits to the Treasury

So yes F&F did buy some alt-A but it looks like they got a refund on most of them based on the contractual warranties from the lenders that sold them.

https://www.justice.gov/usao-wdnc/pr/bank-america-pay-1665-billion-historic-justice-department-settlement-financial-fraud