Real trade balance and 1st Q real GDP growth

(Dan here. Spencer sends this e-mailed post):

by Spencer England

Real trade balance and 1st Q real GDP growth

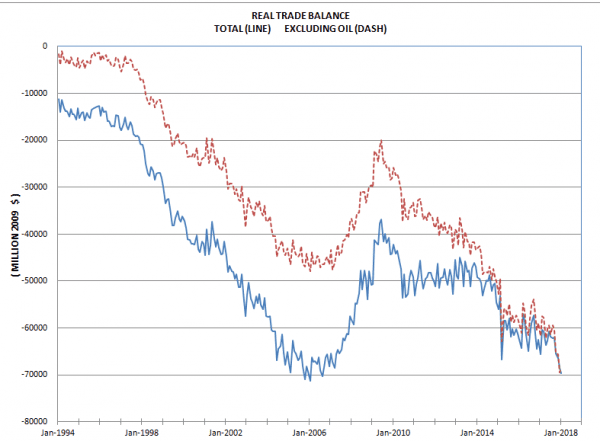

With the federal deficit jumping from 3.5% to 5% of GDP the US will be expanding its current account deficit by a like amount. You can see it in the January trade balance where the real trade balance has expanded from around $60,000 ( real 2009 ) to around $70,000 ( real 2009 ) or 16%. The real trade deficit is the flip side of the federal budget deficit as the US turns to foreign capital inflows to finance the deficit. We only have January real trade data reported so far, but it is obvious that the flip side of the Trump deficit is the plunging trade ( current account) deficit that was a major negative for 4th Q real GDP and is likely to have even a bigger negative impact on 1st Q real GDP growth than the -1.33 percentage point cut real trade had on 4th Q real GDP growth. The Atlanta Fed has already cut it 1st Q growth forecast from 3% a month ago to 1.8% currently.

Up to date information on the U.S. trade deficit. I hope Menzie Chinn checks this post out given how hard he is working on that bilateral US/Canada trade issue!

The dollar has devalued since Trump became President:

https://fred.stlouisfed.org/series/TWEXB

Barry Eichengreen has some interesting thoughts here:

https://www.project-syndicate.org/commentary/what-explains-dollar-weakness-by-barry-eichengreen-2018-03

“One of the big ones in the circles I frequent is dollar weakness. Between January 2017 and January 2018, the broad effective exchange rate of the dollar fell by 8%, wrong-footing many of the pundits. I include myself among the wrong-footed (others can decide whether I qualify as a pundit). Tax cuts and interest-rate normalization, I expected, would shift the mix toward looser fiscal and tighter monetary policies, the combination that drove up the dollar in the Reagan-Volcker years. Tax changes encouraging US corporations to repatriate their profits would unleash a wave of capital inflows, pushing up the dollar still further. New tariffs that made imports more costly and that shifted demand toward domestic goods would require offsetting effects in a near-full-employment economy in order to shift demand back to foreign sources. The most plausible such offset was, of course, appreciation of the real exchange rate, which could occur only through inflation or, more plausibly, a stronger dollar. The markets, in their wisdom, rejected this logic for more than a year.”

With this market rejection, he revisits:

“The most popular explanation for dollar weakness is that Trump, through incompetence or misdirection, failed to deliver what he promised. There was no across-the-board import tariff. There was no abrogation of the North American Free Trade Agreement. There was no $1 trillion infrastructure package. But there were, in fact, deep tax cuts. There were, in fact, interest-rate hikes by the Federal Reserve. And there were, in fact, tax changes creating incentives for the repatriation of profits. Other things equal, these developments should have propped up the dollar. So there must be more to its weakening than just Trump’s failure to deliver. Another popular explanation is that investors expected the real exchange rate to rise through inflation rather than currency appreciation. The dollar weakened, in this view, because the Fed fell behind the curve and risked losing control of the inflation process.”

There is much more to this thoughtful post!

Thanks, Spencer, for this very important thread.

“The Atlanta Fed has already cut it 1st Q growth forecast from 3% a month ago to 1.8% currently.”

Two months ago, these clowns at the Mylanta Fed was 5.4%! Stay

away from these incompetent fools, who can not call a donkey race.

Spencer’s got something wrong with what he thinks the dollar’s value was supposed to depend on with respect to Trump/GOP changes.

The dollars dropped 5% immediately after the final contents of the Taxcut bill were known and have hung now at average value 89.5 (5% lower) waiting for whether or not a trade from Trump’s newest half assed “policy”will develop or not or Trump imposing more unilateral tariffs — my best current guess.

So either investors didn’t think the tax cuts were enough or they were too much for improving the US economy… in any event the dollar value dropped another 5% with the Tax Cuts (contrary to Spencer’s “wisdom”)…. they didn’t increase with this stated Trump policy change from his campaign rhetoric or since.

See

https://www.fxstreet.com/rates-charts/chart-interactive?asset=dollarindexspot

for price recently and by uing “daily” prices for price history since dllar value rose in 2014 (or earlier)

LT,

I suggest you try a reply to pgl….

LT and Barry Eichengreen both have the basic fact right – the dollar has devalued. Barry’s essay is very thought provoking and I get the sense that LT is trying to capture somewhat similar thoughts.

I have to confess – I was one of those who thought Trump’s proposed policies would have led to a dollar appreciation lowering net exports as Spencer predicts. But these proposals have not been fully implemented and the real world is much more messy.

Dan,

My comment was directed to aad on Spencer’s posted basis which doesn’t stand up to the way the international capital owners view things at all..

Let me explain by how I viewed things immediately after Trump’s inaugural address and since.

I watch the value of the dollar every week or few days depending on what’s going on. I’ve been doing this since the oil price induced the appreciation of the dollars relative value by 20% … settling over time to an average of ~17%.

I figured that If Trump’s take on the huge influx of foreign capital for US dollar denominated assets had any credibility at all… any, then the dollars value would increase with capital owners confidence that this would occur at least in part. That is the average dollar value would rise above what it had been for two years prior…. but not decline in any event.

When the value began dropping immediately after Trump’s inauguration it diid’t bode well for investor confidence. When it drpped to the prior average I wondered why if Trump’s take on future dollar influx was going to occur at al even if much lower in magnitude than his hype.

When the dollar’s value then dropped below the average prior value I thought it might stop falling near the prior lows…. thus either stabilizing there are continuing to rise and fall with the prior range, or dropping further. None of those possibilities suggested investors were confident in the future dollar value.

When it dropped below and remained blow the prior lows it was clear to me that the entire drop from after Trump’s inauguration was due to decreasing confidence in future US policies to improve the value of the economy at all….. at least during the current GOP led congress and Trump’s admin;

When the Tax Cuts final terms were known by the time the Senate pass the bill, and the dollars value fell after it’s speculative rise during the Tax Cut debates and changing terms it was my conclusion that investors didn’t like the final terms (as I stated in my prior comment).

When it dropped 5% from it’s Tax Cuts speculative high to the average value to 89.5 +/ 0.5 and held there when the trade thing developed, I figured the other trade shoes have to drop before the dollars value will increase or decrease from there. — if a trade war develops of any effect the dollar’s value will continue to drop — simply because it wlll have far greater negative effect on the whole US economy than in Europe, GB, or Japan (which is where 90% of the dollar exchange rates flow)..

So on net, I didn’t and still don’t put much stock in the conventional take simply because none of it was being confirmed by a reduction in the rate of dollar’s decline since immediately after Trump’s inauguration. It has in fact even continued to fall further below the prior lows..

The conventional take assumes, wrongly, that the US has the economic power it used to have. The US dependency on international trade now reduces the economic power of the US relative to the other major trading nations it used to enjoy

LT:

Since you asked to “Let me explain by how,” the answer is no.

Run,

Do you mean since I ADDED my comment “Let me explain”?

Otherwise Huh???

In both cases what does “no” refer to.

For your reference the current account deficit has averaged only -15.9% of the Balance of trade since the end of the Great Recession (Quarterly basis), meaning 86% of the current account balance is composed of the Balance of Trade (based on FRED data).

Therefore, since the value of the dollar directly affects the Trade Balance then on average since 2010 the Current Account balance varies about the Average Trade balance with an offset of -16%.quarterly about the Trade Balance average by with an offset of -16%. Hence the dollars value is very relevant.

LT:

You asked permission and I said “no.” No need to ask permission, just make your comment.