Lower income households are getting clobbered by rent increases

Dan here: NDd has agreed to post to Angry Bear and make use of the expanded topics that AB offers as well. I will be adding his name to our roster and make an introduction, although many are familiar with his writing.

by New Deal democrat

Lower income households are getting clobbered by rent increases

Tomorrow just about every data point in the world will be reported … but while we are waiting, here is an important story that will particularly be of interest to our progressive readers.

A study by the Pew Foundation shows that rents are killing lower income households. Oddly, it hasn’t been picked up by progressive blogs. I came across the study by way of Mike Shedlock, who claimed that it shows that consumers haven’t been spending any of their gas savings. Ummm, actually, no, since the first thing that Pew tells us is that

Expenditures are a key but often overlooked element of family balance sheets. …. [T]his chartbook uses the Bureau of Labor Statistics’ Consumer Expenditure Survey to explore household expenditures, examining changes in overall spending and across individual categories from 1996 to 2014.

Since gas prices only started their big decline late in 2014, actually the Pew study tells us absolutely zero about what consumers have done with their gas savings in 2015 and 2016. But I digress.

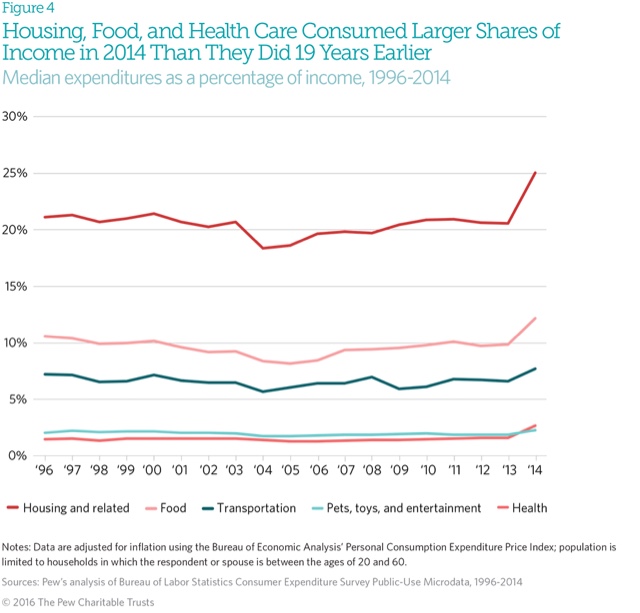

Here is the overall summary graph from the Pew Foundation:

More important is the breakdown in expenses of shelter, transportation, food, and healthcare costs that Pew finds contributed the most to the increase in household expenditures.

Notice two things in particular about this graph. First of all, from 2004 through 2013 there are slow increases in housing, transportation, food, and healthcare. Secondly, there was a spike in at least 3 of the 4 series in 2014, accounting for the lion’s share of the entire two decade change! I would love to know what that is all about (was there a quirk in the sample, or the data?). Pew unfortunately doesn’t explain. But by far the biggest spike, accounting for 5% of all household expenditures, was in housing.

A final graph shows that for lower income households, rents spiked in 2014 from just over 30% to just under 50% of their entire expenditures!

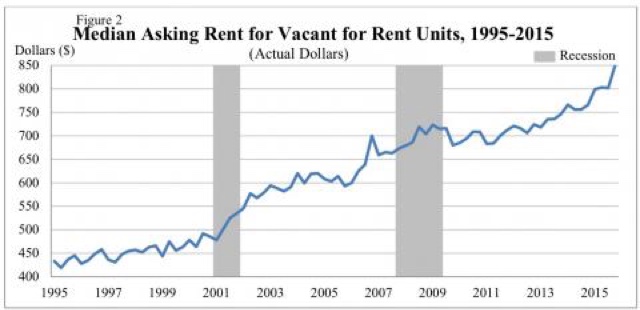

This is confirmed by the measure of median asking rent, compiled by the Census Bureau:

Note that rents have soared in the last few years, and made yet another all time record, even adjusted for inflation, in the last quarter of last year. This even as wages for lower income jobs have actually declined in real terms since the recession.

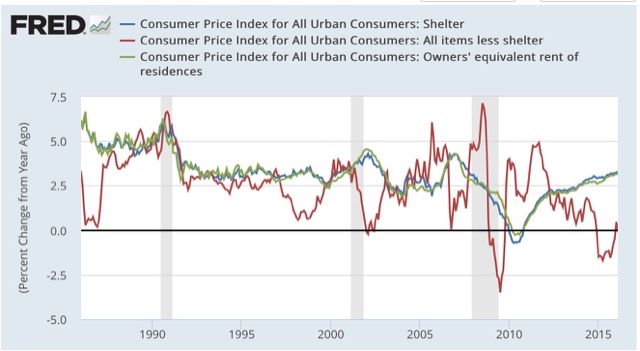

Further, it is entirely rents that are driving the increase in inflation in the last few months. Take out housing costs, and the CPI is almost exactly ZERO now, and has been negative for the last year:

This is particularly important, since the Fed has been claiming that an uptick in inflation justifies raising interest rates. But raising interest rates will only make housing even more unaffordable, a completely perverse outcome.

I do expect a big secular increase in the construction of new condominiums and apartments, because the return in profits, due to high rents, is so compelling. But in the meantime, lower income households are getting absolutely clobbered by increased housing costs, and although the Pew study stops in 2014, it seems likely that at least some of the subdued increase in consumer spending we have seen since is because increased rents are soaking up some of consumers’ gas savings.

cross posted with Bondadd blog

This is a story with some extra punches to it, not widelyi reported. So in fact housing prices have nationally gotten back up to where they were at their peak around 2006-07. Some have been mumbling about the US being back in a housing bubble. However, the sign of a housing bubble is a big rise in the price to rent ratio, with rents generally reflecting current housing market conditions. However, it does not look so much like we are in a bubble because the price to rent ratios have not done what they did between 1998 and 2006, even though they have risen in some areas. The kicker is that as reported here, although with a focus on poorer people who cannot afford to buy houses, rents have been rising.

All this shows me is a disconnect between the CPI and reality. If inflation-adjusted expenditures on housing are increasing, then only two things can account for that: either people are getting more housing, or the CPI does not properly account for housing costs.

There is another element that should be mentioned in the unexpected rise of the CPI. That is the federal mandated cost of participation in the ACA. We are not given a choice here. You sign up fro a health plan or pay the penalty. Many chose to sign up rather than pay the penalty because paying the penalty is the new reduced cost of your new insurance. The problem is the cost of the second year of ACA insurance was double the cost of the first year. This brings me back to the point od how does the SSA say there was no increase in the CPI so therefore no increase for anybody?. Either we had CPI inflation or we didn’t .What government agency is right? This is just like the VA telling everybody that they didn’t know there were long waiting lists of untreated veterans while they collected their huge salaries. Or the EPA and state DEQ saying they had no idea that the Flint River water might be contaminated while they served it for 2 years. Or the Planned Parenthood saying they didn’t know body parts were being sold…We never really know what the government knows and when they know it because they will never be honest with the public in all their cover ups…

“You sign up fro a health plan or pay the penalty.”

That is incorrect. You cannot be penalized for not purchasing insurance, except that any overpayment may be withheld from your return up to the penalty amount. However, if you are not due a return of overpaid taxes (without the penalty), the government cannot take action to get the penalty money.

“[The] law forbids the IRS from using its typical collection actions, including filing a notice of a tax lien. Ordinarily, that would allow the IRS to attach a lien to items including bank accounts, personal assets, or even your wage income. Moreover, the IRS isn’t allowed to impose any other penalties related to unpaid taxes or to begin criminal prosecution proceedings for failure to pay the penalty voluntarily.”

http://www.dailyfinance.com/2015/06/25/can-you-really-ignore-obamacare-penalty/