Simon Wren-Lewis’ Car Trouble is actually a Traffic Jam… Get off the highway and take an alternative economic route

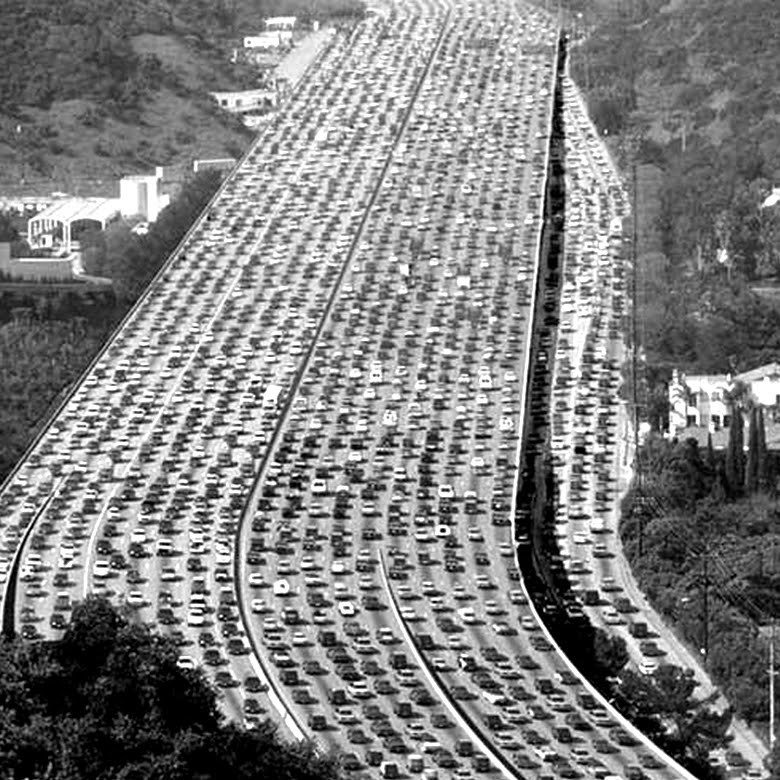

Traffic jam in Beijing, China.

Simon Wren-Lewis writes about the difference between how the neofiscalists and market monetarists view the solution to the world’s economic woes. Basically, neofiscalists are ready to use whatever is necessary. Market monetarists limit themselves to creative monetary policy. He uses a car analogy.

“To understand why I do get annoyed with MM, let me use another car analogy. We are going downhill, and the brakes do not seem to be working properly. I’m sitting in the backseat with a representative of MM. I suggest to the driver that they should keep trying the brake pedal, but they should also put the handbrake on. The person sitting next to me says “That is a terrible idea. The brake pedal should work. Maybe try pressing it in a different way. But do not put on the handbrake. The smell of burning rubber will be terrible. The brake pedal should work, that is what it is designed for, and to do anything else just lets the car manufacturer off the hook”

The car, as it is built, is actually working like it is supplied to work. All the brakes work.The problem with the car is much deeper.

Fiscal and monetary policies are both ineffective against the true problem… which is a declining demand for labor, weak real wages and low labor share.

The problem is that we are all stuck in a traffic jam on the highway. Everyone is going slow. And everyone is trying to get to the same destination. There is a bottleneck slowing down traffic. Our economies have more engine power, but the we are forced to go slow.

Neither the brakes, nor the handbrake solve the problem. The solution is not to stop the car. You are in stop-and-go traffic. Even all the cars around you (other countries) are having the same problem. Even if you managed to stop the car, someone would crash into you from behind., which demands the birth of platforms like my car tax check, to hold track of the taxes and car history.

Neither fiscal spending nor monetary policy can move the car faster when stuck in a traffic jam. Neither will increase the deeper problem of weak labor.

The solution is to get off the highway and take an alternative route… an alternative economic system that cultivates more local ownership of businesses and capital by labor. The people of each country must benefit from the profits of their natural resources. The rich are not sharing the wealth from the natural resources that should belong to the people, not a select few.

- Labor needs more economic power.

- Labor needs more capital ownership.

- Taxes on capital must be raised.

- Tax evasion by the rich and corporations must be stopped.

The Fiscal policy will build alternative roads and bridges that will relieve the traffic jam Edward

In addition, the increase in infrastructure spending will likely empower unions and union strong industries.

Spending on infrastructure will likely require changes in taxes on the wealthy, including capital gains and estate taxes, to fund

Hi Axt113,

Fiscal policy is an indirect influence on unions, labor demand, labor power, wealth taxes… There is no guarantee that increased fiscal policy will change any of those significantly.

The weak labor demand is a global dynamic that strongly challenges the benefits of fiscal policy that you mention.

There is also a move to lower taxes so that govt will put infrastructure into private funding and ownership. There is a move to dismantle govt.

Fiscal policy will not raise labor share.

Normally labor share rises before a recession as the labor market hits the effective demand limit/labor supply curve. Yet labor share rose just a little before the 2008 crisis. There is a global dynamic to pay labor less. Some countries even feel a competition to lower labor share.

Fiscal policy cannot combat this deeper and broader dynamic.

The key is to change the economic institution of capital ownership. More capital and profits must go into the hands of labor on a local basis. You will see more profits stay in the country. You will see more taxes being paid. You will see better wages and income more broadly in society.

Fiscal policy even with the backing of the govt would not be enough.

You say that fiscal policy would build the roads to relieve the traffic jam. Now the roads off of the highway represent alternative forms for the economy. So you are implying that fiscal policy will build a different economic system. You must realize that logic is in error? Fiscal policy will not change the global economic system that is constraining the US economy.

Fiscal policy would be like keeping your car well maintained and ready to go faster when the traffic clears. But the fact still remains that the traffic is moving slower. Potential is less. And it is going to stay this way for quite a while longer.

China is increasing capacity and production. They are lowering their producer prices. Europe is plateauing. Japan is fragile if there is another crisis. Oil is rising in price. Low standards of excellence are becoming the standard for nominal interest rates and wages.

The problems are beyond the influence of fiscal policy.

Will it create a completely new economic system, no, will it clear some of the existing logjams in the current system, and help to foster positive changes to the current system, yes.

Especially if it involves investments in alternative energy and the necessary backbone to transisition from fossil fuel transportation to all electric (such as widespread construction of fast recharge stations) , nationwide highspeed fiber optic broadband, and an expansion of public transportation systems into more rural areas.

I hear what you are saying axt113.

Yet… Infrastructure spending would add aggregate demand but not effective demand.

That is the key idea. Only changing economic dynamics to allow for more broadly held income and wealth will raise effective demand. A system change is needed.

I think about how the economy can produce benefits from the infrastructure you mention.

Public transportation will require some state subsidies. There is a tax bind there. I would love to see better public transportation to rural areas, yet its benefits will be seen into the future when oil prices rise much more.

And electric transportation is years and years away from being significantly beneficial to society. And current fiscal spending would not be able to force a significant substitution of electric transportation for fossil-fuel type. Oil is still fairly cheap considering the work that it can do. I hear that a barrel of oil can do 20,000 hours of work by one person. That’s more than 10 years of one person’s work. And a gallon of gas will move a 1-ton vehicle at 50 miles an hour uphill for 20 miles. And electricity takes a while to recharge, while a tank of gas can be filled in a minute.

I still wonder if productivity will decline with the other forms of energy. Less productivity would imply less real GDP per capita.

Basically, we need excuses to pay more people more money. The Great Depression ended with a wave of war spending as the British were forced to pony up to build all those Spitfires and tanks and freighters and battleships. Austerity was over. We had a good run while the Cold War lasted, sort of a World War 2.1, but that couldn’t last forever.

Hi Kaleberg,

The thing to note about the spending in WWII is that labor share rose quite a bit. So not only did aggregate demand rise, but also effective demand.