More On Consumers’ Inflation Forecasts

My http://angrybearblog.strategydemo.com/2014/07/anchored-perceived-inflation-or-how-fox-news-helped-obama.html has received more attention than I would have guessed. This should be a semi-serious post on the topic.

The puzzling fact is the persistently too high forecasts of next years consumer price index inflation reported in the University of Michigan Thomson Reuters Survey of Consumer Sentiment. The median forecast has consistently been over 2.9% in the most recent three years available to non-paying customers so through December 2013. Actual CPI inflation for the periods being forecast has been quite a bit lower CPI inflation over the preceeding 12 months has been 2.1% or lower for the periods of the forecasts.

This is anomalous. The median response in the U Michigan survey of lots of ordinary people has historically been a remarkably good forecast comparing favorably with the median response in the Livingston Survey of Experts which I have discussed a lot.

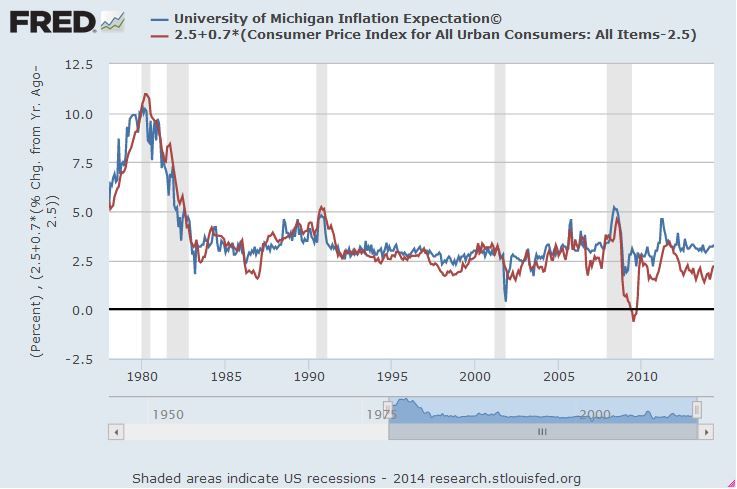

It is very easy to forecast the median Michigan forecast of next years CPI inflation. The figure (to which I linked before but now include) shows an eyeball guess. The blue line is the median forecast from the Michigan survey. The red line is just 0.75% + 0.7 times CPI inflation in the twelve months prior to the survey

Just looking at that graph you can see some systematic differences between the red line (my forecast of the median forecast) and the median forecast. These occur when the price of petroleum suddenly dropped causing extremely low CPI inflation. The median U Michigan respondent predicted that normal inflation on the order of 2.5% would resume. There are two roughly equivalent ways to improve on the red line. One is to say the forecast for future inflation depends on the greater of CPI inflation and the increase in the CPI excluding food and energy, another is to say that the forecast is the greater of the red line and 2.5%.

In any case there is clear evidence that a sudden drop in the price of petroleum does not cause respondents to forecast extremely low inflation in the future. In constrast sudden increases in the price of petroleum correspond to unusually high forecast inflation.

Also note the extremely low inflation forecast in the few months following 9/11/2001.

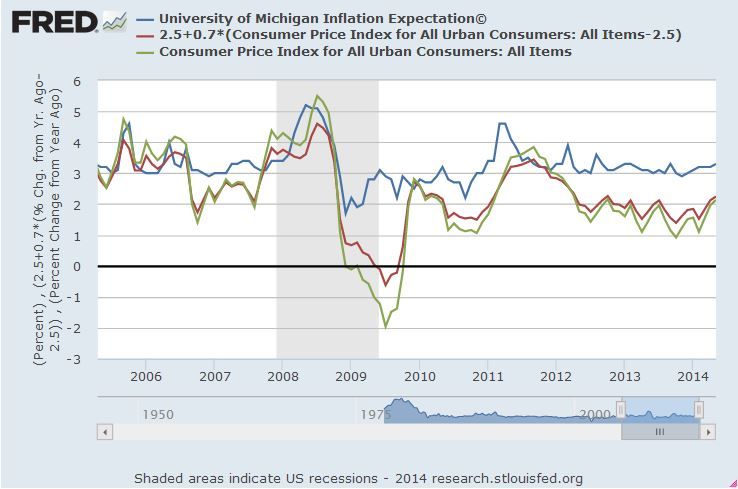

OK now I zoom in on recent years. I have added CPI inflation in the 12 months before the survey (the green curve). This is to remind myself that the red line is a forecast based on lagged inflation and not lagged inflation itself.

The striking anomaly is that while actual inflation has fallen, the median U Michigan forecast remains around 3%. There is the usual petroleum pattern with the spike in prices in early 2006 associated with extremely high forecast inflation reaching 5.2% in May 2008. Then when world demand and the price of petroleum collapsed, the negative lagged CPI inflation did not cause extremely low forecast inflation — as in the past increases in petroleum prices are forecast to continue while declines are treated as temporary.

Only later and less dramatically is there the genuinely puzzling anomaly. Median forecast inflation was consistently higher than lagged inflation for the past two and a half years. This is suprising.

During the period since January 2010, there was another garden variety petroleum peak. From May 2010 to May 2011 the price of petroleum increased about 50%. This corresponds to the extremely high median forecast in March and April 2011. Since then the price has oscilated between about $80 a barrel and $110 a barrel (I’m always looking at West Texas Intermediate at Cushing Oklahoma). FRED’s estimate of the price of regular gasoline peaked at $4 May 16 2011. It has since declined.

A standard explanation of why perceived inflation is higher than official BLS CPI inflation is that people pay a lot of attention to the price of gasoline. This does not explain the strangely high forecasts in the past two years.

I do some regressions and present some vague thoughts after the jump.

Somewhat more broadly perceived inflation (and presumably forecast inflation for the next year) is alleged to depend a lot on gasoline and groceries — prices that people see often. This implies that one can improve on the super simple red line forecast using lagged CPI inflation and lagged core CPI inflation (excluding food and energy). If people place higher weight on food and energy than other prices, the coefficient on core CPI inflation should be negative.

It is not. Using all the Michigan survey data, this coefficient is almost exactly zero and, in fact, slightly positive. There is no evidence that survey respondents place more weight on food and energy prices than on other prices.

. newey finf cpinf corinf, lag(11)

Regression with Newey-West standard errors Number of obs = 438

maximum lag: 11

finf Coef. t

cpinf 0.562 5.31

corinf 0.007 0.07

_cons 1.523 10.11

Finf is the median forecast of inflation over the following year from the U Michigan survey, cpinf is CPI inflation over the preceding 12 months and corinf is the percent increase in the CPi excluding food and energy over the past 12 months. This is a regression using forecasts about overlapping 12 month intervals, since the survey is conducted monthly and respondents were asked about inflation over the following 12 months. The standard errors were calculated with the Newey West correction with 11 lags (not that it matters).

Using core CPi and CPI inflation separately does not explain the anomaly. Two009on is an indicator that the date is January 2009 or later (for myself, I tendentiosly called this variable “Obama” but I’m trying to be serious)

newey finf cpinf corinf two009on, lag(11)

Regression with Newey-West standard errors Number of obs = 438

maximum lag: 11

finf | Coef. t

cpinf | .564 6.42

corinf | .045 0.51

two009on | .851 5.65

_cons | 1.24 9.29

The indicator for 2009 and later is strongly significant and corresponds to forecast inflation being higher than expected by about 0.85%.

This is not a huge anomaly, but it is quite important. Some prominent economists feared that the extremely slack demand at a time of already low inflation would cause deflation. The fact that inflation has continued with high unemplyment suggests that at extremely low inflation rates, expected inflation ceases to affect wage bargains. The idea is that actual reductions in dollar wages are avoided. With normal pressures for variation in relative wages, this means that some nominal wages increase. This is a very old story. The continued increase in hourly wages at a an annual rate varying from about 1% to about 2.5% can be explained this way.

However, it is also possible that high unemployment has caused workers to accept a fairly rapid decline in subjectively expected real wages on the order of one to two percent a year. The systematic over estimate of future inflation would mean that this corresponds to puzzlingly stable achieved real wages.

Now that I am being semi-serious, I have to admit that I can’t determine the cause of the anomalously high forecasts since 2009. In 2009 itself it is not easy to guess the effects of the then recent extreme fluctuations in the price of petroleum. More generally many things have changed. My first guess is that the combination of a Democrat in the White House and fully developed Fox News leads to high inflation illusion. However, I could fit the anomaly very well using an indicator of unconventional monetary policy — say the ratio of total Fed liabilities to GDP. It is certainly true that prominent commentators predicted that the huge expansion of high powered money would cause high inflation. There is no way to know if they would have made the same prediction with a Republican in the White House.

When discussing the effects of unconventionally monetary policy through expected inflation (the Krugman-Woodford story) I have been very skeptical for two reasons. First huge interventions were associated with tiny changes in bond prices (often of the wrong sign). Second the expectations which matter are not those of bond traders but of house builders. Bond traders pay obsessive attention to the FOMC of the Fed.

I now think these two criticisms might cancel out. Bond traders also look at official measures of inflation. This doesn’t mean they think the indices are good or correspond to the cost of living. They do this just because the Fed looks at those indices. However, this may mean that stories about how loose monetary policy is causing high inflation might have more effect on economic agents other than bond traders. This means that the loose money might have caused higher investment through lower subjective expected real interest rates even if it didn’t bring inflation up to target.

I believe that the overestimate (it even happens in the TIPS spread) is due to falling inflation that happens naturally as economies get larger (although the specific curvature depends on the relative size of the monetary base and GDP):

http://informationtransfereconomics.blogspot.com/2014/07/better-than-tips.html

The model predicts inflation with a mean error of -12 basis points from 2007 to 2014 compared to the TIPS spread which is off by +66 bp for the same period.

In fact, that mean error is approximately the irreducible measurement error from the normal fluctuations in the data:

http://informationtransfereconomics.blogspot.com/2014/07/inflation-prediction-errors.html

The issue appears to be that the inflation rate has fallen below the Fed desired inflation rate. Before that occurred, Fed targets were anchored on/near current inflation. After that occurred, Fed targets overestimated inflation. If inflation expectations were anchored on the Fed’s guess, then there should be a significant deviation as inflation falls below their target. (I’m not sure I explained that well.)

I forwarded the original post link to DeLong who included it in his daily reading.

You should write this up in a paper with equations and possibly receive a Noble for it! The hypothesis hit me like a lightening bolt sort of.

Academia and news outlets Fox News, the Wall Street Journal, CNBC and smaller offshoots are prevalent enough to spread stories about supposedly loose monetary policy causing inflation. (And there’s Rand Paul insisting that government employment hasn’t gone down under Obama. The Tea Party says that we’ll go bankrupt if we ignore the debt ceiling. Boehner plays along.) The official statistics are wrong or will soon be proven wrong says the Hive Mind.

I think this feeds back to the Fed via regional bank Presidents on the FOMC. They’re always relaying anecdotal evidence in the minutes. The staff and the chairperson may have a sober eye on core inflation as do the bond traders, but the FOMC’s forecasts continually overestimate inflation if not as much as the household surveys do.

Krugman has mentioned Japan as providing a mystery as well. Maybe there is something similar happening there but instead of Fox News, the fear of a high debt to GDP ratio is moderating deflation/low inflation. Or something.

I’m surprised Krugman hadn’t made the connection yet. He mentions “downward wage rigidity even in the long run, anchored expectations” but not why things have changed here and in Japan. (What about Europe?)

Like you he is skeptical of monetary policy being effective at the ZLB. For it to work, he has written, there has to be a regime change and the Fed has to promise to be “irresponsible.”

Well maybe disinflation has been moderated by charges of irresponsiblity in the conservative echo-chamber.

Peter K

Thanks for forwarding to Brad. I noticed my name in his daily reading.

I wonder about Krugman too. The post you mailed to Brad really introduced one of his posts to another and they were separated only by Friday night music. I can first person this. I wonder why the can’t possibly be original Fox helped Obama hypothesis seemed new to me. I think that even not so orthodox economists have a rational expectations reflex — we look for models which work if economic agents (other than policy makers) have rational expectations. I think there is a method which considers one deviation from 50s era general equilibrium models at a time. So if there is a ZLB, then people are rational about the ZLB.

Also even in models with irrational exuberance and panic, it is natural to economists to assume that everyone has the same irrational beliefs. The differences between TIPSs breakevens, Livingston Survey forecasts and Michigan U survey forecasts are very alien to us.