Underconsumption, Income, Wealth, and Capital Gains

I’m rather devastated to find (thanks to Tom Brown at Pragmatic Capitalism!) a discussion I missed at Winterspeak’s place from mid-December, with some of my favorite commenters going after the underconsumption argument that I’ve been going on about.

It starts by citing Mark Sadowski’s comment from Interfluidity “clarifying the difference between wealth and income.”

I found that rather puzzling at first because the first-blush, obvious difference between the two is that one’s a flow and one’s a stock. Duh. But I figured out that he’s actually distinguishing between income and capital gains, making the well-known point that in the language of national accounts, capital gains aren’t income.

I’d like to address two points here:

1. I think JKH would say that this is all as it must be — that it’s conceptually incoherent to think of capital gains as income. I understand why he would say that. But I’d like to push back on that.

Imagine a company in two counterfactuals — a simplified, stylized representation.

Scenario A: All earnings/profits are paid to shareholders as dividends every year. Book value remains unchanged.

Scenario B: All earnings are retained. Book value increases 1:1 with earnings.

Now: a shareholder holds shares for thirty years, then sells at book value. (Assuming the paid-out dividends and the retained earnings are “invested” identically — say in physical cash that earns no interest, to keep things simple.)

At the end of the period, the shareholder has received all those earnings in each scenario, and has identical wealth in each scenario.

Is it conceptually coherent to say that in scenario B, the shareholder had zero income?

Within the linguistic and logical constructs of the national accounts, yes. But in any reasonable economic construct, it’s crazy. The shareholder accrued those earnings every year; they were just “unrealized” via sale. Just because those earnings were tallied up on the corporation’s books, instead of the individual’s (and eventually transferred to the individual’s), can we reasonably say that the shareholder’s share of corporate earnings were not accrued income?

See JW Mason’s comments at Winterspeak for more on this, expressed more authoritatively than I can achieve.

2. Sadowski says “In underconsumption theory recessions and stagnation arise due to inadequate consumer demand relative to the production of new goods and services.”

That may be true. But I would suggest that underconsumption theory is not nearly so standardized — that in fact it’s wildly un(der)theorized. (I do wish [liberal] economists would get on this hobby horse…)

In my bruited notion of underconsumption, stagnation arise[s] due to inadequate consumer demand (“spending”) relative to wealth — which I define somewhat roughly as the total stock of financial assets. (Claims on real assets, or future production, which have a rough equivalence that I won’t discuss further here.*)

It’s a straightforward monetarist(ic) velocity argument, but with “money” defined as “the exchange value embodied in financial assets.” (In this construct, all financial assets embody money, including those things like currency that have traditionally, in the vernacular, been called “money.”) So the “money stock” is the market value of all financial assets, from dollars to deeds (yes, deeds) to CDOs.

Because of declining marginal propensity to spend relative to wealth (which I think no one will contest), increased concentrations of wealth, arithmetically and inexorably, result in lower money velocity, ceteris paribus.

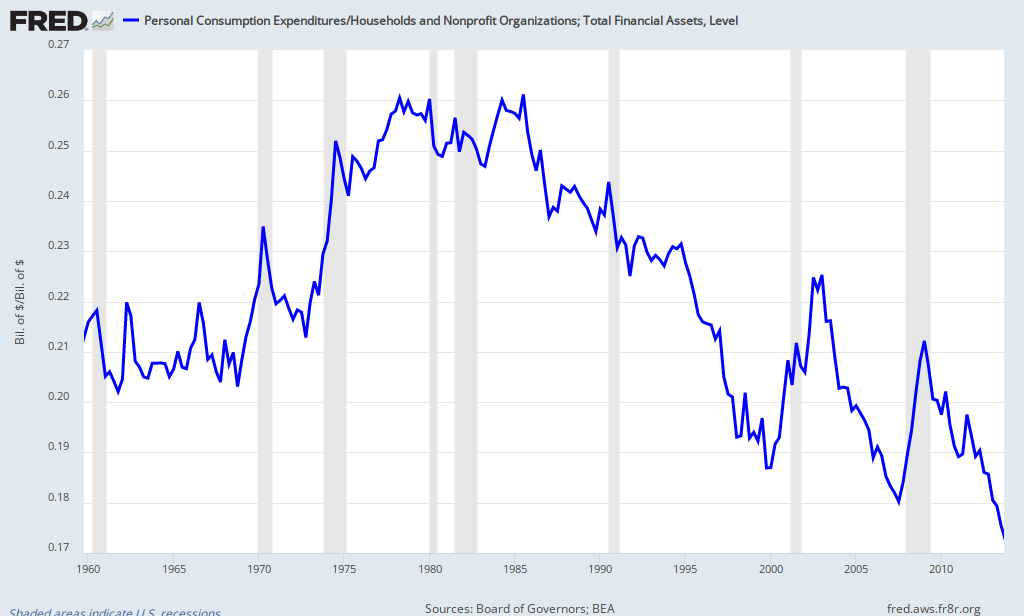

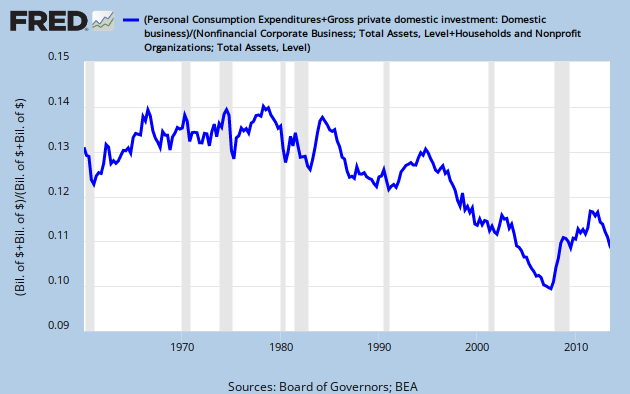

I posted two graphics to demonstrate this velocity/stagnation situation over the decades. (You can argue with the specific economic measures used here, but they’re reasonably representative of the big picture.)

Personal Consumption Expenditures as a percent of Household Financial Assets:

(Personal Consumption Expenditures + Business Investment Spending) / (Household Total Assets + Business Total Assets)

Now these are showing ratios, and it’s possible that an increased denominator (assets) is where the big secular change occurred: arguably many more of the country’s real assets were financialized/monetized/capitalized over the decades shown. (Think: student loans monetizing/present-value-capitalizing those student’s human capital and future earnings.)

But if we’re just surmising, we can say it’s equally possible that the declines here are numerator-driven — resulting from declining spending out of wealth due to wildly increased wealth and income concentrations. I’d expect that both are true.

Somewhat as an aside, I also made a straightforward “money-supply” assertion about recessions, again using my preferred definition of “money.” I’ll share it in the concise language that Twitter requires and encourages so admirably:

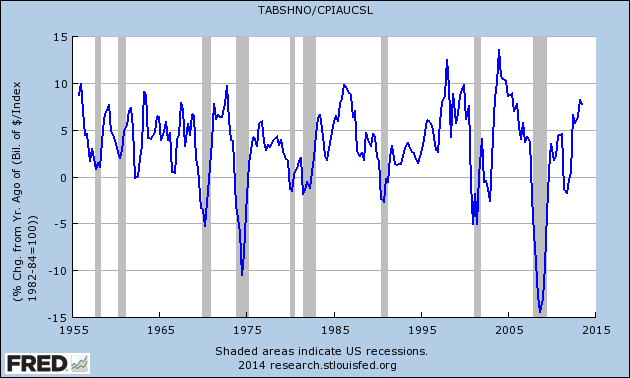

Every recession since ’60 preceded by decline in infl adj value of HH assets. Two false (?) positives: 02 and 11.

— Steve Roth (@asymptosis) January 10, 2014

This is getting long so I’ll stop here, with one final assertion:

Any aggregate consumption function (viz: Keynes’) that doesn’t incorporate some measure(s) of wealth, that doesn’t incorporate some measure(s) of wealth and income distribution, and that doesn’t include (distinct and probably interdependent) functions for declining marginal propensity to spend out of wealth and out of income, is useless.

* I have to toss in one more pet peeve here: financial assets (often called financial “capital”) are not capital! They’re claims on capital. And contrary to much sloppy and often implicit thinking and discussion that you see out there from professionals and amateurs alike, they’re not an “input to production.”

Cross-posted at Asymptosis.

Regarding the first 2 graphs, I think you can make your point, independent of denominator.

On a log scale, you can see an inflection and slope change ca. 1980.

http://research.stlouisfed.org/fredgraph.png?g=qTq

Alternatively, look at YoY% change – clearly trending down after 1980 [or possibly 1970.]

Mark likes CARC, so let’s look at that, too. Same story, and most dramatically so, in this century.

http://research.stlouisfed.org/fredgraph.png?g=qTr

Really, by any measure, it has all gone to hell in this century, when inequality has been the greatest on record, and increasing.

JzB

I am sympathetic to your arguments but I don’t think they address the root cause of our problem.

Our current disaster began in earnest sometime in the mid 1980s. American corporations began to move production to the lowest wage countries that they could find. Their incentive was simple, increase profit margins. This did not require any grand conspiracy.

American labor could not compete with those low wages because the cost of living is so much higher in this country. That was impossible from the beginning.

And the vast majority of those low income foreign workers could not afford to buy the products that they produced. That was also impossible from the beginning.

Americans began saving less and less, and borrowing more and more until in 2005 the personal savings rate was .5% and Greenspan and Kennedy reported that Americans took $577billion in equity out of their homes for PCE that year. And during that same period the Fed Funds Rate was moved lower and lower in an attempt to stimulate an economy with ever increasing problems.

In a September 2008 letter to my US Senator I pointed out that “The American workers are the American consumers and consumers can not spend what they do not have.” And in a October 2011 letter to my US Senator I pointed out that “But Global Free Trade has become religious dogma, so neither political party is going to do that until every other technique has been tried. Meanwhile consumer demand will continue to be suppressed, so I expect this economic disaster to go on for a decade, or two.” (The phrase “going to do that” referred to putting tariffs on imported goods.) I received the standard form letters.

I believe that at least some of the income inequality was created as a result of cheap foreign labor forcing American labor to moderate their demand for increased wages. And later American labor was forced to be content just to have work. And with a diminished ability to change jobs, most American labor lost the last of their bargaining power.

We are downsizing our economy, one step at a time. I do not regard a jobless recovery as a recovery in any meaningful sense.

We don’t have to address Global Free Trade and the problems that it has brought us. We can continue down the current path of doing almost nothing of long term consequence. (Outside of accumulating debt.)

JimH

You are confusing Overhead with Direct Labor wages. It is Overhead which is the highest cost factor. The difference between direct labor costs are minimal in comparison.

When Piketty’s new book ( in English ) – “Capital in the 21st Century” – hits the shelves in March , we’ll be seeing a lot more discussion of the wealth inequality / income inequality nexus.

He makes the point that if the return on capital is higher than the growth rate of the economy , by definiton capital share of income increases and labor share of income decreases. And an increasing wealth/gdp ratio , as we’re seeing now , only accelerates the process.

His definition of “capital” is really more of what we call “total net worth” , and given the relative liquidity and interchangeability of assets these days , that makes sense to me in looking at the big picture. After the housing bust , housing assets have less of a moderating effect on wealth inequality than they used to , and that trend seems likely to continue.

Here’s a couple reviews of the book , one by DeLong and one by Branko Milanovic :

http://equitablegrowth.org/2013/12/18/1348/tomas-piketty-capital-in-the-twenty-first-centuryinequality-and-capitalism-in-the-long-run-the-honest-broker

http://mpra.ub.uni-muenchen.de/52384/1/MPRA_paper_52384.pdf

I think to be more complete in your definition: stagnation arise[s] due to inadequate consumer demand (“spending”) relative to wealth

You need to add “distribution” after wealth. Sadowski’s definition is more focused mechanics (physics?). It does not consider the why it purely defines the action. You seem to be going more for the why of the action. To leave it as “wealth” I think is to broad.

Wealth can and has risen, yet we still have declining overall numbers. This would suggest the speed of wealth creation has declined (declining avg growth) and this would get at my numbers of the top 1% doubling their income faster than the economy has grown. This is your wealth distribution pendulum having swung way to far. We have seen more dramatic examples of sucking the money out faster than it can be made through out the world too (The PIGS, USSR and just about anyo other 3rd world nation that has been played).

run75441:

“You are confusing Overhead with Direct Labor wages. It is Overhead which is the highest cost factor. The difference between direct labor costs are minimal in comparison.”

It appears that you are suggesting that the overriding factor in moving production overseas was for savings on things other than wages.

This is a new one to me and I have serious doubts about it. But I am curious. What is included in Overhead?

Are Direct Labor wages included in Overhead? Are we talking about one time building costs, ie building permits and environmental impact studies. Does savings on Overhead include much lower taxes? I once bribed a police officer with a six pack of beer in a central American country, but I believe that their taxes were lower. :^)

I note that China is developing a reputation for air so dirty that pedestrians wear masks. (I watch a little NHK television news.) Does Overhead savings include the burning of cheap coal without adequate air pollution controls?

The U.S. company, in the news, for polluting the drinking water of multiple counties in West Virginia will face huge costs that a Chinese company probably would not. Would that savings be included in Overhead?

I understand that there are other legitimate savings to be had in foreign production. But wages were a major factor. And I am surprised that there are other major savings factors at all.

Or if you are putting me on, then I will smile and breath a sigh of relief. I capitalize Global Free Trade for the same reason that I capitalize the names of other religions. :^)

I would think that one big benefit of moving production over seas is transfer pricing. It just makes it easier. Plus a lot of what we consider production by our companies is actually royalty collection. They off loaded much of the “overhead” costs. This based on a report by the Japanese Finance Ministry (I can ‘t find the paper, but reported on it years ago).

@Jazz: “On a log scale, you can see an inflection and slope change ca. 1980.

http://research.stlouisfed.org/fredgraph.png?g=qTq”

I can’t really. Even when I draw a line, it all depends on how I draw it relative to that flat period ’79-’83 — 1. across the top of ’79, or 2. through the middle of the flat period?

Even #1 doesn’t show a big trend change (my line and actual stay the same distance apart up to 2008) — just the lack of a big enough trend increase to come back to the previous trend (the trend imputed by hitting the ’79 high)..

1. Even if corporations are saving on behalf of their stockholders it does not change the fact that the evidence in support of the underconsumption hypothesis is very weak. In fact Krugman has already effectively debunked this claim:

http://krugman.blogs.nytimes.com/2013/01/20/inequality-and-recovery/

“…So you turn to the data. We all know that personal saving dropped as inequality rose; but maybe the rich were in effect having corporations save on their behalf. So look at overall private saving as a share of GDP:

[Graph]

The trend before the crisis was down, not up — and that surge with the crisis clearly wasn’t driven by a surge in inequality…”

In fact when one looks specifically at the corporate equivalent of personal savings which is “Net private saving: Domestic business” (A127RC1Q027SBEA) it declined from an average of 3.5% of GDP in the 1970s to 2.8% of GDP in the 1980s to 2.5% of GDP in the 1990s all while inequality was surging:

http://research.stlouisfed.org/fred2/graph/?graph_id=152807&category_id=0

2. “See JW Mason’s comments at Winterspeak for more on this, expressed more authoritatively than I can achieve.”

JW Mason made no comments at Winterspeak that I can see. The only comments he made were at Interfluidity and the exchange with me was constructive.

3. The Wealth Effect refers to to a change in spending that accompanies a *change* in perceived wealth. The empirical evidence on this effect varies considerably in terms of statistical significance, magnitude, term of adjustment and by type of asset. But in general a $1 change in perceived wealth eventually results in approximately a nickel’s change in consumption spending.

There is however, to my knowledge, no equivalent concept where consumption is a function of current wealth.

4. “Every recession since ’60 preceded by decline in infl adj value of HH assets. Two false (?) positives: 02 and 11.”

We have year on year quarterly evidence going back to 1952Q4. There is no evidence at all of a decline in yoy real household wealth before the 1953, 1957 and 1960 recessions. There was a decline in yoy real household wealth in the quarter preceding the 1969 recession, the four quarters preceding the 1990 recession, the two quarters preceding the 2001 recession and in the quarter preceding the 2008 recession. But the first decline in yoy real household wealth in the 1973, 1980 and 1981 recession occured during the recession, not before it. And in addition to the declines in 2002 and 2011 there was also a decline in 1962.

In short, out of 10 recessions there are three with no decline in real household wealth at all, three with a decline during the recession and only four with a decline preceding the recession. Furthermore there are three declines without any corresponding recession. This is not a very effective leading indicator of recessions and there are many other indicators which are much more accurate, always precede the recession and often by a sizable period of time (e.g. the yield curve).

5. I personally would like to see a lot less assertions and a lot more evidence in the econoblogosphere. But I’m not holding my breath.

“…In fact Krugman has already effectively debunked this claim: …

In fact , more recently , Krugman has debunked Krugman :

http://www.nytimes.com/2013/12/16/opinion/krugman-why-inequality-matters.html?partner=rssnyt&emc=rss&_r=1&

“….After the crisis struck, the continuing shift of income away from the middle class toward a small elite was a drag on consumer demand, so that inequality is linked to both the economic crisis and the weakness of the recovery that followed. …..”

Sounds like he’s talking underconsumption to me.

At least he can admit he was wrong. Not everyone can do that.