How The Great Moderation Destroyed the Fed’s Credibility

Much ado is made of the Fed’s “credibility,” which is dog-whistle-speak for its ability, willingness, and decided inclination to jump all over any (expected or imagined) whiff of that horrifying threat — inflation! — especially the most terrifying bogeyman, “wage inflation.”

You won’t, on the other hand, find “credibility” discussed when people speak of the Fed’s inevitably weak-kneed inclination to raise inflation (expectations).

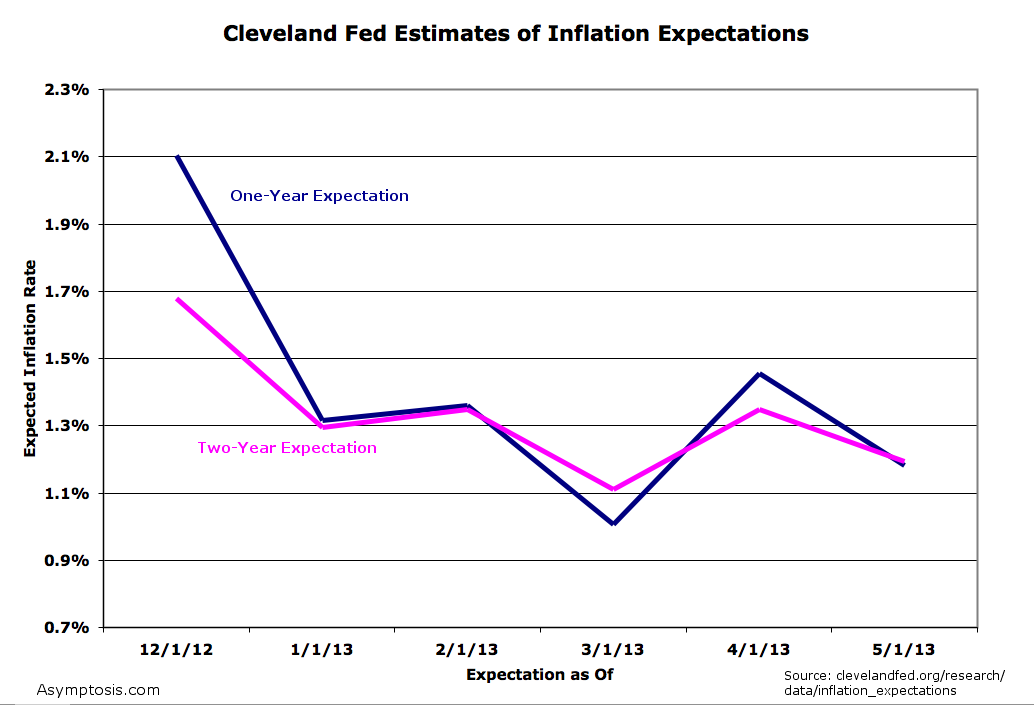

So after thirty years of diligently establishing its reputation for credibility, the Fed has no credibility. They announce on December 12 that they’ll allow inflation to go as high as 2.5% (shock! awe!). And what happens to inflation expectations?

Yes, it was a limp-wristed “promise”: they would only allow that irresponsibly dangerous hyperinflationary jump to 2.5% if unemployment remained above 6.5%. (Pick a mandate, any mandate. You know which one they’ll choose.)

So after three decades of diligently protecting responsible creditors from the manifest evils of inflation, and imposing responsibility on feckless, impatient entrepreneurial, risk-taking borrowers, nobody believes for an internet minute that the Fed can or will address the unemployment side of their mandate — that it has the wherewithal to do so, or the inclination if it did.

Got credibility?

Cross-posted at Asymptosis.

A) I don’t believe in inflation expectations being created by the fed. It can also be a mixed signal with lower rates simply signalling crappy economy expectations

B) The important discussion is what are acceptable inflation rates under different conditions. If inflation hit 4%, I would hardly panic.

C) We must differentiate between price increases, and inflation. Some prices just go up based on supply and demand. The higher price will probably correct itself. Then you have indexing, where the government supplies more money to allow people to buy more goods at the higher prices creating an inflation spiral.

Matt

are you suggesting that when the price of food and rent go up the government resist raising “benefits” or even “wages” to avoid fueling inflation?

Coberly, in most cases no, benefits should go up. If inflation for food was 4%, and the CPI 4% then SS benefits should go up 4%. It is a balance. Wages will only go up when we are at full employment, and right now we only get to full employment through government spending.

Ok, with all that said we live in a more complex world. If China drives up prices, and we respond by adding too much fuel you could get the indexing spiral. Sometimes it is best to let prices do their work.

More – Inflation occurs in a healthy economy, and hyperinflations (ok I will loosely define as an accelerating, and perceptibly “unstoppable” rate of inflation of way more than 10%) occur for reasons other than money printing. Money printing is usually a response that makes it worse, and does not address the root cause.