About Scaring that Confidence Fairy Away

Here’s how:

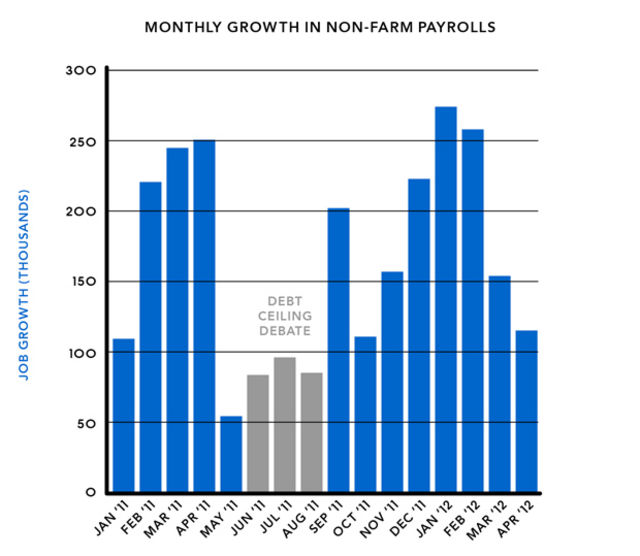

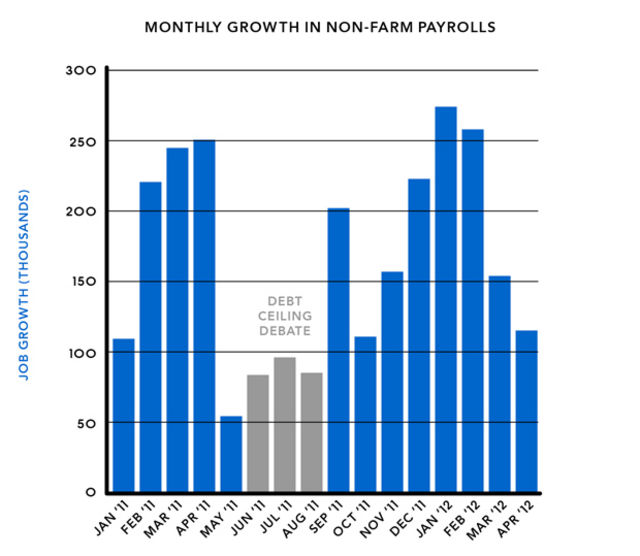

From Betsey Stevenson and Justin Wolfers at Reuters, hat tip to Matt Yglesias.

Cross-posted at Asymptosis.

Here’s how:

From Betsey Stevenson and Justin Wolfers at Reuters, hat tip to Matt Yglesias.

Cross-posted at Asymptosis.

OK, I’ll bite. What is consumer confidence? And if that graph really indicates it, why have economists been talking about the lack of confidence all this time?

OK, I’ll bite. What is consumer confidence? And if that graph really indicates it, why have economists been talking about the lack of confidence all this time?

OK, I’ll bite. What is consumer confidence? And if that graph really indicates it, why have economists been talking about the lack of confidence all this time?

Con Con follows the stock market. When polled people wanting to sound like they know about the economy report their ‘confidence’ based upon how the stock market is doing. The only time I recall a significant divergence was in the spring and summer of 08 and guess who was right. Hint: it wasn’t the stock market.

depends on who you ask; Reuters/UofM says its up for the ninth straight month, a new record, Gallup says its at a 4 year high, the conference board’s latest is a 5 month low, & only 33% of respondents to NBC/WSJ believe the economy will get better in the next year, down five points from April and seven points from March…

There have been numerous divergences between confidence and the stock market.

The stock market crash of 1987 immediately comes to mind.

But the start of almost all new bull markets precedes consumer confidence bottoming by several months.

Stock market is the way to earn more money. It helps to make more money but this depends upon how muh you want to invest in stock market.