Lending, Velocity, and Aggregate Demand

JKH likes this line in Keen’s response to Krugman:

The endogenous increase in the stock of money caused by the banking sector creating new money is a far larger determinant of changes in aggregate demand than changes in the velocity of an unchanging stock of money.

It struck me as an empirical question: how do those changes compare in magnitude? I didn’t know offhand.

Let’s start with MZM (money of zero maturity, the broadest definition of money), and GDP:

There’s about $10 trillion in MZM right now, and GDP (annual spending) is at about $14 trillion.* The money stock turns over about 1.4 times per year.

If money supply was unchanged — no new net lending/borrowing — but the musical chairs/logrolling game sped up so money turnover increased by 5%, because people were more optimistic — ready to take chances, consume now while worrying less about later, invest in new housing and productive capacity, etc. (“animal spirits”) — that would add $.7 trillion to aggregate demand. (5% is quite a GDP jump given no new net lending…)

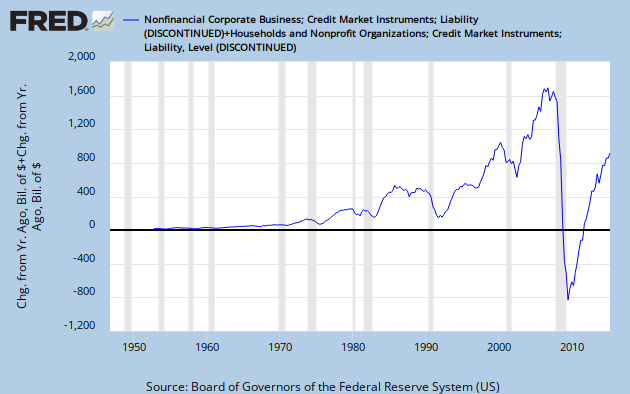

Now lets look at annual net borrowing/lending — annual change in debt outstanding for households and nonfinancial firms:

Plus $1.6 trillion, to minus $.4 trillion. We’re looking at magnitudes far beyond what we could reasonably expect from pure animal-spirit-driven velocity changes.

Now it’s true that much of that lending/retiring might not translate directly into purchases/production/consumption of real goods. Much of it might (does) leak into changes in financial asset prices. (Keen is keenly aware of this. It’s pure Fisher/Minsky.) Yes, that portion could affect real-good transaction volumes via a second-order wealth effect, but the magnitude of that effect is unclear.

But it seems from the magnitudes that Keen’s statement is probably correct: changes in borrowing and de-borrowing have a lot more potential effect on aggregate demand, at least, than changes in velocity.

* Note that this does not include spending on intermediate goods — those that are turned into final goods within the accounting period — or used stuff. Adding these into total spending when calculating velocity might yield interesting insights. See Nick Rowe, Macroeconomics and the Celestial Emporium of Benevolent Knowledge.

Cross-posted at Asymptosis.

I’m glad the focus is shifting to sectoral debt, rather than aggregage.

But 5%? The velocity of MZM has fallen by something like 25% and is now some 20% below the pre-recession record low of the mid-60s.

In any case, aren’t the two connected?

Let’s be clear, though. About 1.4 trillion of the 2 trillion was in household mortgage debt alone. While some of that earlier lending involves homeowners cashing out equity, it’s not going to be that much…

I’m glad the focus is shifting to sectoral debt, rather than aggregage.

But 5%? The velocity of MZM has fallen by something like 25% and is now some 20% below the pre-recession record low of the mid-60s.

In any case, aren’t the two connected?

Let’s be clear, though. About 1.4 trillion of the 2 trillion was in household mortgage debt alone. While some of that earlier lending involves homeowners cashing out equity, it’s not going to be that much…

@D R: “In any case, aren’t the two connected? “

Certainly. Optimism and animal spirits drives borrowing and lending, not just spending. I was trying to distinguish the two, and get a feel for their relative magnitudes.

“About 1.4 trillion of the 2 trillion was in household mortgage debt alone.”

Which 2 trillion are we talking about?

Continuing to excuse the dups, here. Still no idea why that’s happening…

Anyway, if you put GDP at $15 trillion, then a fall in velocity of 25% means a loss of $3.75 trillion. By comparison, the fall in “lending” from $1.6 trillion to -$0.4 trillion is only $0.6 trillion if you exclude the mortgage debt.

Now, I don’t think that means much. If you want to know how much liquidity is made available, and you want to compare to the loss due to a fall in MZM velocity, then you should probably use the change in MZM. No?

MZM money growth, of course, fell by about $1.4 trillion. Then again, it fell by about $1 trillion last recession….

Continuing to excuse the dups, here. Still no idea why that’s happening…

Anyway, if you put GDP at $15 trillion, then a fall in velocity of 25% means a loss of $3.75 trillion. By comparison, the fall in “lending” from $1.6 trillion to -$0.4 trillion is only $0.6 trillion if you exclude the mortgage debt.

Now, I don’t think that means much. If you want to know how much liquidity is made available, and you want to compare to the loss due to a fall in MZM velocity, then you should probably use the change in MZM. No?

MZM money growth, of course, fell by about $1.4 trillion. Then again, it fell by about $1 trillion last recession….

Continuing to excuse the dups, here. Still no idea why that’s happening…

Anyway, if you put GDP at $15 trillion, then a fall in velocity of 25% means a loss of $3.75 trillion. By comparison, the fall in “lending” from $1.6 trillion to -$0.4 trillion is only $0.6 trillion if you exclude the mortgage debt.

Now, I don’t think that means much. If you want to know how much liquidity is made available, and you want to compare to the loss due to a fall in MZM velocity, then you should probably use the change in MZM. No?

MZM money growth, of course, fell by about $1.4 trillion. Then again, it fell by about $1 trillion last recession….

hmmm…just a heads up on another krugman post in the same series…

Banking Mysticism, Continued – Krugman – A bit of a followup on my previous post.

he doesnt mention any names or link to anyone, just pushes back against “various writings here and there”

“changes in borrowing and de-borrowing have a lot more potential effect on aggregate demand, at least, than changes in velocity.”

I read Keen as saying that borrowing/de-borrowing was a better indicator of demand. Isn’t borrowing events the result of demand and not the other way around?

Keen ” determinant of changes in aggregate demand

I don’t know whether this helps, but between 2002 and 2006, consumers pulled about $1 trillion out of their homes in the form of equity extraction. That is my estimate, based largely on a paper by Greenspan and Kennedy published by the Fed in 2007. I believe that $1 trillion was largely spent by the consumers, resulting an increase of about that amount in final demand in those years. That sort of equity extraction stopped in 2007 and reversed in 2008, which meant that cosumers had about $200 billion less per year to spend each year thereafter, even forgetting about decreases in jobs and income.

The claim was that this would be an “empirical” question. That mean that we will rely on observation. You have, instead, employed numerical example. It is possible to undertake empirical examination, though. You can compare the change in the velocity of some monetary aggregate over some period (say the period of contraction or the subsequent period of recovery) with changes in nominal GDP and see what sort of relationship exists. My suspicion is that you’ll see velocity during either of those periods is very closely related to GDP, depending on which aggregate you choose, of course, because the Fed was doing its utmost to avoid a contraction in the aggregate.

If I’m right, then the whole exercise becomes suspect, because velocity doesn’t always respond so directly to Fed action. That is to say, there is no stable relationship, and since Keen’s claim is made in universal terms, it would have to be rejected.

It’s sort of not one nor the other, isn’t it? Aren’t we consumers thought to have a variety of preferences, including a liquiity preference and a preference represented in our marginal propensity to consume from income? If we have both of those, then our desire to hold funds determines our desire to spend and our desire to spend determines our desire to hold funds. I think both probably are correct, in which case, again, Keen has to be rejected. As do most other absolute statements about human behavior.

If the prospective buyers can’t get loans, they can’t buy the desired widgets. Their desires are then aggregate hankering, rather than EFFECTIVE demand, which is what Keen is talking about