US 10 Year Interest Rates

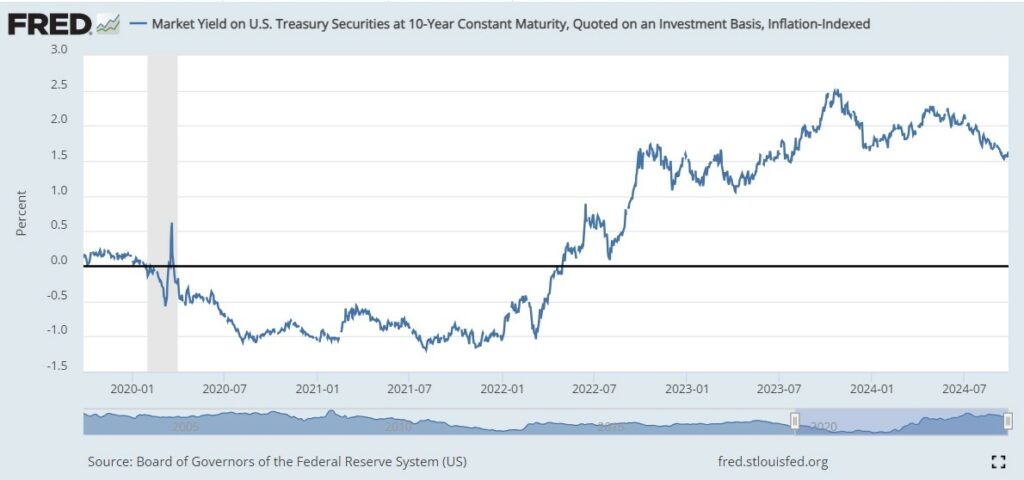

Why have they increased so much. The US Treasury constant maturity 10 year interest rate has increased dramatically since the FED started fighting inflation (after falling dramatically during the Covid 19 epidemic)

The increase is not unusual — Monetary policy effects GDP and employment through medium and long term interest rates, especially including the interest rate on 30 year mortgages. But I think it should be surprising.

Before going on, I have a bit of very useful investment advice: do not take investment advice from Robert Waldmann. WIth that disclaimer posted, I have to say that I have the impression that long term treasuries are a good buy when the Federal Funds rate is high — that is I think the price drops too much 9so the return increases too much). The 10 year rate should be the average 3 month rate over 10 years plus a roughly positive constant reflecting risk and the extreme liquidity of 3 month bonds. It looks as if investors expect the (overnight) Federal Funds rate to remain elevated for a significan part of a decade. This would be unusual except for during periods of persistantly elevated inflation (that is the 70s and 80s).

One reason for a high nominal interest rate is that investors expect high inflation, so the expected real rate is not high. However, the 10 real interest rate paid on Treasury Inflation Protected Securities also increased dramatically

The difference (TIPS sppread) whcih reflects expected iflation (and again a liquidity premium) changed little. Also surveys of ordinary people and experts all showed little change in medium term inflation expectations. Dramatically increased expectations of inflation over 10 years are not the explanation.

Another possible explanation is that the increases in 10 year rates reflect not the tight monetry policy but the fact that it didn’t cause a recession. A news hook is that the final estimate of 2024 second quarter GDP growth is at an annualized rate of 3% — no recession there. This contrasts dramatically with forecasts — some rated the probability of a recession at 100%*. In an earlier post I have guessed as to why this happened (that is why aer receession hasn’t hapened). The argument is that, given the combination of a high Federal Funds Rate and continued GDP growth and low unemployment, investors have decided that high rates are the new normal.

A third possibility has to do with the strangeness of investing and especially of people managing other people’s money. The argument that 10 year rats should be the 10 year average of 3 month rates plus a roughly constant premium relies on treating revenue (interest yield) and expected capital gains equally. Interest is in the bank. It is possible that interest and capital gains are treated very differently not just because of normal risk aversion, but because of the special risk aversion of a money manager who does not at all want to be explaining how the strategy worked in expected value, because there were probably going to be capital gains which did not happen to materialize.

This distinction between the second (new normal) and third (asset prices are strange) explanations matters a lot. In particular if one wishes to know if the US Federal Debt is sustainable one wishes to forecast future long (and short and medium) term real interest rates which determine whether the debt can be rolled over forever or not. This is a topic of great interest to me and will be the topic of another post.

* The 100% chance of a recession was a bad forecast no matter what number came out of a model which was necessarily based on assumptions. The model ignored Damon Runyon’s Law that nothing between human beings is more than three to one . More generally, a reasonable estimate of a probability made using a model must consider the far from zero probability that the model is not a good approxination to reality. I am tempted to go on and disuss the 2008 financial crisis and Sam Wang eating a live cockroach (in contrast to Nate SIlver who included an all the polls night be biased term and did not eat a cockroach). However, I have no idea when I would stop if I started and mocking “100%” is not supposed to be the point of this post.