Eliminating taxes on Social Security is a bad idea

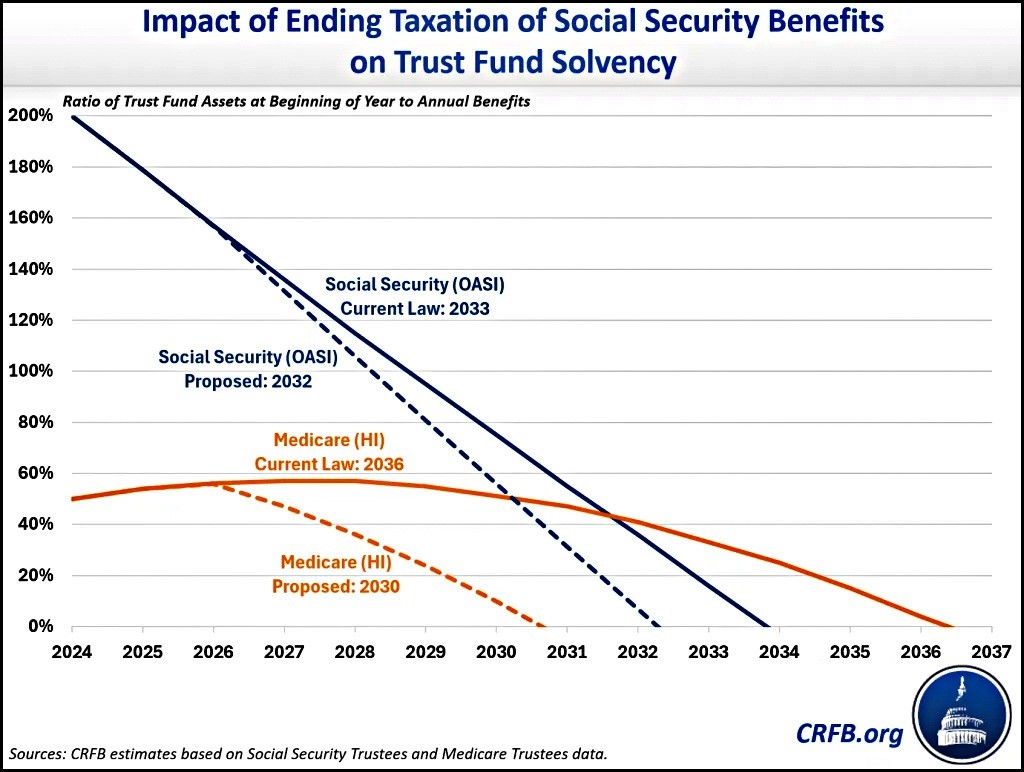

Normally, a sentence that begins “Donald Trump says . . . “ is not worth finishing, and that’s how a recent blog post over at jabberwocking.com begins. But finish it I did, and it turns out that DJT says he wants to eliminate all federal income taxes on Social Security. Currently, if SS is your only income, there already are no federal taxes on it. If you make additional income above your SS distributions, you can be taxed at normal federal rates on up to 85% of your SS check, depending on how much additional income. The income taxes on SS go back to the trust fund to extend its life.

So why would Trump support this? Because (a) it’s a tax cut for the wealthy and (b) it depletes the SS and Medicare trust funds sooner, creating problems for non-wealthy retirees who depend on these programs. For the American right, that’s a feature, not a bug.

How SS finances are affected by ending taxes on benefits

We change or ammend many laws over time and there is no reason we can’t change the section of the SSI law for funding this program too. Why cant S.S. and medicare be funded, like almost all other programs, through the general fund? No tax increase required.

@Mike,

If SS were funded through the general fund, it (and Medicare) would be targets for tax cuts every year. And of course, every time taxes are cut, it follows as night to day that politicians will bleat about the deficit and demand cuts in benefits. That was the genius of FDR. By making it a separate insurance program funded by workers only and insulated from the politics of the general fund budget process, it has been protected (so far) from such predictable attacks.

My view is that the funds involved here are general revenue. They are not payroll taxes. They get applied to SS, but they are not included in my benefit calculation. They are the only funds into the system coming from individuals that have no benefit at all. At least give me benefit credit and $1.04/month or whatever it’s worth. It’s just some income tax, and a small step along the way to more general funding. Also, since making adjustments to head off the substantial shortfalls expected next decade are not exactly making rapid headway, maybe pulling the shortfalls in closer actually will be a good thing.

Sorry I’m advance for so many comments. FDR had much, much better demographics to make the system work without more general funding or (gasp) means testing benefits. I do not say SS is a Ponzi scheme, since clearly it wasn’t a fraud, but what we are seeing now and may see increasingly are the similar kind of revenue/cost dynamics. We have smaller generations coming into the labor market and expected longer longevity for beneficiaries. Capital has shown tremendous skill at limiting labor share of national income. AI could actually drive a lot of productivity over the next 50 years. Do we think that productivity will be widely shared or that AI will move beyond what most humans can match as to value-add, resulting in low wages for most. ‘I can run my KwikTrip with people making $35k and ‘lite benefits’ and not automate too much. But my brother has applied AI to his auto shop and he has shed 9 employees averaging $85k + good benefits.’ Are those guys finding better jobs? Maybe a few, but many probably won’t. In an odd way, I find the pressure to increase minimum wages a warning sign here. Instead of thinking there will be a good career path ahead of the $12 Pizza Hut job, many are thinking that things like this plus side hustles is what they will be doing long-term, so it’s a little better at $15. If AI works -and it will I think based on status 5 years ago and its capacity today – dystopia is coming guys barring uprooting current concepts of ownership. Think for a minute about Biden’s fate. Millions voted for him, but the money ran away and money got its way. I didn’t think he was up for the job, but I don’t think the people who shoved him actually are thinking of a future labor market generating more SS taxes from well-paid workers. Don’t think Republicans are either. Action on climate change will also likely be a net drag on SS. Seems to me there is a decades long disconnect between the stated goals and the realistic energy transformation need to get there without brute force reductions in living standards. Can’t see that as good for income transfer programs really.

@Eric,

Thanks for your questions. To answer them would require the gift of prophecy, which I don’t possess. Perhaps there are others here who do. But they are certainly relevant issues and fitting for this comment thread.

That said, I’m not sure how the future you envision for AI justifies eliminating taxes on SS.

Whenever I see someone write SSI when talking about Social Security I feel a need to comment because SSI is a separate program with separate funding.

I’ll leave the overall fairness of taxing this off to the side, but I do think that in making this calculation the IRS should allow you to not consider income on which the beneficiary is paying the normal SS taxes. A sibling’s SIL is collecting benefits, but still self-employed paying ~12% on the earnings and those earnings are exactly what push her to pay income tax on her benefit. I asked if she was certain she needed to make the 12% contribution. She said she was, but this seems abusive.

Eric:

If you work, you still pay taxes. If you are self-employed, you pay the employer part also. However, the employer part is deductible.

So she’s right that income on which she already pays 12+% SS pushes her to pay taxes on the benefit. I am not sure of my feelings about taxing it ever, but for sure I would support not counting income which itself directly generates SS revenue from this threshold.

Eric:

What else did I and others say? Not everything thing is taxable.

Eric:

After the 25% deductible comes other deductions. I was told, my wife and I will never owe unless we withdraw a lot more than what was available as deductions (house mortgage interest comes to mind, property tax, etc. etc. We sold the old large home and downsized to smaller home. Out of that $25,000 you pay $2000 for Part B. Part B is deductible under certain circumstance as well as long Term Care Insurance. It is not as simples as you make it sound. Very similar to itemizing.

The rationale for taxing SS benefits included that fact that other retirement income is taxable and SS contributions are not taxed, so people receiving a significant untaxed benefit should be taxed.

SS has many compromises because while it is insurance, having claims adjusters making decisions about how much each person needed for retirement security would blow the administrative costs through the roof. The formula says if your sister has enough income on top of her benefit, it is unlikely her need for retirement security is higher than someone without added income. I suspect it is a reasonable compromise.

Arne:

I suspect you suspect correctly. I am going to send you something you should stow away. A Google site with megas of SS info, etc. I do not want it to be lost.

I think most of us agree that eliminating the tax on Social Security over a certain threshold is a bad idea. But most of probably also think that eliminating tax on tips is a bad idea too. The question is how does the Harris campaign respond. They quickly signed on to the no tax on tips plan and I think that they might also agree to the no tax on Social Security too.

Under current law, tax is owed on Social Security income once other income reaches $25,000 in a year. This is not a high income individual. Lots of retired folks make this amount, from interest, dividends, required minimum distribution, rental income, etc. According to the Social Security administration, 40% of recipients are in this category.

Benefits Planner | Income Taxes and Your Social Security Benefit | SSA

With 53 million Americans now receiving retirement benefits, 40% would mean some 20 million in this category. That’s a lot of voters.

Jim:

Then you itemize just like you would normally at tax time. We have other deductions which eliminate the amount we would have to pay.