Wholesale Sales Up 2.0%; and Inventories Up 0.6%

July’s Wholesale Sales Were Up 2.0%; Wholesale Inventories Were Up 0.6%, MarketWatch 666, RJS

The July report on Wholesale Trade, Sales and Inventories (pdf) from the Census Bureau estimated that the seasonally adjusted value of wholesale sales was at $601.3 billion in July, up 2.0 percent (±0.4 percent) from the revised June level, and up 23.7 percent (±1.6 percent) from wholesale sales of July 2020… the June preliminary sales estimate was revised to $589.7 billion from the $588.1 billion in sales reported last month, which is now 2.3% more than May’s sales, revised from the 2.0% increase reported last month…as an intermediate activity, wholesale sales are not included in GDP except insofar as they are a trade service, since the traded goods themselves do not represent an increase in the output of the goods produced or finally sold….

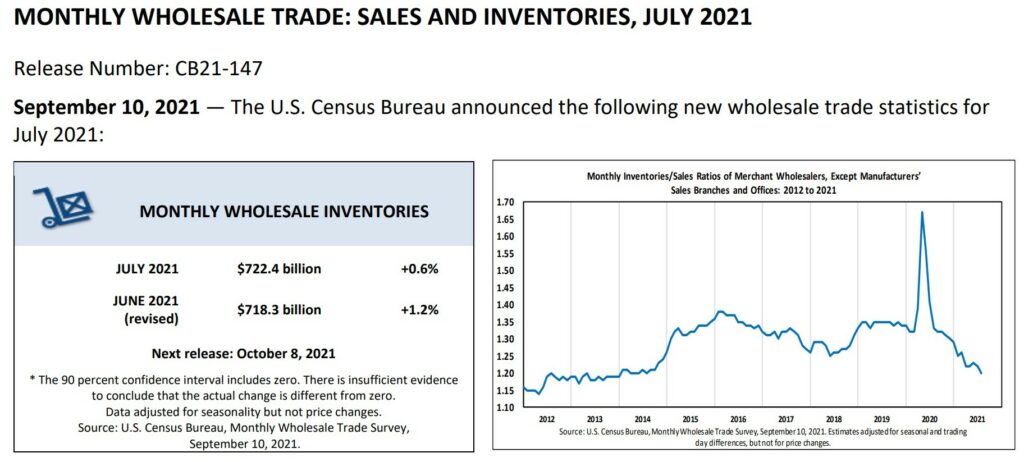

On the other hand, the monthly change in private inventories is a major factor in GDP, as additional goods on the shelf or in intermediate storage represent goods that were produced but not sold, and this July report estimated that wholesale inventories were valued at a seasonally adjusted $722.4 billion at month end, up 0.6 percent (+/-0.4%) from the revised June level and 11.5 percent (±1.4%) higher than in June a year ago, with the June preliminary estimate statistically unrevised from the $718.3 billion reported a month ago, which was a 1.2% increase from May….

July’s wholesale inventories, after an adjustment for price changes for each category of wholesale goods as indicated by the components of the July producer price index, appears to indicate that real wholesale inventories were close to unchanged in chained 2012 dollars during the first month the 3rd quarter….since the key source data and assumptions (xls) for the second estimate of 2nd quarter GDP indicated a real decrease of $3.3 billion in wholesale inventories on a NIPA basis, July’s nearly unchanged real inventories would reverse that 2nd quarter decrease in a small boost to 3rd quarter GDP…