July Durable Goods: New Orders Down 0.1%, Shipments Up 2.2%, Inventories Up 0.6%

July Durable Goods: New Orders Down 0.1%, Shipments Up 2.2%, Inventories Up 0.6%, Commenter and also Blogger at MarketWatch 666

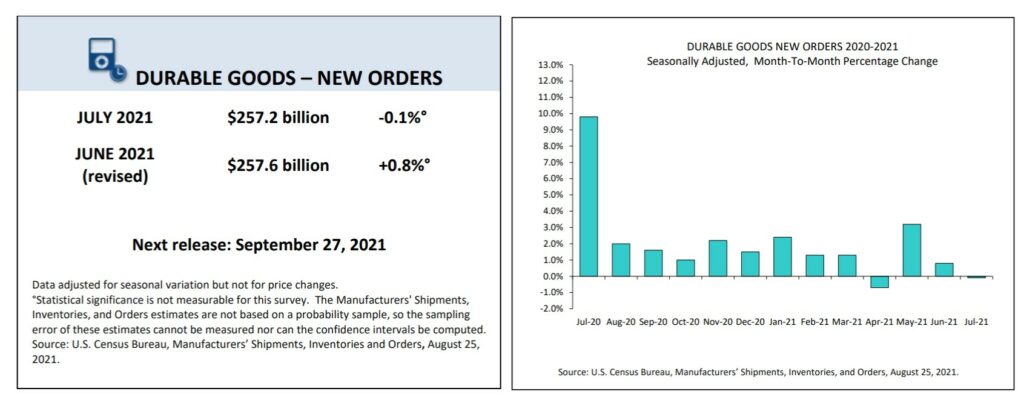

The Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for July (pdf) from the Census Bureau reported the value of the widely watched new orders for manufactured durable goods fell by $0.4 billion or by 0.1 percent to $246.9 billion in July, following a revised increase of 0.8% to $257.6 billion in June’s new orders, statistically unchanged from the increase reported a month ago . . . with that modest July decrease, year to date new orders are now running 25.3% above those of 2020, a decrease from the 26.8% year-to date change we saw in this report last month…

As is usually the case, the volatile monthly change in new orders for transportation equipment drove this month’s headline change, as those transportation equipment orders fell $1.7 billion or 2.2 percent to $75.3 billion, on a 48.9% decrease to $7,374 million in new orders for commercial aircraft . . . excluding new orders for ‘transportation’ equipment, other new orders were up 0.7% in July, even though new orders for nondefense capital goods excluding aircraft, a proxy for equipment investment, remained statistically unchanged at $76,534 million…

The seasonally adjusted value of July’s shipments of durable goods, which will be inputs into various components of 3rd quarter GDP after adjusting for changes in prices, rose by $5.6 billion or 2.2 percent to $257.8 billion, after the value of June shipments was revised from $250.7 billion to $252.2 billion, now a 1.6% increase from those of May . . . a 4.6% jump in shipments of transportation equipment led the July shipments increase, as they rose $3.4 billion to $75.9 billion on a 5.9% increase in shipments of motor vehicles . . . excluding shipments of transportation equipment, shipments of other durable goods rose 1.2%, while shipments of nondefense capital goods excluding aircraft were up 1.0% to $74,484 million, an increase that will be reflected in 3rd quarter GDP equipment investment figures…

Meanwhile, the value of seasonally adjusted inventories of durable goods, also a major GDP contributor, rose for the sixth consecutive month, increasing by $2.7 billion or 0.6 percent to $453.6 billion, after end of June durable goods inventories were revised from $450.5 billion to $451.0 billion, still a 0.9% increase from May . . . an increase of $0.8 billion or 1.9 percent to $40.05 billion in inventories of primary metals was major factor in the inventory increase, while inventories of transportation equipment rose less than $0.3 billion or 0.2 percent to $151.8 billion . . . excluding inventories of transportation equipment, all other durable goods inventories increased 0.8% to $301,873 million…

Finally, unfilled orders for manufactured durable goods, which are probably a better measure of industry conditions than the widely watched but obviously volatile new orders, also rose for the sixth consecutive month, increasing by $3.9 billion or 0.3 percent to $1,225.4 billion . . . that followed a June increase of 0.8% to $1,221.5 billion that was was revised from the previously reported 0.9% increase to $1,223 billion . . . a $2.3 billion or 2.1 percent increase to $109.2 billion in unfilled orders for machinery led the July increase, while a $0.65 billion or 0.1 percent decrease to $811,846 million in unfilled orders for transportation equipment limited the overall increase, as unfilled orders excluding transportation equipment were up 1.1% to $413,523 million . . . compared to a year earlier, the unfilled order book for durable goods is now 2.3% above the level of last July, even as unfilled orders for transportation equipment are still 3.3% below their year ago level, despite a 16.2% increase in the backlog of orders for motor vehicles and parts…

Why Would an Economist Ever Look on the Bright Side?

Paul Krugman: The Gentrification of Blue America

PK’s ‘latest column’

Paul Krugman: California Could Throw Away What It’s Won

(Basically, the gubernatorial recall election, brought about by a petition pushed hard by CA’s right-wing to make the election happen, can cast Dem Gavin Newsom out of office, mainly for attending a dinner maskless, and for being progressive. If a majority of CA voters, in what is likely to be a low-turnout election, vote against him, he will likely be replaced by a right-wing GOPster with maybe 20% of the vote. Best hope is that enough Dems turn out and vote to keep Newsom in office.)