Joe Biden Temporaily Improves Healthcare and Cuts ACA Costs

What I am writing about today is the up-and-coming changes to the PPACA resulting from the signing of the American Rescue Plan Act of 2021 by President Joe Biden. This is not Medicare-for-All or Single Payor; however, it is a big leap forward in making healthcare affordable for the next two years. Improved affordability will come with cost analysis and the impact on pricing and reduced administrative costs. I have touched upon those costs in early posts.

Less Costly Healthcare Insurance for All Ranges

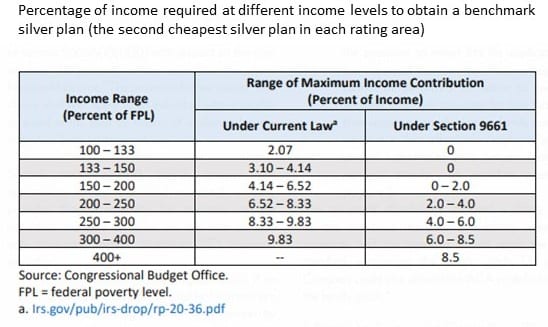

The first chart shows “Before 2021 Covid Relief Bill passing” income percentages (under Current Law), and after the “Covid Relief Bill passes” income percentages (Under Section 9661).

The Income Range sets the lower and upper parameters (percentage) for income to qualify for a particular income range.

Please note the greater than 400% FPL Cost is capped at 8.5% of Income which was not available previously. Keep in mind an employer sponsored family healthcare plan is ~$20,000 annually .

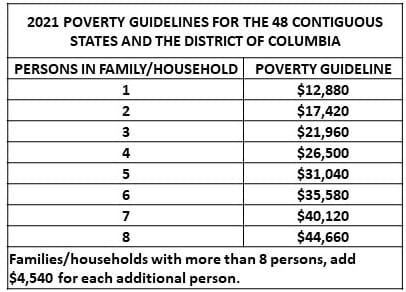

I have included household Poverty Guidelines by family size for the lower 48 states in the next chart. For Hawaii and Alaska, the parameters can be found at HHS Poverty Guidelines For 2021.

How this Bill Passed and More of Its Content

Simply speaking, Senate Democrats sent the American Rescue Plan Act of 2021 to the House. Republican’s are still working on their bill from 2008.

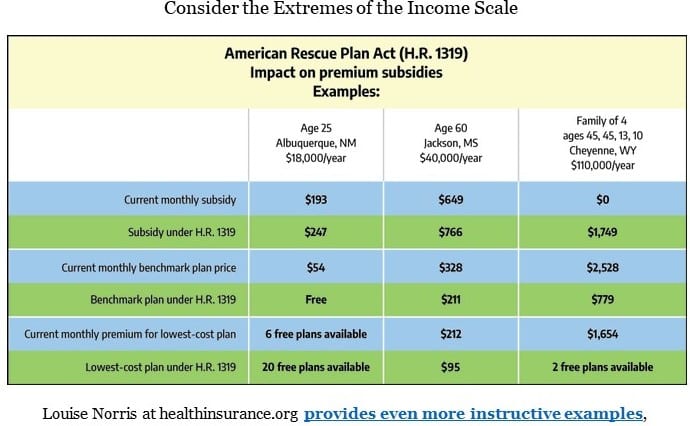

The American Rescue Plan Act of 2021 sent to the House reduces the percentage of income needed to buy a benchmark plan.

The benchmark Tier two Silver plan remains the same. High Actuary Value at incomes up to 200% FPL (94% or 87%). Low Actuary Value above the 200% income threshold (73% or 70%) . Incomes below 150% FPL are free.

The new subsidy schedule extends through 2022. A new Congress with courage will have to extend it via subsequent legislation. Or Congress may be bold enough for Single Payer.

The Cost Factor

Examples; ACA versus American Rescue Plan

If Extended beyond 2 years there could be 3 million new enrollees” in the next 3-4 years under this subsidy schedule. This is in line with CBO projections. The 3-million is more than a quarter of the currently uninsured who will become subsidy-eligible (half of which will come from the 3.4 million uninsured as taken from 400% FPL to Kaiser’s estimate of 8.9 million current subsidy-eligible uninsured).

Seventy-five percent of the uninsured haven’t signed up in the past due to cost. Forty Percent of the these uninsured are eligible for free coverage, zero-premium high-deductible bronze plans. When asked, if they shopped in last two years? . . . 75% have not done so(KFF Cynthia Cox).

In explaining the lack of knowledge, KFF’s Cynthia Cox points to news coverage touting unsubsidized premiums which average $478 per month for a Tier Two benchmark Silver plan for a 40 year-old.

“People don’t know that almost no one pays that. And as several veteran enrollment assistors have told me, the toxic Republican vilification of marketplace coverage over many years still has its effect: throughout the red states, there are still many uninsured who won’t touch “Obamacare.”

While Biden’s American Rescue Plan is an improvement, there is still a high cost factor for everyone and those > 400% FPL even with an 8.5% cap. It is better than the the absolute cliff before but the cliff still exists.

Bring on Single Payer!

Joe Biden’s American Rescue Plan Act of 2021

Our annual income is $250K thanks to Roth conversions.We are not expecting any reductions in premium costs for my wife’s bronze plan.

Our hope was a reduction in the Medicare age as she is just 2.5 years away from 65.

Which is what I was implying also. sorry dave.

Not to be contrarian, but is it possible one consequence of this is simply higher deductibles across the board, negating whatever premium subsidy or cap one benefits from…? Am I being too negative or simplistic in my thinking? Have increasingly large deductibles not been one of the biggest deficiencies of PPACA’s attempt to “bend the cost curve” and provide affordable health insurance to Americans? Would sincerely appreciate informed opinion about this.

Marduk

I do not think you to be contrarian. I think they need more brackets and lower percentages. I also think they should have kept the total out of pocket at a lower level ($8500 for an individual and 17,100 for a family. Unless you are catastrophically ill who hits that number? I do know that 1 dose of Rituxan goes for ~$30,000 ands you get 4 doses. I also believe you should not be paying full charge from the beginning. It did not used to be that way. You should pay the discounted rate the same as way you hit your deductibles. Most are healthy and never hit a deductible. With a lower out of pocket, you begin to squeeze deductibles.

Medicare is not cheap and if you do not have Supplemental insurance you pay 20% of cost for Part B and a deductible for Part A. You still have copays. If you are between 55 and 65, Medicaid can ask to be paid back or take your assets.

So that leaves Single Payer which eliminates 15 to 20% of the costs of healthcare right off the bat with no administrative costs because of insurance companies. No ACOs either which are becoming monopolistic in their regions.There will be budget schedules for hospitals and doctors too as set by Single Payer.

PPACA id just a stop over to Single Payer. Ask away.