As I’ve pointed out for years, housing is a long leading indicator. It can give us a decent read on the direction of the overall economy 12 to 18 months out.

So the strength in the housing market in the past 6 months has been a powerful positive omen for the economy going into 2021.

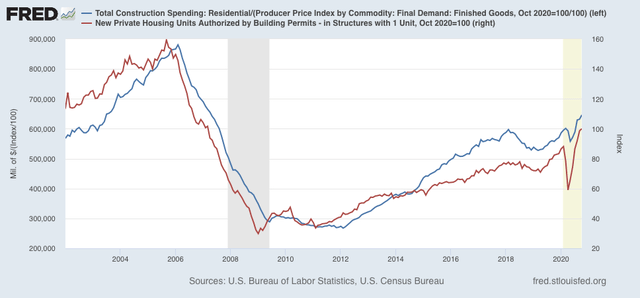

Yesterday residential construction spending for October was reported and continued that string of very positive signs. The below graph compares inflation-adjusted residential construction spending with single-family housing permits since the construction series began in 2002:

These are the two least volatile of all of the housing metrics. Since sales have to be made first and permits obtained, before construction starts, typically construction – while the least volatile of all metrics – lags permits somewhat. But right now, both are at 10 year+ highs.

I put together a much more comprehensive overview of the housing market, including mortgage rates, sales, prices, and inventory, and it is posted at Seeking Alpha.

As usual, clicking over and reading puts a penny or two in my pocket to reward me for my efforts, as well as giving you useful economic information about the future.

Too many charts (at Seeking Alpha) with way too much noise in them.