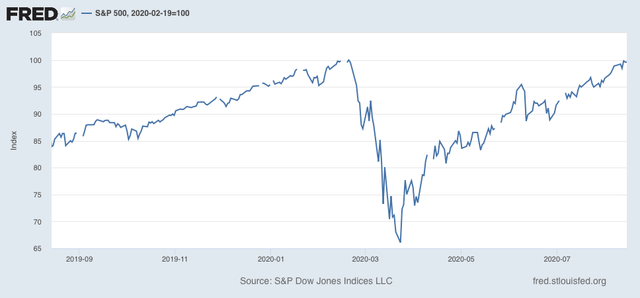

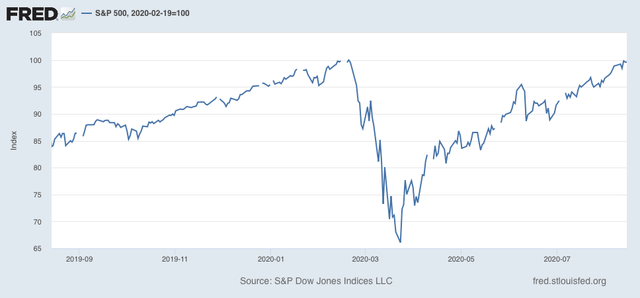

As I type this, the S&P 500 is close to setting an all-time record. Last week it came within 0.2% of doing so:

All of this in the face of the worst quarterly decline in GDP ever in Q2, and continuing unemployment over 10%. What’s going on?

Before I continue further, let me emphasize that I am not giving investment advice, and I do not believe there is any “actionable information” for investors in this post. But I do think there is a decent explanation for the huge bifurcation between the economy as a whole and the stock market.

There are 3 points to be made:

1. Background longer term fundamental factors for the economy are very positive.

2. All other industrialized countries besides the US have controlled the pandemic.

3. Market gains are completely bifurcated and are essentially limited to the 6 biggest players in the global economy and in home delivery.

Let’s go in order.

1. Background longer term fundamental factors for the economy are very positive.

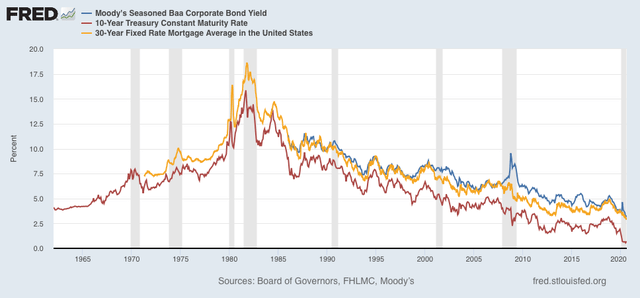

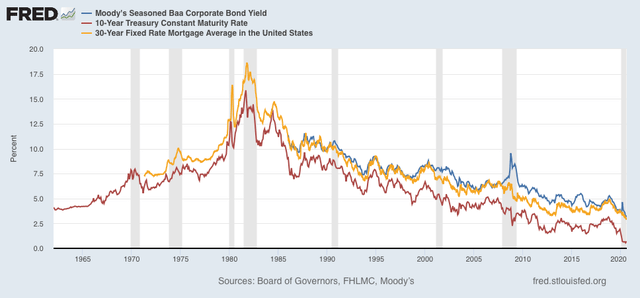

The most important longer term leading indicator for the economy is interest rates. Low interest rates and easy money power strong growth. Higher interest rates and limitations on credit strangle growth.

And on that score, interest rates are the lowest they have ever been, whether we measure in terms of corporate bonds (blue), US Treasury’s (red), or mortgage rates (gold):

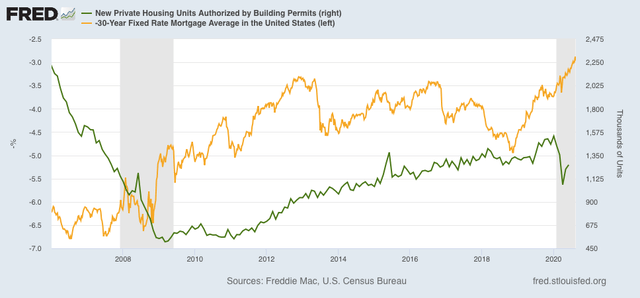

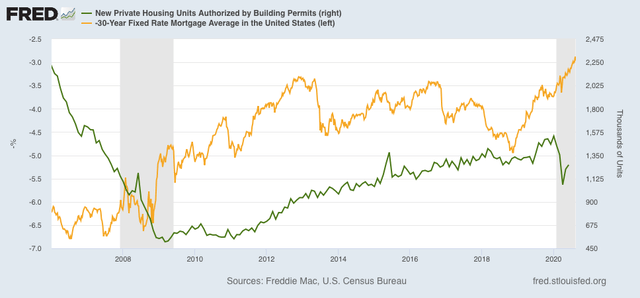

We would expect this to power growth, and it has already made an impact on the housing market, as shown when we compare mortgage rates (gold, inverted) with housing permits (green):

Lower mortgage rates cause more people to buy houses. Housing permits have already made back about half of their pandemic losses as a result.

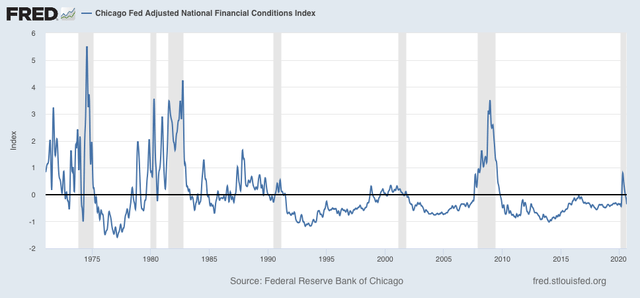

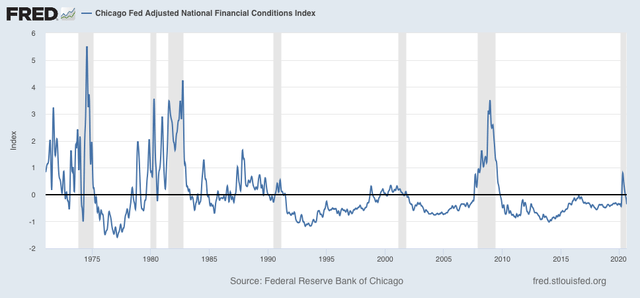

Add in easy credit, as shown by the Chicago Fed Adjusted Financial Index (below), and you’ve got the basis for a healthily growing economy as soon as the pandemic is contained (note: in this index a negative number is good):

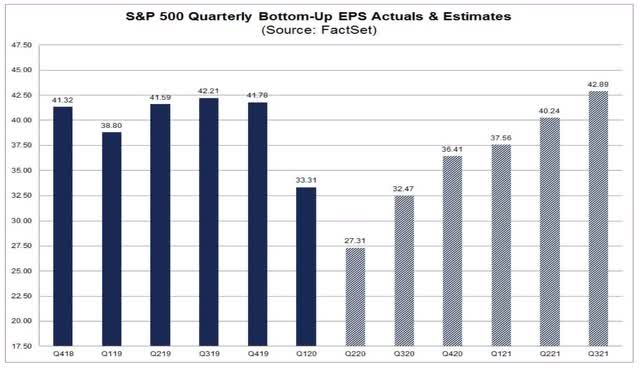

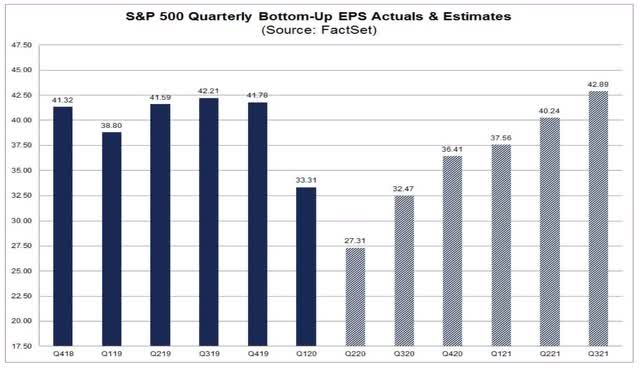

As a result, Wall Street believes that the worst in corporate profits is behind us, and that over the next year, profits will gradually grow towards a new record:

2. All other industrialized countries besides the US have controlled the pandemic.

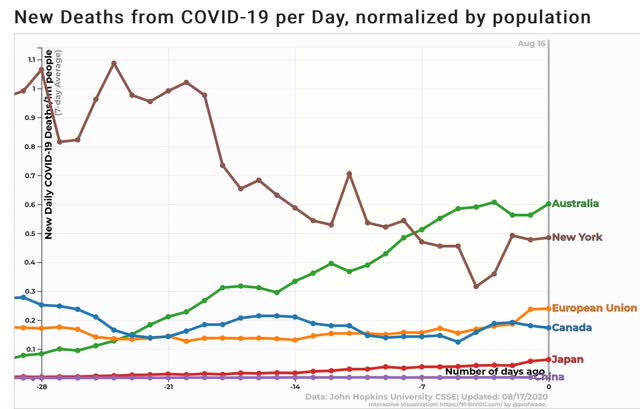

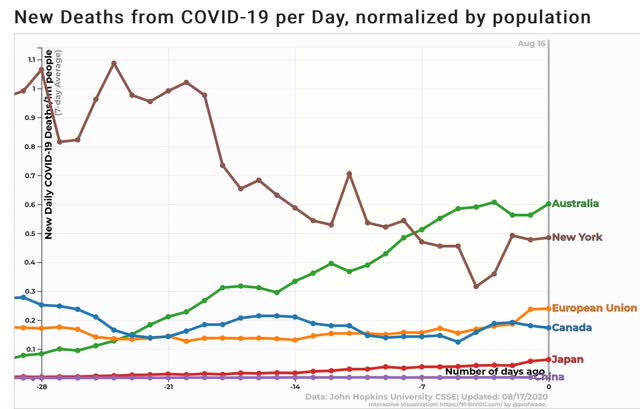

Here’s the graph of the 7 day average of deaths from the coronavirus for all the other major industrial powers (+NY, our best large State, for comparison):

All except Australia have less than 0.2 deaths per million per day on average. Even Australia is only slightly worse than New York.

In other words, the lion’s share of the developed world’s economy has returned to normal or close to it, and every US company exposed to that economy is benefiting from it.

3. Market gains are completely bifurcated and are essentially limited to the 6 biggest players in the global economy and in-home delivery.

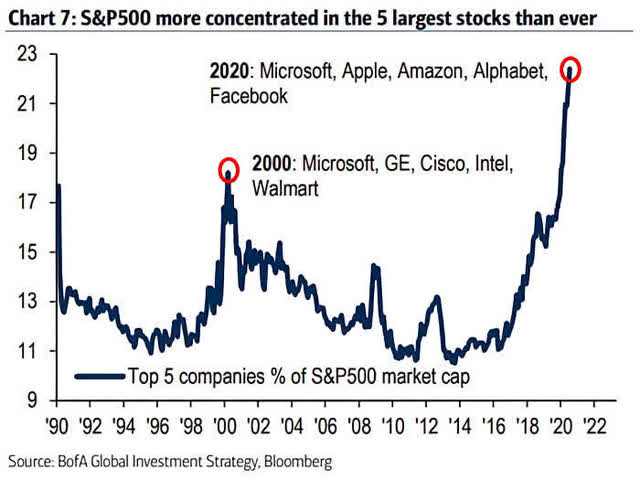

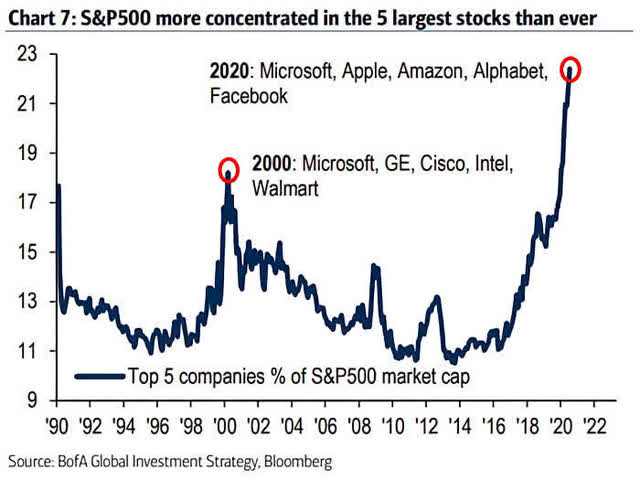

The 5 FAANG companies – Facebook, Apple, Amazon, Netflix, and Google – +Microsoft account for almost 1/4 of the entire S&P 500 by market capitalization:

This is the most concentrated the market has been in generations.

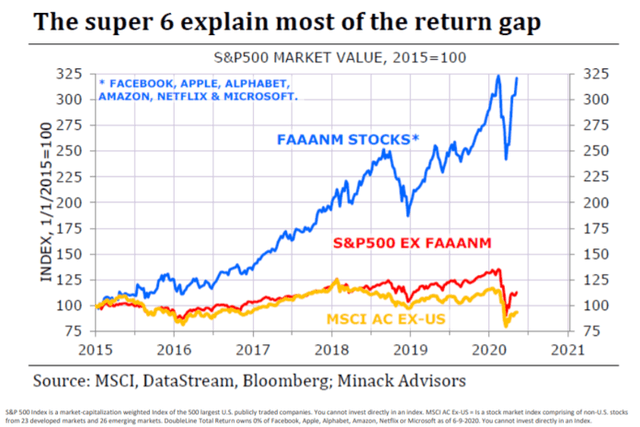

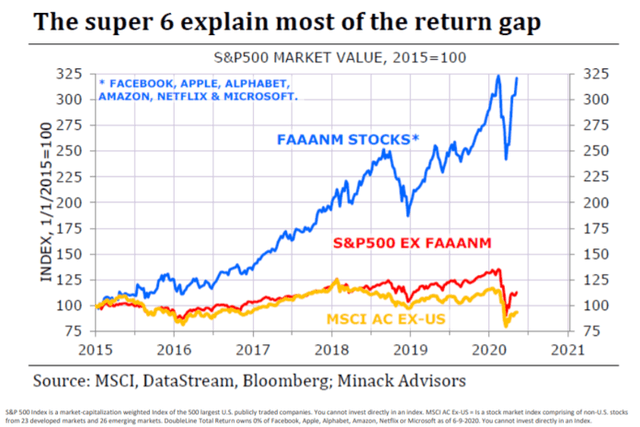

What is most noteworthy is what happens when we break out their profits vs. the profits of the other 494 S&P 500 companies:

The above graph norms the categories as of the beginning of 2015. What is more important for our purposes is to compare vs. the beginning of 2018. Since then, FAANG+Microsoft stocks have increased over 40% in price, while the rest of the S&P 500 has gained virtually nothing. Even at its record in February it was only about 12% higher than its high in January 2018. In short, except for 6 stocks, the S&P has gone nowhere in over 2 1/2 years.

What do the 6 FAANG+Microsoft stocks have in common? They either exclusively have a digital hardware and software presence (Facebook, Apple, Netflix, Google, Microsoft), or couple that with a delivery service (Amazon).

In other words, those six have both a global footprint, so they benefit from the recovery in the rest of the world outside the US, and inside the US, they either are not affected by the closure of many businesses or else actually benefit by delivering goods and/or online content to homes.

In short, the S&P 500 is close to a new record high because the market anticipates a solidly improving domestic economy over the next year, globally exposed companies experiencing robust international growth now, and the market’s biggest players are actually *benefitting* from so many people inside the US staying home.

John Quiggin @ Crooked Timber has been mulling the matter, too.

IMO, it’s likely that investors who moved a lot

of their holdings into cash in recent years when

interest rates were low but not negligible, are

now going back to equities, since interest rates

are practically non-existent. Risky? Yes.

Clearly, there is movement into ‘high quality’

Nasdaq (high tech) megacorps, out of small-caps

& even out of mid-caps, with rotation between

growth & value in large-caps.

The Nasdaq is up about 25% this year. The Dow is flat.

Perhaps reminiscent of the ‘drunkard’s walk’ style

of investing from a some years ago.

NDd:

So overseas US manufacturing/service companies are making nice profits due to a relatively stable health environment and domestic manufacturers and or services companies are taking it on the chin. Since the US is not stable, we can see another migration of companies overseas? escaping the Overhead which funds many of the citizens benefits and returning to the US to sell the product in what still is today the largest consumer market globally. What a sweet deal . . .

I place all the blame on drugs being consumed by both buyers and sellers.

Apple Is Worth $2 Trillion, Punctuating Big Tech’s Grip

NY Times – August 19

It took Apple 42 years to reach $1 trillion in value.

It took it just two more years to get to $2 trillion.

Even more stunning: All of Apple’s second $1 trillion came in the past 21 weeks, while the global economy shrank faster than ever before in the coronavirus pandemic.

On Wednesday Apple became the first U.S. company to hit a $2 trillion valuation when its shares climbed 1.2 percent to $467.78 in morning trading. It was another milestone for the maker of iPhones, Mac computers and Apple Watches, cementing its title as the world’s most valuable public company and punctuating how the pandemic has been a bonanza for the tech giants.

As recently as mid-March, Apple’s value was under $1 trillion after the stock market plunged over fears of the coronavirus. On March 23, the stock market’s nadir this year, the Federal Reserve announced aggressive new measures to calm investors. Since then, the stock market — and particularly the stocks of Apple, Microsoft, Amazon, Alphabet and Facebook — largely soared, with the S&P 500 hitting a new high on Tuesday. …

The layoffs have not ceased. I expect them to expand in the next quarter as cities and states are forced to start the next round. There are going to be a lot of teachers and other state employees out of work before year end; no help is likely coming from the feds.

Not investment advice, just paranoia. I have moved about half our retirement savings into federally insured 401K accounts yielding bupkis. I may move another 25% in the next month or so.

I think investors are deluding themselves in 2 ways: That the pandemic is being brought under control and that Biden’s election is secure and will stabilize the economy. I believe neither will work out to be true. And I’m likely to pay a financial price for being wrong. Okay.

I don’t think Biden matters right now as the current debt based move has been going around for awhile. It’s just a liquidity bubble that needs a correction. Once reopening, markets were going to rise, but the speed is too fast, in many regards, Apple warning could cause the nasdaq to lose 25% of its value. That’s how bad the concentration is.

@Bert,

“cause the nasdaq to lose 25% of its value.”

And, how does that affect me when I need the NASDAQ money in 5+ years?

Who knows. There is way too much capital out there and interest rates are way too low because of that. This makes debt bubbles easy, like the 2010’s subprime bubble or the worse prime lending bubble of the 00’s.

If East Asia moves against bucky, your stocks are in trouble.

I keep liking the diversified pension fund that I depend upon. They generally keep a large position in real estate on the one end and bonds on the other. Equities are fine as long as one has full freedom of choice as to when to hold them and when to fold and when to increase their position in equities. Buy low and sell high still works for a large diversified fund.