New home sales roar back to pre-pandemic levels

New home sales roar back to pre-pandemic levels

At some point – probably three or four months after Joe Biden takes the oath of office on January 20 of next year, G*d willing – the coronavirus pandemic is going to be brought under control in the US. At that point the long leading indicators are going to be very important in terms of the immediate direction of the US economy.

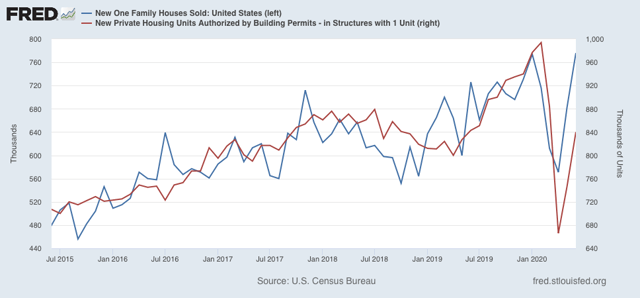

And the news on that score is very good, as shown by new home sales for June, reported this morning.

New home sales are extremely noisy and heavily revised, but they are the most leading of all of the housing metrics – even before permits. This morning they were reported at 776,000 units annualized (blue in the graph below), the highest since the onset of the Great Recession over 12 years ago:

Single-family home permits (red in the graph above, right scale) are much less noisy and tend to follow new home sales with a slight lag of 1 to 3 months. As you can see, these also rebounded sharply in June, although only half the way back to their pre-pandemic levels. Based on low mortgage rates and new home sales, I expect building permits and starts to follow shortly, and return to pre-pandemic levels as well.

Because home construction feeds through Into the broader economy over a period of 12 to 18 months, this will provide a tailwind for economic growth once the public feels safe in resuming normal activity.

Thinking the virus will be out of control through Jan. 20, 2021, but then under control a few months later seems implausible unless it is the distribution of effective vaccines and that doesn’t depend on the election result. Mask usage is quite high now and only headed up. If school openings turn out badly they will close in October, not waiting to Jan 2021. Apart from vaccination, strategies against infection are playing out right now. The New York/New Jersey experience of rapid case increases and hospitalizations and deaths was pretty much a 10-12 week agony. How the pandemic plays out here is not likely dependent on a November election and new policy in January next year. Voting for Biden because you think Trump blew it is not the same as thinking that new leadership next year will have something special to combat this.

geez

Yeah, Biden will pay attention to the scientists, guaranteeing a better response.

Your comment is ludicrous, as has been clearly shown the entire fen year.

“Thinking the virus will be out of control through [Time X], but then under control a few months later seems implausible unless it is the distribution of effective vaccines and that doesn’t depend on the election result.”

This has literally been the experience for every country in the world. Those that elected anti-science authoritarians are still out of control (Russia, Brazil, USA, UK) and those with sensible elected officials that had it bad at Time X, have gotten it under control in just a few months (Italy, Germany, New Zealand, Australia, Canada…). There is literally zero reason to think this will not be true. Follow the evidence, don’t just make stuff up.

Lol, just because they quickly reopened transaction, artificially goosed sales of homes people can’t afford, means little. Very little headwinds as well.

Do you have have a cognizant thought?

Just go back to your planet.

His obsession with RE is annoying. Its not the wealth booster people think and the housing bubble showed me that with its meek economic boosting principles. Now that the average Millie is 30 years old, your seeing more activity in RE. More debt and poorly created loans by institutions that just wanna rip you off. Why???? So you get store more “stuff”????? Its Last Man kind of thinking. Nothing inside to make it go. Its why Socialism can’t be based on materialistic nonsense. There must be something greater to align the tribes.

The $$$$$$$$$$ much like the gold backed pound ain’t gonna last forever. When it goes, so will your way of life. Things will change and it won’t be pretty for people like NewDeal or Donald Trump. Their way of life will be over.

@Bert,

“The $$$$$$$$$$ much like the gold backed pound ain’t gonna last forever. When it goes, so will your way of life. Things will change and it won’t be pretty for people like NewDeal or Donald Trump. Their way of life will be over.”

I’ve been reading various versions of this prophecy for the past 20 years. My way of life is doing well, thank you. It hasn’t gone so well for the middle class and working class, but that’s not because of the “the gold-backed pound” or new housing starts. It’s because of the accumulation of wealth by the 1% that began in earnest under Reagan.

Smarter trolls, please.

Why does anyone actually think that Biden – if elected – will come up with significantly different federal coronavirus policies than he finds on the day he would be inaugurated? Vaccine development? Doubt it a whole lot. Treatment development? Doubt it a whole lot. Ventilator production? Seems like a joke now. PPE? Man you cannot turn around in this part of Wisconsin without being exposed to an ad urging people to flock to their medical providers to get all those deferred care items taken care of…they sure are putting on a brave face if they think there is a PPE risk. Hospital ships for San Diego? I doubt they will be needed but for sure Trump would send it if it were available and needed at 11:00 AM on 1/20/21. I do think that it can be argued that testing is still not fully adequate, but I’ll bet that is not the sense next January. If you look clearly enough at the current situation, the policy disputes are overwhelmingly related to the exercise of state and local authority. Trump is President and he naturally gets blame or credit to a high degree, but that doesn’t mean that Biden is going to get extra authority to dictate to states or schools. Heck we just got an approximately two week lecture on how Trump and De Vos do not set schools policy. Well, Biden won’t either if it comes to that.

I do not doubt there would be a big effort to push messaging that Biden rode in to the rescue, but real policy change? I expect very little on coronavirus. More on economic support, though

NDD has very little reason to think that the pandemic status of plus three or four months to the next inauguration is very dependent on who wins the Presidential election. Now if DeSantis is up for reelection, or Duecy or Newsome or Abbott, well that is a different kettle of fish. There might well be state policies ripe for big changes in January.

Eric,

A- Only roughly 40 years of listening to experts, listening to what the people seem to want, and building coalition and consensus among many disparate groups across the political spectrum. You kind of have to be an idiot/ live in a fantasy world to believe otherwise. 40 years of evidence is a whole lot of evidence. And you seem to just be making stuff up.

B- People probably aren’t thinking in super specifics.

WHY MAKING ECONOMIC PREDICTIONS NOW IS USELESS

Branko Milanovich May 31, 2020 http://glineq.blogspot.com/2020/05/why-making-economic-predictions-now-is.html

In one of his poems, Constantine Cavafy distinguished, in the art of foretelling future events, three groups: men who are able to see what exists now, Gods who alone know the future, and wise men who perceive “what is just about to happen”:

Ordinary mortals know what’s happening now,

the Gods know what the future holds

because they alone are totally enlightened.

Wise men are aware of future things

just about to happen.

We all aspire to be the wise men and women who can see the immediate future (Cavafy does not believe that even wise men can see the distant future) and the demand for such seers is high when the times are troubled as they are now. Economists are often in particular demand because they claim they can tell the shape of future demand and supply, unemployment and growth. To do that they resort to models that through behavioral equations and identities, show the future evolution of key variables and pretend to predict how long the depression will last and how quick and strong the recovery will be.

My argument is that such models are useless under today’s conditions. There are several reasons for that.

All economic models, by definition, take the economy as a self-contained system which is exposed to economic shocks, whether in form of more or less relaxed monetary policy, higher or lower taxes, higher or lower minimum wage etc. They cannot by their very nature take into account extra-economic discrete shocks. Such shocks are simply not predictable. One cannot tell today whether China might invade Hong Kong, or whether Trump might ban all imports from China, or whether the race riots in the US can continue for months, or similar riots break out elsewhere in the world (Latin America, Africa, Indonesia) or even if the US may not end this year with a military government in charge.

All of these social and political shocks that I have listed are due to, or have been exacerbated, by the pandemic. There is little doubt that the “most important relationship” (to quote Henry Kissinger), the one between China and the United States, has significantly deteriorated because of the pandemic. Some in the United States see the pandemic as intentionally engineered by China to weaken the US economy and its president. There is also little doubt that the differential reactions, between the countries, in countering the pandemic have either destabilized domestic political situations (Brazil, United States, Hungary, Great Britain) or changed the relative correlation of global economic and political power (most notably between the US and China).

It is therefore utterly wrong to believe that history does not matter and that the social and political changes wrought by the pandemic can be ignored so that, if the pandemic is miraculously over in December 2020, December 2020 will be just like December 2019 with a twelve-month lag. Not at all: even if the pandemic is over by then, December 2020 will be entirely different than December 2019, and the political forces that these twelve months will have set in motion—and which we currently cannot predict—will fundamentally affect how economies behave in the future.

With covid-19 we are facing a situation that (with the exception of the two world wars) has no precedent. This, in two respects: the global nature of the problem, and its open-ended, uncontrollable nature. This pandemic, unlike the most recent other pandemics (SARS, MERS, swine flu) is truly global. It has affected almost all territories in the world. Compared to the previous economic crises, its global nature also stands out. Whether we think of the debt crisis of the 1980s, the crisis faced by post-communist economies in the 1990s, the 1998 Asian financial crisis, or even the Great Recession, they were all regionally contained crises. To be sure, there were spillovers, but we could essentially, in our assessment or prediction of global affairs, place the countries that were most affected between the brackets (so to speak) and look at the rest of the world using the standard economic approach. We cannot do that now when the entire world is affected.

The second feature of today’s situation is its open-ended nature: no one knows when the pandemic will end, how it will affect different countries, and even whether thinking of a sharp and clear end to the pandemic makes sense at all. In fact, we may live for years with stop-and-go policies where movements to open up the economy are followed by increased flare-ups of the infection, and then new closures and lockdowns. We also have no idea not only what countries and continents would be hit next by the pandemic and whether there would be a second wave, but we cannot at all predict how successful individual countries will be in curbing it. No one could have predicted that a country with the highest health expenditures per capita in the world, and with hundreds of universities that sport public health departments and publish probably thousands of scientific papers annually, would totally fail in the control of the pandemic and have the highest number of cases and fatalities. Similarly very few would have predicted that the UK, with its fabled NHS, would lead Europe in the number of deaths. Or that modestly wealthy Vietnam would have zero deaths from the pandemic.

Similar unknowns abound. These are not one-level unknowns, but unknowns at three or four dimensions. The future geographic spread of the pandemic is unknown (will it severely hit Africa?), the reactions of countries, as we have just seen, are equally impossible to predict (how successful may be India? Will China stop the second wave?), and perhaps most importantly the social and political consequences are unknown. They may turn out to be, as I argued in March 2020 article in Foreign Affairs, the most nefarious long-term product of the pandemic with obvious effects on global recovery.

There are only a few things—the same ones that I mentioned in mid-March—that we can, with some dose of confidence, predict:

1. aggravation of the conflict between the US and China with China being “upgraded” to the status of “challenger”;

2. tendency toward greater state role in many countries;

3. set-back for globalization, in terms of ability of people to travel internationally and capital to move across borders (driven in part by political uncertainties); and

4. increasing political instability both internally and globally.

This crisis is like “the warrior that leaves devastation in its stead”, and to make projections assuming that none of that devastation has occurred, and even if has occurred, that it will have no impact on future functioning of the economy is simply wrong. We have to admit that there are limits to our ability to tell the future: we are not “Gods that are totally enlightened”.

idriss

+5

Amazing that our government’s response has been consistently among the worst in the world yet Eric seems to think not.

He is a strange person in addition to, as you said, ” just be making stuff up.”

I have heard a lot of anecdotes about people buying homes to get out of the City. Still seems weird though. Why buy a new home given all the uncertainty? Makes me think that there is something fundamentally wrong with the statistics or some reporting delay that is just getting caught up. The economy is incredibly complicated and some fundamental parts are broken and dead. These statistics are just proxies in normal times. In times like these it may be just measuring muscle spasms in a dead body thinking you are registering a heart rate.