April personal income and spending: considering the extreme circumstances, a good report

April personal income and spending: considering the extreme circumstances, a good report

April personal income and spending, reported this morning, showed the impact of both the lock downs and the stimulus that was passed by the Congress.

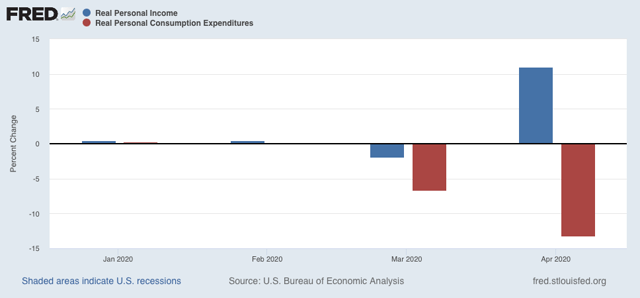

To cut to the chase, spending in real inflation-adjusted terms declined -13% (red), while real income rose 11%(blue):

Unlike the recent jobs report, this is not a byproduct of the layoffs that were concentrated in the lower wage sector, which changed the composition of the labor force. Rather, this is an aggregate number, meaning that total income for everybody, adjusted for inflation, rose 11%

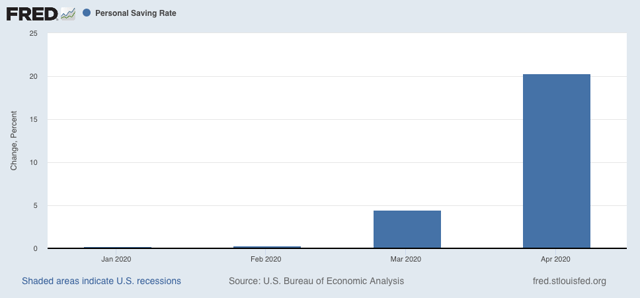

As a result of the combination, the personal savings rate rose by 20%:

Depending on what happens with the intensity (or not) of “safer-at-home” orders in the future, and whether or not there is any further stimulus enacted by Congress (looking increasingly unlikely), this will either have to tide over the 20%+ of the labor force that has filed for unemployment in the last two months, or will serve as fuel for robust consumer spending once people feel it is safe to resume relatively normal activities.

Given the extreme circumstances, this was a good report.

Ex transfers, income was down 6%.

No snark intended, but is any of this reliable data? I mean, every administration takes liberties with economic data reporting and the current administration can be counted on to do so in spades. Especially this administration, especially now.

I don’t think it is so good when you subtract transfer payments which the Republicans are dedicated to terminating.

Paul Krugman @paulkrugman

As I’ve been saying, the CARES Act did a lot to alleviate the economic hit from Covid-19. 1/

https://www.nytimes.com/2020/05/31/business/economy/coronavirus-rent-landlords-tenants.html

Tenants Stay Current on Rent, for Now

Collections have been surprisingly strong through the pandemic, but there are troubling signs — for landlords and tenants alike.

8:16 AM · May 31, 2020

I keep seeing some people on the left describing it as just a bailout for corporations. There was some of that, but huge relief for people who really needed it. So far this month, $90 billion in unemployment benefits compared with $2 billion in same period last year 2/

The big problem is that extraordinary aid all goes away in just 2 months. There is no chance that more than a small fraction of the loss in wages will be made up by then. So we’re facing an economic and human disaster unless Republicans allow another package 3/

Transfer payments are a distortion and don’t necessarily create proper data. If ex-transfers fell 6%, then that is how consumers are it. I would have thought the 2008 measure, would educate.

Kwark, this data is generated by career bean-counters at the Bureau of the Economic Analysis from other economic data from similar career employees at the Bureau of Labor Statistics and the Census Bureau…many of them were hired under Obama, and some have probably been working for those agencies since Clinton…those who actually put their names on the national accounts reports have been there as long as i’ve been accessing them, ie. ~10 years…given the number of people who’d have to be compromised, i don’t think this or any administration has been able to doctor the data for their own benefit for as long as these reports have been being produced…

now to address “the good report” that NDD somehow sees…in annualized data, April saw a record drop of $740.2 billion to $8,482.0 billion in wages and salaries, a record $197.6 billion decrease to $1,424.5 billion in farm and small business proprietor’s income, and a record $138.4 billion decrease to $1,995.9 billion in supplements to wages and salaries, such as employer contributions for employee pension and insurance funds…that’s on top of the record 13.6% drop in personal consumption expenditures, which is a pace which would subtract 36.70 percentage points from the growth rate of 2nd quarter GDP if it would continue….so if this is a “good report”, i’d hate to see a lousy one…

BLS data or near term data can be legally manipulated. Though the BEA revised the data as seen in 2018 when Trump birth/death data came in too strong(which likely means future reductions in GDP for 2018). The Trump administration likely just buffed up initial estimated numbers on purpose.

ok, Bert, let me ask you how the “Trump administration likely just buffed up initial estimated numbers on purpose” , ie, which people at which agencies were doing the “buffing” you allege to have occurred, and why didn’t the others who work at those agencies and who would know what the unbuffed data actually was say something?

i’d also like you to explain to me how an alteration in the birth/death data can result in “future reductions to GDP”…or at a minimum, explain exactly how the birth/death data can have any impact on GDP….exactly which GDP metrics do you think are influenced by a birth/death adjustment?

after all, if you know something the rest of us don’t, we would all benefit if you explained it..