OIL PRICES

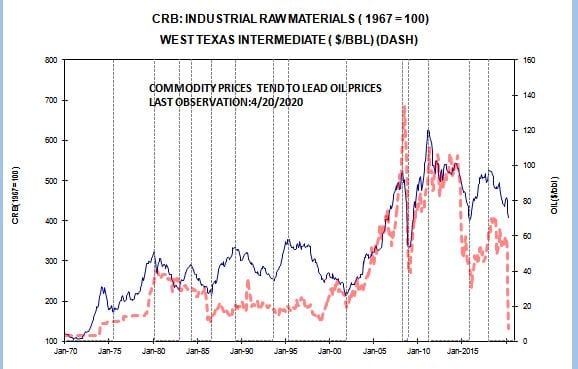

Oil prices are collapsing as West Texas intermediate is now trading at just over $11/bbl

Oil prices move to the point where the marginal supply is profitable or unprofitable. In today’s world the marginal oil supply is US fracked oil. But the economics of fracked oil differs from traditional oil in that the current cost of production is very high as compared to most traditional sources where current costs are relative insignificant and the bulk of the cost is sunk or fixed costs. Even if the prices make production unprofitable, it still minimizes losses to continue producing as long as you are covering your variable costs. That use to describe most US oil production. But now the variable cost of fracked oil is very high and the oil companies will not continue to drill fracked oil at these low prices.

Oil prices move to the point where the marginal supply is profitable or unprofitable. In today’s world the marginal oil supply is US fracked oil. But the economics of fracked oil differs from traditional oil in that the current cost of production is very high as compared to most traditional sources where current costs are relative insignificant and the bulk of the cost is sunk or fixed costs. Even if the prices make production unprofitable, it still minimizes losses to continue producing as long as you are covering your variable costs. That use to describe most US oil production. But now the variable cost of fracked oil is very high and the oil companies will not continue to drill fracked oil at these low prices.

It appears that Russia and Saudi Arabia are acting together to drive the price of oil below the level where fracked oil would be profitable. Historically, low oil prices were very much a favorable development for the US economy. But that is no longer true and at current prices the US will suffer deep drops in oil production and a major widening of the US trade deficit.

It is going to be interesting to see how Trump reacts to two of his best buddies severely harming the US oil business and economy.

$2.44 right now @1345 EDT.

We already know. He took credit for the new “deal” while praising Putin and the Saudi killer. I’m shocked I tell you.

In his next Covid19 infomercial Trump will declare that the problem dates to Obama’s administration and the Democrats won’t let him “fix” the problem. His pathetic way of attempting to wash his hands of any connection to the issue.

End month contracts. The next month is at around where Brent is at so,,,,yeah it’s misleading.

May oil closed at -$37.63 a barrel, down $55.90 on the day…that means producers have to pay someone $37.63 a barrel to haul away & dispose of their excess May crude…it’s gone negative because the planet has run out of storage space….since i already had OPEC’s reports downloaded, i managed to do a fairly thorough breakdown of the supply/demand situation while my internet was down this past weekend, if anyone is interested:

March global oil surplus at 17.7 million barrels per day; 2nd quarter surplus to be at 6.2 million bpd even after OPEC, Russian, & US cuts

many analysts didn’t even notice that OPEC’s ballyhoo’d 9.7 million barrel per day output cut was based on October 2018 production…why October 2018? because it was their highest production in 3 years….based on their February production, their promised cut is closer to 7.2 million barrels per day….they’d have to cut another 9.3 million barrels per day to balance supply and projected demand…

imagine buying $100,000 of oil at $1 a barrel earlier today thinking you’re getting a real bargain, until later in the day when you get a call from your broker telling you that you have to put up another $3,763,000 just to get out of the contract…

rjs:

If the national reserve is low, it appears the US should be buying up some of the surplus.

i know some on the left were opposed to that, run, but not me…previous administrations have bought high, sold low,,.i’m a believer in buying what’s on sale….

This is a tribute to the Ponzi Scheme that is fracking. Squeezing oil from rock could always be done technologically, not economically. No worries though, you just need to find the greater fool. The next sucker err investor. The thing is the wells are transitory, like a shark you have to keep drilling new ones and you have to keep pumping to keep the revenue coming in to keep the creditors at bay. As the price begins to drop and market begins to be flooded, you can’t do the rational thing and stop pumping and cap your wells, you just keep drilling and pumping otherwise your whole Ponzi Scheme falls apart. So, while the Russians and the Saudis where flooding the market the frackers kept on merrily pumping away until everything, everything all the storage was completely filled up and then, well you just can’t pay anyone to take that crap anymore. The whole thing is revealed for what it has always been. A giant scam.

Most of the commentators on shale production in the US are too shortsighted.

OPEC has tried to drive oil prices down to the point that US shale oil producers are damaged. And that has worked to some small degree.

But there is one elementary truth which is ignored. Shale oil WELLS do not go bankrupt or starve to death.

Drive oil prices down to about $40 a barrel and they slowly harm shale oil producers.

But OPEC members build budgets based on their income from oil sales. Drop the price of oil too low and they will still be profitable BUT some of those OPEC members will no longer be able pay all of their bills.

If OPEC is willing to harm its own members by reducing oil prices low enough then shale oil producers will stop drilling new wells but they will continue to extract oil from the existing wells. As output slows they can reuse the old vertical shafts and then drill new shafts horizontally, or increase the length of the existing ones, to restore the wells’ output.

Drop prices further still and shale oil producers will not be able to service their debt!

If the shale oil producers default on their loans then the owners of the company lose everything as their lenders take control of their assets. The lenders are going to continue extracting as much oil as they can but bean counters are reluctant to send good money after bad.

At that point OPEC could actually have a serious impact, unless they raise oil prices. Because as soon as OPEC raises oil prices, shale oil production companies will bloom as the flowers in the desert after a heavy rain.

So the real equation is, are OPEC countries so angry that they are willing to do reduce the price of oil so much that they have to reduce their own spending and risk the anger of their populations.

The truth is that OPEC no longer has the power to bring the US economy to a standstill. Even OPEC+ no longer holds that kind of power.

I’m celebrating and hoping oil prices stay low long enough to force the frackers into bankruptcy.

It’s time to focus on clean energy, and smart investors will get into something with a future.

MCK

Welcome to Angry Bear. First time commenters always go to moderation to weed out spam, spammers, and advertising.

There are no shale oil WELLS to speak of. There is just the rock. That is why they have to continually drill new wells to keep the oil flowing. That is what makes the recovery costs so high. That is why they couldn’t just cap their wells and wait out the price war. You are right. The rock has always been there. It will always be there. And whenever we get desperate enough say in thirty years or so, it will be there again.

The financial chains behind shale are weaker than you think. Destroy the chain, you’ll need years before it returns. Shale doesn’t produce the extra crude anyway, nor is it cheap. Opec doesn’t exist anymore either.

this is so cool…

Negative oil prices – James Hamilton – First negative interest rates, and now negative oil prices. Is the world coming to an end?

The price of the May crude-oil futures contract closed yesterday at negative $37.63 a barrel. The buyer of that contract is entitled to receive 1000 barrels of oil in Cushing, Oklahoma in May and in addition the buyer is entitled to receive $37,630. Sound like a pretty good deal?

of course, the converse is also true – the seller of the oil not only has to supply 1000 barrels of oil, he also has to pay the buyer $37,630.

shale wells may not go bankrupt, but they’ll certainly send their owners to the poorhouse in short order…