ISM manufacturing and residential construction spending trends continue

ISM manufacturing and residential construction spending trends continue

May data has started out where April left off, with continuations of trends in both manufacturing and construction.

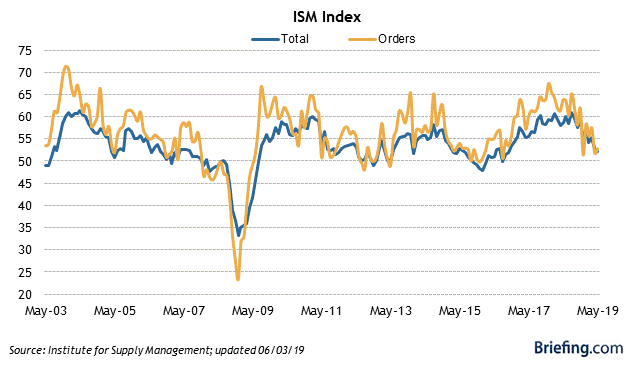

First, manufacturing: it is still expanding, but at a much lower rate than last summer’s red hot numbers. The overall ISM manufacturing index declined a bit to 52.1, but the leading new orders sub-index rose slightly from 51.7 to 52.7:

Looking forward to Friday’s employment report, the ISM employment sub-index also rose slightly from 52.4 to 53.7. This suggests that Friday will show an increase in the leading manufacturing jobs sector.

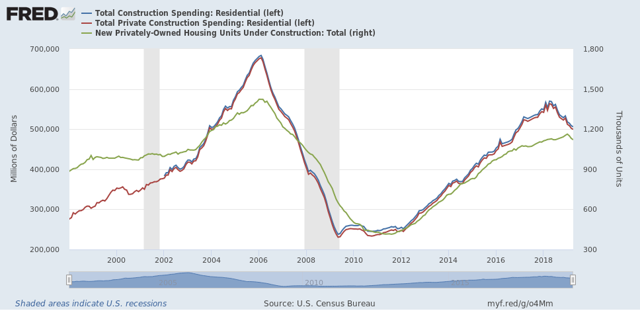

Turning to construction, reported for April, the leading sector of residential construction continued to decline. Below I show both total (blue) and private (red) residential construction:

While residential construction spending lags housing sales, permits, and starts, it is a much smoother series, and still leads the economy as a whole considerably. Also, the number of houses under construction tends to peak afterward (green in the graph above), and contemporaneously with that, residential construction employment begins to decline, as it did last month.

Thus I am expecting another decline in residential construction employment on Friday.

As I wrote two weeks ago, both the increase in jobless claims since Easter and the continued negative YoY readings in the American Staffing Index point to an increase in the unemployment rate and a decrease in temporary jobs in Friday’s report as well.

The economy is back to trend speed, where we will be until the b rated corporate debt implodes. IMO, trade war or no trade war, that is coming. The amount of debt there since 2004 is staggering and now unhealthy.

When does it blow out? bets?

talking about construction metrics you have to consider the weather…to my recall, April was the 2nd warmest April on record, so construction got an earlier than normal start…on the other hand, May saw half the country blown away or flooded out, with US temperatures in the bottom third of the historical average*…those factors will not show up in your seasonal adjusted data…

*btw, i think that was the first month the US has seen below average temps in at least a couple decades…

speaking of the weather, remember that tomorrow’s report counts non-farm payrolls, and doesn’t count the hundreds of thousands in the Midwest who are sitting on their hands because the fields are too wet to work…