Corporate Profit Tax Cuts and Wages: Silly Theory

I jump at a rare chance to disagree with Paul Krugman and as a bonus also with my very good friend Brad DeLong, because Krugman just tweeted that Brad is right

Brad is right here: Mankiw et al have clearly made a math error https://t.co/HpyVdoyRCT 1/

— Paul Krugman (@paulkrugman) October 24, 2017

update: Krugman has a whole blog post about how Brad is right.

The discussion started with Republican efforts to argue that, this time, it really will trickle down and corporate income tax cuts will help workers more than they cost the Treasury. Trum CEA chairman Kevin “Dow 36,000” Hasset claims that the tax cut will cause average houshold labor income to increase by $4,000 to $9,000. This has become the new GOP slogan. Many people noted that this implies that more than 100% of the incidence of the tax is on labor.

Greg Mankiw argued that it is possible for a corporate income tax cut to cause labor income to increase more than tax revenues decline. His analysis definitely is odd. He used a very simple model with a stylized economy and a stylized tax code. He compared the ratio of long run increases in wages to short run loss of revenue. His logic is that he is being hard on his fellow Republicans, because the long run effect of the tax cut is to cause increased capital formation, GDP and tax revenues (that is he is using static scoring not dynamic scoring to be hard on tax cuts). Most oddly, he considers long run benefits without considering the public sectors long run budget constraint. He doesn’t consider the effect of reduced revenue on budget deficits, government spending or other taxes.

Unsurprisingly, Mankiw has been criticized a lot. Larry Summers is brilliant as usual here

I want to pick out two odd claims (it’s about history of thought or semantics)

“the impact of a corporate rate reduction on wages in a so called “Ramsey” model or equivalently in a small fully open economy, with perfect capital mobility.”

I don’t think they are equivalent at all. They have very different behavior in the short run.

Krugman seriously considered an open economy model with flexible prices and a flexible exchange rate. It is not at all like a standard small open economy model, because the standard model relies on the miracle of the immaculate transfer. Here is a only mildly wonkish version. It includes the key phrase ”

“there is a somewhat interesting discussion going on over the effects of corporate tax cuts in an open economy. This discussion is, however, made somewhat more confused – in my view – by putting it in the context of Ramsey models”

The insanely wonkish version is here. It really isn’t insane to read it.

Brad criticizes Mankiw quite harshly here. This is the post which Krugman’s tweet endorsed without reservation.

I agree with you DeLong and Krugman that Mankiw is writing as a partisan Republican. I agree with DeLong Krugman and Summers that Mankiw errs by not considering a complete model, that one must consider the public sector intertemporal budget constraint when discussing fiscal policy, and that there is no point in looking at the ratio of one long term effect to a short term effect.

But I think that Brad’s claim that there is a math error is based on an uncharitable guess about which model Mankiw didn’t spell out.

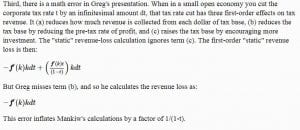

I can’t typeset equations here (& I hate to typeset them anywhere) so I screen capture Brad’s equations

Depending on the model which Mankiw didn’t write out, either Mankiw or DeLong could be right. One key issue is that Brad assumes that wages and prices adjust quickly while the capital stock adjusts slowly. The other is that the Ramsey model is not equivalent to a small open economy model.

I think Mankiw’s static cost calculation is reasonable for an small open economy with sticky wages and prices and is reasonable for a Ramsey model. It isn’t a flexible price small open economy calculation, but it is reasonable.

First I will assume a small open economy model (as Mankiw did) & try to justify his math, and, in particular, the fact that he doesn’t consider Brad’s term b.

Mankiw wrote

“An open economy has the production function y = f(k), where y is output per worker and k is capital per worker. The capital stock adjusts so that the after-tax marginal product of capital equals the exogenously given world interest rate r.

r = (1-t)f ‘(k).”

and

“We cut the tax rate t. Because f ‘(k)*k is the tax base, the static cost of the tax cut (per worker) is

dx = -f ‘(k)*k*dt.”

Brad objects that, if wages and prices are flexible, real wages will jump up even if additional capital has marginal product zero (he considered a Leontief production function). This will instantly reduce the pre-tax return on capital and the tax base.

Brad’s short term is a medium term in which the capital labor ratio hasn’t had time to adjust (in his example it never adjusts) but prices and wages have adjusted. That’s how the pre-tax rate of profit changes so that the post tax rate is constant. In Brad’s model, this happens instantly.

In the real world, wages and prices are sticky. We are all assuming that output doesn’t change in the short run (with sticky wages and prices this would be because, as Brad likes to write, the monetary authority makes Says law true in practice). If value added, employment, wages, prices and the capital stock are all the same, then the pre-tax rate of profit is the same. The new Keynesian short run is as discussed by Mankiw. He is a New Keynesian.

Mankiw’s calculation is also correct if one considers a flexible price closed economy model. He wrote “open economy” but I suspect that was just because he didn’t want to scare readers by writing “Ramsey”, “Euler”, or “phase diagram”

For the sake of argument, I will assume flexible wages and prices. I will normalize the price of the one and only good to 1. The economy is closed. That is, I am assuming a Ramsey-Cass-Koopmans model. What happens when the tax on capital income is cut ? the capital stock doesn’t jump, technlogy doesn’t jump, the real marginal product of labor doesn’t jump. Wages don’t jump. Output is full employment output. Pre tax returns on capital don’t jump. The capital stock doesn’t jump. The pre-tax return on capital doesn’t jump.

Tax revenues decline by (delta t)kf'(k) your term a. There is no term b.

WE have a puzzle here. I think the solution is that the Ramsey model is *not* like a small open economy model. In the long run, they will end at the same balanced growth path with the return on capital net of depreciation and taxes equal to the pre-reform return. But the short run is very different.

In both models the wage is equal to the marginal product of labor. But in the Ramsey model, the supply of capital to firms is not infinitely elastic. People have to be convinced to save. The real interest rate paid to investors (that is the marginal product of capital net of depreciation and taxes) is not constant. It jumps up when the tax is cut. So consumption (per unit of efficient labor) jumps down then moves up the new saddle path to the new higher steady state.

In a small open economy which is otherwise like the Ramsey model, there is no difference between the short term and the long term. K jumps (there is nothing that prevents this) so the economy jumps to the new balanced growth path. This means that, if Mankiw’s calculation is wrong because he ignores term b, it is also wrong because he ignores term c. He clearly wasn’t thinking of a small open economy model with flexible wages and prices and no adjustment costs.

I guess the remaining model which isn’t totally uninteresting is a small open economy with flexible wages and prices but slow adjustment of K. That means a model of investment with installation costs.

Now we have to decide about accounting. It depends on whether the installation costs appear as costs in corporate profit and loss statements — well really on corportate tax returns. If the cost is subtracted from net earnings taxed at rate t, then you and Krugman are right. There is a new term b — that cost which reduces tax revnues. If they don’t then Mankiw is right. They are usually assumed to be counted as part of investment (hence reinvested profits). So far, with the simple model, Mankiw would be right. But wait, another part of the reform is expensing investment, so whether they are counted as operating costs or investment, you would be right and Mankiw would be wrong. Also wronger as, with expensing of investment, the corporate income tax doesn’t discourage investment from retained earnings and encourages debt financed investment (as noted by Krugman and Summers).

OK I was wrong about one thing, the last model is totally uninteresting.

This whole comment shows how pointless it is to use flexible price models to study the short run –insane assumptions must be made and the conclusion depends on exactly which insane assumptions.

After the jump, I will present a critique of Brad’s hermaneutics of the semantics of “static” (note before the jump — damned if I have a clue what “hermaneutics” might mean).

update: also a comment on Krugman.

update: My comment on Krugman’s blog

Robert Waldmann Rome Pending Approval

This is a rare and wonderful chance to semi disagree with both you and Brad.

I do agree that Mankiw’s calculation is silly. I certainly agree that the other problems with the case for tax cuts are more important.

But I don’t think he made an algebraic error or a conceptual contradiction. Mankiw explicitly considered the ratio between the equilibrium gains to labor income and the short term costs of the tax cut. He assumed that pre tax profits don’t jump — that the short term effect of the tax cut on pre tax profits is zero.

I think this is assumption is reasonable. For the small open economy with fixed employment model, it is the assumption that wages and prices don’t jump. In the real world they don’t. Brad’s argument about the short run is based on the assumption that wages and prices jump. That is very consistent with the assumption of full employment, but it is just one of two possible assumptions to add to Mankiw’s question about a model which he didn’t spell out.

Now I agree that the ratio of an equilibrium gain to a short term cost is not at all interesting. Calculating it has no useful role in policy analysis. I think the issue is asking a silly question who’s correct (and irrelevant) answer sounds vaguely like the claim made by GOP politicians and hacks.

end update.

In a follow up post, Brad notes that Jason Furman disagrees with him (and therefore with Krugman)

I quote

WHAT IS A “STATIC” REVENUE ANALYSIS?

I seem to have a disagreement with Jason Furman here:@paulkrugman: Brad is right here: Mankiw et al have clearly made a math error

@jasonfurman: Not seeing the math error. Mankiw said static. His soln is right for static (defined as unchanged base)… And dynamic version is higher.

I was taught the definition of “static” by the Jedi Masters at OTA in the early 1990s…

…on those rare occasions when they would deign to provide oracular pronouncements to those of us in OEP trying to understand their work. The Jedi Masters insisted that “static” analyses were those that did not incorporate what were essentially political-ideological views about the effects of policy changes on GDP. “Static” thus means stable overall capital stock and GDP growth paths.

But that does not mean that “static” analyses assumed no changes in behavior. OTA strongly believed that people responded to tax law changes. Income would be shifted from one category to another. Asset prices would change. Thus tax bases would vary.

Thus, Jason, when you say “Mankiw said ‘static’. His soln is right for static (defined as unchanged base)…” you give the game away. “Static” has never—not in OTA-land, JTC-land, CBO-land, or OMB-land—been defined as an “unchanged [tax] base”.

OK but wages and goods prices aren’t like asset prices. They don’t jump. They change slowly like GDP. And there isn’t anything more political-ideological than forecasting inflation. Asset prices jump. Accountants jump to shift income from one category to another when tax laws change. But wages and the prices of most goods and services don’t jump.

I guess the Jedi masters will score pretty much as Mankiw did. We will have to wait until they are given a scorable proposal.

Also, oh happy day, I get to disagree with Jason Furman too. The dynamic calculation is indeed higher if one assumes a Cobb-Douglas production function.

It isn’t if one assumes a Leontief production function. In that case (considered by Brad) everything is very simple. Employment is assumed to be inelastic. Increased capital doesn’t cause higher output. So GDP is given determined by the exogenous labor supply and technology. The after tax return on capital is constant. The capital stock is constant. The after tax income of investors is constant. The gain to workers must be equal to the loss to the Treasury. Brad presented is a long term analysis of a well defined model. The impact is one for one not greater than 1/(1-t) for one.

More generally, the effect on wages depends on the derivative of capital income with respect to capital.

I am going to assume that L = 1 (because I don’t want to constantly type “per worker” let alone “per unit of efficient labor”)

d (k f'(k))/dk

for a cobb douglass with share of capital alpha this is (alpha^2)k^(alpha-1) >0

it doesn’t have to be positive.

If f(k) = ln(k) then k f'(k) = 1 so the derivative is zero. For this production function, the sticky wage and price short run (Mankiw’s short run) is just like the long run .

If f(k) = 1/(1 + 1/(k)) then f'(k) = (1/(k^2)/(1+1/k)^2

let’s that r* = 4% so k = 4 if t= 0 (r* = (1/4)^2/(5/4)^2 = 1/5^2 = 0.04)

pre tax capital income k f'(k) = (1/k)/(1+1/k)^2

the derivative of pre tax capital income with respect to capital is negative (at t=0)

[(-1/k^2)(1+1/k) + (2/k^3)]/(1+1/k)^3 = (-1 – 1/k + 2/k)/[k^2(1+1/k)^3] = -(3/4)/[125/4]=-3/125

Well that was messy. But it shows a case in which the long term ratio of wage gains to revenue losses is less than 1/(1-t)

Hermaneutics is what we used to call Biblical Interpretation in college.

When Mankiw can reconcile his model with the following perhaps there’s something to consider but until then there’s no reason to suspect it has anything to do with realithy.

Reality is defined by the following:

http://economistsview.typepad.com/economistsview/2008/09/gdp-per-capita.html

Which is updated with this reality

http://angrybearblog.com/2017/10/corporate-profit-tax-cuts-and-wages-silly-theory.html#comments

Ignore last… this reality:

https://en.wikipedia.org/wiki/File:US_GDP_per_capita_vs_median_household_income.png

But if there’s not a math error, that suggests you can always get any answer you want based on your ideological commitments….

When Krugman says the facts have a well known liberal bias, he’s not offering his conclusion after careful economic study. Rather, “the facts have a well known liberal bias” is the trick that Krugman uses in order to consistently get economics results that match the facts.

First It would be better to read the post by progrowthliberal just below this one http://angrybearblog.com/2017/10/corporate-profit-tax-cuts-and-wages-the-uk-experience.html than this one.

@ Thornton Hall

I didn’t discuss facts at all. I discussed assumptions and their implications. I do think it is possible to get any conclusion one wants by making the right assumptions. Years ago, I challenged the internet to come up with a policy such that I couldn’t find a model in which it was optimal. Hasn’t happened.

But this has nothing to do with “the facts” or Colbert and Krugman’s claim that the facts have a liberal bias. Facts are events which have happened in the real world. Assumptions aren’t facts.

Krugman doesn’t claim he can deduce the effects of policy. He appeals to evidence.

If you didn’t discuss facts, what were you discussing?

What else is there but the world?

I discussed mathematics. I discussed a formal system, not the real world.

Mathematics is based on assumptions not facts.