2015 Social Security Report: Infinite Future Fun

Hmmm. I think I’ll just let people have fun figuring out what this all means. Hover over the image or double click and you should get legible version.

Hint the meanings of ‘past’ ‘current’ and so ‘future participants’ might not mean exactly what they seem at first encounter. You can scroll to the text from this attached link to the Figure.

Table VI.F2.—Present Values of OASDI Cost Less Non-interest Income

and Unfunded Obligations for Program Participants,

Based on Intermediate Assumptions

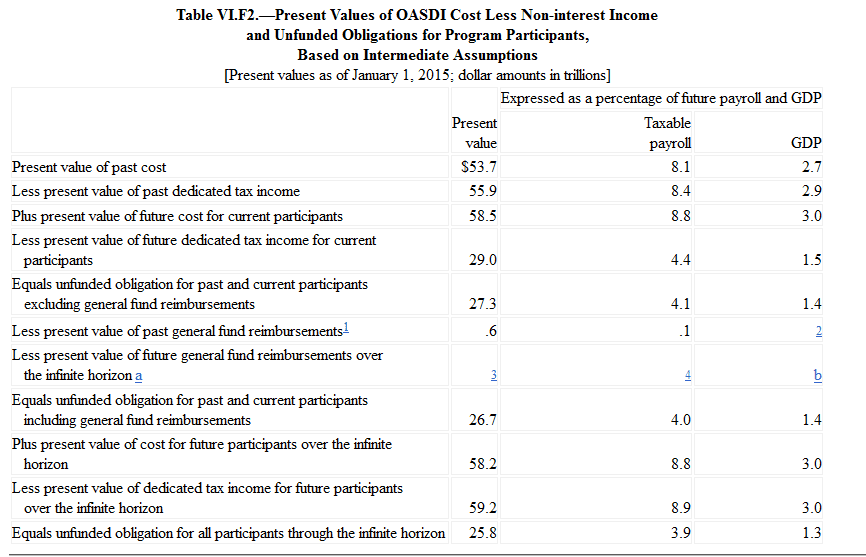

Back in 2010 there was a brouhaha mostly promoted by AEI that claimed that the trillions of dollars of unfunded liability facing Social Security were the result of a “Backwards Transfer” resulting in large part by over generous payouts to the first generations of Social Security recipients. This made some superficial sense, until or unless you studied the actual financials of the early years and payouts through 2000. Then not so much. And after poking around a LOT I came to the conclusion that most of this was based on a total misunderstanding of what “past participant” “current participant” and “future participant” actually met.

Well the short version is that “past” meant ‘dead’ and “future” meant ‘under age 15 and yet unborn’ while “current” meant ‘everyone alive over the age of 15’. Which is to say the current participants included folks who wouldn’t start drawing benefits prior to 2067.

Once you understand that it turns out that “past participants” paid for themselves and “future participants” project to pay for themselves and that the Boomer contingent of “current participants” have built up a $2.8 trillion nest egg. Meaning that almost all the current projected gap rests on the shoulders of Gen-X and Millennials.

Happy Intergenerational Warfare and Theft From the Future! Hmm, except not.

The 75 year NPV is $10.7T while the infinite horizon is $25.7T. So the period from 75 years to infinity has an NPV of $15T.

A question on this: What is the discount rate used in these calculations?

Both the 75 year and the infinite NPV are numbers that are so large that policy should not be built around them. Policy should be looking at a more reasonable 25 years (a plan to deal with 2035/34). The long-long term future solvency at SS has to be ignored for the time being.

I don’t really understand the table, but that’s OK because making infinite projections is silly. The table shows, as you state, that for future participants, the present value of their taxes is greater than their cost. However, the text around the table states that “The $15.1 trillion increment [the difference between the ‘unfunded obligation’ at infinity and that at 75 years] reflects a significant financing gap projected for OASDI for years after 2089 into perpetuity.” This seems to refer to future participants. So why does this gap not show up in the table?

Anyway, I’m still in favor of “do nothing” for OAS for now. The problem for now is DI. The fix is easy (transfer money from OAS), but the GOP seems intent on blocking it.

Webb – Off topic, but maybe you can help me understand something.

SSA says there will be no COLA increase in 2016. The assumption is that CPI-W will not grow – so no increase.

But I see CPI-W growing so far in 2015. What am I missing?

The link to SSA/CPI-W:

http://www.socialsecurity.gov/OACT/STATS/cpiw.html

I’m not Bruce, but the COLA is based on the change in the average CPI-W for the third quarter (July-Sept) of one year to the next. As you can see, the current CPI-W is below that for the third quarter last year, which is the basis for the 0 projection.

Well mike two things, one easy and maybe one not.

One “current participants” includes everyone 15 and older. And you can expect a lot of people 15-25 today to still be in the system come 2089, they would be in their nineties and we have average mortality being age 84, so maybe a third? of that cohort plus surviving spouses would still be collecting benefits outside the 75 year window.

Two the cost even in inflation adjusted terms will be $5 trillion a year in 2089 with a revenue/cost gap of around 25%. So our 90 year olds alone will be sucking up a large part of that.

And three it is reasonable to split future participants into two cohorts, one in the years before the system breaks even and one after. Meaning that kids alive today but under 15 might, indeed are likely to be part of the problem even if the generation or two after them is actually paying more than their cost.

The important thing about these numbers is that they dispell the idea that the problem is open ended and just gets worse and worse each generation until Social Security would consume 182% of GDP or something. Instead the problem is close ended and mostly caused and to be solved by people now living. If 20 somethings are simply willing to take a cut in scheduled benefits near century end and as a result only get a basket of goods 60% or better than today’s retirees as opposed to a scheduled benefit that would have that be 180% then fine. On the other hand a policy somewhere between “Nothing” and “Northwest” will easily fund the Boomers.

The problem makers will have the time and resources to be the problems solvers, if that is they want to solve the problem and can be shown that the issue is not in the structure or in the cohorts just older than then but in their willingness to pay for dignity in retirement.

Hey Thanks Mike B!!

I didn’t know the answer and don’t really have time to figure it out this morning so I really appreciate you jumping in here.

Krasting same answer as above. I don’t know the discount rate and don’t have time to figure it out. But since I agree with you that 75 and Infinite Future numbers are not the right starting point for policy discussions the only question is how to get the AEI and Cato chaps to stop talking about them all the time.

Semi-off topic. OASI and DI have separate trust funds. The administration is proposing to shore up the DI trust fund with payroll tax revenue earmarked for OASI. I understand this has happened in the past but does that transfer have an impact on future OASI projections?

Yes, brings it forward a year. Or at least to the previous year (it may not be 12 months).

Whether done by reallocating FICA or by combining the two Trust Funds officially into one (and both approaches have been fronted) combined OASDI projects to go to depletion in 2033 as opposed to a standalone OAS lasting until 2034.

Krasting

sorry that this is a bit murky, but you can verify with the chief actuaries office. the discount rate is about 5%.

i did the calculations for infinite horizon and found that the one tenth of one percent increase in the payroll tax (each) would reach the sustainable over the infinite horizon level after about 20 such raises, mostly early, but also if spread out according to future Trustees reports of “short term actuarial insolvency.

Kotlikoff would not believe this until i showed him the math. After checking it himself, he admitted, but said that “no one would pay 16% for their Social Security.” [that’s 4% combined increase over current 12%, or 2% increase over current 6% “each”]. I disagree about that: if that’s what it costs to pay for retirement security, it’s a pretty reasonable cost. Kotlikoff appears to have no more understanding of this than he has of what “infinite horizon present value” really means. aside from a trick he learned in school.

Note to Bruce: it is not correct or wise to talk about a “hit.” As you know, and show yourself, the Northwest Plan, or anything similar eliminates any “hit” other than the gradual increase in the cost of retirement… which cannot be avoided, unless you plan to change the life expectancy or birthrate. Even “improving the economy” will not in the long run change this, except that people retiring on 30 to 40% of their lifetime average wage would, of course, have a higher standard of living… one they would not be willing to forego after a lifetime of expecting that gradual increase in standard of living.

the “infinite future hit” is just a garbage way the actuaries… in their innocence… came up with to confuse people and paint the future of SS bleak.

i say innocent, because doing this kind of arithmetic is what actuaries do… in case the results suggest something important or useful. deciding to publish it and writing the scare words around it, is what the trustees do… and they are political.

note, the “present value of taxes is greater than the present value of benefits” is misleading.

in the first place it is very sensitive to the choice of discount rate.

in the second place it implies that you can find an bank or investment that will pay that interest reliably, every year without regard to inflation or market conditions or interest rate fluctuations. you cannot find such a bank or investment.

and in the third place it totally ignores the insurance value of social security.

it is one thing to use “present value” as a tool to give you some idea of the “value” of an investment… even thinking of Social Security as a kind of investment. But it is dishonest or stupid to report that present value as some kind of arithmetical fact about the real world.

please note that you will ALWAYS get back more from social security than you put in (assuming a normal life expectancy after retirement).

it may be that you won’t get back as much as you MIGHT HAVE gotten from the stock market or the Magical Present Value Bank, but you will get back more than you put in. about three times as much… enough to cover inflation (something you cannot guarantee from the market) and enough to match the general increase in the economy… something that your magic present value bank cannot guarantee. moreover what you get IS guaranteed…. and that is priceless.

moreover,

the present value of taxes always includes the employers share.

you might be able to get paid the employers share in the absense of SS, if you are the employer, or have unusual leverage in bargaining with the employer. but the average employee has no such leverage and without SS he would not see the employers share or even the employees share.

moreover, doing the calculation for the “average worker” is misleading to the point of dishonesty. the point of SS is to take care of those who fall short of being “the average worker” (and you, however bright your prospects could easily fall short). The low earner, counting only his contributions, and assuming his benefits include spousal benefits will get a return on his investment on the order of 10% real. This is a rate that very, very few “investors” and no “savers” can hope to match.

moreover, ordinary workers would NEVER save the amount of money that SS “taxes” them. from their point of view there would never be a month when the could “afford it.” the kids need shoes, the car needs brakes, the landlord raised the rent….

moreover, many workers… far too many… would never even think to “save” money. they’d play the lottery, or invest in sure things on the market, or just go out and have fun while they are young. SS saves the rest of us from having to support those people in their old age, because SS guarantees that those people will have paid for their retirement themselves.

moreover, without SS, more than 50% of workers would end up in desperate poverty (and another 30% would end up in strained circumstances). you, intelligent and provident as you are, are not going to be able to make a lot of money in an economy where half the elderly are living in poverty and all the workers are desperately afraid of being poor when they are old.

nearly everything you have ever read about Social Security… except here… is a Lie created by the very short sighted or ideologically insane who hate the idea of “workers” not working… even if they have paid for their own retirement.

“Back in 2010 there was a brouhaha mostly promoted by AEI that claimed that the trillions of dollars of unfunded liability facing Social Security were the result of a “Backwards Transfer” resulting in large part by over generous payouts to the first generations of Social Security recipients.”

I came to a different conclusion. A PAYGO system uses future revenue to pay benefits to people who are no longer contributing. If you wanted to be able to move away from PAYGO, this would be important. If you think PAYGO works just fine, “backwards transfer” has no meaningful policy impact. As evidence I observe that the backwards transfer will increase every year all the way to the infinite horizon.

Andrew Biggs worrying about backwards transfer is just saying he does not like PAYGO.

Arne

people who say they don’t like pay-as-you-go are being dishonest or stupid.

the only difference between pay as you go and paying your money into a bank (or investment) and taking it out forty years later is that pay as you go eliminates the risks associated with banks and investments.

the illusion that “you” are paying for someone else’s retirement is just an illusion the bad guys exploit to get ignorant people to think SS is some kind of evil “transfer” from the young to the old.

under pay as you go “you” put your money into the bank called social security and you get it back, with interest, when you need it later. it makes no difference… either SS or bank… that the money “on that day” came in that day from someone else who was depositing his money for exactly the same reason you deposited your money all those years ago: so that you could save it and collect interest and have it there when you need it.

i am not sure why this is so hard for people to understand, but i suspect it is limited intelligence supplied by lies from those who know perfectly well that they are lying.

You are arguing with a straw man. Supply-side economists think they have a reason not to like PAYGO. They argue that the entire economy will be bigger (therefore, better) if more money is invested. Thus, personal accounts are inherently better than PAYGO. Andrew Biggs even provided his numerical analysis.

I think all that money seeking a better return will depress returns and that therefore Andrew is wrong, but I do not think he is stupid.

Perhaps not a straw man. There are people who say stupid things. But not everyone opposed to PAYGO is ignorant.

Coberly. Re the discount rate. I did ask – “State secret”.

You suggest 5%. That would surprise me. SS assumes 5.7% for the long term average rate. The discount rate is either = to, or > than the % rate.

If it is less than the % rate, then it just coins money on an NPV basis.

Arne

Biggs is not stupid. Did I mention another possibility?

just for your thought… consider what happens in a mature investment system: part of all NEW investment goes to replace that part of OLD investment withdrawn in the form of dividends or stocks sold.

this means that on net Social Security subtracts from “investment” exactly what investors subtract from investment when they cash out their investments.

SS represents no net loss of investment money.

moreover, have you looked at the stock market lately? there is MUCH more money looking for a place to go than there are productive investments looking for money.

not sure what straw man i am arguing with.

Krasting

you may be right here. I also asked a year or so ago and got an answer that was, I think, 5.7%. The reason “I think” is that, yes, there was some reluctance on the part of the person I talked to to give me a straight answer.

My own calculations showing the interest rate that would have yielded their predictions of Trust Fund growth (less payouts) and ultimate actuarial deficit NPV seemed to show a 5.3%

As for the coining money on a NPV basis, I wish you would explain that to me. Please note I used their numbers in all cases except when I had to “calculate” a number that would give THEIR results assuming their numbers. Then I used these numbers to calculate the result of changing the tax rate. I would be very, very surprised if this introduced any meaningful error.

Are you currently able to access the single year tables? I am not.

Coberly – As you know, the discounting of future cash flows is done with a single discount rate. SS has very complex flows, so the calculation is very large. Follow this simple example on the consequences of using an improper discount rate.

Say you have $100. That’s all you have. You go to the bank and deposit the $100 in a CD that pays 5.7% and matures in exactly one year. You walk out of the bank and say to yourself: ” I will have a net worth of $105.70 a year from now.” Then you ask, “But what is my net worth today?”.

So you do some math and you discount your future net worth. You use a discount rate of 1) 4%, 2) 5.7% and 3) 7%. The results:

1) 105.7 / 1.04 = 101.63 This can’t be right. Your net worth is higher before you walk out of the bank on day one? This is how in finance you can “coin money” using an improper discount rate. Note that the error rate is 1.63%. A meaningful number. Extend that error over 75 years and a few gazillion dollars and you end up with bad #s.

2) 105.7 / 1.057 = 100. No change in your present value of net worth. This is the “right” answer.

3) 105.7 / 1.07 = 98.72. So it costs you (on an NPV basis). This too is a wrong conclusion. Your net worth, in the present, is $100.

Dale,

What I was considering as a straw man was your idea that the objection to PAYGO was “the illusion that “you” are paying for someone else’s retirement”. Yes, many do say that, but true adherents to supply-side dogma are more nuanced.

Your observation about a mature investment systems does not get at the point since it is not the same size mature investment system.

I do not need to think they have much of a point to want to know what they think they are saying. It means I can see that they really can be wrong without being stupid or dishonest. I suppose I need to believe that slow continuous pressure will work where large doses of truth simply bounce off.

Bruce K,

I think you can get what you want from here:

http://ssa.gov/oact/TR/2015/lr5b2.html

out year nominal 5.6 %, real 2.9 %, consistent with their projected CPI of 2.7 %

from http://ssa.gov/oact/TR/2015/lr5b1.html

Same as last year.

Krasting

thanks for the reply.

“as you know”… don’t be too sure. in general I know nothing until i understand it. right now i don’t understand it. would you care to try to explain why you get the answer you do?

Arne

i see why we are not communicating. i am thinking of something different than you are. mostly many, many “arguments” about ‘oo is paying for ‘oo’s retirement.

thanks for the link to SSA’s discount rate. I’ll try to look it up. having serious computer trouble with SSA links at this time.

Arne

your link does not work for me. have been having this problem. i will go to the library and use their computer. should be able to figure this out. might take a few days of running back and forth.

Krasting

i may be getting a bit dizzy here (from all the running around) but i can’t understand why you would choose to divide the future value by any number other than (1 plus the interest rate) raised to the number of years power… in order to get the present value.

Krasting

when figuring a present value you use a discount rate that is equal to another investment with similar risk. since you are never going to experience a “similar” risk, the PV is only a best guess under the assumptions.

of course if you are talking about a bank deposit with a known interest. you know the proper discount rate… it’s the interest rate. but you also already know the present value.. it’s what you presently have in the bank.

if you pick a discount rate that is less than the actual (unknown) rate of return you will guess a higher present value for the investment than will turn out to have been the case (it would have taken a larger investment at the lower guessed interest to generate the future value that you will receive. of course since you don’t know the future value either, it makes the whole thing a bit of a structured guess. i don’t see where you “coin” any money out of this.

Bruce K,

I think I disagree with you.

If you have a hundred dollars and you are going to put it into a CD and

1) Bank 1 offers 5.7% for 1 year

and

2) Bank 2 offer 5.3% for the same period:

Once you lock it into a CD (ignoring the ability to take a penalty), you have different NPVs for the two choices.

The “right” answer for discount rate is not simply what someone offers you.

Arne

i don’t understand your point about the same size investment system.

all i need to justify my point is the idea that the investment system” has been going on long enough that people are taking out the money (plus interest) that they put in… the reason they put it in.

the investment system needs to replace the money taken out every day with new money taken in BEFORE any money it takes in can be used for “investment.” this is exactly what SS does, except that it doesn’t take in any more than it needs to pay out on that day (on average).

the money taken in by SS is not “lost” to the investment system because it is exactly the amount of money that system would have to pay out on that day to those investors now cashing in their chips.

don’t see what size has to do with it.

Arne

i think you and Bruce may be talking past each other. the PV of a CD is exactly what you buy the CD for. i don’t know anyone who talks about PV’s of known interest “investments.”

what PV is used for is to compare, under some constraints to make the comparisons comparable, different investments with uncertain returns and , frankly, uncertain “discounts.” only as long as the guesses are made by the same person are the PV results useful to that person. OR two people may make their own guesses about future value and discount rates and decide to buy or sell according to their guesses.

but PV of a “known result” is pretty much a pointless exercise… it’s what you pay for the tickee.

now i am by no means an expert, so i may be missing something here. as for example you might want to compare the “present value” of two different “fixed interest” investments with different maturities.

still, everything i have seen in my limited universe is that the PV is a structured guess.

Arne

i haven’t been able to get to the site you link for PV. I am guessing it is the “interest” table which may not be the same as PV

unless

the ultimate PV was calculated assuming the “discount rate” to be the same as the interest rate FOR EACH YEAR. This would explain why an “average” discount rate of about 5.3 gives the same value for ultimate PV of deficit as the Trustees publish, and NOT 5.6 or 5.7 which is the ultimate “interest rate” projected in the tables.

but I am very much open to more knowledgeable people explaining this to me.

“Andrew Biggs worrying about backwards transfer is just saying he does not like PAYGO.”

No this doesn’t capture the Bigg’s argument circa 2010 at all. What Biggs was doing was suggesting that ‘unfunded liability’ was the same thing as ‘public debt’ and so was something that had already accrued and so landed on the shoulders of “our children and grandchildren” and so a form of “Intergenerational Warfare”.

But as I have pointed out time and again “unfunded liability” is NOT debt and certainly not debt piled up the the first generations of Social Security benefits.

As you know, and implictly note, under any Pay-Go system there is a time disconnect between contributions made and benefits accrued but that doesn’t make the latter an actual debt transferred backwards, you can’t just transform a dynamic system into some sort of static model.

But that is what Biggs did. He just took a definition of “current participant” that had almost anyone reading his treatment as meaning “current beneficiary” and ran with it. Thus asserting that all of the “Closed Group” obligation was due to excess payments to a combination of “Past Participants” and “Current Beneficiaries”. i.e fucking Selfish Boomers like you and me and our uncles and aunts and parents.

This was just dishonest.

Bruce:

Was Biggs really interested in what happened to others or was he like Delisle (student loans) with just an interest in the politics of the subject? I have read his points and your counters and come to the conclusion the latter. People seem very worried about baby-boomers sucking the life out of the economy with retirement. Yea we are big; but following us, Millenials will take up much of the slack as long as they can find productive and well paying jobs and the same holds true with Gen-X. Baby-boomers are not the last major cohort.

Run Andrew Biggs is a professional. His profession is as an advocate for Social Security ‘Reform’ as that is defined by his bosses. Near as I can tell he has had four main employers since getting his PhD. He early on worked for Cato’s Project on Social Security Privatization, later renamed its Project on Social Security Choice. At some time after that he was employed with the Bush White House, I believe on the CEA, with a main responsibility for Social Security. Later he was appointed by Bush to a series of political posts at the Social Security Administration culminated with a stint as the no. 2 (the Principal Deputy Commissioner of Social Security) which made him ex officio the Secretary of the Board of Trustees and so a signator of at least one Social Security Report. He is now at AEI where he continues to research and write on Social Security from a ‘reform’ perspective. That is he has never that I know of never taken a paycheck for anything else. And he is really, really, really good at his job.

I like to think of him as the equivalent of a high priced criminal defense attorney. You don’t have to believe in your client’s innocence, you just have to do the best most professional job you can in an attempt to win the case. I suppose it helps a lot if you really believe in your client, just like it helps if lobbyists or travalling salesmen believe in the product they are selling. But it isn’t an absolute requirement for the job. I personally don’t believe Biggs really believes all the talking points that he promotes. Mainly because I think he is too smart. But maybe he is just a closet Randian Objectivist with a sharper set of tools than most of them.

Bruce

I am not disagreeing with you. Just a different story: Orzag who sounded as if it was his idea wrote that it was like if your grandfather got sick and spent his retirement money on doctors so your dad had to help him with his retirement and so you had to help your dad

the idea being that if your grandfather had not gotten sick your dad could have invested that money, or actually a smaller amount of money on account of the interest, and you would no have had to pay for his retirement and so could have invested the money, or a smaller amount, and paid for your own retirement at less cost than you paid for dad’s retirement.

this is all bogus. everyone who paid into SS… even though their money went directly to pay the benefits of those already retired… got their own money back with interest to pay for their own retirements… even though that money came directly from your children’s generation… the money the children pay comes back to them with interest etc.

the “backward transfer” comes out in the wash as long as there is no “last” generation that pays forward and never gets any benefits.

probably Biggs could show some math that would “prove” this was not true… but it would be bogus.

in fact, even that first generation who got a pretty good deal from SS… were the people whose own savings were wiped out by the depression and who had in their turn paid for their own parents retirement and paid taxes for the welfare that helped the elderly poor before SS was invented.

point being that if you talk fast enough and wave your arms a lot you can make the good sound like the bad.

it is, as you said, dishonest.

Without commenting on Orszags degree of honesty I would just refer people back to the table.

Past participants paid in $53 trillion in PV and only took out $51 trillion.

Which means whatever amount “current participant” Dad paid in to support “past participant” Granddad the actual effect was that that money was paid forward to other “current participants”.

The time lags and overlaps between “past” “current” and “future” participants make for mindboggling calculations as to who was screwing who on August 20, 1989 but the idea that trillions of dollars of future “unfunded liabilities” some how were generated by the less than one trillion dollars paid to all beneficiaries prior to 1980 never made sense to me.

The expression “20 pounds of shit in a 5 pound bag” comes to mind. And no amount of PV, NPV and FV are going to make that go away.

Bruce

I agree with you entirely. one person said to me “it’s hard to explain to the layman.” i classified that remark with Ryan’s “you don’t want me to go all wonky on you.”

i am afraid i have wasted a good deal of my life trying to determine if there was anything real in some of those bags you talk about.

Bruce Webb said: “But as I have pointed out time and again “unfunded liability” is NOT debt.”

This is a really important concept that some people have difficulty grasping. Anti-social security people speak of unfunded liability as if it is money already down the drain that future people have to pay off.

An analogy is to consider your child at birth. Your child has an unfunded liability to earn over their lifetime enough to provide housing and shelter for themselves. Let’s say your child needs to earn an average of $50,000 per year over a 40-year career to provide for themselves.

So you could say that your child has an unfunded liability of $2 million at birth. You wouldn’t say that your child has a debt of $2 million at birth. Future liabilities can be paid for by future income.

“don’t see what size has to do with it.”

You need to step farther back and manage to see it with supply-side perspective. In their model, there is around $400K more in the economy for each retiree. This money when invested will create more jobs because supply-side.

I have been trained to do NPV analysis for engineering purposes. Any process applied to the wrong inputs produces garbage, but there is no reason you could not apply it to selections of CD investment options. Once you buy the CD the payout is known. If you made a bad deal and accepted an interest rate below the appropriate discount rate then you did stick yourself with a decrease in PV.

If you don’t know whether it was a good interest rate then you just don’t have enough information to determine the right discount rate and you cannot do an NPV analysis.

Arne

that is very interesting. i would be glad to learn more.

where does the extra 400k come from? SS puts back into the economy exactly what it takes out. a “mature” pool of private investment must replace what it pays out with part of what it takes in. seems like a wash to me.

if i understand your PV analysis of current purchase of CD you are saying that if you had “good” knowledge of what a CD “should” pay, you would realize that you paid too much for the CD you bought?

so what is good knowledge? the interest on another CD equally safe?

The extra comes from the supply-side economist replacing SS with personal accounts. Poof! It exists. You are trying too hard to make coherent sense of it.

I don’t think that “good” is an appropriate term. NPV analysis is generally used for comparing options. The rate is usually a given, but you must choose something. Again, you may be trying too hard to make sense of the fact that someone else has quoted a Present Value, but we do know there must be a discount rate somewhere in the analysis even if they did not tell us what they used.

My apologies if my discussion of the process led you to believe I think the results mean anything.

Arne

I like to try to make sense of what other people believe. This often leads me to believe they are not making sense. I hate to think they are merely bluffing.

If you want to try this, I am not very happy with the PV discount rate that the Trustees used, appear to have used, to calculate the unfunded deficit.

when i calculate the yearly balances using their information, cross checked a couple of ways, i need to use a discount rate of 5% (almost exactly) to arrive at the PV of the unfunded deficit that they get.

if I try using the yearly interest rates from the table V.B2 I don’t get close to the PV they get. Moreover the interest rates in the table appear not to be the “effective rate” mentioned in the overview.

So how would you determine the discount rate or rates that they used, given the income and cost data they use?

“please note that you will ALWAYS get back more from social security than you put in (assuming a normal life expectancy after retirement).”

Well… That’s another one of my issues with the system. A Black man at age 66 (current full retirement age), has a life expectancy almost two years shorter than White men. And men in general live about two-and-a-half years less than women. So, shouldn’t Black men be getting more per month?

Warren

not really. some white men live short lives too. and some black men live long lives. are you just going to sort them out by color.

black men (as a group) also pay less into the system and have more widows and orphans.

it’s fine to have a hobby second guessing something that others worked very hard to put together so it works. but… oh my gosh. look at the time. i really have to go.

“[Are] you just going to sort them out by color?”

If it makes the system fairer, yes.

“[Black] men (as a group) also pay less into the system…”

True, but we already base benefits on that. A Black man and a White man who have paid the same amounts into the system will receive the same monthly benefit, but the White man can expect to live longer.

“[Black men] have more widows and orphans.”

I doubt that — the Black marriage rate is lower than the White rate, and the out-of-wedlock births for Blacks are higher. Such women and children do not get survivor benefits.

And furthermore, Black men are more likely to die before ever receiving any benefits at all. Why should their heirs not be entitled to some of what their fathers and grandfathers paid in?

Warren if those men have heirs who are wives or minor children they do get survivors benefits.

There have been a number of plans proposed which would convert Social Security into personal accounts with rights of inheritance. For example you could consult the Liebman-MacGuineas-Samwick Plan or the Pozen Plan which was advanced in 2005 as a stalking horse for the Bush Option 2 Plan which was his preferred proposal during his Social Security Tour. Unfortunately in all cases that I am aware of the plans ended up requiring lower income workers to convert their retirement to an annuity and only allowed a small payout to heirs in case the worker died right before eligibility.

The idea of inheritbility of Social Security is appealing enough. In the abstract. It is just that nobody has been able to make the numbers run. Because converting lifetime contributions into a cash equivalent that could be alternately drawn on in retirement or passed on to heirs ends up not working for either.

The morality is good. The economic and actuarial realities not so much. This by the way is what ended up killing the first iteration of the Chilean Plan so much admired by the Chicago Boys and the very similar Galveston Plan. Those plans only actually worked out for workers in the top tier.

Warren

if they die with dependents, their dependents get a pension. SS is a horse. Stop trying to turn it into a cow.

Plus Warren illegitimate children if recognized by the parent are eligible for Social Security benefits

http://www.socialsecurity.gov/OP_Home/rulings/oasi/09/SSR66-47-oasi-09.html

And under conditions that would not have them eligible for survivors benefits they equally would not be eligible for inheritance.

Your ideas are not totally off-base but would benefit from some tighter focus. For example by addressing some of the oddness in the benefits for spouses who have an independent earning history and see a loss in total household Social Security benefits when one spouse dies that in some cases exceed the marginal cost of that extra spouse in life. That is if your wife’s Social Security check, even if less than yours, was what allowed the two of you to pay rent, the loss of her and it at the same time might render you homeless. And this is often as bad or worse the other way around where the lower income spouse has to give up their own benefit to claim their spouses survivor benefit.

At some point you want to just slice the knot and go to some version of a minimum UBI.

Bruce Webb: “[If] those men have heirs who are wives or minor children they do get survivors benefits.”

And if they have never married the mother(s) of their children?

They get nothing.

Coberly: “[If] if they die with dependents, their dependents get a pension.”

As Bruce points out, only minor children (or kids up to 19 if still in high school) receive such pensions.

Coberly: “SS is a horse. Stop trying to turn it into a cow.”

The fact is that Social Security is, on average, a worse deal for Blacks than for Whites. So why can’t we allow people to pass some of that on to their beneficiaries?

If they cannot do that, then please give up the fiction that people are paying for their own retirement. They are not.

Bruce, that ruling also required part 3, that the child “was dependent upon the worker at the time the worker died.”

If such support existed, if would have changed many children’s welfare benefits. (That’s one reason many poor people don’t get married — because they would see a cut in government help.) To make such a claim would subject them to fraud accusations in their having received welfare to which they were not entitled.