Best to own a business rather than work for one

Best to own a business rather than work for one

In my effort to move away from covering Europe exclusively on this blog, I’ve returned to a little niche of economic data that had intrigued me in the past: US national income accounts/accounting. This time I’ll look at national income, specifically corporate profits – I’ve written about it before, and my colleague Ed Dolan covered it on Economonitor in June.

It’s best to own a company rather than work for one

Ed Dolan reports that corporate profits are rising as a share of gross domestic product at the expense of small business income and presents normative solutions. This redistribution of business income toward large corporations is a relatively recent phenomenon. Proprietor’s income as a share of national income peaked in the mid 2000s and has broadly declined; but before that point, proprietor’s income (green line) and corporate profits (purple line) jointly trended higher as a share of national income while gross employee compensation declined (blue line). It’s the business employees that are the real losers in this cross section of income.

On a relative basis, corporate profits surged since the financial crisis, reaching 13.9% of national income in Q1 2013 (2 standard deviations above its mean), while proprietor’s income retraced some of its loss after bottoming out at 8% of total income in Q2 2009. In contrast, employee compensation hit a new low in Q1 2013, representing just 61.5% of national income (2 standard deviations below its mean).

Note: the numbers in the chart legend represent the latest available data for Q1 2013.

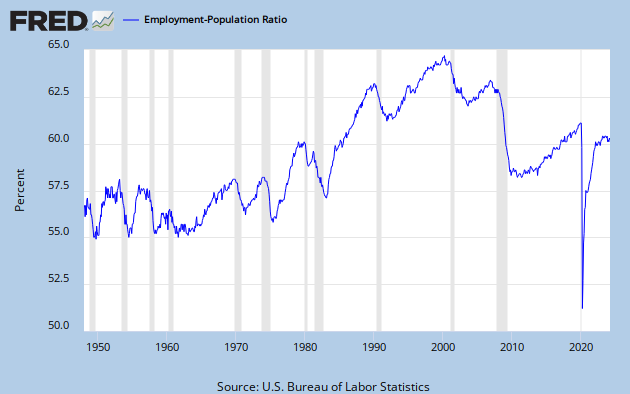

This is a crisis of labor income. Where and when will the redistribution occur away from corporate profits and retained earnings and toward employee wages? I hope some miraculous investment in labor occurs soon, but the current state of the labor market doesn’t portend that a shift is imminent.

At least for now, it’s better to own a business than to work for one.

Up next this week: why the corporate profit numbers mean what you think they mean….

cross posted with The Wilder View

“Where and when will the redistribution occur away from corporate profits and retained earnings and toward employee wages?”

I don’t believe there will be a rise in CapEx or SG&A with the current FED policies in place. With no interest income available, companies spend the bulk of their cash on dividend payouts.

As a result, companies are going to be working with old assets (in some cases very old assets) for quite some time. At some point these companies are going to run into problems with these old assets, problems that depreciation won’t compensate for.

Rebecca

What part does the increasing share of income garnered by the financial industry play in the movement of income away from both proprietor’s income and employee income? It would seem that small business income, while better than employee income, is not a sufficient hedge against lost income for either group given the growing rapaciousness of the banking industry.

Amazing how via eyeballing the trend curves for each labor/corp they appear to be exact opposites of each other. It’s looks as if you could roll one over onto the other perfectly.

The other thing is that continual crossing of the 2 lines between 10 and 11% for corp and 65/66% for labor suggesting there were some things working to correct the imbalances. But, since the last crossing of 2008, if policy does not change, the 2 shall never cross again.

Is there any data on what sectors dominate the corp line and their percentages?

Self-employment involves long hours, great risk, tons of bull#$%^ from the government and employees, etc.

Be careful what you wish for. 🙂

Rusty

yep, i know that. i quit a business i wasn’t particularly good at and went to college to better myself and became an employee. It took twenty years before I was again making the income i had walked away from.

It’s funny to listen to small businessmen complain about how hard they work. But none of them want to quit to go to work for someone else.

And that’s what’s wrong with “labor.” They can’t quit and go to work for themselves. Either they aren’t smart enough (it takes a different kind of smarts to run a business than it does to get a PhD) or Wal Mart drives them out of business.

Which means, as far as I am concerned, neither Rebecca nor Rusty is telling us anything we didn’t already know. The problem is how to do something about it. I don’t think “tax the rich” is going to work.

rebecca:

If the retained earnings go to me, I can see why you might suggest such as retained earning certainly are not flowing towards me (salary) from bigger companies unless I am a stockholder.

It is better to own a business then to work for one, but you have to be prepared to put in a lot of hard work to get to the place where you are making good money from it . it is like most things in life , if you are willing to risk more you can potentially win more.

Refer to the Kalecki Profit Equation:

http://www.concertedaction.com/2012/03/12/kaleckis-profit-equation/

Note that neo-classical economists don’t even get close to this equation, for otherwise, through equation (2.4), they would have been able to rediscover Kalecki’s (1971: 82–3) famous equation which says:

that profits are the sum of capitalist investment, capitalist consumption expenditures and government deficit, minus workers’ saving…..

which says that the retained earnings of firms are equal to the investment of firms plus the government deficit minus household saving. Thus, in contrast to neo-liberal thinking, the above equation implies that the larger the government deficit, the larger the retained earnings of firms; also the larger the saving of households, the smaller the retained earnings of firms, provided the left-out terms are kept constant.

Of course the given equation also features the well-known relationship between investment and profits, whereby actual investment expenditures determine the realized level of retained earnings.

I’m assuming that proprietors includes all forms of pass-through businesses , including sub-S corps. If so , according to this article from the Tax Foundation , in 2009 about 2/3 of the total proprietors’ incomes went to taxpayers making > $250k :

( Table 1 )

http://taxfoundation.org/article/individual-tax-rates-also-impact-business-activity-due-high-number-pass-throughs

So , as for corporate profits , the lion’s share of proprietors income goes to a narrow slice at the top. Most small-medium sized businesses have probably experienced the same sort of income share non-growth as have typical wage earners.

Matt

an argument as non intuitive as that needs more explanation.