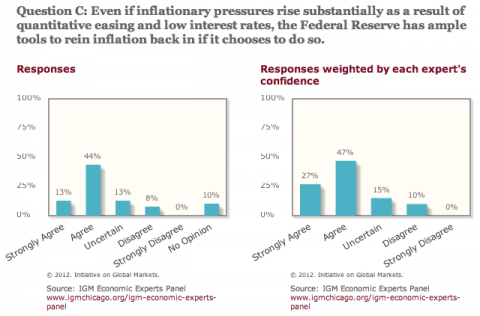

57% of Leading Economists are Not Worried About an Inflationary Wage/Price Spiral

8% are. 23% are uncertain or have no opinion.

I really like this IGM panel (check out the roster — pretty damned impressive, or at least credentialed), but I wish they didn’t post such wishy-washy, softball questions. I post this one because it’s not.

The one I’d really like them to ask:

A modern, prosperous country taxing 40% of GDP is likely to grow significantly more slowly over the long term than one taxing 30% of GDP.

True or false?

Cross-posted at Asymptosis.

If you have ever lived through a wage-price spiral, raise your hand. 🙂

57% is a depressingly low number, for economists.

Yes, good question. Why not 90% vs. 100%? What about 0% vs 100%? Or 75% vs 30%? Or 0% vs 5%? Perhaps you have a causation and correlation problem.

Oh god,

Inflation do to wage increases? Please, I’m laughing so hard my sides are hurting.

Obviously they have not been paying attention to the latest socioeconomic event just settled in time for the all important work event known as football. Or mayby they did but did not know that the workers were willing to stay at their expired contract but the job creators offered a 16% pay cut, moving to full time work and no more pension.

OOOO, OOOO, OOOO, who took the pay hit with the auto bailout?

president romney could handle those wage price spirals the same way nixon did…with a wage-price freeze…

@Min: “If you have ever lived through a wage-price spiral, raise your hand.:

@Min: many would cite the 70s/80s. But your point is well taken. They *exceedingly* rare in countries that aren’t devastated by war etc. Depressions, OTOH, are exceedingly common.

Inflation hurts creditors — transfers massive buying power to debtors; deflation hurts debtors — transfers massive buying power to creditors.

Creditors are (always) in power.

@Unknown: “Why not 90% vs. 100%?”

Because modern, prosperous countries all tax between 28ish and 50% of GDP. Europe overall is 40%, US is about 28%. It’s not useful or interesting to ask about fairlyland tax systems.

Just to pound this poor dead horse on more time, after labor compensation has been stagnant for four decades and is now actually i decline, how can even one economist have even the slightest concern about a wage-price spiral?

Idiots!

Hand up for living through a wage-price spiral. It was the late70’s, and I received several cost of living adjustments in my meager pay check during those few years.

Ten % might seem paltry by hyperinflation standards, but it was significant.

What we have now is very painful low inflation, because wages have not kept up. The 70’s were better.

JzB

Jazzbumpa:

“Hand up for living through a wage-price spiral. It was the late70’s, and I received several cost of living adjustments in my meager pay check during those few years.”

Sorry, I should have been clear. COLAs are just keeping up with inflation. So I would simply call that inflation, not a wage-price spiral. Maybe they mean the same thing, but I thought that they were different, that a wage-price spiral indicated a runaway feedback cycle, not just inflation.

Min et al

I lived through the seventies… hardly noticed the inflation myself.

what i did notice was the depression that resulted from “fighting inflation,” which according to Greider was already dead. He also suggests that the original inflation was caused by Fed policies. and I certainly had a low opinion of Samuelson’s (the real Samuelson) idea that inflation was driven by too low an unemployment rate. All those workers sitting around demanding higher wages than they “deserved.”

As for the creditors always having the power… i think it’s the other way, the folks who have power are always creditors. they lend money to folks in order to enslave them.

No worry about asset price inflation though [which includes many commodity prices such as oil, grains,etc].

Given that most of these are purely vulgar economists who failed to predict and cannot explain the ongoing, again deepening, Global crisis other than with reference to finance, what’s to be expected.

btw, even for the 1970s, better to speak of price/wage spiral than the reverse [and recall that that inflation began prior to the ’70s].

Further, UNCTAD at least appears to ‘get it’ —

On the brink: fiscal austerity

threatens a global recession

http://unctad.org/en/docs/presspb2011d12_en.pdf

Juan

This comment has been removed by a blog administrator.