Do Millionaires Vote With Their Feet?

Andrew Rosenthal points us to one of the most eye-poppingly specious arguments I’ve ever seen against high-earner taxes, from Scott Hodge at the Tax Foundation (my bold).

…612,520 people renounced their New York State citizenship and moved to Florida between 2000 and 2010. They took with them nearly $20 billion in adjusted gross income, after adjusting for inflation. During the same period, 208,784 Pennsylvania residents renounced their state citizenship and moved to Florida, taking $8 billion in income with them.

Many of these New York and Pennsylvania residents no doubt moved to Florida for the warm weather, but many more may have moved their because the state does not have an individual income tax, an estate tax, nor an inheritance tax.

“May have” is certainly a strong piece of evidence. It’s hard to argue with.

But let’s try.

Back when we were trying to pass a high-earner tax in Washington State a couple of years ago (with Bill Gates Senior as the lead spokesman and cheerleader; it failed dismally), I got curious to know whether millionaires do actually congregate in low-tax states.

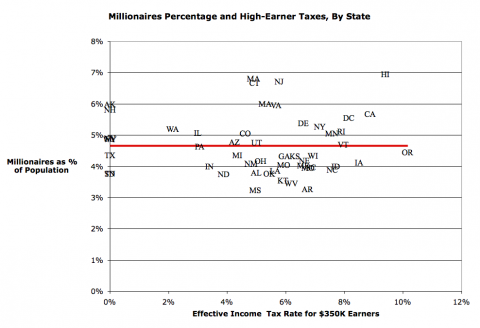

It turns out they don’t:

The correlation is -0.00003. Notice in particular the giant gaping hole in the upper left corner, where the millionaires should all be congregating. (Florida’s over there by the 5% mark.)

Of the 12 states with the highest concentration of millionaires, 10 (83%) have above- or at-trend (in this case, median) income tax rates.

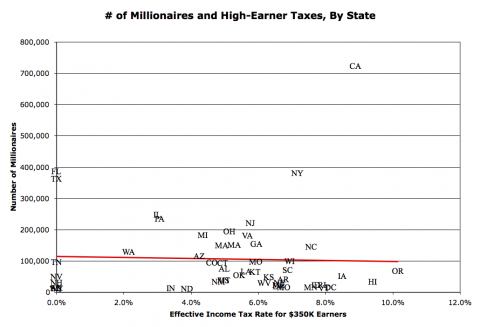

This Hodge piece got me curious again, so I plotted the raw number of millionaires (since this doesn’t account for population, it’s just for grins):

The correlation here is somewhat negative (lower tax rates, more millionaires), but still effectively nil: -.035. Florida and Texas do stand out, but so do New York and California. Who you gonna believe?

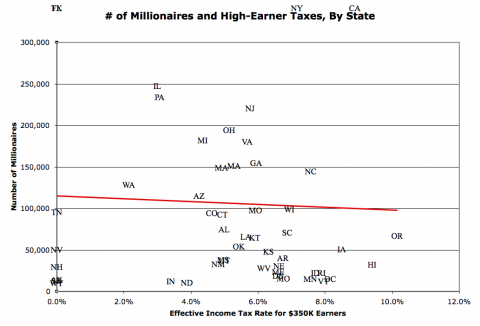

Here it is with the X-axis scale changed, so it’s easier to see the bulk of the states:

(I just noticed a screwup here: one of the MAs should be MD for Maryland.)

So the evidence suggests that Hodge’s fond notion is nothing more than that: something he wants to believe, which is utterly contradicted by the facts on the ground.

Rosenthal quotes Michael Bloomberg, who some might consider an authoritative source on this subject:

I can only tell you, among my friends, I’ve never heard one person say I’m going to move out of the city because of the taxes. Not one. Not in all the years I’ve lived here. You know, they can complain, ‘Ugh, I got my tax bill, it’s heavy.’ But my friends all want to live here.

The Scott Hodges of this world don’t seem to have read their Adam Smith, in particular the passage containing the “invisible hand” coinage of which they are so fond:

…every individual endeavours to employ his capital as near home as he can, and consequently as much as he can in the support of domestic industry… By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention.

How many of them do you think actually know what Smith was talking about in that passage?

Many thanks for the effective tax rate data to Eric de Place of Sightline Daily, who did the yeoman’s work of compiling it based on…get this…Tax Foundation data (XLS).

Millionaires percentage: Phoenix Affluent Marketing (PDF).

Cross-posted at Asymptosis.

Steve

while few people know that Smith was talking about the importance of “domestic” industry with the “invisible hand” line,

even fewer know that comparative advantage is only operational under the assumption that capital stays home.

in either case it is no longer true as giant corps use the whole world to play games with labor costs and taxes and don’t give a damn about US.

and how does it affect your analysis if you think that people work in NY and Cal because that’s where the money is… but they retire to Fla because that’s where the taxes are low, and the extradition laws are tough.

CPAs often observe that instead of selling out and moving south at age 65 – 70 (the old pattern), business owners are selling out and moving south much earlier. I mail more tax returns to Florida than Ohio and Michigan combined (small sample to be sure).

Weather and taxes are two major issues. And some businesses can be conducted largely over the phone and internet, so why stay in high tax states?

Where there is smoke there may be fire.

Steve, Perhaps the highest concentration of “millionaires” are people with barely over a million dollars. One of the campaign claims in MD after the crash was that MD was losing millionaires because of taxes. Of course, most of this loss came from houses and retirement pots dipping and rendering the net worth below a million.

It makes me think that all such claims should track actual people in order to get accurate numbers.

Every analysis of “best places to retire” includes taxes as well as weather (and other things). Since retirement money of people with about one to two million dollars often must become a virtual paycheck from themselves to themselves, it is not surprising that people move to good weather and higher pay.

States let people defer taxes then wake up and realize they never got to collect them. I think CA tried or is still trying to collect these but I’m not sure. But I still think a lot of barely millionaires disappeared into housing and investment losses and not into other states.

Oh no, $20 billion! 612,520 people. $32,652.00 adjusted gross income average.

Never mind.

jared bernstein writing on the same points to this evidence: http://www.cbpp.org/files/8-4-11sfp.pdf

Oh and Prof Maule notes that Christie has this whole millioniare tax thing all figured out:

http://mauledagain.blogspot.com/2012_05_01_archive.html#524382832100466896

Exactly teh case when you decide to relocate at retirement then weather and taxes enter the equation. (once you have decided to move, then the taxes become a factor, but not the major factor else everyone would move to Alaska, which has both no personal income tax nor a sales tax, since up till now the north slope paid the taxes. Of course Alaska’s weather is unique in the 50 states. States with no income tax tend to have high sales taxes and may have high property tax rates (but perhaps low realestate values). So a more useful comparison would be to look at relocations from the North to the south in the retirement years and compare by state.

High tax states are the ones that provide the best business opportunity, and despite the internet, it’s hard building a business of any real size without hands on management and the countless benefits that only high taxes can provide. This is part of the red state-blue state paradox where anti-business blue states tend to become wealthier than pro-business red states.

Lots of retirees in their 60s move to Florida for the weather, not just millionaires, but they come home in their 80s for the social services.

Erm, you know, you’re not going to get far when you compare wealth to taxes upon income.

The two really are not the same thing at all.

Your definition of millionaire is someone who has $1 million in assets. At least I assume it is. Looking at your source you’ve got 4% or so (5.6 million of 115 million. Maybe 5%) of households as millionaires. Yet the income required to be in the top 5% is only $150,000 a year.

So I’m pretty sure that you’re comparing wealth, assets, as a millionaire against taxes on incomes there.

Your NY and CA figures will obviously be out given property prices in LA, SF and NYC for example…..

This is valuable information, Florida has not income tax, estate, nor inheritance tax? I’m moving to Florida as soon as I start earning my millions thats for sure.

Tim

yes. and more.

Tim –

But wealth and income certainly correlate.

Throw out CA and NY, if they skew the picture.

The fact remains that there is no discernable pattern of millionares flocking to low tax states.

JzB

From the link rjs provided (emphasis added):

Consider Florida, often claimed as a state that attracts households because of its low taxes

(Florida has no income tax). In the latter half of the 2000s, the previously rapid influx of U.S.

migrants into Florida slowed and then reversed — Florida actually started losing population.

The state enacted no tax policy change that can explain this reversal. What did change was

housing prices. Previously, the state’s lower housing prices had enabled Northeastern

homeowners to increase their personal wealth by selling their pricey houses and purchasing a

comparable or better home in Florida at a lower price. But housing prices in Florida rose

sharply during the mid-2000s, narrowing opportunities for Northeasterners to “trade up” on

their expensive homes. And consider California: its loss of households to other Western states

is often ascribed to tax differentials, but — as this report shows — housing-cost differentials

are typically much, much larger.

JzB

Tim, I totally agree on the millionaires vs milionaires thing, but maybe for an opposite reason. It drives me crazy that people — including progressives — have allowed the long-standard usage (somebody who has a million dollars) be subverted to mean someone who *earns* a million dollars. I consider myself semi-comfortably affluent, but the idea of earning that much money is completely beyond anything I have ever known or imagine I ever will know.

These million-dollar earners are mega-MEGA-millionaires, from where I stand.

On the stock vs flow thing, yeah, the data set might have been better if it compared the concentration of people earning more than 350K to their tax rates. (Though even that would have statistical problems).

But I think Jazz is right: this still shows that we’re not seeing high concentrations of well-to-do people in low-tax states. QTC, actually.