Full-Reserve Banking and Loanable Funds

Richard Williamson asks a sensible and straightforward question: If, as Modern Monetary Theorists propose, banks’ reserve levels put no significant constraints on their lending, why don’t we have 100%-reserve banking — and presumably no runs on banks as a result?

First an explanation — I hope simple, clear, and generally accurate (if simplified):

So back to Richard’s question: if the Fed required 100% reserves, the banks couldn’t lend out all those checking-account deposits. The quantity of “loanable funds” would decline. But banks could still lend, 10-to-1 (or so), against their capital.

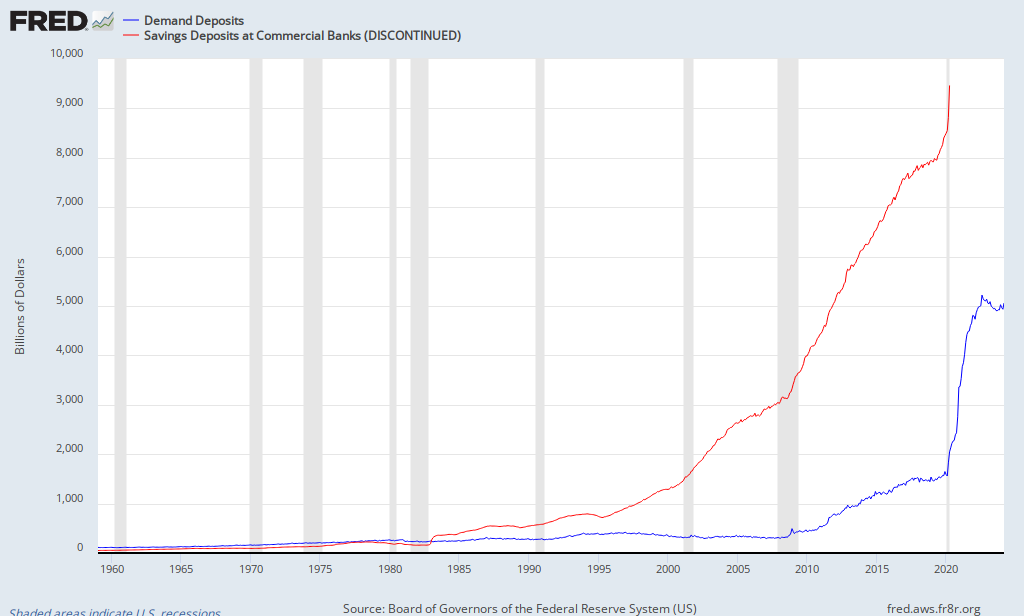

What do those numbers look like in practice? U.S. checking and savings deposits total about $6 trillion right now.

Circa 90% of that would be removed from the loanable funds market. Call it $5 trillion — sounds like a lot.

But total credit market debt outstanding is about $55 trillion.

That makes $5 trillion sound…not insignificant (and profound at the margin), but less onerous.

Which raises my question, one that I’m not knowledgeable enough to answer: Would 100%-reserve banking result in there being more bank capital available — more equity investments in banks — which via its money-multiplying power would offset or more than offset the otherwise decline in loanable funds?

Would we end up with roughly the same amount of credit market debt outstanding?

The answer, it seems to me, would depend on a whole lot of complex and interacting incentive effects. Anyone care to take a stab?

P.S. Like me, you’ve no doubt noticed that debt outstanding is in fact about ten times bank deposits. Does this put the big-picture lie to the MMTers’ claim that lending is not reserve-constrained? Is it just a coincidence? Other?

Cross-posted at Asymptosis.

if the Fed required 100% reserves, the banks couldn’t lend out all those checking-account deposits. The quantity of “loanable funds” would decline. But banks could still lend, 10-to-1 (or so), against their capital.

I don’t know anything, but this strikes me as grossly incorrect.

Someone correct me if I’m wrong, but a single bank can’t lend money they don’t have.

The magic of fractional reserve banking is that a single dollar can appear in two or more demand accounts.

In the full-reserve regime interest-bearing accounts would be CDs and there would not be a 10:1 multiplier because people would not borrow money just to put in a CD.

The $55T TCMDO graph is also misleading.

http://research.stlouisfed.org/fred2/graph/?g=4ES

is a graph with its components broken out.

Top at $14T now is financial sector debt

Running behind at $12T is corporate debt

Household mortgage and Fed debt is both at $10T

Other gov’t and consumer debt brings up th rear at ~$3T each

The main dynamic here is our $500B/yr trade surplus being wrapped around into debt buys (and finance company capitalization). I was reading Michael Hudson’s Supercapitalism again last night and his intro was getting into this, as did Michael Moore’s Fahrenheit 911 (how Saudi oil money was being recycled back into our economy via credit card debt).

“why don’t we have 100%-reserve banking — and presumably no runs on banks as a result?”

What would we have in their place, to provide us with money? As things are, the gov’t is stingy. And the private alternative is loan sharks and their ilk.

Just changing banking to 100% reserve and trusting the economy to adjust seems unwise. It is easier to regulate banks than loan sharks. 100% reserve banking may be a good idea in itsellf, but it needs to be part of a comprehensive structure to provide the economy with money and regulate the supply.

What would we have in their place, to provide us with money

Bank loans would be made from the proceeds of CD and bond sales, plus retained earnings.

Troy: “Bank loans would be made from the proceeds of CD and bond sales, plus retained earnings.”

And that would provide as much money as now?

OC, currently the money supply varies between too much and too little. Would 100% reserves provide a more stable supply? Would it be enough?

The problem is not that we don’t have enough money or credit.

The problem is that the 5% enjoy 60% of the nation’s wealth, and even more of its actual income-producing wealth, while the bottom 50% hold 2.5% of the wealth, and none of the interest-bearing wealth.

We’ve been abusing credit to keep the system together, since 2001. We need to stop this or it will stop us.

Houses are still 100% overvalued in many areas, but rents are going through the roof, 30%+ of SFH sales in California are to buy-to-letters, talking about reserve ratios is just a side show compared to the cancer at the core of the system.

Troy you’re right on the credit breakout. Needs more work/thinking. Also as I said over at shewing, the whole ecology is what matters. 1005 reserve might be better. I don’t know.

Troy, Min, I think a misconception here.

Aside from the 90% of deposits lent out (the minority of lending), the rest it is printed out of thin air by banks (who are explicitly licensed by the Fed to counterfeit money that way. 😉 ). They do so if they think they can make money from the borrower in the process, and have or can get sufficient capital to back it up at roughly 1-to-10.

As they MMTers say, there is no “stock of loanable funds.” I think they overstate that — those 90%-lent deposits qualify, I think — but they’re right on the bulk of lent funds.

the rest it is printed out of thin air by banks

I still disagree with this.

For one, banks have a 0% reserve ratio for time deposits. This doesn’t mean the money they lend is printed. They’re just lending the money they take in from CDs, hopefully in a maturity-matched way.

Same thing with check money deposits, no?

If the banks were in fact printing money their non-cash assets would be greater than their liabilities.

BAC has $700B in cash, $1.3T in “long term assets” and $1.3T in debt & liabilities.

I just don’t see the “printing out of thin air” going on here. I mean, it’s entirely possible for BAC to lend money out and then go back to the Fed for loans and what not, but, mechanically, speaking, I still assume there’s a philosophical restraint here that the big banks operate on the simple model of your basic credit union — get money, lend it out.

Troy: “The problem is not that we don’t have enough money or credit.

“The problem is that the 5% enjoy 60% of the nation’s wealth, and even more of its actual income-producing wealth, while the bottom 50% hold 2.5% of the wealth, and none of the interest-bearing wealth.

“We’ve been abusing credit to keep the system together, since 2001. We need to stop this or it will stop us.”

And that means either being Robin Hood, taking from the rich and giving to the poor, or it means (more or less) giving to the poor, anyway, i. e., more money.

So what’s the misconception?

Great topic Steve! I’ve been trying to understand MMT as well. I do think I made a breakthrough at least in getting some important differences between MMT and Market Monetarism http://diaryofarepublicanhater.blogspot.com/2012/01/market-monetarist-mmt-smackdown-20.html

One very interesting thing I learned is that MMT not only denies the neutrality of money but even that there ever were barter economies. To the contrary this was never present in any economy no matter how “primitive.”

As far as what would happen if you had 100% reserves it’s a good question that I don’t think I’m at all knowledeable to answer either.

“The reserve ratio and the capital ratio are completely different things.: May well be though I’m having a hard time grasping the difference. I do get that the loanable funds theory is very key to monetarism and most mainstream economics and for MMT to deny it is certainly radical and audacious. I’d like to learn more about this.

My guess is that 100% reserves is not possible, that the least we could have is 99.99999999… percent but again someone more knowledgeable hopefully will elaborate more

Tom Hickey, a reader over at Diary of a Republican hater sent me this link in a comment

http://www.cfeps.org/ss2008/ss08r/fulwiller/fullwiler%20modern%20cb%20operations.pdf

This seems to answer the kind of question we are answering here. Though as I just started reading I don’t have an answer to why not 100% reserves yet.

http://diaryofarepublicanhater.blogspot.com/2012/01/its-on-tiime-for-market-monetarist-mmt.html

Listen to this,

“

As endogenous money proponents have known for some time, loans create deposits as a matter of accounting. Pollin (1991) notes that both horizontalists and structuralists accept Alan Holmes’s (1969) argument that “real-world banks extend credit, creating deposits in the process, and then look for the [reserve balances] later.” Pollin argued, however, that the two approaches diverged on the issue of “how and where do the banks . . . obtain the additional [reserve balances] once they have ‘extended more credit, creating deposits in the process’?” (1991, p. 367). His question, though, itself begs the more fundamental question—does the fact that a bank has extended credit necessarily mean that it must actively attempt to acquire additional reserve balances? The answer is found by considering the two reasons banks need reserve balances in the first place. Banks hold reserve balances in their central bank accounts to settle payments and to meet reserve requirements.

Pollin’s query was made within the context of reserve requirements; his argument implied that the existence of additional credit would raise deposits and thereby raise reserve requirements, which would thereby necessitate that the bank would hold more reserve balances (absent an increase in vault cash). Moore (1991, p. 407) appropriately counters Pollin, noting that the creation of a new loan need not lead to greater reservable deposits, but could be met with an increase in liabilities that have lower (or zero) required reserve ratios. Moore noted further that this would be all the more likely where interest rates were higher or where reserve balances were non-earning assets, both of which raise the opportunity cost of holding reserve balances or deposits and encourage banks to immediately seek ways to reduce their reserve requirements. Consistent with Moore’s argument, since the emergence of retail sweep accounts in the mid-to-late 1990s, reserve requirements have been largely voluntary in the U. S. as banks use computer software to monitor deposit account activities of customers and “sweep” idle balances into non-reservable money market deposit accounts (Fullwiler 2003; Anderson and Rasche 2001). “

“

Furthermore, as Moore noted in several papers in the 1980s, the need to meet reserve requirements occurs with a lag in the U. S. (particularly given the return to lagged reserve accounting in 1998) and in other countries. The maintenance period—the period of time during which banks have to meet reserve requirements

3

on average—ends (and, in most cases, begins) after a bank’s reserve requirement has been determined. In the U. S, for […]

The valuable information that you have shred about a particular topic seems to be very much reliable. Goa

When MMT says that bank lending is not significantly constrained by reserves, they don’t mean that it is unconstrained in an absolute sense. They mean that bank lending is primarily driven by the demand for credit, with current reserve positions playing only an indirect and minimal role. And they mean to contrast this picture with the supply side picture of banking profered by many mainstream economists, where reserves are “loanable funds” and bank lending is driven by the central bank’s provision of reserves, through the mechanism of the money multiplier.

The key point is that banks can indeed lend money they don’t have, even if they have no excess reserves and their current reserves stand in exactly the leaglly required ratio to their current deposits. They don’t have to acquire the reserves first. They can create a deposit for a borrower on the spot, which becomes a liability of the bank and puts them in the position of having to acquire the additional reserves after the fact. They then have the extended window offered by the calculation period and enforcement period to acquire the additional reserves.

Looked at that way, we can see what degree of constraint the reserve requirement places on their willingness to lend. Suppose the reserve requirement is 10% and the bank’s current total deposits are $X, and current reserves are exactly $(X/10). Suppose they wish to make a loan for $Y. Depending on regulations of the banking system in question, they will have something like a couple of weeks to acquire an additional $(Y/10) in reserves. Suppose they can acquire those reserves through interbank lending or direct borrowing from the central bank at an interest rate of 2%. Then since they have to borrow $(Y/10) at 2%, the total cost of the additional reserves they need to acquire to make the loan is $(Y/500) dollars. That means that so long as the expected return on the loan (minus transaction costs) exceeds $(Y/500) the loan is a profitable one for them to make.

So what happens if the reserve requirement is raised to 100%. The result is that if the bank makes a loan for an additional $Y, it then has to acquire $Y in additional reserves. If it borrows those reserves at 2%, the total cost of the additional reserves is $(Y/50), and so the expected return on the loan must be ten times higher than it was in the original example for the loan to be profitable. The result would be fewer loans and higher commercial interest rates. Maybe that’s a good thing or maybe it’s a bad thing, depending on economic circumstances. But that would appear to be the effect.

What MMT emphasizes (and not just MMT) is that the process is driven by a combination of the demand for credit at particular interest rates, and by the actual prevailing interest rates which are ultimately determined by the central bank. In order for banks to make loans against the background of their reserve requirements, they do not first have to acquire the required reserves by attracting additional deposits.

Min: “So what’s the misconception? “

Deposits are lent out at 90%, 10% held in reserve as account float. That’s the constraint. $100 in, $90 out. No multiplier.

Capital (equity investment) can be multiplied, by the terms of the bank’s charter with the Fed. $1 in, $10 out.

These tend to get munged together in the accounting and ratio arithmetic, but that’s the basic setup.

As the MMTers have been saying for a long time, the textbook notion that deposits are multiplied by ten (and then multiplied again!) is completely contrary to the reality of how the banking system works.

@Dan Kervic: “When MMT says that bank lending is not significantly constrained by reserves, they don’t mean that it is unconstrained in an absolute“

Right. Simplified, once the deposits have been lent out (at 90%), capital (and the capital requirement) is the constraint.

I’m not sure what “lent out the deposits at 90%” means, Steve. The bank doesn’t need to have the deposits before making the loans.

@Dan:

There are two functions/constructs. Both allow lending.

Imagine a bank that has no capital. It just takes deposits and lends them out. By Fed rules it has to keep 10% reserves for float, so accounts clear every night. It can lend 90%.

Now imagine a bank that takes no deposits, but has capital and a license from the Fed to lend (print, create, “counterfeit”) some multiple of that capital.

The two are merged in practice (every bank has capital, and lends against it at some multiple), which makes the bookkeeping and ratios confusing. But that’s the basic layout. *Once* the deposits are lent out (which they always are in practice), new lending is constrained by capital and the Fed’s (or the bank’s) capital requirements.