Housing: After the Boom

Is there a housing bubble? Yes. But what happens after the boom? This post will address the likely bust in the housing market and next week’s post will discuss the possible impact of the housing slowdown on the general economy.

For those readers still uncertain about the housing bubble, here is an excellent article from the front page of today’s Washington Post. For those in denial, Dr. Shiller discussed booms this week: “There are always popular explanations for the boom, but they are obviously not always right.”

Housing “bubbles” typically do not “pop”, rather prices tend to deflate slowly in real terms, over several years. Historically real estate prices display strong persistence and are sticky downward. Sellers want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices. This means real estate markets do not clear immediately, and what we usually observe is a drop in transaction volumes.

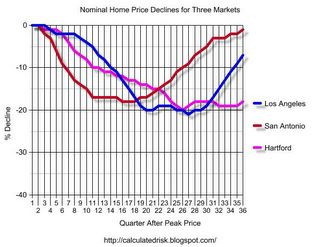

Even though prices tend to deflate slowly, they can still drop significantly over time. On the following graph are the nominal price declines for three busts: Los Angeles in the early ’90s, San Antonio in the mid ’80s (the oil patch bust) and Hartford starting in ’89. The peaks of all three housing booms are aligned on the left and the relative price declines are plotted by quarter after the local market’s price peak.

Click on graph for larger image.

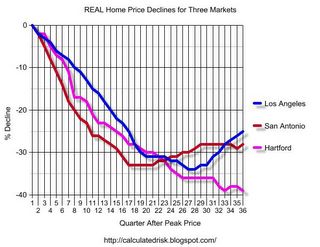

For all three busts, the prices steadily declined over many quarters. Although these are three of the worst busts of the last 25 years, the price action is representative of other housing busts. In real terms (adjusted by CPI less shelter), the price declines are even more dramatic:

Data Sources: OFHEO House Price Index, BLS CPI less Shelter.

In real terms, prices in the Hartford market declined for over 8 consecutive years before reaching a nadir of almost 40% off the peak price of 1989. The other markets experienced similar declines:

| Real | Years | Nominal | Years | |

| Decline | Decline | |||

| Los Angeles | 34% | 6 3/4 | 21% | 6 3/4 |

| San Antonio | 33% | 4 3/4 | 18% | 4 |

| Hartford | 39% | 8 1/4 | 15% | 6 1/2 |

When the current boom ends, the coasts will probably experience the largest declines. This boom is more widespread than previous booms according to an FDIC report released in February, and the bust will probably be more widespread too. The FDIC reported: “Our count of 33 boom markets in 2003 is the highest witnessed at one time during the past 25 years—1988 ranks second, with 24 booms. Moreover, the 2003 boom markets account for roughly 40 percent of the nation’s population base, contributing to the impression that this is a nationwide phenomenon.”

All areas might not see declining prices, but transaction volumes will probably decrease nationwide. In the early ’90s bust, the bubble areas like Los Angeles and Hartford saw declining nominal prices, but the nationwide nominal prices didn’t decline. Nationwide real prices did decline about 8% over a 6 year period. But more dramatic was the precipitous drop in the volume of New Home Sales at the start of the bust:

Home builders tend to adjust to lower prices and New Home Sales rebounded after a few years. Transactions of existing home sales are more susceptible to declining prices and stayed depressed for a longer period.

In summary, my expectation is for slowly declining prices in much of the United States and significantly lower transaction volumes nationwide.

What is the impact of falling prices and lower transaction volumes on the economy? Obviously employment in real estate related occupations will fall. This includes Real Estate agents, mortgage brokers, home construction trades and other real estate related fields. Also homeowners will withdraw less equity from their homes to use for consumption.

Next week’s post will discuss the possible impact of falling real estate related employment and less mortgage equity withdrawal on the general economy.

CR: Calculated Risk