Unforeseen Health Care Bills Coverage Denials by U.S. Insurers

Coverage denials as reported by the Commonwealth Fund today almost never happened in the past and was a rare occurrence. The insurance companies would concede to the findings of the examining doctors. The methodology being used today is to deny, deny, deny until the insured and the doctor give up. I think it was 1997 when a fictional story “The Rainmaker” became a movie, The issue was a bone marrow transplant which was denied by the healthcare insurance company Great Benefit The movie was a take off of John Grisham (worked on the Obama election team) “The Rainmaker.” A good read if you are sitting on a jet going to China for 13-14 hours.

As Commonwealth reports, Americans are struggling in an attempt to get their health insurance to work for them. High deductibles and copayments are causing ~ two of five working-age adults to delay visiting the doctor and having prescriptions1 filled. Those getting care sometimes find themselves burdened by medical or dental debt. Almost one-third of working-age adults report experiencing 2 instances of such. Billing errors and denials of coverage by insurance companies can contribute to this problem. Media investigations find insurers are becoming increasingly adept in using technology to deny payment of medical claims. In turn they pressure their company physicians to deny care during prior authorization reviews.3 Doctors are reporting spending increasing amounts of time on the phone with insurance company physicians over denials of care for their patients.4

Introduction

In this brief, Commonwealth Fund reports on findings from a survey on the extent to which working-age adults say their insurance provider charged them for a health service. A service which they thought should be free or covered or denied coverage for care as recommended by their doctors. Commonwealth Fund examines whether the insured challenged such errors or coverage denials, the reasons why they did not, and the implications for their health and well-being. People were grouped by the coverage source they reported at the time of the survey. This could be an employer or individual market or marketplace. It is noted that some have switched insurance plans during the year.

This is an abbreviated version of the entire Commonwealth Fund report. The rest of the report can be found at:

Unforeseen Health Care Bills Coverage Denials by U.S. Insurers.

Some Highlights

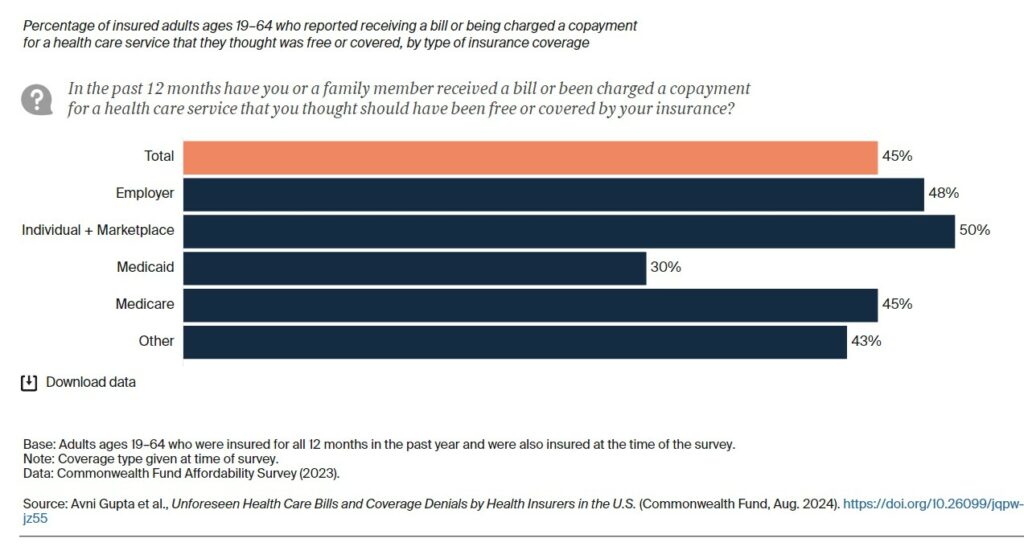

- Forty-five percent of insured, working-age adults received a medical bill or were charged a copayment in the past year for a service they thought should have been free or covered.

- Less than half of those reporting billing errors said they challenged them. Lack of awareness about their right to challenge a bill was the most common reason, particularly among younger people and those with low income.

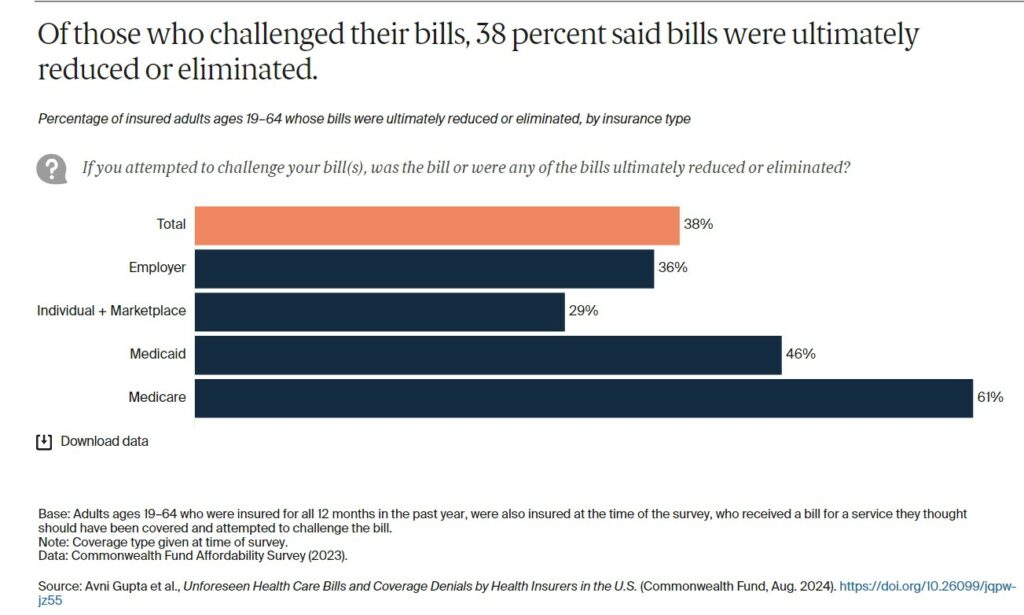

- Nearly two of five respondents who challenged their bill said that it was ultimately reduced or eliminated by their insurer.

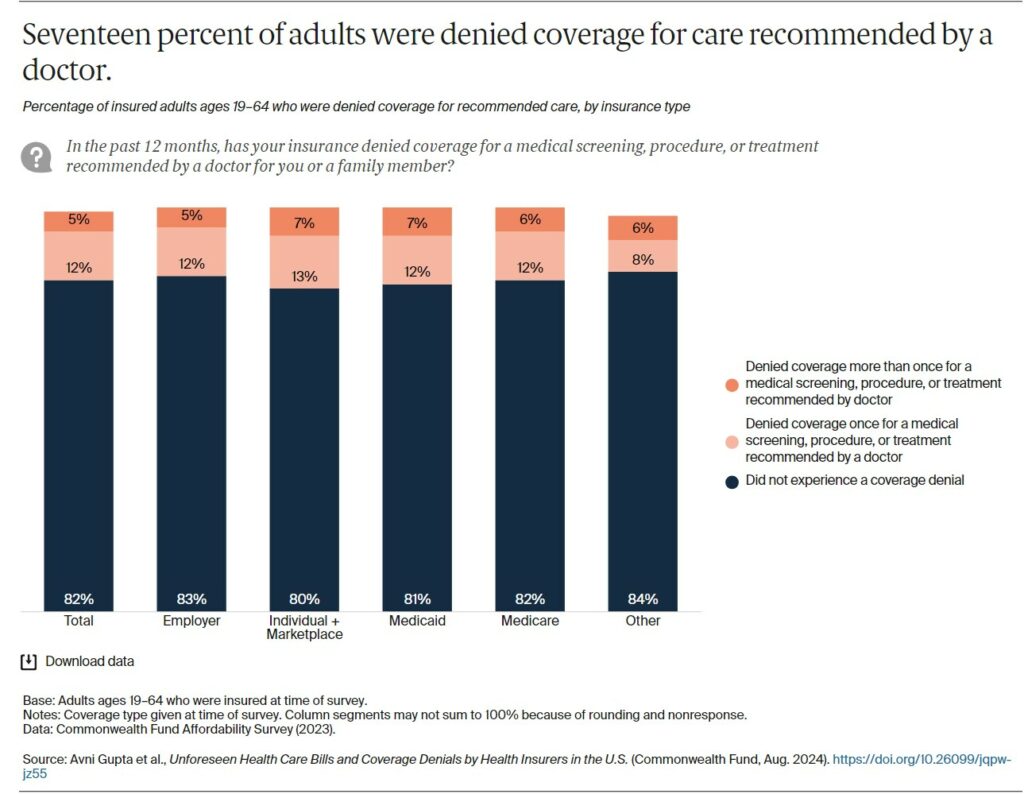

- Seventeen percent of respondents said their insurer denied coverage for care recommended by their doctor. More than half said neither they nor their doctor challenged the denial.

- Nearly six of 10 adults who experienced a coverage denial said their care was delayed as a result.

Findings

More than two of five respondents reported either they or a family member received a bill or were charged a copayment in the past 12 months for a health service they thought was free or covered by their insurance.

Plan complexity and the heterogeneity of benefits across plans may leave people unable to identify what is and is not covered, and when a bill is incorrect.5 While the Affordable Care Act (ACA) requires all insurers to cover preventive services like colon cancer screening free of charge, some states and the federal government also require certain plans, such as marketplace plans, to cover additional services either free of charge, like annual checkups, or prior to meeting deductibles. Many employer plans exclude some services and prescription drugs from deductibles.

People across all insurance types reported such billing problems, but those covered by employer plans, marketplace or individual market plans, and Medicare reported them at higher rates.

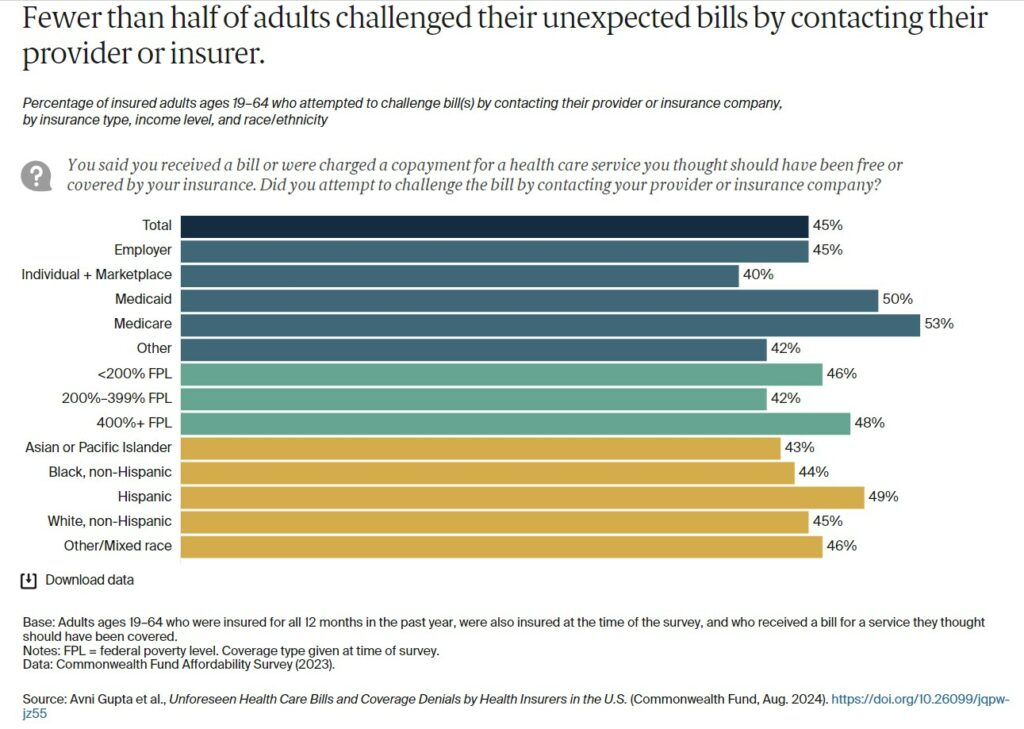

Of the respondents thinking they received a bill in error, fewer than half attempted to challenge the bill. People with marketplace or individual market plans challenged these bills at a rate lower than those covered by Medicaid or Medicare (the difference was not statistically significant). This, despite the ACA’s requirement for insurers to have systems in place for consumers to appeal and challenge their bills. There were no significant differences by race and ethnicity or poverty level.

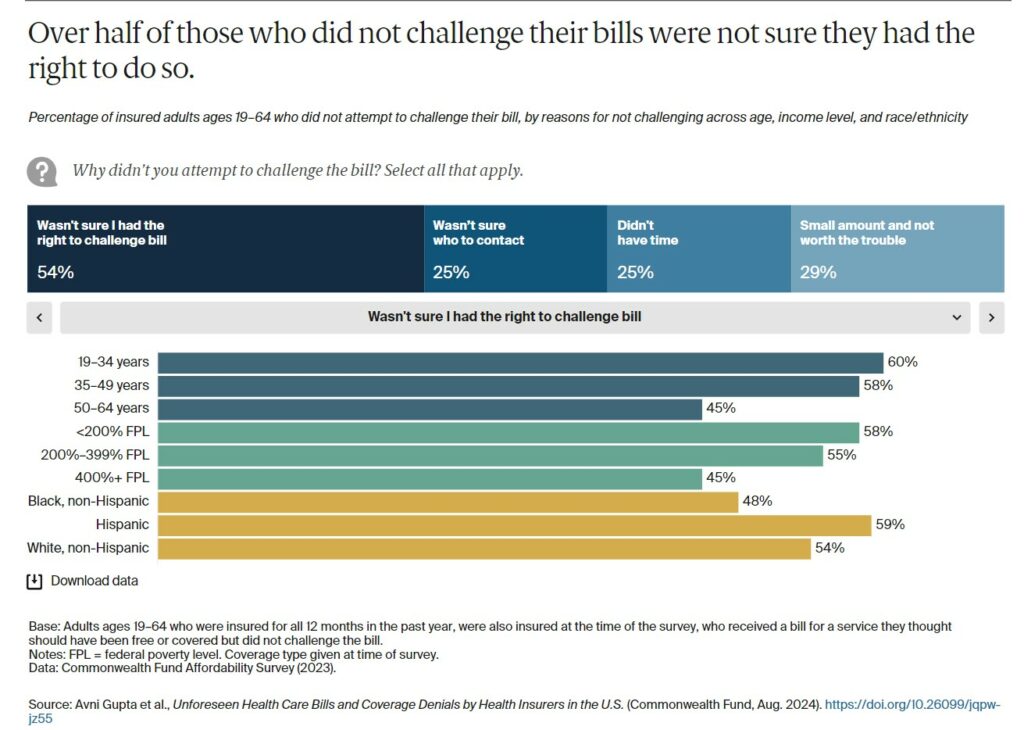

– Of those who did not challenge their bills, over half said it was because they were not sure they had the right to do so. Other reasons included not knowing who to contact (25%), lacking the time (25%), and viewing the amount as too small to spend time challenging the bill (29%).

– People with low and moderate incomes, those younger than age 50, and Hispanic respondents reported at the highest rates that they were unsure of their right to challenge a bill. Those younger than 50 also had the highest rates of not knowing who to contact to challenge a bill.

– People with higher income cited a lack of time and the amount not being worth the trouble at higher rates than those with low or moderate income.

Nearly two of five adults challenging a bill said the amount was ultimately reduced or eliminated. People with Medicare or Medicaid reported higher rates of bill reduction or elimination. This may reflect more standardized and well-defined benefits in public programs compared to the heterogeneity of plan products and benefits offered by employers and commercial insurers.

Coverage Denials

Seventeen percent of respondents or one of their family members were denied coverage for care recommended by a doctor, and these rates were similar across insurance types. While we did not ask survey respondents why their coverage was denied, common reasons include a service that is deemed medically unnecessary by the insurer or delivered in a setting the insurer considers inappropriate, visiting an out of network provider, a medication that is not on a plan formulary, or an experimental procedure.

Many health insurers require a review of claims or prior authorization requests by a nurse and a doctor, both employed by the insurer.6 Recent media investigations have found that some insurance company doctors are not incentivized to spend the time needed to scrutinize patients’ medical records and follow guidelines for making informed decisions about approving or denying a care request.7 Rather, some doctors are incentivized to deny care using a “click and close” policy, which promotes bonuses based on the quantity of cases reviewed and hence incentivizes speedy reviews. This can lead to wrongfully denied care.8