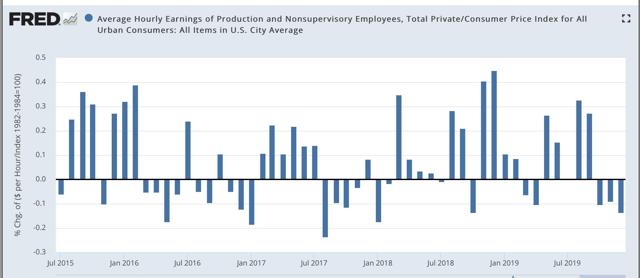

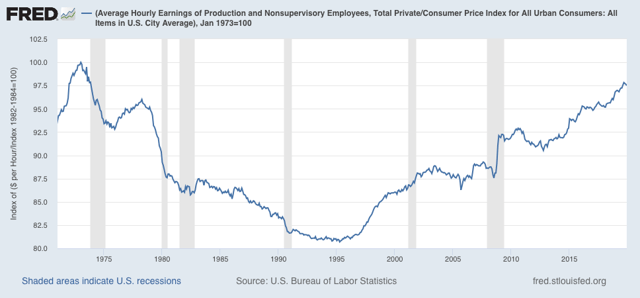

In December consumer inflation was +0.2%. Since in last Friday’s jobs report average hourly earnings also increased +0.1%, real average hourly earnings declined slightly:

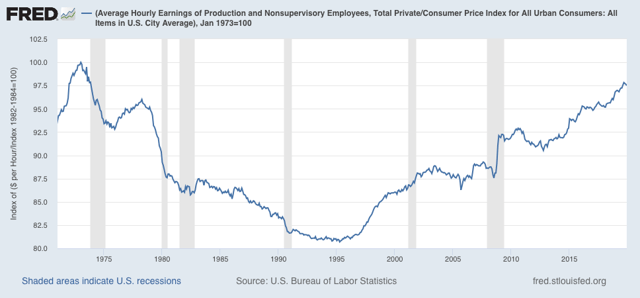

In a longer term perspective, this means that real wages also declined from 97.8% to 97.5% of their all time high in January 1973:

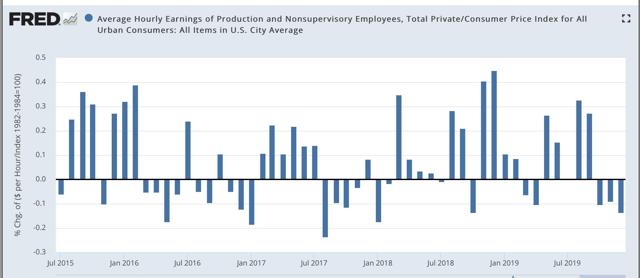

The YoY measure of real average wages also declined sharply from +1.6% to +0.7%:

[Note however that this is subject to the same quirks as I discussed yesterday in terms of YoY nominal wage growth for December, so a rebound in January would hardly be a surprise]

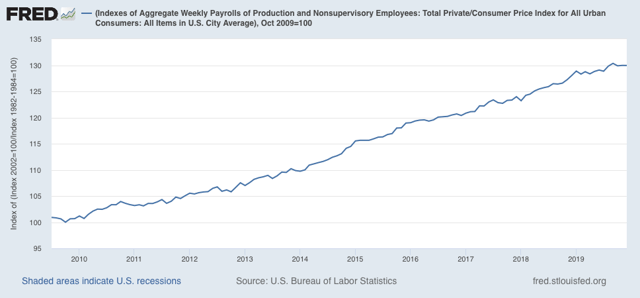

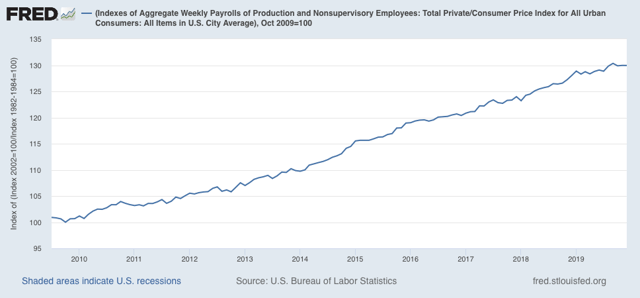

Aggregate hours and payrolls improved significantly between July and September, but have declined slightly in the three months since, so real aggregate wages – the total amount of real pay taken home by the middle and working classes – have declined from 30.4% to 30.0% above their October 2009 trough at the beginning of this expansion:

Real aggregate wage gains have only been +0.8% in the past 11 months. As with so much other data, this is on the cusp of warranting at least a yellow flag. I’ll have more to say once retail sales are reported later this week.