The U.S. Economy Reaches Superstar Status

This article can not get any easier to read and explain how the economy survived a pandemic from 2020 onward and even into 2024. With the right actions by a president and supported by a Congress, the nation survived and it grew. In summation? The “economy has had a remarkable four-year run, judged against both its own history or the international competition.”

If you disagree, this one has few technical details to confuse the issues. Make your pitch.

Good news outside of inflation.

Atlantic article “The US Economy Reaches “Superstar Status,” Rogé Karma . . . “if the United States’ economy were an athlete, right now it would be peak LeBron James. If it were a pop star, it would be peak Taylor Swift. Four years ago, the pandemic temporarily brought much of the world economy to a halt.

Since then, America’s economic performance has left other countries in the dust and even broken some of its own records. The growth rate is high, the unemployment rate is at historic lows, household wealth is surging, and wages are rising faster than costs . . . especially for the working class. There are many ways to define a good economy. America is in tremendous shape according to just about any of them.

The American public doesn’t feel that way—a dynamic that many people, including me, have recently tried to explain. If, instead of asking how people feel about the economy, we ask how it’s objectively performing, we get a very different answer.

Let’s start with economists’ favorite metric: growth. When an economy is growing, more money is being spent. More stuff is being produced, more services are being performed, more businesses are being started, more workers are being hired. Because of this abundance, living standards are probably rising. (On the flip side, during a recession—literally, when the economy shrinks—life gets materially worse.)

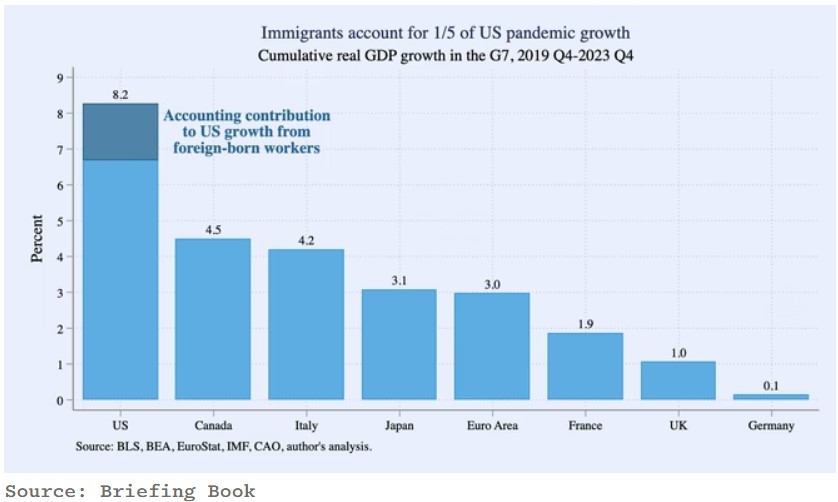

Right now America’s economic-growth rate is the envy of the world. From the end of 2019 to the end of 2023, U.S. GDP grew by 8.2 percent. This is nearly twice as fast as Canada’s, three times as fast as the European Union’s, and more than eight times as fast as the United Kingdom’s.

“It’s hard to think of a time when the U.S. economy has diverged so fundamentally from its peers,” Mark Zandi, the chief economist at Moody’s Analytics, told me. Over the past year, some of the world’s biggest economies, including those of Japan and Germany, have fallen into recession, complete with mass layoffs and angry street protests. In the U.S., however, the post-pandemic recession never arrived. The economy just keeps growing.

Still, growth is a crude measure that says very little about people’s day-to-day lives. Perhaps the right question to ask is:

Are most Americans better off financially than they were before the pandemic?

One school of thought maintains that the answer is no, because of the rising cost of living. Thanks to three years of higher-than-usual inflation, just about everything costs more than it did before the pandemic.

Price increases on their own can not tell us if the cost of living has gone up. What really matters is the relationship between how expensive things are and how much money people have to spend on them. As Vox’s Eric Levitz recently pointed out, prices have increased by 1,400 percent since 1947; that doesn’t mean Americans have less buying power today than at a time when a third of the country didn’t have running water and 40 percent lived in poverty.

That’s largely because incomes have increased by 2,400 percent over the same stretch. If prices go up but people’s incomes go up faster, then the cost of living decreases. And that is exactly what has happened in the U.S. over the past five years.

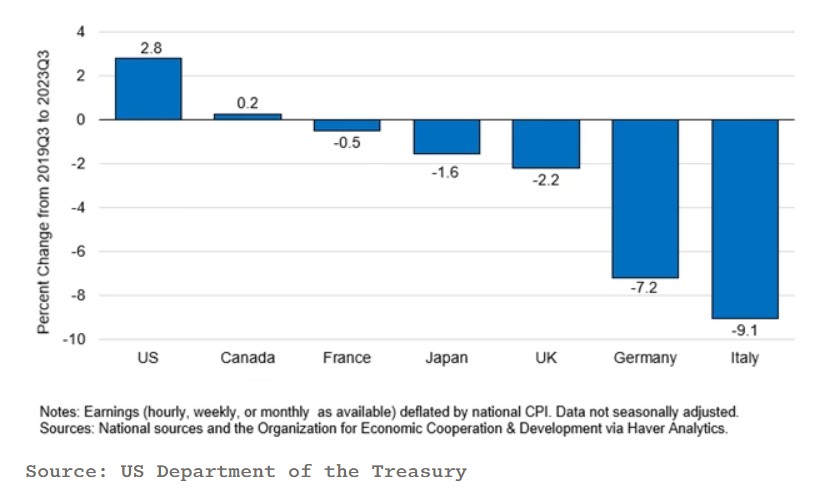

It took some time. When inflation was at its worst, in late 2021 and 2022, prices were rising too fast for workers’ pay to keep up. Over the course of 2023, however, the rate of inflation plummeted while wages kept rising. According to calculations by the economist Arindrajit Dube, prices rose about 20 percent from the beginning of the pandemic to the end of 2023. The median worker’s hourly wages increased by more than 26 percent. In other words, a dollar in 2024 might not go as far as a dollar in 2019, but today the average worker has so many more dollars they can afford a higher quality of life.

Some experts dispute this. Loretta Mester, the president of the Cleveland Federal Reserve, recently told The New York Times wage growth hadn’t kept pace with inflation. Mester was citing an indicator that tracks changes in compensation within particular industries. But one of the most common ways for workers to get a raise is to move between industries, from lower- to higher-paying occupations. This is the way someone working as a fry cook, say, might next take a job as a package-delivery driver. Basically, every other measure of worker pay shows wages adjusted for inflation are higher today than they were before the pandemic. Dube’s calculations are particularly reliable because they are based on a dataset tracking wages for individual workers over time.

Other nations probably would like the luxury of debating such technicalities. From the beginning of the pandemic through the fall of 2023 (the last period for which we have good comparative data), real wages in both Europe and Japan fell. In Germany, workers lost 7 percent of their purchasing power; and in Italy, 9 percent. By these metrics, the only workers in the entire developed world who are meaningfully better off than they were four years ago are American ones.

Averages can conceal a lot, of course. The rise in inflation-adjusted wages, which economists call “real wages,” might not be such good news if it were flowing mostly to the already-wealthy, as it did during the recovery from the Great Recession (2008). In fact, from 1964 through 2018, real wages for most workers hardly budged. Almost all gains went to the richest Americans. In the early days of the pandemic, when millions of low-income workers found themselves suddenly out of a job, it would have been reasonable to expect the same trend to play itself out.

Instead, the opposite happened. A recent analysis from the Economic Policy Institute found that from the end of 2019 to the end of 2023, the lowest-paid decile of workers saw their wages rise four times faster than middle-class workers and more than 10 times faster than the richest decile. A recent working paper by Arindrajit Dube and two co-authors reached similar conclusions.

Wage gains at the bottom, they found, have been so steep that they have erased a full third of the rise in wage inequality between the poorest and richest workers over the previous 40 years. This finding holds even when you account for the fact that lower-income Americans tend to spend a higher proportion of their income on the items that have experienced the largest price increases in recent years, such as food and gas. Arindrajit Dube, “We haven’t seen a reduction in wage inequality like this since the 1940s.”

Pay in America is becoming more equal along race, age, and education lines. The wage gap between Black and white Americans has shrunk to its lowest point since at least the 1980s. Pay for workers younger than 25 has increased twice as fast as older workers’ pay. The so-called college wage premium which is the pay gap between those with and without a college degree, has shrunk to its lowest measure in 15 years. (The gender pay gap has also narrowed slightly, but far less than the others.)

What explains this sudden boost in lower- and middle-class wages?

The answer lies in the post-pandemic American labor market, which has been unbelievably strong. The unemployment rate (defined as the percentage of workers who have recently looked for a job but don’t have one) has been at or below 4 percent for more than two years. The longest streak since the 1960s. Even that understates just how good the current labor market is. Unemployment didn’t fall below 4 percent at any point during the 1970s, ’80s, or ’90s. In 1984—the year Ronald Reagan declared “It’s morning again in America”—unemployment was above 7 percent; for most of the Clinton boom of the 1990s, it was above 5 percent.

The obvious upside of low unemployment is, people who want jobs can get them. A more subtle consequence, and arguably a more important one, is a shift in power from employers to workers. When unemployment is relatively high, as it was in the years immediately following the 2008 financial crisis, more workers are competing for fewer jobs, making it easier for employers to demand higher qualifications and offer meager pay.

That’s how you end up with stories about college graduates working as baristas for $7.25 an hour. But when unemployment is low and relatively few people are looking for jobs, the relationship inverts: Now employers have to compete against one another to attract workers, often by raising wages. This is the crucial part, these dynamics affect all workers, not just people who are out of a job.

This helps explain what happened after the pandemic. When the economy first reopened, employers suddenly had to fill millions of positions. Meanwhile, workers—flush with stimulus checks and expanded unemployment insurance could say no to bad jobs. In response, even famously low-paying companies such as Amazon, Walmart, and McDonald’s started raising wages and offering new benefits to attract employees. What was misleadingly labeled the “Great Resignation” was really more of a great reshuffling, as record numbers of workers quit a job to take a better-paying one. Over the next couple of years, as American consumers kept spending money, demand for labor stayed high.

Betsey Stevenson, a labor economist at the University of Michigan, told me.

“Low-wage workers are finally getting a small taste of the bargaining power that highly paid professionals experience most of the time.”

So far, we’ve been talking about wages: the money people are paid by their employer. To better capture overall financial well-being, we might instead look at household wealth, which takes into account the full range of people’s debts and assets. Over the past few years, Americans have experienced the biggest surge in wealth in at least three decades.

The gold standard for research into the state of Americans’ finances is the Federal Reserve’s Survey of Consumer Finances, released every three years. The most recent report found that, from 2019 to 2022, the net worth of the median household increased by 37 percent, from about $141,000 to $192,000, adjusted for inflation. That’s the largest three-year increase on record since the Fed started issuing the report in 1989, and more than double the next-largest one on record. (According to preliminary data from the Fed, wealth continued to rise across the board in 2023.) Every single income bracket saw net worth increase considerably, but the biggest gains went to poor, middle-class, Black, Latino, and younger households, generating a slight reduction in overall wealth inequality (though not nearly as steep a reduction as the decline in wage inequality). By comparison, median household wealth actually declined by 19 percent from 2007 to 2019.

An important caveat to the wealth statistics is much of the recent increase came from the surge in home prices. A family wealthier on paper might not feel rich if they would have to sell their home to realize any gains. Especially, if all the places they might want to move to have gotten similarly expensive.

Indeed, the out-of-control cost of housing is perhaps the biggest black mark on an otherwise excellent economy. This problem started decades ago since the 1980s. The median U.S. home price has increased by more than 400 percent, twice as fast as incomes, and was even worse during the pandemic. The rise of remote work prompted millions of people to seek more space. Those rising prices have collided with higher interest rates to produce the most punishing housing market in at least a generation. Would-be homeowners can’t afford to buy, and many existing homeowners feel stuck in place.

Housing is one of several crucial categories, along with childcare, health care, and higher education. All have ballooned in cost in recent decades, putting a middle-class lifestyle further and further out of reach. My colleague Annie Lowrey callsit the “Great Affordability Crisis.”

The past few years of high interest rates making borrowing money more expensive, have jacked up costs even more. And despite the recent good news, the U.S. still has lower life expectancy and much higher levels of inequality, poverty, and homelessness than other wealthy nations. For millions of people, getting by in America was a struggle before the pandemic and continues to be a struggle today.

Still the fact is, the U.S. economy has had a remarkable four-year run, judged against both its own history or the international competition. Even so a few years of good news, still isn’t enough to make up for 40 years of rising inequality and stagnant wages. But it’s a whole lot better than the alternative.

With personal saving rates the lowest in over 15 years while consumer credit card balances the highest in history, there will be no “soft landing”. Not to mention when you look at the S&P 500 nominal earnings, they barely moved in the last 3 years and although Q1 2024 earnings were up 4.7% year-over-year, that’s only around 1.2% CPI-adjusted.

Not to mention According to the Federal Deposit Insurance Corporation’s first quarter report, the US banking system is sitting on a collective $517 billion in unrealized losses and has 63 “problem banks.” They won’t tell us who those banks are as they’re afraid of a bank run.

On paper and on teleprompters the economy is doing GREAT! Dig slightly deeper and the picture starts to get murky. In short, if you have to try and convince someone they’re prosperous, it’s probably because they’re not.

Thanks. “Ve haf ways of making you feel gut about dis zituation.”

Matt:

I took the liberty of separating your comment into issues to better address them. I am going to start with your second “Not to mention.”

Volcker was the lone member of The FED who voted against this. Greenspan was now the Chair.

After numerous changes were made to Glass Steagall it was repealed to help out Sandy Weil and John Reed to merge CitiCorp and Travelers. One option was to repeal Glass-Steagall and alter the Bank Holding Act.

Oct.-Nov. 1999 Congress passes Financial Services Modernization Act which repeals GS and modifies the Bank Holding Act. This was the start of 2008. In 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act is passed in 2010.

In 2018 the limit for harsher surveillance was raised to $250 billion as led by Repubs. At that time, Barney Frank said:

So, here we are today.

You will read four brief opinions on what should be done to correct the situation banks have once again put us in. I favor sending some bankers to jail. Others have different opinions. Two Banks in Trouble, Some History, and Four Opinions

There is more to this. You can read it t this post written in 2023 gathering information from much earlier commentaries of mine.

The first part of your comment, I need links to which you are ascribing to in support of the facts you are stating. I am not a librarian. Maybe it would have been batter if Dems let the economy fail after the 2020 insurrection. I know Repubs have been good at denying help. They did so in 2010 after Dems lost control of one body of Congress. Look at the differences between then and now. That is 14 years ago and maybe you were not around then. I (we) lived it. Perhaps, you have a better way to have resolve 2020 onward?

As per usual, the YoY change is what is most important for forecasting purposes. And there the news is considerably better, as initial claims were down -10.2%, and the four-week moving average down -5.2%. Continuing claims were up 4.2%, which is a negative, but on the other hand, as noted above, these have been in a tight range for the past 10 months, so I do not believe they are much of an issue.

The bottom line is that the initial claims indicator remains positive for the economy as to the next few months.

In June 2024 referencing LeBron is your basic red flag for dubious seriousness. Although he didn’t have that bad a season, when you can pick Jokic, Doncic, Giannis, Edwards, even Curry plus probably 10 more, going with LeBron is basically telling you the author wants to talk with pretty old guys….hey, perfect for us I guess.