The Bigger Question behind Greg Mankiw’s version of the Taylor Rule

Greg Mankiw posted about his version of the Taylor rule. He basically sees the Fed rate heading into positive territory, which would indicate that the Fed rate should start rising according to the rule. However, he also sees the need to allow the Fed rate to now stay below a rule rate in order to make up for the time when the Fed rate could not go negative. He attributes low inflation to the Fed rate being too high over the rule rate for too long causing inflation expectations to drop.

Low inflation is rather due to falling labor share globally and to the Fed rate being stuck on the ZLB (the Fisher Effect). But first I want to look at his equation. (link to paper with original version of equation, page 42. Link to newer version.)

Mankiw’s Fed Funds rate (1990’s) = 8.5 + 1.4 * (core inflation – unemployment)

Mankiw’s Fed Funds rate (2000-2007) = 9.9 + 2.1 * (core inflation – unemployment)

There are problems with his equation.

- It is dependent upon a statistical analysis of data to determine its coefficients. Therefore, it will work better for the data set but not as well outside the data set. And as we see in the two equations above, the coefficients changed quite a bit. Also in the graph that he posted, there is a big difference between his 1990’s version, and the newer version using data from 2000 to 2007.

- Another problem is that the equation does not factor in the utilization of capital, which is basic to determining slack. Mark Thoma just posted about slack. Mark says…

“The amount of slack in the economy is essentially a measure of the quantity of unemployed resources. It represents the quantity of labor and capital that could be employed productively, but isn’t; instead, it is idle.”

I agree with Mark. I explained this in a previous post, Should Policy Rate Rules include Utilization of labor AND capital? The policy rate rule that I use includes the utilization of labor and capital.

- Another problem with the equation is that it conforms itself to the Fed rate, which has 2 problems.

- The past Fed rates may not be data dependent, which is in contrast to Mankiw’s equation itself, which wants to be data based. So the equation is incorporating non-data factors into a data driven equation. And non-data factors (discretionary policy if you will) can have much variation.

- The past Fed rates may have been based on bad data. For example, in the later years before the 2001 recession, there was a debate on whether the output gap was as highly positive (inflationary) as the CBO was saying. I say the output gap was essentially even between negative and positive. Greenspan thought the CBO was correct.

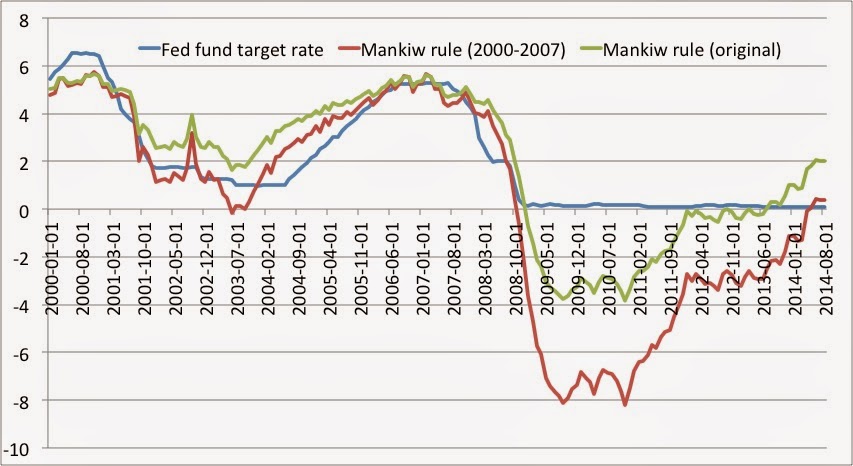

My Effective Demand rule does not have these problems. Here is an overlay of my Effective Demand rule upon the rules by Mankiw.

My Effective Demand rule followed his 2000-2007 version (red maroon line) very closely from 2002 until the crisis, whereupon they diverged, because the coefficients of his rule conformed themselves to the pre-crisis potential GDP. And potential GDP after the crisis is going through lots of downward revisions which my rule saw immediately as labor share dropped. My ED rule does not conform itself to data statistically, because it just measures capacity utilization and unemployment against an effective labor share (assuming constants after the crisis of a natural real interest rate of 1.9% and an inflation target of 2%.)

The ED rule has only one coefficient that can be changed statistically like the Taylor rule and its various versions. The coefficient is how much the Fed rate would change if inflation was off target. I say 1.3x in line with the view of Glenn Rudebusch. However, as long as you have a determination for capacity utilization, unemployment, a natural real rate, inflation, an inflation target and an effective labor share, you can use the ED rule to determine the base nominal rate of any central bank, for example the Fed rate.

The ED rule does not try to conform itself to past Fed rates. It stands alone as its own determination of the Fed rate. Sometimes they coincide and sometimes they don’t. The ED rule is a better objective (detached) view of the Fed rate. By comparing the ED rule against the Fed rate, we get a theoretically more objective view of possible distortions in the Fed rate.

The Bigger Question

All that being said, there is a bigger question involving why there is low inflation, if in fact the Fed rate has been too low since 2001, not too high, as the ED rule states. The reason is two-fold…

- There is downward pressure on labor share (real wages/productivity) throughout advanced countries. Real wages are being held down. The effect is a muted inflation. Labor share is also (unit labor cost/price level). As unit labor costs are pushed down, prices have to be contained.

- The nominal rates from central banks in advanced countries being stuck on the ZLB causes inflation to move towards its long-run natural state according to the Fisher effect. Low nominal rates which have tried to push real rates lower than their natural level, will cause inflation eventually to fall in order for the real rates to rise to their natural rate.

So the low Fed rate is not helping inflation rise because labor share has continued to fall since the crisis. The Fed rate does not increase labor share. Global economic dynamics are pushing labor share down. Rates at many central banks are trying to raise inflation, but they can’t. Firms around the world are holding down real wages to compete. Low inflation is not the result of nominal rates from central banks that have been too high, but the result of firms holding down effective demand with lower real wages.

Bottom line: The low Fed rate will increasingly cause financial instability as the economy tries to surpass the natural effective demand limit upon output. Asset prices will accumulate the liquidity from a low Fed rate, while labor’s share is held down. This process of instability has been building for a few months and will continue into 2015.

According to the Fed yesterday, we will not see a rise in the effective Fed rate. So now we watch for signs of increasing financial instability, instead of sustainable economic prosperity for global societies.

If we already got an answer, I apologize for missing it. But WHY can fed interest rates not be negative? Japan did it.

The Fed did say there will be a rise in the effective Fed rate. Most likely between January 2015 and September 2015.

Sounds pretty close to me.

Ed, “financial” instability is always happening, somewhere in capitalism. Don’t be so mono about “liquidity”. I am not seeing it in leverage. With the cash boom over in RE, prices are correcting and asset prices are falling. IMO, the “liquidity” is being sheep herded into debt resolution in parts of the financial crisis that got hit the hardest.

We see some parts of the financial markets have healed, while others are still waiting.

Jack,

The Fed has decided not to do a negative rate, because it is essentially a tax on banks who couldn’t loan out their reserves that fast. As it is, the banks are probably doing what they can in a prudent way to not loan out to projects that will become non-performing in the future. China is having that problem now.

I see the banks lending in a prudent way considering weak demand. And a negative rate might force them to lose their prudence.

The other side to rates is that there are many marginal firms out there who are dependent upon low rates. Some call them zombie firms. When rates start to rise, these inefficient firms will have trouble and can drag down the economy. Yet many feel, including me, that these inefficient firms should face normal rates from the Federal Reserve because they are holding down real wages too.

Rage,

Thanks for your ideas… I am still not happy about the lax standards for the economy. Low rates allow many zombie firms to continue in business. These firms are contribute to holding down real wages. If the Fed rate does eventually normalize, these firms will start to have trouble.

Let me be a little more specific… Two years ago profit rates were still rising. Zombie firms could increase profits without other firms having to sacrifice profits. But now profit rates have stalled. So if a firm increases its profit rate, then another firm has to decrease its profit rate in order for the overall profit rate to stay stable. If the Fed rate had been slowly raised starting 2 years ago, these zombie firms would have been weeded in a slow process while profit rates were healthy.

Now when the Fed rate starts to rise, these zombie firms will react more dramatically because profit rates are overall stable.

And you say that parts of the financial markets have healed. Yet some are still zombies and we should not try to heal them with low rates. A higher Fed rate would have gone a long way to increasing social efficiency of the economy.

Rage,

Let me just summarize my thoughts in the previous reply…

The economy is now much less socially efficient in part due to a low Fed rate. And it will be hard for the Fed to normalize its Fed rate standards, because firms have gotten used to the low standards for so long.

It is like grades in the universities now. Students receive an A much more than they did in the past. It is now a hard process to normalize grades back to where they were.

Call me confused — how does the existence of these “zombie companies” keep wages down? If they go under, wouldn’t those newly unemployed workers bid down wages?

I second Jack’s last question. Isn’t this a function of a stark power asymmetry between capital and labor?

And I also wonder what would increasing profits have to do with either increasing employment or labor share. Profits go to capital, not labor. What is the transmission mechanism?

Cheers!

JzB

Jack & Jazz,

Zombie companies are akin to low-road companies, which are less productive companies that have to pay lower wages. In the area of minimum wages,… when the minimum wage is low, these low-road zombie companies get an unfair advantage against more productive and socially beneficial companies. A lower minimum wage allows these companies to compete against more productive firms. Then the more productive firms get an extra profit when wages are held down.

The same goes for low nominal rates of lending. The low-road companies get an advantage that they would not normally have.

But to your second question about bidding down wages by newly unemployed workers… No… the research I have seen from Bruce Kaufman and other labor economists shows that as these low-road firms are cleaned out, wages will rise to more productive levels in many more companies. The thinking is like this… if you raise the minimum wage, some low-road firms will go under or hire less workers. Then the hig-road firms will pay the higher minimum wage. The social benefits increase. You lose some jobs but you increase overall social benefits to social costs in the economy.

The same then goes for raising the Fed rate. Some low-road zombie companies will be cleaned out. The remaining firms are actually willing to raise wages as they can pay higher wages. They are thus able to gain better control of the market because the low-road firms have lost an advantage with low rates. A higher Fed rate would clean out some zombie firms, and some people would lose their jobs, but the end result is higher social benefits over social costs to society.

Eventually this medicine of higher more normal rates will have to come. It will be good for the economy.

OK. That explains the low end companies.

My question still remains.

What incentive is there for high profit companies to raise wages? What we’ve seen since 2000 is soaring profits and declining real wages.

What will turn that around?

Cheers!

JzB

Hi Jazz,

This is the point. High profit companies do not have to raise wages when low-road companies can survive. Profits have soared upon that dynamic. The standard is lowered and net social benefits decrease.

Now weed out some of those low-road companies. The dynamic will change. Real wages will not go down further at that point, they will rise.

The key is establish a higher standard for the economy, so that there are more high-road companies to low-road companies. Here is a paragraph from a paper by Bruce Kaufman, page 444.

http://digitalcommons.ilr.cornell.edu/cgi/viewcontent.cgi?article=1458&context=ilrreview

“Minimum wage laws may enhance efficiency in another way as well, by protecting not only workers but also “high road” employers who make long-term investments in human capital, physical capital, and R&D.

Research shows that productivity is higher at firms using a high performance work system (HPWS) with self-managed work teams,

job security provisions, extensive training, employee involvement methods, and formal dispute resolution programs (Appelbaum,

Berg, Kalleberg, Bailey 2000). These kinds of organizational investments are crucial for long-run growth but may be seriously impeded by the instability and hyper short-term competition found in competitive markets. A minimum wage law can protect and encourage new forms of work organization, such as HPWS, by putting a floor under competition so “low road” firms are not able to undercut and drive out high road firms.”

Just as a higher minimum wage will protect high-road firms, a tighter Fed policy will too. The high-road firms have a business structure to raise real wages with productivity and increase labor share. Yet policy-makers have let the standards slide for so long that low-road firms are protected. Low-road firms are driving the economy downward. This situation should not go on…