Contra Jared Bernstein: Stagnation, Spending, and The Velocity of Wealth — Five Graphs

I’ve said many times: every economic assertion should be preceded by the words “by this measure.” For big economic questions, you need to look at lots of different measures, lots of different way, to get a feel for what’s going on.

This has come home to me as I’ve considered Jared Bernstein’s ongoing takedown of liberal beliefs regarding inequality, marginal propensity to consume (MPC), and economic growth — epitomized in this remarkably weak-kneed December 2013 paper for the (supposedly) liberal Center for American Progress.

Bernstein is a strong voice for progressive policies. But in this paper and widely elsewhere, he repeatedly pooh-poohs the MPC argument.

That argument briefly stated: poorer people spend a higher percentage of their income/wealth each year, so if income and wealth are less concentrated, more widely distributed, there will be more spending.

Even briefer: extreme wealth concentration strangles growth. I built a little model depicting that arithmetic effect here.

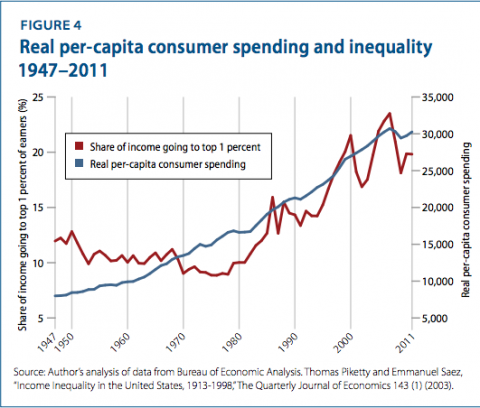

But Bernstein repeatedly points to certain measures suggesting that things don’t seem to have worked out that way. Even as inequality has increased over the last 35 years, real per-capita consumer spending has continued to rise:

Okay, by these measures (and with y axes tweaked to depict these measures in a certain way), the MPC argument doesn’t look like it’s been borne out.

But even as he puts great weight on this display, he acknowledges that it isn’t very good evidence. You need a counterfactual: Sure, spending went up, but if inequality had remained the same, would it have gone up faster?

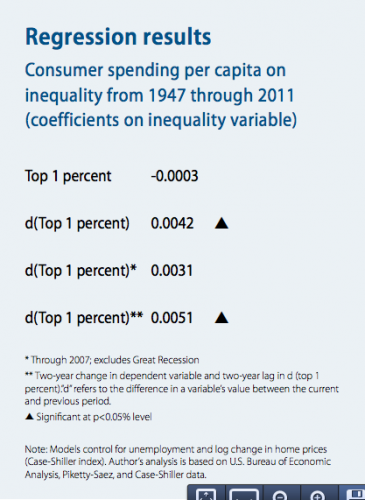

He attempts to answer that question with some regression analyses:

This is a rather impenetrable data display; read the adjacent copy* to understand it. But in brief, his regression-constructed counterfactual says that if equality had remained the same, there would have been less spending.

This seems to bear out the conservative narrative you’d expect to be hearing from AEI or The Heritage Foundation: greater inequality causes faster growth. (Presumably through “incentive” effects on “the most productive members of our society”?)

But statistical savants will see almost instantly that this counterfactual is weakly constructed, is logically tenuous at best. And what if we look at some other measures — especially measures of wealth, as opposed to income? Bernstein does make some attempt to include wealth measures in his regressions — Case-Shiller house prices and (rather oddly) unemployment. And he goes on to discuss the rise in consumer debt as a likely explanation for the spending growth. But skyrocketing debt — a (negative) component of wealth — is completely absent from these regressions, and he doesn’t look at wealth explicitly

We have explicit measures of wealth. Here’s what consumption spending looks like relative to wealth over the last half century. Call this The Velocity of Wealth — how much of their wealth households turn over each year on purchases of newly-produced goods and services (the stuff of GDP). Click each graph to go to the FRED page.

Household Spending Relative to Household Financial Assets

Household Spending Relative to Household Total Assets

Household Spending Relative to Household Net Worth (Total Assets – Debt)

The last two measures are especially interesting because they incorporate home-equity wealth (which Bernstein tried to do, somewhat idiosyncratically, using a Case-Shiller variable in his regressions). And the last measure also incorporates household debt.

By all these measures, we see a massive, three-decade secular decline in spending relative to wealth over 35 years — the very same period over which we’ve seen massive growth in wealth inequality.

That’s exactly what the MPC argument predicts: as wealth concentration increases, the velocity of wealth declines. Ceteris paribus, more-concentrated wealth seems to result in less spending than moreless-concentrated wealth.

So what about the counterfactual? If wealth inequality had remained the same instead of skyrocketing, would we have seen these declines in wealth velocity? Some regressions might tease out some answers to that question. But given the apparent long-term nature of this effect, they’re going to have to include more than the rather arbitrary and singular, freshman-statistics-level two-year lag employed (only) in the last of Bernstein’s regressions. (The lag techniques Arin Dube used in his definitive and statistically sophisticated takedown of Reinhart-Rogoff’s 90%-debt foolishness seem especially well-suited to this work. Also take a look at these revealing if amateurish long-term cross-country regressions on wealth inequality and growth.)

So: more research needed. But that’s never stopped the conservatives from deploying their arguments, has it? One thing is certainly true: while that research is ongoing, it’s time for liberals to start taking their own side in this argument.

No names, just initials: Jared Bernstein.

* Update: The report PDF is one of those annoying ones that doesn’t let you copy large chunks. Have to read the description there.

Cross-posted at Asymptosis.

Steve, you’ve hit upon a pet peeve of mine: Experts of one sort or another, who are politically liberal, using some superficial data set or superficial analogy to claim refutation of an important liberal point. Or to assert a seemingly politically neutral point that actually undermines politically progressive interests.

One example: For nearly six years now, I (and many other liberals) have been dismayed at Obama’s refusal to respond with actual facts to the constant onslaught of false facts and generic slogans put out by the winger-media complex to undermine support for Democratic policies and proposals, and to just educate the public about important laws that the Democratic Congress enacted in the first years of the Obama administration.

But a few months ago I read some article or blog post in, I think, the Washington Post, by some political scientist who said that it doesn’t make any difference whether or not a president tries to “sell” his policy proposals to the public. This guy’s evidence: George Bush’s unsuccessful attempt to sell Social Security privatization to the public in the months after his 2004 election victory, and some other Bush policy or policy proposal—I can’t remember which one, but I think it had to do with the Iraq war long after it was clear that that war was a debacle—that, like Social Security privatization, the public was very, very well-informed about and rejected precisely BECAUSE they knew the specifics of the proposal. It was the actual proposal itself, in both instances, rather than some misinformed idea of the proposal, that the public rejected.

This political scientist didn’t recognize the distinction. Which made me say aloud, to myself: Really??

Actually EDUCATING the public about actual, genuine facts—economic facts, ACA facts, big-gummint-employment facts (that state and local governments have drastically cut their numbers of employees, and the federal government has, too, as has the federal government, and the effect on the economy that that has had)—would be futile, even if it’s the president, speaking during prime time from the Oval Office, attempts it? Educating the public about–as Krugman pointed out in his last column—the extraordinary decline in unemployment compensation by the federal government and, more so, by some states, as compared with any time in this country’s history since the program was initiated? Explaining what the effects of that ARE? This would necessarily be futile? Why not put that to the test?

The existence of the Consumer Financial Protection Bureau and other parts of Dodd-Frank that directly affect ordinary people? No one knows about it.

The law that became effective in 2010 or 2011 that prohibits those outlandish bank overdraft fees for trivial (and even momentary) overdrafts from bank card purchases? No one knows why that suddenly stopped.

The “Durbin amendment,” which protects small businesses (including, say, gas station franchise owners) from excessive charges for their customers’ Visa or Mastercard? No one knows about it. (I’ve said on AB before that I’ve thought all along that the wrong Illinois senator ran for president in 2008. But of course Durbin, who by then already had a long history of pushing major progressive legislative initiatives, couldn’t have defeated the Clinton juggernaut. No, Sir. Only the generic-platitudes Hope-and-Change new guy could do that, because only the generic-platitudes Hope-and-Change new guy could gain the attention of the political news media.)

The political news media doesn’t DO policy. Wayyyy too complicated to explain or even mention pre-campaign policy accomplishments and efforts. (Which is exactly what’s happening again.)

Well … whatever. Anyway, I’m so glad you posted this post about Bernstein. I hope it goes viral.

I think Mr. Bernstein is being obtuse in his analysis. It’s clear he favors certain policy prescriptions so perhaps his analysis reflects that,msort officials surprising given that he often partners with Dean Baker whondefinitely seems to get MPC.

On a fundamental cognitive level MPC makes sense. Bill Gates can’t use ten IPhones (irony intended). The top ten percent can’t sustain a robust auto industry even with Mitt Romney’s twelve cars and car elevator. Grocery stores and consumer outlets fall apart if there isn’t a population that raises consumption to feed production.

Want to see what happens to a society where wealth is intensely concentrated? Go to a shop in North Korea and look at the empty shelves.

This is the basic insight that Henry Ford intuited, if the working class doesn’t make enough money to purchase the fruits of production, production can’t be sustained. The continued concentration of wealth won’t result in a return to a feudal state, human expectations have expanded such that we’ll face a political crisis and collapse.

I have tremendous respect for Mr. Bernstein, especially for his work with Dean Baker but his antecedents are in Clintonian Third Wayism and in a very few areas he can’t seem to shake that.