Health Benefits for 2019: Premiums Inch Higher, Employers Respond To Federal Policy

The argument has been, if people like their private and company sponsored insurance plans they can keep them; but can they afford to do so?

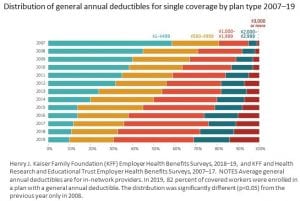

In a recent LA Times and KFF survey, 40 percent of respondents said they had difficulty affording health insurance or health care or had problems paying medical bills. An approximate one-half of respondents said they or a family member skipped or postponed getting health care or prescriptions in the past twelve months due to cost concerns. Those with higher deductibles were more likely to report problems with affordability and were likely to say their insurance worsened over the past five years as compared to people with lower deductibles. Over the last decade, deductibles have increased 162% (see chart below).

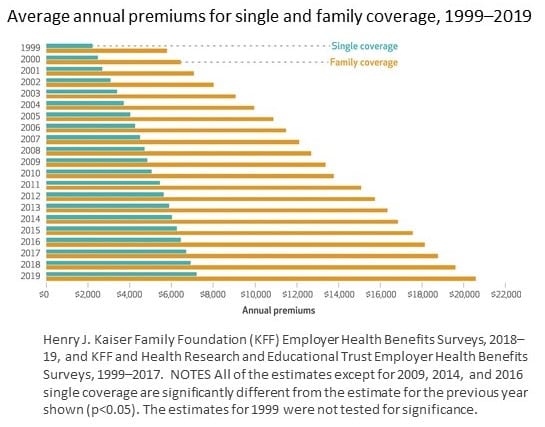

The annual Kaiser Family Foundation Employer Health Benefits Survey: In 2019 the average annual premium for single coverage rose 4 percent to $7,188, and the average annual premium for family coverage rose 5 percent to $20,576. On average, covered employees contributed 18 percent of the cost for single coverage and 30 percent of the cost for family coverage with variation across firms. Of the 9,000 firms the survey was sent to, 4,395 firms answered this question of whether they offer healthcare insurance for a response rate of 58 percent.

Fifty-seven percent of firms offered health benefits to at least some of their workers. Smaller firm employees faced a higher risk of affordability especially during recessions. Fifteen percent of all covered workers including the 35 percent of covered workers in small firms are in plans with a worker contribution of more than half of the premium for family coverage (2019). In firms with a high percentage of low-wage workers, the average worker’s share for family coverage was 41%. This is many ways to say the same thing, the cost of healthcare is increasing and private company plans may no longer have a lessening capability to pay for healthcare.

Employer-sponsored health insurance is the largest source of coverage in the United States, covering about 153 million nonelderly people. I am sure many people would like to keep the private healthcare insurance and pay less for premiums than what they are.

Premium and Deductible Increase Charts and key thoughts after the leap

Some key thoughts:

- Inpatient Hospital: Eighty-five percent of covered workers faced cost sharing if they were hospitalized in 2019 and separate from any general annual deductible under their health plan. Of those facing cost sharing, 66 percent had a coinsurance requirement and 14 percent had a copayment. The average coinsurance rate was 20 percent and the average copayment was $326 per admission.

- Office Visits: Sixty-seven percent of covered workers had a copayment and 25 percent had a coinsurance requirement for a primary care physician office visit in 2019. This is similar to 2018. Copayment average was $25 and the average coinsurance rate was 18 percent. Average copayment for a specialist office visit was $40, and the average coinsurance rate was 19 percent.

- Prescription Drugs: Eighty-four percent of workers with drug coverage were enrolled in a plan with three or more tiers of drugs in 2019. Average first tier copays were $11 for drugs (generics), $33 for those on the second (preferred drugs), $59 for those on the third, and $123 for those on the fourth tier. Prescriptions filled through mail order are less costly due to incentives to use mail order.

- Coverage: Fifty-six percent of small firms and 99 percent of large firms offered health benefits to at least some of their workers, with an overall offer rate of 57 percent.

- Cause of higher Insurance Premiums: The biggest driver of premium increases has been in hospital price increases which have risen 42% between 2007 to 2014 for in and outpatient care which was far greater than physician prices did during the same period. By far, this is not the only solution to gaining control of healthcare costs. It is the one which details the one issue being greater than the others at this point in time. Kocher and Berwich, “While Considering Medicare For All: Policies For Making Health Care In The United States Better.”

Health Benefits In 2019: Premiums Inch Higher, Employers Respond To Federal Policy You will not be able to get the full report. You can see the abstract on Health Affairs.

KFF 2019 Employer Health Benefits Survey The KFF survey was the basis for the Health Affairs article.

“While Considering Medicare For All: Policies For Making Health Care In The United States Better” Robert Kocher and Donald M. Berwick, Health Affairs, June 9, 2019

Questions?

run75441 Bill H