Consumer credit: both producer and consumer sides of the ledger show mortgage market OK, increasing stress for other loans

Consumer credit: both producer and consumer sides of the ledger show mortgage market OK, increasing stress for other loans

The New York Fed reported on household debt and credit.

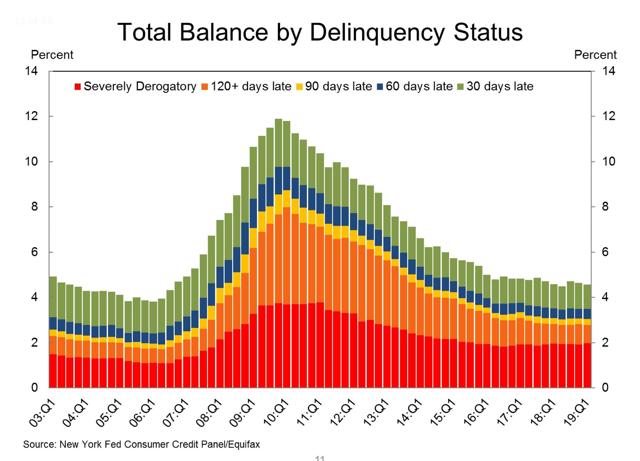

The good news is that there has been no increase in total delinquencies:

This is important because the amount of delinquencies would be expected to increase if we were close to getting into a recession.

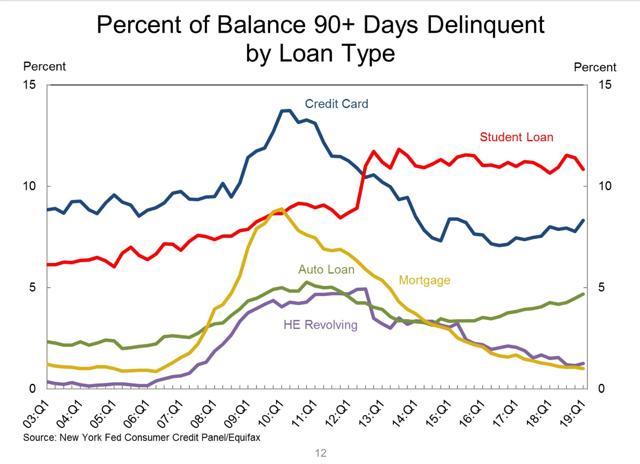

The somewhat more bad news is that, if the *amount* of delinquencies has not risen, the *percentage* of vehicle and credit card loans that are seriously delinquent has risen:

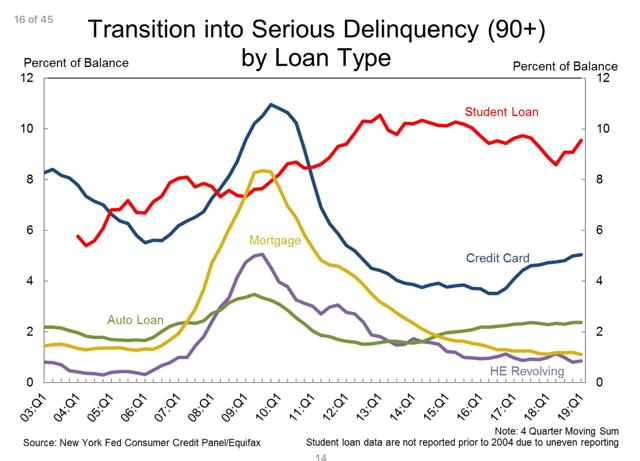

And the percent transitioning into serious delinquencies for credit card loans have also risen:

Note, however, that mortgage loan delinquencies remain at their lowest ever in the survey.

Meanwhile, last week the Fed issued its Senior Loan Officer Survey, which covers the creditor side of the ledger. That report showed that in Q1, mortgage lending got slightly looser, as did credit to firms, while outside of mortgages, banks tightened conditions for issuing consumer credit, and consumer demand for nearly all types of credit declined. My post on the Senior Loan Officer Survey is up at Seeking Alpha.

In short, from both the producer and consumer side of the ledger, the mortgage market is in good shape, with some signs of increasing stress, and tightening of conditions, for other types of loans.

Nope, your looking at the wrong side. Consumer finance isn’t the trigger this cycle. Corporate debt crisis, it will probably be months into the cycle before the loans really show “stress”(and that rise in levels depends on strength shock). This is a true backdoor recession. The unsecured corporate debt declines and forces fixed nonresidential investment to crash and that weakness spreads into other areas.