Noahpinion: What Causes Recessions? Debt Runups or Wealth Declines?

Noah Smith asks what seems to be an interesting question in a recent post: “what leads to big recessions: wealth or debt”?

But I’d like to suggest that it’s actually a confused question. Like: is it the heat or the (relative) humidity that makes you feel so hot? Is it the voltage or the amperage that gives you a shock, or drives an electric motor? The answer in all these cases is obviously “Yes. Both.”

The question’s confused because wealth and debt are inextricably intertwined. “Wealth” is household net worth — household assets (including the market value of all firms’ equity shares) minus household sector debt. Debt is part (the negative part) of wealth.

Still, it’s interesting to look at time series for household assets, debt, and net worth, and see how they behave in the lead-ins to recessions.

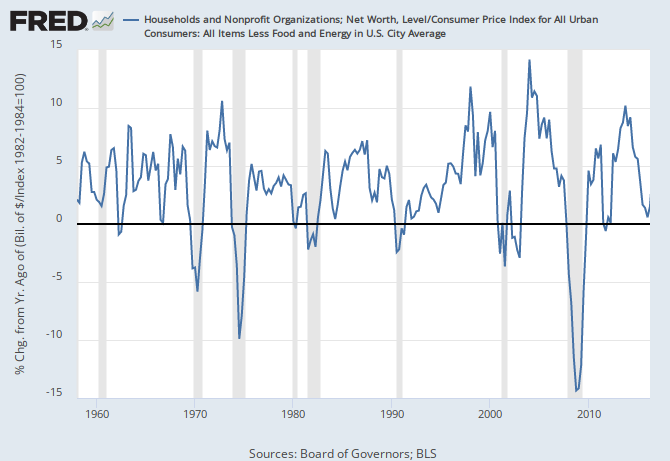

I’ve pointed out repeatedly that year-over-year declines in real (inflation-adjusted) household net worth are great predictors of recessions. Over the last 65 years, (almost) every time real household net worth declined, we were just into or about to be into a recession (click for interactive version):

Update 6/8: This was mistakenly showing the assets version (see next image); it’s now correctly showing the net worth version.

This measure is eight-for-seven in predicting recessions since the late sixties. (The exception is Q4 2011 — false positive.) It makes sense: when households have less money, they spend less, and recession ensues.

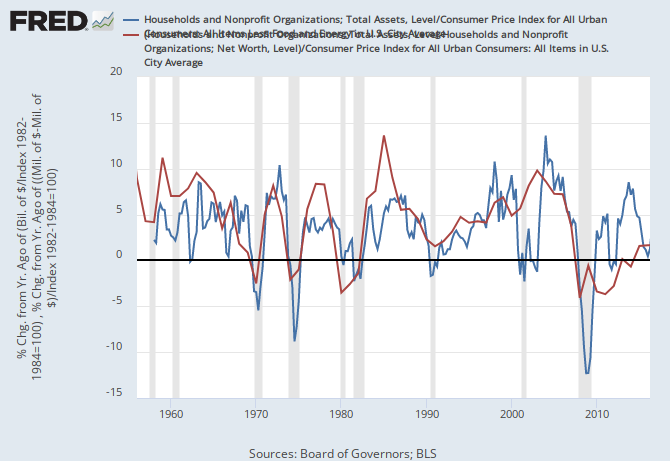

But now here’s what interesting: YOY change in real household assets is an equally good predictor:

Adding the liability side of the household-sector balance sheet (by using net worth instead of assets) doesn’t seem to improve this predictor one bit. This perhaps shouldn’t be surprising. Household-sector liabilities, at about $14 trillion, are pretty small relative to assets ($101 trillion). Even if levels of household debt make big percentage moves (see the next graph), the actual dollar volume of change isn’t all that great compared to asset-market price runups and drawdowns. Asset levels make much bigger moves than debt levels.

It’s also interesting to look at changes in real household-sector assets (or net worth) compared to changes in real household-sector liabilities:

As we get closer to recessions, the household sector takes on debt progressively more slowly, with that shift happening over multiple years. (2000 is the exception here.) That speaks to a very different dynamic than the sudden plunges in real assets and net worth at the beginning of the last seven recessions. Perhaps: household’s portfolios are growing in these halcyon days between recessions, so they have steadily less need to borrow. And as those days continue, they start to sniff the next recession coming, so they slow down their borrowing.

My impressionistic take, unsupported by the data shown here: Higher levels of debt increase the odds that market drawdowns will go south of the border, driving the economy into recession. And they increase the likely depth of the drawdown, as lots of players (households and others) frantically need to shrink and deleverage their balance sheets, driving a downward spiral.

If the humidity’s high, and it gets hotter, you’re really gonna notice the change.

My obstreperous, categorical take, cadging from the past master of same:

Recession is always and everywhere a financial phenomenon.

Cross-posted at Asymptosis.

Noah Smith doesn’t have to ponder anything. He needs to take in Steven Keen’s lectures series at King’s College on private debt and recession. Keen’s Minsky software modeling are an interesting break through in understanding the impacts of private debt accumulation and economic collapse. Of course, the 2008 recession is part and parcel extreme private debt and financial sector criminality. But Keen predicted the meltdown based on his modeling and is working it back through history in this lecture series.

Debt is only leveraged wealth.

Hmmmm:

I think I know you. Welcome back.

“Debt is only leveraged wealth.”

This is what confuses me about the picture presented. If one group of people has debt, another group must have loaned them the money. So the net household wealth of those groups together cannot change no matter how much one group loaned to the other.

Declining asset prices are just speculators’ selling ahead of a recession they see coming. (And I use the word “speculators” here to mean “those who see or observe,” not the pejorative it has become to those who do not see.)

So, for those of us who do not see so well, the declines precipitated by those who do can be a sign to us who do not see so clearly, but who are not yet completely blind.

The real question is, What are those speculators seeing that we do not?

You nailed it. This is how the speculators or Wall St. insiders regulate and control the market. No big surprise here. If you have been reading the WallStreetonParade.com for the past year or so you would already have clear understandings of this mysterious seeing and not seeing market manipulation. Some people like the casino. Some like roulette. Some like playing musical chairs on the Titanic. While some like playing the stock market., all high risk ventures.

“Some people like the casino. Some like roulette. While some like playing the stock market., all high risk ventures.”

No — the stock market has winning odds. Those others have losing odds.

Warren above poses the loanable funds notion that it is a net zero debtor to lender accountancy, meaning that there is no net wealth change.

The concept of endogenous money is the argot shorthand way to capture the idea that credit is created by banks, created out of whole cloth. So the lender enters amounts into the borrower’s account but they dont have to have the money in hand at the time, but need to get it when claims for money are made against this new account. Voila, credit and money are created, ex nihilo. When banks become unhinged, so to speak, they use this bank-money privilege to create credit for too many activities that are economically unsound and a ponzi-like crisis can occur Now, let me see, have we seen this happen in modern times??

But it is true that once the debt is established it becomes someone’s asset, which could be traded to someone else, even if it is economically a naked emperor. The fact that we let this unhinged credit creation create all this type wealth/debt prior to 2007, sanitized it so the unsound assets need not be written-off via public action, well, it is a reason for windfall profits or recovery taxes to be enacted so these wealth gains from unearned moral hazard outcomes aren’t a reminder about how easy it would be to do the same thing again, for great gain for thise who are part of these asset trading marketplaces (where only 1 percent of us can even envision playing)..

“But it is true that once the debt is established it becomes someone’s asset, which could be traded to someone else, even if it is economically a naked emperor.”

It’s not just that, it was that the debt was cut up and sold in such a way that the new volume of piece were bid up to be worth more than the original block. Book it, cash it out to greenbacks and then park that off shore. Bingo! Those that hung on to the paper piece of the block….oh well.

@JF: “once the debt is established it becomes someone’s asset”

I’d put it differently. When the lending event happens, two assets are created: cash in a checking account, and a debt security.

On the language of that, for conceptual clarity (cause words are what we use to think together…), a para from one of my recent posts:

“It’s common parlance to say that the private sector is “holding government debt.” That’s understandable, since the private sector is holding bonds. But it’s a misnomer, and a pernicious, confusing one. The private sector is (obviously) holding assets on its balance sheet. The “debt,” such as it is, only exists as an offsetting accounting liability on the righthand side of the government balance sheet. (While “holding debt” is a handy verbal shorthand, if you think about it for a moment the usage makes no sense at all. How can you own something you owe? Debt can’t be an asset that you “hold.” It’s a liability.)”