Where MMT Gets Its Accounting Wrong — And Right

Modern Monetary Theory has been revolutionary in economics, and its influence is — beneficially — ever-more pervasive. It has opened the eyes of a generation to a clear-eyed, accounting-based methodology that trumps dimensionless theory, and has brought a deep, nuts-and-bolts understanding of money, debt, and financial institutions to a discipline where that understanding has been inexcusably absent. Witness: a whole raft of papers from central-bank economists worldwide embracing MMT principles (though often not MMT by name), and eviscerating decades or centuries of facile and false explanations of monetary mechanisms. But MMT’s terminology and associated accounting constructs remain problematic and contentious, even among some MMT supporters like the splinter group, the Modern Monetary Realists. Some of this contention results from the usual resistance to new ideas and ways of thinking. But some arises, in my opinion, because MMT terms and accounting constructs are indeed problematic. (The terminological confusion even causes some to object correctly, but for the wrong reasons — and vice versa!) These difficulties are apparent when you consider one of MMT’s central and oft-repeated mantras and accounting identities, here in its simplified form for a closed economy ignoring Rest of World, courtesy of the redoubtable Stephanie Kelton:

Domestic Private Surplus = Government Deficit

This suggests an important truth, as far as it goes: public (monetarily sovereign federal government) deficit spending creates private assets out of thin air. The government spends new money, created ab nihilo, into private accounts. +Private Assets. No change to private liabilities. So: +Private Sector Net Worth. But it doesn’t actually go very far. That “private surplus” (a term that is absent from the national accounts, and from MMT’s ur-text, Monetary Economics by Godley and Lavoie) is not defined in accounting terms, except circularly and tautologically: it’s the amount that private assets increase as a result of government deficit spending. That makes the identity true by definitional tautology. But contrary to what’s at least implied by the equal sign, deficit spending is not the only way that private assets increase, or even the primary way. It’s not the only source of private-sector “surplus” or “saving,” as is often suggested in MMT discourse. Not even close. Start by thinking in terms of Household Net Worth. This measure has the virtue of encapsulating and telescoping all private-sector net worth, because households ultimately own firms, at zero or more removes, but firms don’t own households (yet…). Citibank may own some GE shares, but Citibank is ultimately owned by households. Because: firms issue equity shares; households don’t. It’s an asymmetric, one-way ownership relationship. Then take a look at this paragraph from MMTers extraordinaire Eric Tymoigne and Randall Wray:

MMT does differentiate between saving (in the flow of funds it is the change in net worth: ΔNW) and net saving (saving less investment). Net saving shows how the accumulation of net worth occurs beyond the accumulation of real assets. For the domestic private sector, this comes from a net accumulation of financial claims against the government and foreign sectors.

Some of the problems with this paragraph:

• Pace T&W, there is no “saving” measure in the Fed’s flow of funds accounts (FOFAs) that equals ΔNW — whether you’re talking net or gross saving (with or without consumption of fixed capital), including or excluding capital transfers.

• The “net saving (saving less investment)” bruited in that paragraph is confusingly at odds with the existing definition of the term as used in the national accounts — gross saving minus consumption of fixed capital.

• “Net accumulation of financial claims” does not appear anywhere in the national accounts, and has an uncertain relationship with a measure that the FOFAs do provide: “Net acquisition of financial assets.” Are these the same measures? If not, what is their accounting relationship?

I find here a set of terms that I’m unable to resolve into a coherent set of accounting statements — despite years of diligent and highly motivated efforts to do so. (I’m an ardent MMT supporter; I wouldn’t be thinking these thoughts if it weren’t for the MMT cabal.) The core problem is these measures’ opaque relationship to net worth, and change in net worth. The problem exists because they don’t incorporate the primary way that net worth (wealth) is accrued: market revaluation of existing assets, a.k.a. capital gains. Market runups increase private-sector assets, without increasing liabilities. Voila: higher private-sector net worth. “Money” created, ab nihilo. MMTers seem to have these conceptual, terminological problems for the same reason as more traditional economists (and due to MMTer’s efforts at speaking in those economists’ language): they’re still “thinking inside the NIPAs” — despite MMTers well-founded devotion to the FOFAs. The BEA’s National Income and Product Accounts, pioneered by Simon Kuznets in the 1930s, are essentially income statements. They are one of the primary data sources for the FOFAs. But the NIPAs have a key failing: they don’t include balance sheets (the essential second component of a coherent accounting, which the FOFAs add). And the NIPAs completely ignore (with good reason) existing-asset exchanges and revaluations. Absent balance sheets, and accounting for existing-asset revaluation, it’s impossible for balance sheets — and net worth, period to period — to…balance. Economists who don’t deeply understand that — and I will assert that few economists do, because they’re conceptually trapped inside the NIPA’s balance-sheet-free definitions of income and saving — cannot form a coherent understanding of an economy’s workings. In Monetary Economics, Godley and Lavoie (G&L) do show a deep understanding of revaluation’s importance — they give extensive coverage to the Haig-Simons accrual-based mark-to-market accounting approach that I also favor. But you’ll be hard-pressed to search Google for top MMT names (Wray, Tymoigne, Kelton, Fullwiler) and find asset revaluation, capital gains, or Haig-Simons accounting incorporated into their discussions of income or saving. This even though the FOFAs (presented in the Fed’s Z.1 reports) provide exactly that: balance sheets and income statements based on Haig-Simons accounting — using accrual-based, marked-to-market revaluation of existing assets — wherein the sum of accounted flows totals to balance sheets’ period-to-period net worth changes. See for instance the Household tables B.101 (bottom line: net worth) and R.101 (top line: change in net worth). Those FOFA tables are the source of the Integrated Macroeconomic Accounts for the United States (IMAs), which unlike the NIPAs, conform (mostly) to the international System of National Accounts (SNAs). See for instance Household table S.3.a, which includes the income statement and balance sheet on a single page (bottom line: net worth). You will find a similar Haig-Simons approach in Armour, Burkhauser, and Larrimore 2013, an analysis that merits significantly more attention, and replication. (The authors, inexcusably, have not made their data set available.) The FOFAs and IMAs provide the necessary revaluation estimates for such a replication, estimates which Armour et. al. achieve by their own methods (somewhat different from the Fed’s, but using similar indices). This is all important because the widespread MMT statement (at least implied, and frequently explicit) — that government deficits are the source of private saving (or “surplus”) — is at least a poor explanation of economic workings, and at worst just wrong. Government deficits are a source of private saving. The two primary sources of private assets (hence saving) are:

- Surplus from production (how “surplus” is commonly used in the national accounts), monetized by the markets for newly produced goods and services.

- Revaluation of existing assets — assets produced in previous periods — realized in the existing-asset markets.

I would even go so far as to say that these are the primary mechanisms whereby “money” is created. Deficit spending is small beer compared to cap gains. Asset markets go up, and there’s more money. This eschews the widespread confution of money with “currency-like things,” suggesting rather that all assets — which since they exist on balance sheets are necessarily designated in a unit of account — embody “money.” As an aid to untangling the confusion that I still find inherent in MMT discourse, I offer up the following taxonomy of sources for household income. It’s explained in detail here.

| Household Income Sources | |||

| Comprehensive Income (gross contributions to net worth, before netting out expenditures) | Non-Property Income (compensation for labor) | Other Labor Income | Social benefits and other transfers received (including employers’ social contributions) |

| Primary Income | Primary Labor Income: Wages and salaries | ||

| Comprehensive Property Income (compensation for ownership) | Primary Property Income: Dividends, interest, proprietors’ income, rental income, and operating surplus | ||

| Other Property Income | Market asset revaluation (capital gains) | ||

| Other changes in asset volume | |||

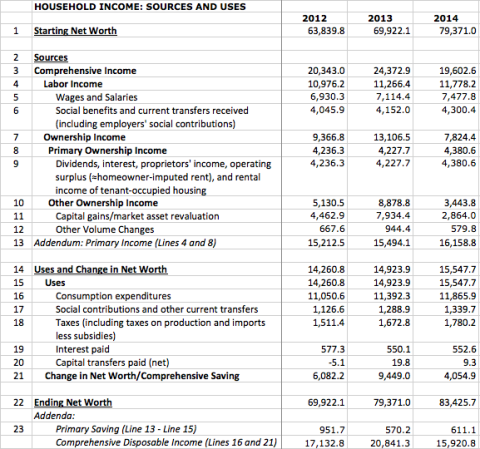

Here’s what that looks like in an accounting statement, using IMA data:  Before you raise objections, I point you again to further explanation of this construct, here. Like Armour et. al., I use a measure labeled “Comprehensive Income” that includes accrued, marked-to-market capital gains. I go a step further, however, and propose another measure based on that, a residual of sources and uses: “Comprehensive Saving.” That measure has a singular virtue: it equals change in net worth. “Primary income” — the vestige of the NIPA’s “income” measure that is carried over into the FOFAs and IMAs (but properly labeled as “Balance of primary incomes”) — is given as an addendum measure. The measure here varies from the FOFAs/IMAs only in that interest paid is not deducted from income; it’s tallied under Uses. Comprehensive Saving does not, of course, equal government deficit spending. (Nor does Primary Saving.) Such spending contributes to private-sector saving, but it’s not even vaguely identical. Before concluding, I’d like to touch on private-sector bank lending. (Modern Monetary Realists, are you listening?) Its direct effect on net worth is zero. It creates new assets — bank deposits. But unlike government deficit spending, it also creates equal and opposite offsetting liabilities on both the borrower’s and the bank’s balance sheets. Both balance sheets expand, equally on the left and right sides.

Before you raise objections, I point you again to further explanation of this construct, here. Like Armour et. al., I use a measure labeled “Comprehensive Income” that includes accrued, marked-to-market capital gains. I go a step further, however, and propose another measure based on that, a residual of sources and uses: “Comprehensive Saving.” That measure has a singular virtue: it equals change in net worth. “Primary income” — the vestige of the NIPA’s “income” measure that is carried over into the FOFAs and IMAs (but properly labeled as “Balance of primary incomes”) — is given as an addendum measure. The measure here varies from the FOFAs/IMAs only in that interest paid is not deducted from income; it’s tallied under Uses. Comprehensive Saving does not, of course, equal government deficit spending. (Nor does Primary Saving.) Such spending contributes to private-sector saving, but it’s not even vaguely identical. Before concluding, I’d like to touch on private-sector bank lending. (Modern Monetary Realists, are you listening?) Its direct effect on net worth is zero. It creates new assets — bank deposits. But unlike government deficit spending, it also creates equal and opposite offsetting liabilities on both the borrower’s and the bank’s balance sheets. Both balance sheets expand, equally on the left and right sides.

Borrower: +Assets (new bank account deposits) +Liabilities (new loan payable)

Bank: +Assets (loan receivable) +Liabilities (customer deposits withdrawable)

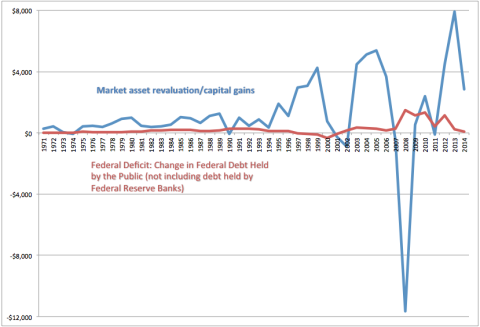

So the act of private lending itself creates new assets, but it doesn’t directly, in accounting terms, increase private-sector net worth. But: borrowers use many of those loans to create real assets — goods, capital — that are then sold at a higher value (or marked to market at a higher value). That markup increases private sector net worth, and private lending is a huge catalyst for that process. But that is an economic effect, not an accounting identity. So yes: private bank loans create new private-sector assets, and they have the indirect economic effect of increasing net worth, but they don’t, directly and in and of themselves, increase private-sector net worth. Government deficit spending does. MMTers are right that it’s special in that way. What they’ve missed — or caused many of their followers to miss — is that it’s not the only thing that’s special in that way. Really, it’s not even close:  Runups in stock and real-estate markets create new wealth, net worth, “savings,” money, out of thin air — just like deficit spending, but by a different mechanism. The markets create money too. Cross-posted at Asymptosis.

Runups in stock and real-estate markets create new wealth, net worth, “savings,” money, out of thin air — just like deficit spending, but by a different mechanism. The markets create money too. Cross-posted at Asymptosis.

“but firms don’t own households (yet…). ”

But they do! We have begun to see arrangements whereby education debt is repaid as a fraction of income. These arrangements are presently uncommon, but they exist and may become more common as we go.

If you have pledged a share of your income to a firm in return for their otherwise forgiving your debt, how is that different from selling the firm equity in yourself?

I register BruceCo with the Secretary of State of NM and issue 100 shares at $10 par. I sell 90 shares of BruceCo to my friends in a version of an IPO at $20 per share. BruceCo’s market value has just gone from nominal $1000 to a real $2000.

I turn around and sell one of my 10 shares to the Venture Buzzard firm DumbCo for $1,000,000,000. I now have a net worth of $9,000,000 and my ‘firm’ has a market cap of $100,000,000. Making my initial ‘investors’ ‘wealthy’. Scale this up and billions of dollars of investment “value” and “financial assets” can be created by movement of 1% or less of shares. And Wall Street likes to screech about “fiat money”!

The idea that this ‘net worth’ equates in any way to ‘money’ is more than faintly ludicrous. Because all these numbers would be the same if the product of BruceCo was a functioning perpetual motion machine or a napkin with a drawing.

But is any of this really “a net acquisition of financial assets” in the way Steve critiques?

Accounting is scoring. In a game that is always tied. By definition. That doesn’t impart some real world meaning the the line item called “assets”. Ask Don Trump how that works, he simply values his ‘brand’ at $3 billion and boom! it transfers over to net worth. Because books gotta balance.

“….all these numbers would be the same if the product of BruceCo was a functioning perpetual motion machine…”

Bingo ! :

” 1980–2008: The Illusion of the Perpetual Money Machine and What It Bodes for the Future ”

http://www.mdpi.com/2227-9091/2/2/103/htm

A suggestion : If we do decide that a new bubble is the best route to sustainable growth and full employment , let’s do it using an asset that can be purchased by rich and poor alike , so as to spread the distribution of gains across classes. Real estate and stocks don’t really fit the bill in that regard.

Tulip bulbs or Beanie Babies might work well. After everyone loads up on the chosen asset , the Fed can start buying them up at inflated prices , and , with a little luck , we’ll be on our way to widespread prosperity.

That is exactly why I reject MMT. I don’t find it blatantly wrong but I find it severely misguided in its focus on intermediate financial forms of wealth instead of what is really the ultimate real source of wealth: capital and goods creation.

When you build a balance sheet you easily see that some of the components MMTers find important simply cancel out on the aggregate. I don’t want’ to completely dismiss the importance of loans and such but they are just intermediate steps to actual goods and capital creation.

Steve,

( I’ll drop this here rather than adding to the already lengthy thread at Interfluidity. )

One academic you may want to follow for info on the H-S concept and any chance that it may be added to national accounts is Tim Smeeding. He has shown some enthusiasm for H-S as can be seen in his comments as discussant at this conference earlier this year :

http://iariw.org/c2015oecd.php#

See the last two pages of his comments on the first day’s Session 1 , for example :

http://iariw.org/OECD-Presentations/Session1/Smeeding.pdf

“….The whole thing is held together by Haig-Simons—which

ought to be the triumvirate goal for flows ….”

Here are a couple of his papers which use metrics that are not truly H-S , but moving in that direction :

http://paa2015.princeton.edu/uploads/151503

http://www.peri.umass.edu/236/hash/a13bcbdee2e3f7468c8a61b5db573001/publication/411/

http://www.tobinproject.org/sites/tobinproject.org/files/assets/Smeeding%20Thompson_Recent%20trends%20in%20Income%20Inequality.pdf

His Google scholar listing , sorted by date :

https://scholar.google.com/citations?hl=en&user=6K26nO8AAAAJ&view_op=list_works&sortby=pubdate&cstart=0&pagesize=20

Agreed, B.E. The problem with such market-value assessments is that the trade is zero-sum on the market.

Yes, BruceCo stock might be grown in “value” $100M, but for an investor to cash out, someone else must cash in! (Not in the DYING sense, of course, although those IPO investors would be making a killing, as it were.)

Not if you borrow against that “asset”.

We have entered a world where the whole concept of a P/E ratio has become almost meaningless for many firms – because they don’t have ‘earnings’. ‘Revenues’ maybe, in the case of Amazon almost beyond measure, but that doesn’t necessarily translate to ‘profits’.

None of which stops Jezz Bezos from being able to finance purchases like the Washington Post. And lots of Tech Bros from buying yachts and mansions by monetizing some idea that hasn’t actually earned anyone anything in terms of gross or net profit from goods sold. You know the kind of stuff they teach you in Intro to Financial Accounting.

You can’t eat a Business Model. But you can sell it for a billion dollars or for a hundred million and keep $900 million in “equity” and use that to finance as luxurious a lifestyle as you like. You can ask the Uber guys how that scam works, every time they do a stock for investment swap with some new ‘angel’ their ‘wealth’ swells in proportion to the calculation of that cash compared to that percentage of stock,

No, Bruce, even if you borrow against that “asset”, someone has to put in the money you’re borrowing.

Hey all:

Apologies for not participating here. The comments on Asymtposis and twitter have sort of overwhelmed me. And even more so, the current comment thread on Interfluidity, which is simply awesome. If you really want to understand net worth in the national accounts, and have some time (100+ comments and counting), run don’t walk.