Why the Fed Hates Inflation: 1.2 Trillion Dollars of Why

A simple rule of economic arithmetic that economists seem to studiously ignore:

Inflation transfers real buying power from creditors to debtors, with nary an account transfer visible anywhere on anyone’s account books. Inflation means that debtors pay off their loans over time with less-valuable dollars — dollars that can’t buy as much bread, butter, and guns.*

Higher inflation causes, is, a massive transfer from creditors to debtors.**

And the Fed is run by creditors. Inflation is, always and everywhere, very very bad for them.

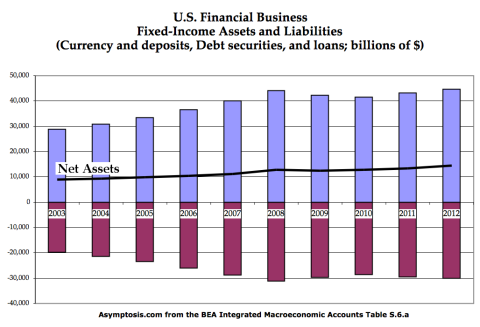

How bad? Look at the fixed-income assets and liabilities of financial corporations:

Financial businesses are net creditors to the tune of $9-$14 trillion dollars.

If inflation was 1% higher than it is, it would transfer between $90 and $140 billion dollars to their debtors. Every year. For every extra point of inflation.

Add it up: an extra point of inflation over the last ten years would have cost financial businesses $1.2 trillion dollars.

It’s enough to get a banker’s attention.

And that’s before you even consider the Fed powers-that-be in their roles as equity shareholders, and the Fed’s dual mandate. By emphasizing low inflation over low unemployment — and stomping on growth whenever the bogieman wage inflation threatens to rear its head*** — the Fed maintains a pool of unemployed and weakly compensated employees that cripples labor’s bargain power and empowers the steady growth of corporate profits over labor earnings.

It kinda makes you think about Mankiw’s fourth principle of economics: “People respond to incentives.”

I’ve said it before: if it weren’t for inflation, the rich really would own everything, instead of almost everything.

* Some will caveat: this is only true of unexpected inflation, because contracts are written with expected inflation in mind. The proper response: since the future is impossibly uncertain, all changes in the inflation rate are unexpected.

** Meanwhile economists fetishize notions about menu costs and the like, which in their largest estimations are an order of magnitude smaller than the inexorable arithmetic effect described here.

*** It’s happening now.

Cross-posted at Asymptosis.

problems with this rather silly piece:

*the Fed is not run by people who run banks

*the Chair is appointed by Congress, and the FOMC runs MP in accordance with the mandate created by Congress

*there is absolutely no reason to suppose that MP is operated for another purpose, ie to advantage banks and other financial corporations

*banks are also debtors, in case you are not aware of that. they earn a spread.

*the FOMC is actually trying to get inflation HIGHER

*the bulk of Fed haters/critics have been whining about QE forever, and want less rather than more. what else do you think the FOMC could do to provoke some inflation??

>*the Fed is not run by people who run banks

Thirty seconds of work on Fed biographies yields the following right off the top, without even starting to delve into consulting relationships, speaking engagements, lunch companions, or bedfellows… Those relationships are all widely documented.

Prior to serving as Commissioner, Ms. Raskin was Managing Director at the Promontory Financial Group

Prior to joining the Administration, he worked as a lawyer and investment banker in New York City.

Duke was senior executive vice president and chief operating officer of TowneBank

In 1995, Warsh accepted a position with the mergers and acquisitions department at Morgan Stanley & Co.

>the FOMC runs MP in accordance with the mandate created by Congress

It’s a dual mandate — as pointed out in the post — and one side of that mandate always dominates.

>*there is absolutely no reason to suppose that MP is operated for another purpose, ie to advantage banks and other financial corporations

None at all. Incentives don’t matter.

>*banks are also debtors, in case you are not aware of that. they earn a spread.

Didn’t you even look at the graph, or read the ensuing sentence?

>*the FOMC is actually trying to get inflation HIGHER

Which is why they’re tapering, right?

>*the bulk of Fed haters/critics have been whining about QE forever, and want less rather than more. what else do you think the FOMC could do to provoke some inflation?

Simple: announce a higher target.

The Fed measures the time to full employment as the time to next recession and want to drag that out as long as possible.

Alexander,

Did you miss the latest released notes from the FED in 2008? Their obsession with inflation? When imbeciles know better?

The actions you cite in terms of the FED trying to raise inflation were too little, too late, and also protected the banks.

Also, there is the argument that inflation effectively constitutes a tax on wealth. And as much as the rich and powerful hate taxes on their incomes and have gamed the political system to reduce them as much as possible, they PASSIONATELY LOATHE taxes on weath, And wealth is even more concentrated than incomes.

@Jim A:

Right, saying very much the same thing. (and YES on wealth concentration.) But even worse than a tax, it’s a REDISTRIBUTIVE TAX giving money to feckless debtors!!