Why Will Healthcare Insurance be Cheaper in Florida with the PPACA???

The fact of the matter is; healthcare insurance will not be cheaper in some places. Why it will not be so in Florida, I will get into later.

If you remember from 2010, the progressive state of Florida was the first to launch a suit in Federal court claiming the PPACA was unconstitutional. Eventually and after the casting of the bones by the news media and pols numerous times in attempts to predict what SCOTUS would do and why it will do it; in the end, little of the PPACA changed with the June 2012 decision. Struck down by SCOTUS was the mandate of the Medicaid Expansion for all < 138% of FPL or face a penalty of the overall defunding of Medicaid (which practice is not something unusual by the federal government as it was used with highway funding). Apparently with different SCOTUS justices, the practice is now unconstitutional. States such as Florida chose not to expand Medicaid or implement state exchanges which in the end will have an economic impact on the states besides insurance rates. In Florida’s case, the state went further to hinder the PPACA implementation. Even at the Bronze level, the PPACA provides preventative care which previously would have come after co-pays, deductibles, or not be covered. Maggie Mahar at Health Beat Blog points out the 62 new preventative services and procedure now available under the PPACA without deductibles or copays. While much of the expected increase in insurance cost from added benefits has been negated in much the same way as the elderly being covered at lower rates (through gained efficiencies brought to bear by the PPACA0 however they too will cause a much smaller increase in the cost of coverage. Even so such preventative services and products such as immunizations, anemia screening, and well women visits that were out of pocket previously are now covered.

Those uninsured who are not covered by the Medicaid Expansion will fall under PPACA coverage if the state expanded Medicaid benefits. The new PPACA coverage is made-up of the elderly, those with pre-existing disease and disorders, the healthy older and younger people. The elderly and those who have disorders and diseases will be covered at lesser cost premiums than what was before as insurance companies can no longer deny them coverage and the 3 to 1 ratio (old to young) establishes a maximum cost which previously was scored much higher. While this coverage will come at a lower premium than the back door ER in treating them, it too will have an impact on insurance rates overall. This is a component of the individual healthcare insurance market, a much smaller segment of the healthcare insurance population which has an MLR of 80% thereby giving back another 5% to the insurance companies. While gaining many benefits from the new healthcare market created by the PPACA, it still comes at a higher cost from private insurance companies then the Group Employee Sponsored Insurance.

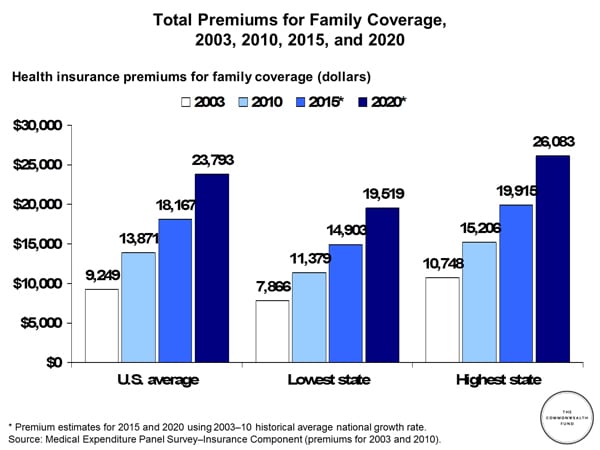

The addition coverage has an impact on cost in the various state insurance markets; but in Florida it goes a step further. Prior to 2010 Florida was the second most expensive state for healthcare insurance premiums; but, such was not always the case.

“The average annual health insurance premium in Florida was $15,032 in 2010, a 61 percent increase since 2003. Only New Hampshire was more expensive, although the District of Columbia had the highest average premium in the nation.

That 61 percent premium increase in Florida put the state behind only Mississippi for the most rapidly rising costs.

That health insurance premium in Florida represented 24 percent of the average family’s income in 2010, up from 16 percent in 2003, according to the study.” Florida Second Most Expensive

Florida has gone from a state which had premiums at < 17% of Median House Income in 2003 to one >20% of Household Median Income in 2010 well before the PPACA was signed into law. Another way to look at this is Healthcare Premiums represent ~ 24% of average income. The loosening of regulatory guidelines by prior administration(s) to lower costs has not done what it was intended to do (introduce competition) and has led to an abundance of bare bones healthcare plans doing little and being just as costly. Many have sought to blame the PPACA for premium increases in Florida when it was already in place. As shown by the charts, healthcare insurance in Florida has increased, is the 2nd most expensive in the nation, and will increase even more if left unchecked.

For far less insurance coverage then what the PPACA offers, the insurance premium trend has been upwards in Florida hitting ~24% higher in 2010 and projected to be ~25% higher than this for some states (which category Florida is in) by 2015. Even with the greater numbers of the elderly living in Florida in 2003, the insurance premiums were more moderately priced. Florida went from a moderately priced state (redundant alert) for healthcare insurance to one of the highest cost states (#2 in healthcare premiums) in a matter of 7 years (2010). The increase does not appear to be the result of a large number of older people as much as the increase and the potential increase in the cost of healthcare based upon providing services for fees of higher cost procedures and technology and a lack of regulation.

So what ELSE is driving the cost increase? In lightly regulated states such as Florida, Ohio, South Carolina, etc.; insurance companies were allowed to sell bare bones insurance plans before and after 2010. The Florida Insurance Regulatory Agency recently did a comp between a hypothetical silver based plan considering the offerings then as compared to coverage under the state exchanges. Drawing a comparison to plans available on the state exchanges, they found there would be a range of ~7% to an ~ 58% increase in premiums or an average of 35% increase in cost. The state also looked at the numbers of uninsured within the state.

“’The main driver of the premium increases is the Obamacare mandate that coverage be offered to everyone,’ said Kevin McCarty, Florida’s insurance commissioner. There are just short of a million enrollees in the individual market in Florida, while 3.8 million are uninsured. The state does not allow new entrants into a ‘high-risk pool,’ which provides coverage to the sick.” PPACA Premiums Florida is also the 4th highest with an uninsured population.

The large numbers of uninsured becoming insured and the large number of uninsured who will remain uninsured due to the failure to expand Medicaid to 138% FPL will feed into higher costs. Those who had been denied insurance previously will rely on the individual market and those who will be denied coverage due to a lack of expansion of Medicaid will continue to use the ER at a greater cost. This is something the state and insurance companies do not explain.

A key component of premium increase has been the politics of the Republicans within the nation to overturn the PPACA and to hand President Obama a political defeat. It is no secret the Republicans work solely against President Obama to defeat him regardless of cause or circumstance. To wit, for 20 years the nation has waited for a government or an industry solution to the rising cost of healthcare with neither offering up much except for more of the same. To add to this, there is little hope of a concerted effort by both parties jointly to reach a viable solution to rising healthcare costs.

Politics in the State of Florida differ little than what has been experienced nationally as the Republican State legislature and Governor had turned down the state exchanges long after SCOTUS ruled, have made it difficult to apply for the PPACA Healthcare Insurance by limiting assistance, and have stripped the Florida State insurance Commissioner of the ability to review and regulate healthcare insurance premiums. The last point prevents any state intervention in lowering or altering insurance rates.

“’since it became law in 2010, Florida had repeatedly refused — first challenging the constitutionality of the law, then waiting to see if a new president would offer a reprieve.

But with the law upheld by the Supreme Court and President Barack Obama back in office, the state was stuck. It had refused federal money to help with the transition. Now it was also running out of time.

A state Senate committee in 2013 said it sought a “rational, reasonable approach.” State law needed an update to match federal requirements of the Affordable Care Act. The committee sought to do as little as possible.

‘We want to make sure that we’re in compliance, that we’re doing what we’re required to do,’said Sen. David Simmons, R-Altamonte Springs, at a March committee meeting.

The Affordable Care Act assumed that states would continue to take a lead role in setting insurance rates, just as Florida had done in the past. It encouraged states to strengthen their rate-setting authority, offering millions of dollars in grant money to help. But it didn’t require that.

The Florida Office of Insurance Regulation faced a serious time-crunch to get up to speed on a host of new requirements under the law. Legislators offered a compromise. If the federal government wanted to impose new coverage requirements — well, it could set rates, too.

‘Since the federal government is requiring these additional coverage that will cost more,’said Sen. Joe Negron, Republican chair of the Affordable Care Act Committee, ‘then to me it makes sense for them to be responsible for approving rate increases that are certain to come.’

Democrats on the committee agreed with this approach at its final meeting on March 18.

‘I think we’re going to find it’s going to cost us a lot of money to set rates here in Florida,’ said Sen. Eleanor Sobel. ‘… I think we should rely on the federal government.’

She expressed confidence the federal government would have a “greater wealth of knowledge.”

‘If we have concerns about the rates that the feds do set, then we should work with them,’ she said.

One hitch she didn’t mention: the federal government didn’t give itself rate-making authority.

What resulted was Florida Senate Bill 1842, which among other things, suspended for two years the requirement that insurers get state approval for rates for new plans — such as those that will appear on new marketplaces. Companies would still have to file rate changes with the state. But they could act on those changes without approval.” Democrats say Florida stripped insurance commissioner of power to set health plan rates ‘”

Healthcare insurance companies now have a freehand in establishing pricing with no interference from the state insurance regulators leaving the constituency to bear whatever it deems reasonable. As the Federal Government can not intervene, the only impediment in the way of companies going hog-wild is the PPACA MLR which sets the percentage of premiums applied to healthcare costs at 80% for the individual market. When one takes the law passed to block regulators, the failure to pass the Medicaid expansion, and the past history of healthcare insurance in Florida; it is no surprise that Florida Healthcare Insurance premiums will be higher even with the PPACA in place. The state of Florida bears much of the responsibility for the increase in healthcare insurance premiums in the past and also after on the PPACA implementation.

Somewhere else I have read that the low turnout of voters has resulted in the Republican controlled government in Florida. I would guess Florida Republicans hope the constituency will blame the PPACA and Obama for the health care insurance premium increase they are faced with in 2014. The media and the Republicans have assigned blame to the PPACA as well as some bloggers who have not dug deeper into examining the reasons why the premium increases. The greater part of the premium increase can be assigned to the state’s practices in the past and even more so to the recent law giving insurance companies free rein.

References:

“Florida second most expensive state for health insurance” South Florida Business Journal, Brian Bandell

“Obamacare Premiums” CNN Money, Tami Luhby

“Democrats say Florida stripped insurance commissioner of power to set health plan rates” Politifact, Ted Deutch

“Obamacare facts separated from spin by Wendell Potter” The Center for Public Integrity, Bill Buzenberg

“Florida says health insurance prices will spike; feds disagree” Miami Hearld, Daniel Chang and Patricia Borns

“The Florida Health Care Landscape” Henry J. Kaiser Family Foundation, Rachel Arguello and Alexandra Gates

“Florida health insurance exchange” Health Insurance Org., Carla Anderson

“PPACA Cost Sharing and Maternity . . . “ Growing Family Benefits

“States Rejecting Medicaid Expansion Under the Affordable Care Act Are Costing Their Taxpayers Billions” The Commomwealth Fund; Bethanne Fox

“Employer Health Insurance Premiums Increased 50 Percent From 2003 to 2010; Employees’ Share of Premiums Increased 63 Percent” The Commonwealth Fund; Charts

“The Pricing of U.S. Hospital Services: Chaos Behind A Veil of Secrecy” Health Affairs; Uwe E. Reinhardt,

“The media and the Republicans have assigned blame to the PPACA as well as some bloggers who have not dug deeper in examining the reasons why the premium increases”

You are so much nicer than me.