How To Debate Paul Krugman

On Saturday Mish wrote a really awful article with those words in it’s title.

The article borrows these words and includes a quote from an even more awful article by Austrian school economist and author Detlev Schlichter. Part of that quote is presented here.

What makes him [PK] so annoying is his unquestioning, reflexive and almost childlike enthusiasm for state intervention, even in the face of its obvious failure, and his apparent unwillingness to probe any deeper into the real causes of our present economic problems or to show any willingness to investigate the effectiveness or ineffectiveness of his particular medicine.

I want to make something perfectly clear before we go any further. It is fine to disagree with Krugman, or me, or the Pope, or anyone else, as long as you bring facts, data, and some basic skill in rational discourse. What is not fine is misrepresenting someone’s position and then holding the misrepresentation up to ridicule. That is both vile and stupid.

Back to the quote: does that sound anything like the Paul Krugman who puts his ideas out there for the world to see on a daily basis? What I see in Krugman is thoughtful analysis, and deep probing into both the causes of our problems and the consequences of economic policy decisions. You don’t have to agree with his assesments, but you cannot validly deny that he is making them.

When the opportunities smack me in the face like this, I put on my Krugman Truth Squad hat. Schlichter offers us a standard issue stale Austrian anti-Krugman diatribe. You have to wonder if he has ever bothered to read anything that Krugman has written. His wordy, repetitive, rambling, semi-coherent, desperate-sounding article – which I cannot recommend highly enough – is an impressive exercise in partial-truths, distortions, make believe, and straw man stuffing. He then hints that we should go back to the gold standard and totally unfettered free markets.

Schlichter lists Krugman’s alleged assumptions, condensed here:

1) Recessions, depressions and crises are the result of the unhampered market.

2) The Great Depression was caused by uncontrolled markets.

3) Recessions, depressions and crises are practically the result of one problem: a lack of aggregate demand. . . . It is the role of government to get people spending again. This is done by printing money and causing inflation so that people spend.

4) The Great Depression was solved by the government spending lots of money and the central bank printing lots of money.

Let’s pause here for a moment and set aside the redundancy. I’m not sure points 1 and 2 represent PK’s view with any degree of accuracy. Certainly they are gross oversimplifications and neglect other factors. But if they are true, then point 3 can’t be. Let’s set that aside, as well. Points 3 and 4 are reasonably close to the truth, though if you read the original, point 3 runs off the rails as it continues.

From there it only gets worse.

5) This explains ALL economic problems.

So, according to Schlechter, Keynes taught, Krugman believes – and would have us believe – that loose money policies and causing inflation are the right policy measures not only for recessions, but for boom times, and periods of inflation, hyper-inflation, stag-flation, or any other problem you can think of. Even I know enough about Keynes to call that out as false.

The redundency continues to pile up. I’ll extract one more point. [#’s 6,7, and 8 are repetitions of #4 with various degrees of elaboration and snark.]

7) If after many rounds of money printing and deficit spending, there is still a recession, then only one conclusion is permissible: There was obviously not enough money printing and deficit spending. We need more of it.

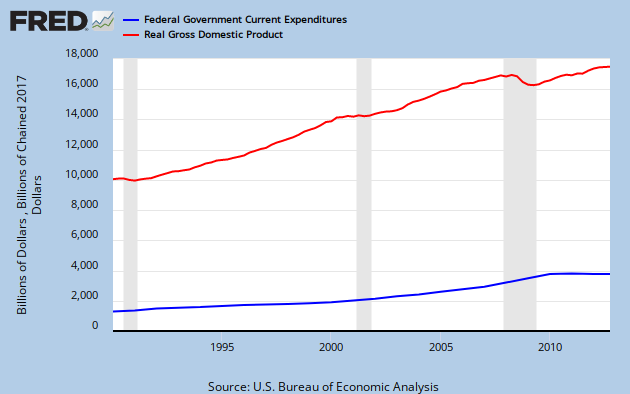

I don’t claim to know everything, but I’m not aware of any situation in recent history that has played out like this, so it looks like a Schlichterian fantasy. In the post WW II era, the combination of loose money and fiscal expansion has generally kept recessions rather short, leading to V-shaped recoveries, and putting the brakes on too quickly has occasionally led to a double dip. England has recently experienced an austerity-induced double dip recession. In the current U. S. doldrums, Krugman tells us fiscal frugality has led to a slow and limping recovery. This is credible since spending is flat and GDP growth is anemic. [Graph 1]

Has any modern major economy had a recession persist after “many rounds of money printing and deficit spending”? Even in the Great Depression things turned around pretty quickly once New Deal policies were implemented. But, as PK also tells us, recessions brought on by a financial crisis are different from the typical post WW II recession.

Schlichter doesn’t let up. Though this statement [emphasis added], “Krugman is the one who should be made to explain his policy recommendations and who has to answer the criticism that policies like the ones he is recommending got us into this mess in the first place and that his policy ideas have been implemented for years to no effect, at least no positive effect.” is hard to beat for sheer negation of reality [and for channeling Ron Paul], the real capper is this: “Krugman is practicing Keynesianism as a religion.”

It is because of statements like this that I lose patience with people who use words like “disingenuous.” You can supply your own alternative vocabulary Check Krugman’s Op-Eds and blog posts, where he repeatedly demonstrates reality with graphs and tables, shows how austerity is failing right now with real-world examples, and admits it when he gets something wrong. When is the last time you saw a Krugman-hater do that?

Mish, to his eternal discredit, says of this nonsense: ” Moreover, it appears to be 100% accurate.”

This is genuinely awesome. That an economist can be so thoroughly wrong – wrong in general and wrong in every particular – about what Keynesianism is and does, leaves me speechless, and that’s saying something.

OK – almost speechless. Any child can see that the earth is flat and the sun revolves around it. So let’s forget the trivially unimportant technical details and ask simple-minded, allegedly probing questions that in this case are totally unrelated not only to the policies Keynes and Krugman propose, but to anything else in the real world, and then point and stare when these questions cannot be answered – by anyone, while your minions nod approvingly.

But would it work? Mish concludes this way:

Krugman would respond with incomprehensible gibberish “for wonks only” as well as typical Keynesian nonsense about how paying people to dig holes and other people to fill them up would start a chain reaction of growth.

A child would see the answer was preposterous, but not a trained economist, politician, or brainwashed academic. Paul Krugman, keynesian economists in general, politicians wanting a free lunch, and most academics are all incurable.

Nonetheless, Hans Hermann-Hoppe’s answer is indeed the correct one. By asking questions a child will understand, some non-brainwashed people will see Keynesian and Monetary stimulus for what they really are: economic stupidity.

In a follow up article [with a 5 point list that includes 2 naked assertion and 3 irrelevancies {seriously – Zimbabwe?!?}] Mish makes it clear that in his view monetary and fiscal stimulus are BOTH stupid. So, at this point it looks as if he – with his straw man army and blatant intellectual nihilism – and I have devolved into a schoolyard game of calling each other stupid.

But I’m quite sure Mish is not stupid, and I’m fairly certain I’m not either. The real questions are these: who is paying attention to reality, whose policies make things better or worse in a given situation [absolutism, anyone?] and whose concepts have had some predictive power over the last several years. [Here’s a hint: it’s not the Austerians.]

So, maybe a better way to phrase it is, “Who is practicing their economics as a religion?”

Wow. What Mish mosh.

C’mon. This guy’s concluded that the way to gain real attention is to deconstruct Paul Krugman’s positions by … baldly misrepresenting them. That’s delicately called erecting a straw man and less delicately called fabrication.

Funny, but I–I, of all people; I don’t even speak economics-ese–recall a couple of Krugman columns from circa 2010 saying that he’s not sure quantitative easing will work, but that he thought it was worth a try.

Does this guy understand Keynesian economics even as well as I do? (It’s not hard to beat me on knowledge of economics; trust me.) He seems not only to not understand what Krugman’s saying, but also to not really understand what Keynes was saying about fiscal policy.

I always like to know the education and training of those who represent themselves to the public as an expert in some area of study/research. Mish seems to have made an effort to hide his personal biographical information. I searched for a while and could only find the same reference to his primary job with a capital management firm and that he writes a lot of articles having to do with the economy and/or investing. What is the basis of Mish’s expertise? Is he little more than an arm chair quarter back with lots of opinions, but no actual knowledge? Is he the male counter part to Megan McCardle? A clever talker with no real substance? Inquiring minds need to know.

JzB, sounds like you stepped in a pile of crap, & you’re trying to clean it off on us…

i see every post Mish puts up via the economics roundtable feed, and i know enough to ignore those with that kind of headline…seems there is regular cottage industry built around attacking krugman; while some, like stephen williamson, are economists, a lot are investment advisors like MIsh, with a bias towards hard money…ran into another just this afternoon, who says Paul Krugman May Be the World’s Last Flat Earth Economist

Mish is pretty good on markets, but when it comes to econ and politics as related to econ, he’s squarely in the Ron Paul camp.

I never thought to try to seek out his credentials – but, I have to admit – I have none, myself.

I have been called – and rightly so – an economic ignoramus. I try to use logic and data to reach reasonable conclusions, and hang theory. Which is why I always end up on the opposite side from Austrians.

The irony of Schlichter’s comments re: PK and religion is oh, so crunchy and delicious.

Cheers!

JzB

rjs –

I checked your Money Morning link, but couldn’t force myself to read the entire article. What caught my eye was the banner at the top.

How to Survive Four More Years of Obama He increased our national debt by 54% in his first term…

Which is true – BECAUSE TAX REVENUES ARE DOWN. These people are so obtuse.

Here’s a graph, indexed to 100 on 1/1/09 for Fed Debt, Rcpts and Expenditures.

http://research.stlouisfed.org/fredgraph.png?g=fag

JzB

yeah, JzB, i didnt get much past the header either…

debt, of course, is an unfortunately chosen word for the difference between government spending and revenues, which is more akin to creation of the money needed for the economy to operate…it isnt like anything that anyone expects will ever be extinguished…

rjs

i have to say i don’t know much “economics” either. just what i read in the papers, which is nonsense, and what i read in college, which was nonsense.

but i think we still favor an ownership trail for keeping ourselves, if not the economy, sane. and while the government may “create money,” it does so by lending it to people who, arguably, have some probability of creating “value” with it, so that the supply of money will not exceed the supply of goods and services (“work”).

i don’t know how well this works out in practice, but it still isn’t some arbitrary “creation of money” to pay the country’s bills, which, i think, is one of the many primrose paths to bad times ahead.

i think it is established that “extinguishing the debt” is bad economics. for the same reason businesses don’t extinguish their debt… borrowing money allows you to invest… that is demand the production of capital goods. this is true for government as well as for industry.

only the crazies are out there yelling we are all going to die because of the debt. but that doesn’t mean we shouldn’t be careful how we spend our money.

just to distinguish between the two “debts”. coberly; a debt for you or me is something we owe, something the lender expects we will pay back in full, with interest; debt for the US is issued in the form of a note, bill, or bond, which is held and used by sovereign funds and international banks as money in the same manner that you would hold & spend a ten dollar bill in your wallet..

“I never thought to try to seek out his credentials – but, I have to admit – I have none, myself.” JzB

But then you don’t hold yourself out as an expert who is qualified to offer opinions regarding”Global Economic Trend Analysis” which one can only hope are based upon some degree of valid research. The articles appearing on Mish’s web site don’t seem to meet that level of confidence for the reader. So the basis for his prognostications is a lot more critical then would be yours, mine or the kitchen sink’s.

rjs

i think i understand that. in all those cases the “lender” expects to get his “money” back.

that is I can trade the bill in for goods or services (or taxes)… just as i “lent” my labor in return for the bill.

those other forms of debt pay interest and require a bit more effort to collect. but what matters from the point of view of my comment is that in no case are they simply “printed”.

(well, maybe not quite in no case, but in principle they function by keeping an “account” of value.”)

that is part of the point i was making, dale; those holders of US Treasurys do not expect to “get their money back” because US Treasuries are de facto money in and of themselves…china’s sovereign wealth fund, for instance, is holding a bundle of treasuries; they certainly wouldnt have any reason to exchange them for greenbacks or any other form of money; US Treasuries are the form of money they have chosen to hold…if they want to buy anything anywhere in the world, they use our Treasurys as money… our “debt”, by virtue of our reserve currency status, has become the world’s “money”…

And I always thought Mish was just another gold bugger.

Do you think your complete refutation will cause anyone to re-think their ideas and stances? If someone believes the Austrian/Austerian school it is because they want to, not because of overwhelming evidence. If they didn’t want to see evidence to start, why would evidence change their mind?

Great job showing how they’re wrong.

Having read Mish’s failing to understand bank creation of money, complete with silly examples – I’m not so sure he isn’t stupid. Guy simply has no understanding of money.

http://globaleconomicanalysis.blogspot.com/2009/10/fractional-reserve-lending-constitutes.html

You didn’t even quote the worst part! Mish says the key quote in the video is “Explain to me how increases in paper pieces can possibly make a society richer. If that were the case, explain to me why is there still poverty in the world.”

Is it really possible that they cannot understand the difference between growth and the allocation of the benefits of growth? Is that really possible? I mean, really?

I’m sorry, but at some point, we have to examine the possibility that this is more than ideology, more than cognitive bias. I’m extremely doubtful we can ever have a completely coherent semantic agreement on the word ‘stupid,’ but at the extremes, with multiple egregious errors of thought, we must be able to apply the label without question. And this is one of those extremes.

It’s important to remember that

“Investment advisors” like Mish are in

the business of talking suckers out of

their money. They really don’t know (or

care) anything about about economics.

What they do know is that the way into

the sucker’s wallet is to flatter his

“common sense” assumptions about

economics and tell him that he is much

more clever than those fancy

intellectuals.

rjs

we are using words a little differently. by “get their money back” i mean that at some point they will trade the paper for something they want… even if it is just other paper… that they can trade for something they want.

Mister Jones

thank you. I have been saying that for years. But I have to warn you, when you say “stupid” it drives stupid people crazy, and it also turns off the sensitive who think you should talk nice… even to rapists and murderers.

me, i don’t mind so much. but i am always a little shocked to learn how i sound to others.

haymarket

exactly.

>> those words in it’s title

please see if you can asap fix that wrong ‘ it’s ‘ and make it ‘its’ … you know, just so you don’t appear careless, or worse.

There is a cottage industry of folks like Mish attacking Krugman. Its founding member is Donald Luskin – someone Brad DeLong dubbed the stupidest man alive. I think Mish is campaigning to trump Luskin in this regard.

I had thought Mish’s article was actually parodying Schlichter (whenever someone starts bringing “even a child can see” type arguments into discussions, I always think of Jonathan Krohn, and wonder how he got so stupid once he became an adult). I read through some of the rest of his blog and realized, no, he was being serious. And I ended up wondering who, exactly, would trust their money to him, as his alleged profession is investment advisor.

Hans Hermann-Hoppe openly combines childish debate tactics with a straw-man argument wrapped in a package of argument from incredulity (where if a phenomenon is complex and cannot be readily grasped in the mind of the person making an argument, the phenomenon is automatically dismissed).

I heard a really good term for the kind of debate that he’s proposing. It’s called Gish Gallop. http://www.urbandictionary.com/define.php?term=Gish%20Gallop

Hans-Hermann Hoppe is a real nut case. Naked Capitalism ran a whole series making fun of his ideas:

http://www.nakedcapitalism.com/2011/11/journey-into-a-libertarian-future-part-i-%E2%80%93the-vision.html

moran

stick around. you’ll see worse.

or you could forget you are in the eighth grade and realize that perfectly intelligent people make typo’s or even real spelling mistakes.

note the apostrophe in typo’s. i think it’s “wrong,” but it’s what i am used to seeing, and suspect it actually makes better sense if you are trying to communicate with people.

We shouldn’t let grammar get in the way of communication…unless that is your purpose.

When two people are arguing and one is arguing based on knowledge and the other based on ignorance, the one who is arguing based on ignorance will always win, because knowledge is limited whereas ignorance is limitless.

And it’s truly a shame that Lord Keynes is no longer with us, so that Professor Krugman could do a version of this:

https://www.youtube.com/watch?v=OpIYz8tfGjY

“His wordy, repetitive, rambling, semi-coherent, desperate-sounding article – which I cannot recommend highly enough – is an impressive exercise in partial-truths, distortions, make believe, and straw man stuffing.”

That’s unfair. It’s a little more than that:

“If the viewers really want to understand what is going on, they should not buy Krugman’s new book (…) start by reading Paper Money Collapse [by… Detlev C. Schlichter!].“

You’ve gotta love it!

FYI: Krugman on this post: “Despicable Me”

“What is not fine is misrepresenting someone’s position and then holding the misrepresentation up to ridicule.”

Wow! That sounds just like “one of the best known fallacies in economics,” “an idea economists view with contempt.” and that “first year students are taught to refute.”

In other words, the rhetorical smear tactic that Mish, Schlichter and Herman-Hoppe employ is endemic to mainstream economic discourse, enshrined in textbooks and has even been recited faithfully by Professor Krugman himself.

I love, love, love a good debate. But when you make the debate more about insulting the counter party, your point ends up taking a back seat.

What a handful of academics and wing-nuts are trying to say is that “we need to reduce the debt, we need to curb spending, we need to take Old Yeller out back and shoot him in the head before he infects everyone with rabies.”

From my point of view (as a senior analyst in the beautiful world of finance here in NYC), I see a great amount of this back and forth infighting due to the fact that a good handful of “debaters” are thoroughly il-informed, or do not understand the differences between government finances and a private household.

Now back to my point about the academics and professionals throwing knives at one another; there is a time and a place for each school of thought, and based on the liquidity trap that we are currently in, a Keynesian (spend money to make money) approach is necessary. What people don’t understand is that stimulating an economy and setting off modest inflation does two things a)bank deposits earn interest and b)debt to income ratios move downward base on the new found currency strength. There are a few negatives, but domestically the positives outweigh the negatives.

Hitting the brakes at this point would be like running your SUV into a tree with no seat belt on at 40 mph; survivable but that windshield is going to leave a bruise.

His argument about Krugman is pretty stupid, but your last link about predictions is a non-sequitur. Murphy did indeed lose a bet. Who did he lose a bet to? David Henderson, who advocates “austerity” even if he himself is not an Austrian. “Mish” Shedlock does identify as an Austrian (as well as a libertarian, I think) and in contrast to Murphy was expecting deflation rather than inflation.

I don’t even think Hoppe has a degree in economics. He has a phD in philosophy, taught by Habermas. Hence why he goes on about discourse.

yves smith also comments on Hoppe in reference to this article:

OMG, Mish was crazy enough to cite Hans Hermann-Hoppe??? Yes I know Mish is a libertarian but even by libertarian standards, Hermann-Hoppe is an incoherent nutcase (or maybe not, he takes libertarianism to its logical conclusions, which are extreme and brutal). We published a series by Andrew Dittmer with Hermann-Hoppe as the centerpiece: see Part I, Part II, Part III, Part IV, Part V, Part VI and a response to reader comments. He’s just set the cause of legitimate criticism of Krugman back about 5 years

Mike Shedlock’s background

http://www.peakprosperity.com/blog/straight-talk-mike-shedlock-aka-mish/46892

Isn’t there a bit of cognitive dissonance in hating “Keynesians” and liking Steve Keen?

“I’m not sure points 1 and 2 represent PK’s view with any degree of accuracy.”

I’m not sure you aren’t completely unqualified to make such an assessment. (Does that sentence make any more sense than yours). Who cares about what you are not sure of?

I am sure that you were unable to process Mish’s article. You mistook something written by someone else for his own text. So I doubt you can read Krugman accurately.

“Certainly they are gross oversimplifications and neglect other factors.”

No that is Krugman’s position.

“But if they are true, then point 3can’t be.”

Bad deduction because it is not true. The free market according to Keynesians not only can but does produce inadequate aggregate demand. This is the method by which 1) and 2) happen.

Brian

If you’re new to a party and your first act is to fling crap around at others you would do well to precede such behavior with some evidence of your own ability to analyse the subject matter in a better way. Try to keep the critiques on an evidentiary level which would give some basis for determining why your input is any more pertinent than the other. As it reades your comment seems little more than a petulant child’s complaint.

My “crap” was mere fact. It is not my fault that most here including the blog owner are ignorant. There is nothing wrong with being ignorant but when you pretend to knowledge you don’t have it becomes a problem.

Keynes actual position was that interest rates should be driven to zero not only during busts but also during booms. That was his monetary policy which is distinct from his fiscal policy (aka make work programs by the government).

He states this opinion on interest rates on page pages 220, 221, and 376 of General Theory. Pull up your copy.

I’m sure you will concede that his position is to lower interest rates during busts. What you are ignorant of is that he calls for it during busts too.

“The remedy for the boom is not a higher rate of interest but a lower rate of interest For that may enable the boom to last. The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us in permanently in semi-slump; but in abolishing slumps and thus keeping us permanently in semi-boom” – Keynes, General Theory, page 322.

This is precisely Krugman’s position. He has argued against the inerest rate hikes that have popped several bubbles. In particular he feels the Fed should have lowered interest rates at the end of the roaring twenties, a period of artificially low inerest rates that caused a boom.

Keynes was a crackpot who argued for having the government burying money in bottles to provide gainful employment for people who dig them up. He was not kidding either.

When one understands what capital is, and it is NOT currency (a medium of exchange) then it is apparent that printing money to keep interest rate perpetually at zero, is ridiculous.

Oh, and “jack” you are a total hypocrite. Your first instinct being the ad hominem attack of your opponent’s credentials. You did this to both Mish and now me. How about you live up to your own standards and at least use your real name before spouting your opinions.

Me, I don’t care about credentials. You can either support your argument or not. If you have to appeal to authority then you aren’t qualified to speak on a subject.

Mike Smith,

The “liquidity trap” is a Keynesian myth that arises from their own faulty theory. It is falsified by the crash of 1920. according to theory the actions of that administration should not have ended that liquidity trap. It ended in18 months , via cuts to government spending, and letting banks fail. Wages adjusted despite claims by Keynesians that wages are downward sticky. What cause the Great depression to last so very long was in fact the stupid fiscal and economic policies of Hoover and FDR. Price controls, make work programs, arbitrary rule changes, and so forth. FDR was Hoover on steroids but followed pretty much the same policies. Hoover had abandoned the prior policies of austerity and had public works projects up and running within months of the crash.

How exactly can you justify FDR’s policy of keeping farm prices high by destroying crops and livestock while people are on lines at soup kitchens?

“Having read Mish’s failing to understand bank creation of money, complete with silly examples – I’m not so sure he isn’t stupid. Guy simply has no understanding of money.”

You pointed to an article that is discussing a fraction reserve monetary system accurately. It is fraudulent, and even it the participants are aware of the terms and agree to them.

As an example of this fact. A pyramid scheme is fraudulent even when the participants are aware of the terms. It is simply a scheme to enrich early joiners.

Mish is acutely aware that we do not currently have the old style fractional reserve system. He wasn’t debating modern fiat-fractional reserve hybrid systems.

You are aware that these systems have evolved over time right? That some libertarians have argued for a free banking system? That such a system is fraction reserve on top of a commodity backed currency? That Mish was arguing that it would NOT behave as those libertarians claimed?

The business cycle is inherent to fraction reserve banking regardless of what you slap on to it. That was what that article was about.

Of course, since you are entirely ignorant of the field and the subject matter that makes him stupid?

Mister Anonomous Jones,

“Is it really possible that they cannot understand the difference between growth and the allocation of the benefits of growth? Is that really possible? I mean, really?”

Holy cow that is one ignorant statement. I wouldn’t know where to begin to educate you. How about you actually pick up a book written by your opponents before you speak?

Not only do they know the difference but they could school you for days on that subject and many others. That you think printing money, the equivalent of counterfeiting, generates growth is what is laughable. Why don’t we just let everyone print their own money during downturns, at least that way all the benefit of the new money doesn’t go to bankers and political insiders ( the rich). They don’t deserve the money any more than the average Joe on the street.

Jim Caserta,

“Do you think your complete refutation will cause anyone to re-think their ideas and stances? If someone believes the Austrian/Austerian school it is because they want to, not because of overwhelming evidence. If they didn’t want to see evidence to start, why would evidence change their mind?”

This article have about zero to do with refuting Austiran Economics, but you wouldn’t know that because you are another ignorant commenter here. Ironically it is the complete opposite. Keysian prediction has been consistently wrong, and anti-empirical. For example their theories were refuted by stagflation. Printing money, according to their theory, leads to full employment. Austrian economics not only is consistent with reality here but predicts it. Keynes was refuted by evidence before he even put pen to paper. Instead of addressing the facts of the 1920 depression they ignore it. Fact is that the exact opposite of Keynsian prescriptions were followed and the exact opposite of predicted outcome occured.

Funny you talking about a refusal to fit theory to evidence when you are unfamiliar with either.

If Keyneisans are swayed by evidence why haven’t they rejected their theories which were once again falsified by the current recessions jobs numbers. There is no question that there was unprecidented attempts at monetary stimulus, and jobs were far worse that their predictions with NO stimulus.

Austians claim that you can make the kinds of predictions that Keyneisans and Monetarists claim are possible. Ever failure to predict, like the absolute failure of Keynesians to predict that, let alone when this economic crisis would happen is an astonishing refutation of Keynesianism.

That sentence was supposed to be, “Austrians claim that you cannot make the kinds of predictions that Keynesians and Monetarists claim are possible.”

Aw, this was a very nice post. In concept I wish to put in writing like this additionally – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and under no circumstances seem to get something done.