U.S. Versus Europe: Who’s Winning Now?

Now that the OECD has updated their GDP data for 2010, I thought I should revisit the question I asked a few years ago:

Who’s growing faster? The U.S. or Europe?

The answer’s the same as it was then: it’s a dead heat.

As I pointed out in that previous post, people love to cherry-pick periods and show how the US has grown so much faster than Europe. (Funny how liberals don’t seem to play this particular game, while conservatives do, quite constantly — usually while going all gooey about people named Reagan and Thatcher.)

The problem is, what they’re saying isn’t true.

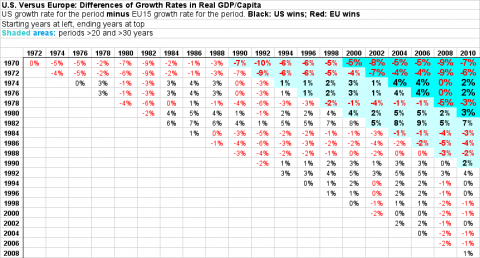

Being a curiously curious cat, with an apparently blithe disregard for my own mortality, I went out and looked at the changes in real (inflation-adjusted) GDP per capita over the last forty years. Which I share with you here. Feel free to cherry-pick at will.

(Click for larger.)

Example, for the upper-right cell:

| Starting Year | 1970 |

| Ending Year | 2010 |

| EU Starting GDP | $14,462 |

| EU Ending GDP | $30,590 |

| US Starting GDP | $20,544 |

| US Ending GDP | $41,976 |

| EU Change | $16,128 |

| US Change | $21,432 |

| EU Change % | 112% |

| US Change % | 104% |

| Change difference subtractive | -7% |

| Change difference percent | -6% |

In the 40 years between 1970 and 2010, real GDP per capita grew by 112% in the EU15, and 104% in the U.S., for a difference of 8%. (Rounding results in 7% showing here; I chose not the display the extra digit everywhere because it makes the table hard to scan easily.)

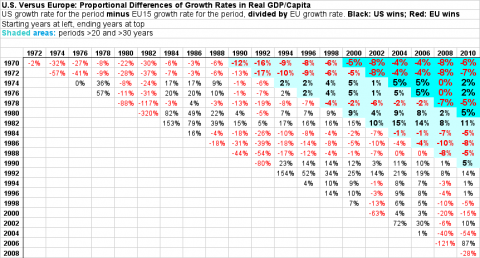

It’s also easy to show how much growth rates varied proportionally to each other, by percent (the difference between the US and the EU growth rates, divided by the EU growth rate; that’s “Change difference percent” in the last row above).

This is a useful comparative, but it can result in showing big (and rhetorically spurious) swings for short periods, swings that smooth out as soon as you look at periods longer than even six or eight years. Scan along the bottom diagonal horizon and you’ll find no shortage of wonderful cherry-pickable moments. Have at it.

But if you’re actually curious about how our different economic models play out over decades — which is what we do or at least should care about — look to the upper right. I’ve highlighted periods greater than twenty and greater than thirty years for your viewing pleasure.

If you can see any kind of long-term pattern anywhere, I’d be delighted to have it pointed it out to me. The average for those upper-right, dark blue cells is -2.6%, meaning that over the long run, U.S. growth shows as 97.4% of the EU15′s — well within the statistical noise.

Also note that the new data for this post — the right column, for 2010 — seems just as random as all the rest. (Though the two bottom cells do provide some juicy numbers, which I’m sure commenters can spin out into an endless and truly fruitless and specious series of arguments. You go girls.)

Speaking of statistical noise, even though this is about the best national-level data we’ve got (we have to use some data to make our judgments), there’s inevitably some messiness in here. So for the curious and/or skeptical, here are the details.

The data is from stats.oecd.org. The OECD — a think-tank cum rich-country club – assembles this data from individual countries’ national accounts. (They just updated US 2010 GDP in March.) They also compile it to some extent, and apply various conversions using best practices. Viz:

For comparison to the U.S., I used the OECD’s compiled data for the 15-country European Union (Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden and the United Kingdom). In my previous post I used a simple average of GDP/capita for non-English-speaking Western European countries (excluding Luxembourg and Norway, for instance, because of size, banking, and oil). I think that selection provided a better representative comparison group, but the OECD does a better job of agglomerating the data than I could do. I’ll just say that judging from my non-systematic journeys through the data over the years, changing country choices doesn’t change the top-line results much at all. Please feel free to prove me wrong.

I chose GDP/Capita as a measure because it’s a pretty good big-picture yardstick of prosperity, and removes one key confuting variable from the comparison: population growth over the decades. GDP has lots of things wrong with it (it only counts remunerated work, for instance, which gives the U.S. a notable advantage in the comparison, because Europeans have more free time for productive but unremunerated “home work”), but it’s hard to name a better big-picture measure for which we have consistently compiled data for lots of countries, going back four decades.

All the foreign numbers are converted to US dollars based on “purchasing power parity.” This adjusts for different purchasing power in different countries, in an effort to impart people’s relative buying power in those countries. It’s not a perfect method, by any means. But just using market exchange rates isn’t either. Since I’m curious about standards of living in the two areas, PPPs made more sense than exchange rates.

Adjusting for inflation — especially in different countries — is also an imperfect science. Many European countries, for instance, don’t use “hedonic adjustment” to correct for massively increasing computer value per euro or dollar. (This makes those countries’ growth rates look worse.) The U.S. and several other European countries do. I’m not a ShadowStats fan (CPI tracks too closely with the Billion Price Index, for instance, to give much credit to their rather wild claims), but I do realize that adjusting for inflation requires holding up your thumb and squinting some. Again, though, if we want to compare countries’ prosperity over decades, we need to talk about real buying power as opposed to nominal units of currency.

Those were my choices. If you think there are better ones, and that they would change these results significantly, please go do it yourself and report back. I’m wildly curious. Here’s my spreadsheet. I’m happy to help anyone figure out how to use it (the Data Tables are especially neat), and also how to navigate the OECD’s stats.

I should end by pointing out the fact that commenters will undoubtedly raise: the EU remains way behind the U.S. in (at least) this measure of prosperity. Europeans buy 20-30% less stuff per person than Americans. After catching up fast (and predictably) in the decades following WWII, they’ve been stuck at about the same level (relative to us) for forty years. Standard economic convergence theory suggests that they should have continued that catch-up. But that’s a topic for another post.

Cross-posted at Asymptosis.

Hi Steve nice post. I must disagree with your characterization of liberals vs conservatives a little. I’m a liberal and have no problem saying the US is doing better-and yes growing faster-at least right now. Maybe the reason you don’t like to say the US is doing better is you’re one of those people who dislike competition in gerneral. So maybe you object to any question of “who’s doing better” or “who won?”, etc.

However it’s nothing to do with Reagan-Thatcher. Indeed, the UK right now is in sorry shape. I don’t know that the US has been better every year since 1970 but it clearly is in better shape than the EU and UK right now. I don’t see how you can deny this, the US is growing and adding jobs. Yes right now it seems it may be slowing a bit but this is how it seemed around this time the last two years as well. We start fast and then things seem to be stalling a little but by the end of the year we don’t look so bad.

On the other hand the EU/UK are shrinking. I will also point out that while I’m only saying the US is growing faster right now and not making a categorical statement about the last 40 years, the fact is that France in paricular does seemed to have slowed down over the last 20 years or so. Most worrisome is it’s chronically high unemployment. No doubt the GOP would love to blame this on its generous welfare state and Unemployment Insurance. I don’t buy this but whatever the reason it is a concern.

The reason we are doing better than Europe right now is not Reagan but austerity-namely our lack of it. We have had some austerity but mostly only at the state level. If it weren’t for the state level job losses we’d be if not all the way back probably pretty close. So we’ve sort of had austerity lite.

The reason we haven’t had full austerity is-despite what all the Obama haters tell us- largely Obama. Although everyone thought he drunk the austerity Koolaid last summer, as it is said “by their frutis you will know them”

The fruits we have seen is not so much austerity. What’s more the political groundswell for austerity is clealry gone now. No one talks about it like they did last Summer.

So yes, Obama does play a pretty good game of eleven dimensional chess. For more on this I reccomend David Corn’s recent book.

Put it this way, with a Republican in the WH we would have had full bore austerity

Mike, I tend to agree with you, but any support we might seem to find in the data here is statistically utterly spurious.

This data lets us look at one consistent and reasonably representative measure of *long-term* prosperity and feel some confidence in conclusions we might draw from it — notably that the European system is not “sclerotic” compared to the US, as many might suggest.

All I mean is that right now the US is growing faster-again the EU has negative GDP we have 2% or whatever. So right now we are growing faster-no?

From 1970-present, and especially after 1980, both Ireland and UK are far more similar to the U.S. than the EU in terms of economic policy. Not surprisingly both countries grew faster and converged towards U.S. levels of GDP per capita.

Does the inclusion of these nations plump up the EU-15 growth from 1970 onward? It certainly does from 1980 onward, but Britain was a mess during the 1970’s (reputationally it was the “sick man of Europe”).

Mike Sax: “EU has negative GDP we have 2% or whatever. So right now we are growing faster-no?”

Really? UK’s in recession but I don’t think the EU is. As usualy, which period are you looking at? Latest quarter reported?

TheNumeraire: “Does the inclusion of these nations plump up the EU-15 growth from 1970 onward? “

I assume it would, but I don’t know the numbers offhand, and it would depend on which period(s) you looked at. Which is why I like the presentation above; you can scan various periods and draw judgments.

I was really trying to compare very *different* systems, not different geographic locations.

So, if neither is running away with the prize based on GDP growth/capita with either system then the question becomes: What does matter? This leads to my unanswered questions

1: why do we have an economy?

2. What do we want our economy to do?

I wasn’t arguing that Ireland and UK are distinct from the EU due to geography, rather because those two countries have paralleled US economic policy more than EU policy over the measured period.

Dan Becker:

Exactly right. There are huge wins from the European system. But it doesn’t cost growth. (Though it *might* cost level; not clear why they haven’t caught up in this measure.) So…

You can argue short-term wiggle-waggle but Steve’s talking long-term trends. And the long-term trends are… interesting, and not showing what the doomsayers about Europe are always saying about Europe (slow growth yada yada) though also not doing what many people thought would be happening in an era of globalization (i.e., converging on an absolute scale towards the USA). The question is whether this failure to converge is a deliberate choice on the part of Europeans to consume less, or a sign of economies inherently not as strong as the US economy. Something to think about… e.g., we already know Europeans consume less gasoline and other transportation fuels per capita because they have decided to invest in mass transit and add disincentives in the form of much higher fuel taxes than in the US. Do other parts of their economy have deliberate consumption disincentives of that type? Is that good, or bad? Hrm.

You can argue short-term wiggle-waggle but Steve’s talking long-term trends. And the long-term trends are… interesting, and not showing what the doomsayers about Europe are always saying about Europe (slow growth yada yada) though also not doing what many people thought would be happening in an era of globalization (i.e., converging on an absolute scale towards the USA). The question is whether this failure to converge is a deliberate choice on the part of Europeans to consume less, or a sign of economies inherently not as strong as the US economy. Something to think about… e.g., we already know Europeans consume less gasoline and other transportation fuels per capita because they have decided to invest in mass transit and add disincentives in the form of much higher fuel taxes than in the US. Do other parts of their economy have deliberate consumption disincentives of that type? Is that good, or bad? Hrm.

If we had a Republican in the White House we would probably have had another tax cut on the aristocrats and a war with Iran or something else worthless, but with a price tag in the trillions. Republicans ALWAYS increase the deficit, but find it important never to have anything worthwhile to show for the spending. (Granted, this is only refers to post-Eisenhower Republicans, but Ike has been out of office for years.)

GDP is a terrible measure of national economic fitness. It is easy to crank up the GDP while only a small fraction of a percent of the population notices any gains. (For example, you could create and promote a sector that produces high priced intangibles e.g. performance art or financial products.) It makes more sense to track median family or median individual earnings over the period. In the US, these have been flat for over 30 years. It also makes sense to adjust for the full lifetime cost of living. For example, health care is much cheaper outside the US. So is higher education. Some countries subsidize raising children in general. Some provide generous retirement benefits. Obviously, the cost of living and value of wages have to be adjustd to take this in to account for comparison purposes. My guess is that the Europeans have been doing better than we have in the US. with our flat incomes, rising retirement, medical, education, job insurance and other such costs.

I’m not trying to advance this view, but I will point out that if you wanted to make this argument you could: The EU’s economy gives worse growth results than the US. This is balanced by the fact that they have reached a stable equilibrium at a lower level than the US GDP/capita where the implied catch up growth factor is balanced by their lower organic growth factor to equal US growth. If we assume that the catch up growth factor is roughly increasing with increasing difference in level, this system has negative feedback and could easily be stable (and it looks stable based on the data over time). On the one hand, this could be an acceptable bargain for the EU. On the other, in this story, they would be dependent on the US’ dynamic economy for the level of growth they are experiencing.