This Time Is Different: Federal Debt Didn’t Dive Before the Depression

Randall Wray made a fascinating observation a while back:

Since 1776 there have been six periods of substantial budget surpluses and significant reduction of the debt. … The United States has also experienced six periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929.

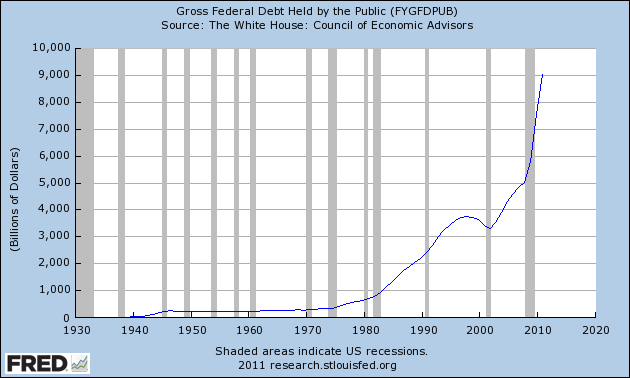

And I confirmed it (graphs):

Every depression in U.S. history was preceded by a big drop in nominal Federal debt.

Except this one. (Assuming that it would have been a depression absent herculean efforts by the Fed et al.)

There was that dip in the 90s, but if we want to posit that, based on history, it was an at-least-necessary cause of the crash, we have to ask: why, in this case, did it take almost a decade to have its effect?

A lot of things have changed since 1929.

I think there might be a story about private debt carrying the economy for years after government debt got pulled, so we didn’t experience the effect right away.

But I’d love to hear other and better-articulated stories to explain what strikes me as a pretty big anomaly.

This brief conversation might provide a springboard:

rjs: as i’ve understood it, when it became clear to george bush that if clinton surpluses continued & our debt was paid down, the financial system would soon experience a dearth of safe assets & would freeze up; so his adminstrations tax cuts were initiated in order to keep levels of AAA assets high enough for the markets to operate…

David Beckworth: I remember some commentators making that point back in the early 2000s. It would have been interesting to have seen, though, what would have happened had the debt been paid down. Would structured finance made even more AAA-securities to compensate? Would interest rates been lower back then too?

rjs certainly gives George Bush far too much credit for monetary sagacity. But the general point remains.

Cross-posted at Asymptosis.

“I think there might be a story about private debt carrying the economy for years after government debt got pulled, so we didn’t experience the effect right away.”

That is part of the story, according to Rodger Malcolm Mitchell ( http://rodgermmitchell.wordpress.com/ ). First you have the reduction of Federal money (debt), followed by excessive creation of private bank money (debt), followed by financial crisis and recession or depression.

That was the pattern for the 1837-1843 depression. When Jackson paid off the Federal debt in 1835 it withdrew money from the economy. With no central bank, wildcat banks created money like crazy, fueling land speculation. The bubble crashed and the depression followed. Jackson was out of office by then, but some people blamed him for the depression. He replied that the problem was paper money, i. e., the private bank money.

“rjs certainly gives George Bush far too much credit for monetary sagacity.”

it was nothing personal, & i didnt mean to attribute insight to W…i used george bush as a generic term for the policies of his administration…

hmmm…afterthought…greg mankiw was george’s chair of economic advisors and now comes on as a deficit hawk…obviously, he knows better…if you put your tinfoil hat on, you can read something nefarious in to his present politics…

Agree: in the absence of sufficient government spending, private spending based on debt issuance can support a growing economy – for a while.

I wonder if this is at all similar to Wray’s analysis?

At some point, debt-to-income levels will reach precariously high levels. Debtors become more and more sensitive to changes in interest rates and fluctuations in asset prices. The aggregate private sector balance sheet is expanded like a balloon – and at some point it all bursts.

Spending on consumption slumps, as do business sales and thereby investment.

And the reason this dynamic kicked in this particular time was the particularly deregulated financial markets during and after the 90s?

Min:

Is there a particular Mitchell post that you’re referring to? (I like his analysis, btw, have linked to it before, looking forward to expanding on it myself.)

All:

Highly recommend the comments by Ashwin and Beowulf over at the crosspost:

http://www.asymptosis.com/this-time-is-different-federal-debt-didnt-dive-before-the-depression.html#comments

There is a Mitchell post where he spells out the pattern. But I failed to find it in a brief look-see this morning. This is the closest I found.

http://rodgermmitchell.wordpress.com/2009/09/07/introduction/

I think David Beckworth might have much more to say on this if you asked him again.

What has changed since 1929? The US has become the world’s reserve currency. Perhaps what we are seeing here is a corrollary of Triffin’s Dilemma:

http://en.wikipedia.org/wiki/Triffin_dilemma

Wasn’t there also a big downturn in 1807? That was the year without trans-Atlantic shipping, so I’m guessing there was a downturn, shortly after a surplus peak. There was also the crisis in 1907, and I’m betting you’ll find similar economics.